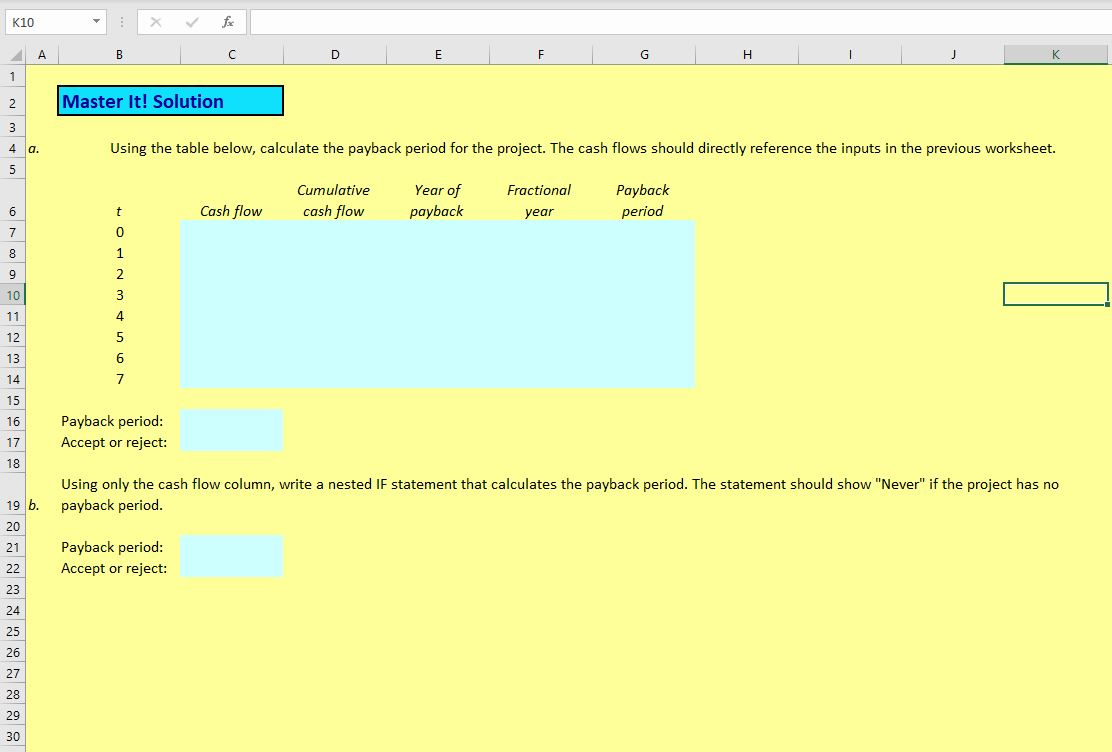

Using the table below, calculate the payback period for the project. The cash flows should directly reference the inputs in the previous worksheet.

Using only the cash flow column, write a nested IF statement that calculates the payback period. The statement should show "Never" if the project has no payback period.

Please determine the Payback period and whether to Accept or reject for both. Please attach the excel formulas for each answer below!

