Answered step by step

Verified Expert Solution

Question

1 Approved Answer

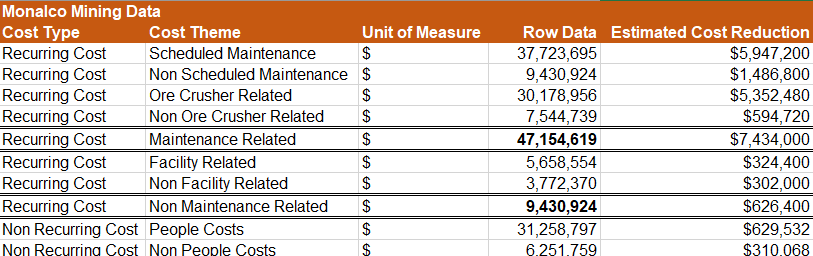

Using the Table of Values provided by the Monalco Mining insights team can we identify $9M worth of potential savings? Dont forget to put the

Using the Table of Values provided by the Monalco Mining insights team can we identify $9M worth of potential savings? Dont forget to put the relevant symbols (+) showing how all the different drivers are connected. Weve included an example of what you should be showing below. Fill out the costs in the next slide and close out this Value Driver Tree Exercise! As an Data Analyst for Monalco Mining, how can we reduce our costs by at least 20% ($9M) through reductions in either Recurring or Non Recurring costs by 31st December 2020?

\begin{tabular}{ll|l|r|r} Monalco Mining Data & Unit of Measure & Row Data & Estimated Cost Reduction \\ Cost Type & Cost Theme & $ & 37,723,695 & $5,947,200 \\ \hline Recurring Cost & Scheduled Maintenance & 9,430,924 & $1,486,800 \\ \hline Recurring Cost & Non Scheduled Maintenance & $ & 30,178,956 & $5,352,480 \\ \hline Recurring Cost & Ore Crusher Related & $ & 7,544,739 & $594,720 \\ \hline Recurring Cost & Non Ore Crusher Related & $ & 47,154,619 & $7,434,000 \\ \hline \hline Recurring Cost & Maintenance Related & $ & 5,658,554 & $324,400 \\ \hline \hline Recurring Cost & Facility Related & $ & 3,772,370 & $302,000 \\ \hline Recurring Cost & Non Facility Related & $ & 9,430,924 & $626,400 \\ \hline \hline Recurring Cost & Non Maintenance Related & $ & 31,258,797 & $629,532 \\ \hline \hline Non Recurring Cost & People Costs & $ & 6.251,759 & $310,068 \end{tabular}

\begin{tabular}{ll|l|r|r} Monalco Mining Data & Unit of Measure & Row Data & Estimated Cost Reduction \\ Cost Type & Cost Theme & $ & 37,723,695 & $5,947,200 \\ \hline Recurring Cost & Scheduled Maintenance & 9,430,924 & $1,486,800 \\ \hline Recurring Cost & Non Scheduled Maintenance & $ & 30,178,956 & $5,352,480 \\ \hline Recurring Cost & Ore Crusher Related & $ & 7,544,739 & $594,720 \\ \hline Recurring Cost & Non Ore Crusher Related & $ & 47,154,619 & $7,434,000 \\ \hline \hline Recurring Cost & Maintenance Related & $ & 5,658,554 & $324,400 \\ \hline \hline Recurring Cost & Facility Related & $ & 3,772,370 & $302,000 \\ \hline Recurring Cost & Non Facility Related & $ & 9,430,924 & $626,400 \\ \hline \hline Recurring Cost & Non Maintenance Related & $ & 31,258,797 & $629,532 \\ \hline \hline Non Recurring Cost & People Costs & $ & 6.251,759 & $310,068 \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started