Answered step by step

Verified Expert Solution

Question

1 Approved Answer

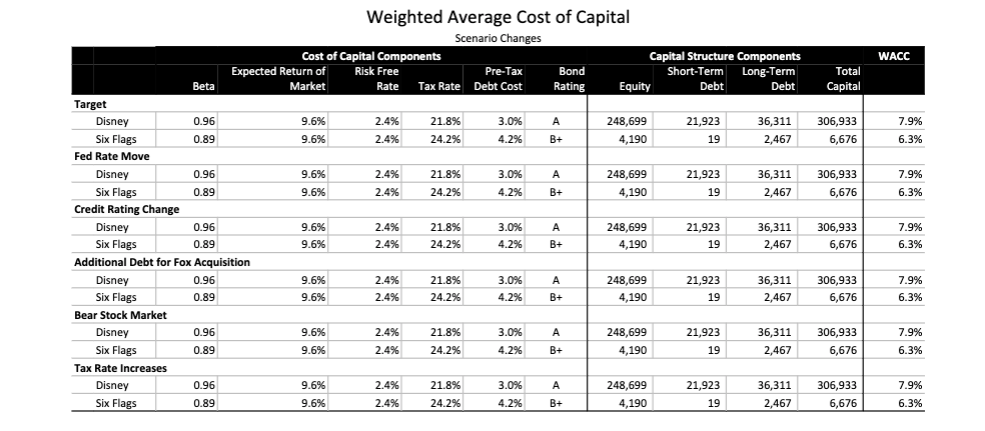

Using the table below, please answer below question Note: Long term & short rate are the same! FED RATE INCREASE An increase of the Federal

Using the table below, please answer below question

Note: Long term & short rate are the same!

FED RATE INCREASE

An increase of the Federal Reserve interest rate by 200 basis points (2.0%) lifts the borrowing costs of every debt issuer. What is Disney's adjusted WACC?

U.S. EQUITY MARKET DOWNTURN

Equity market expectations may cool resulting in an expectation that equity markets may only expand by 200 basis points (2.0%) over the coming year. What is Disney's adjusted WACC?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started