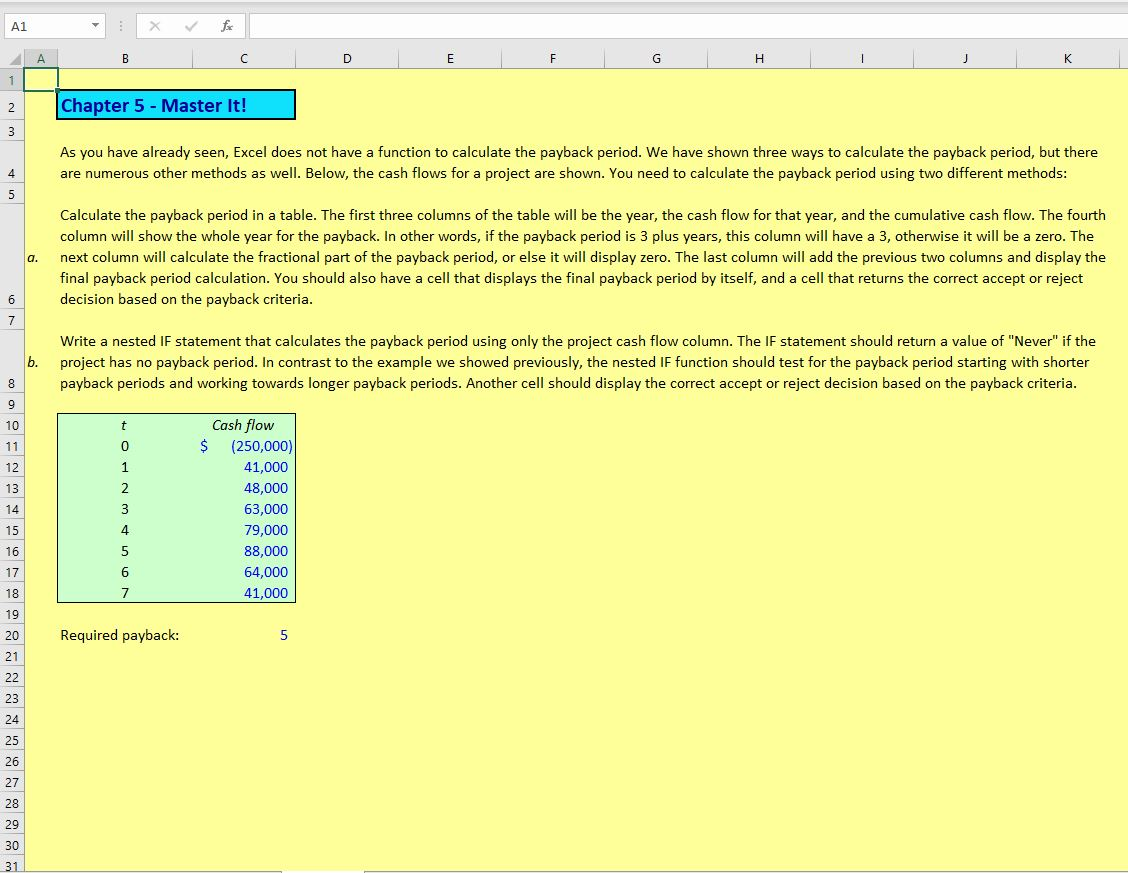

fe A1 K Chapter 5 - Master It! 2 3 As you have already seen, Excel does not have a function to calculate the payback period. We have shown three ways to calculate the payback period, but there are numerous other methods as well. Below, the cash flows for a project are shown. You need to calculate the payback period using two different methods: Calculate the payback period in a table. The first three columns of the table will be the year, the cash flow for that year, and the cumulative cash flow. The fourth column will show the whole year for the payback. In other words, if the payback period is 3 plus years, this column will have a 3, otherwise it willI be a zero. The next column will calculate the fractional part of the payback period, or else it will display zero. The last column will add the previous two columns and display the final payback period calculation. You should also have a cell that displays the final payback period by itself, and a cell that returns the correct accept or reject decision based on the payback criteria. a. 7. Write a nested IF statement that calculates the payback period using only the project cash flow column. The IF statement should return a value of "Never" if the b. project has no payback period. In contrast to the example we showed previously, the nested IF function should test for the payback period starting with shorter payback periods and working towards longer payback periods. Another cell should display the correct accept or reject decision based on the payback criteria. Cash flow (250,000) 10 11 41,000 12 2 48,000 13 3 63,000 14 79,000 4 15 88.000 16 6. 64.000 17 41,000 18 19 Required payback: 20 21 22 23 24 25 26 27 28 29 30 31 fe K10 D. Master It! Solution Using the table below, calculate the payback period for the project. The cash flows should directly reference the inputs in the previous worksheet. 4 a. Cumulative Year of payback Fractional Payback period cash flow Cash flow year 3 10 4 11 12 13 14 15 Payback period: 16 Accept or reject: 17 18 Using only the cash flow column, write a nested IF statement that calculates the payback period. The statement should show "Never" if the project has no payback period. 19 b. 20 Payback period: 21 Accept or reject: 22 23 24 25 26 27 28 29 30 fe A1 K Chapter 5 - Master It! 2 3 As you have already seen, Excel does not have a function to calculate the payback period. We have shown three ways to calculate the payback period, but there are numerous other methods as well. Below, the cash flows for a project are shown. You need to calculate the payback period using two different methods: Calculate the payback period in a table. The first three columns of the table will be the year, the cash flow for that year, and the cumulative cash flow. The fourth column will show the whole year for the payback. In other words, if the payback period is 3 plus years, this column will have a 3, otherwise it willI be a zero. The next column will calculate the fractional part of the payback period, or else it will display zero. The last column will add the previous two columns and display the final payback period calculation. You should also have a cell that displays the final payback period by itself, and a cell that returns the correct accept or reject decision based on the payback criteria. a. 7. Write a nested IF statement that calculates the payback period using only the project cash flow column. The IF statement should return a value of "Never" if the b. project has no payback period. In contrast to the example we showed previously, the nested IF function should test for the payback period starting with shorter payback periods and working towards longer payback periods. Another cell should display the correct accept or reject decision based on the payback criteria. Cash flow (250,000) 10 11 41,000 12 2 48,000 13 3 63,000 14 79,000 4 15 88.000 16 6. 64.000 17 41,000 18 19 Required payback: 20 21 22 23 24 25 26 27 28 29 30 31 fe K10 D. Master It! Solution Using the table below, calculate the payback period for the project. The cash flows should directly reference the inputs in the previous worksheet. 4 a. Cumulative Year of payback Fractional Payback period cash flow Cash flow year 3 10 4 11 12 13 14 15 Payback period: 16 Accept or reject: 17 18 Using only the cash flow column, write a nested IF statement that calculates the payback period. The statement should show "Never" if the project has no payback period. 19 b. 20 Payback period: 21 Accept or reject: 22 23 24 25 26 27 28 29 30