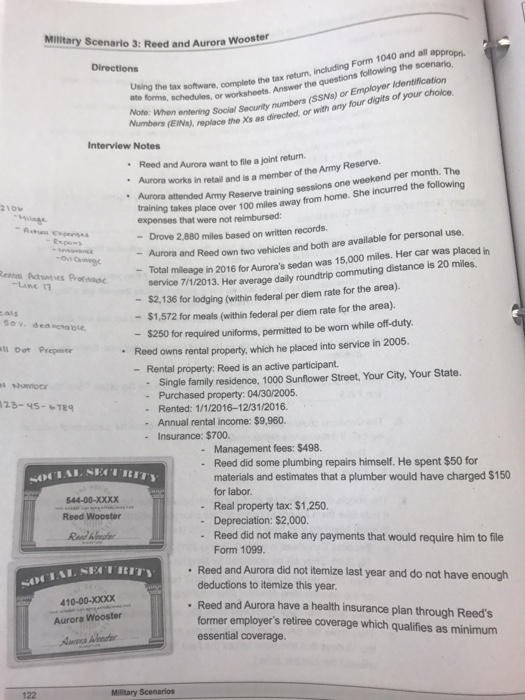

Using the tax software, complete the tax return, including Form 1040 and all appropriate forms or worksheets, Answer the questions following the scenario. Reed and Aurora want to file a joint return. Aurora works in retail and is a member of the Army Reserve. Aurora attended Army Reserve training sessions one weekend per month. The training takes place over 100 miles away from home. She incurred the following expenses that were not reimbursed: Drove 2, 880 miles based on written records. Aurora and Reed own two vehicles and both are available for personal use. Total mileage in 2016 for Aurora's sedan was 15,000 miles. Her car was placed in service 7/1/2013. Her average daily roundtrip commuting distance is 20 miles. $2, 136 for lodging (within federal per diem rate for the area). $1, 572 for meals (within federal per diem rate for the area). $250 for required uniforms, permitted to be worn while off-duty. Reed owns rental property, which he placed into service in 2005. Rental property: Reed is an active participant. Single family residence, 1000 Sunflower Street, Your City, Your State. Purchased property: 04/30/2005. Rented: 1/1/2016-12/31/2016. Annual rental income: $9, 960. Insurance: $700. Management fees: $498. Reed did some plumbing repairs himself. He spent $50 for materials and estimates that a plumber would have charged $150 for labor. Real property tax: $1, 250. Depreciation: $2,000. Reed did not make any payments that would require him to file Form 1099. Reed and Aurora did not itemize last year and do not have enough deductions to itemize this year. Reed and Aurora have a health insurance plan through Reed's former employer's retiree coverage which qualifies as minimum essential coverage. Using the tax software, complete the tax return, including Form 1040 and all appropriate forms or worksheets, Answer the questions following the scenario. Reed and Aurora want to file a joint return. Aurora works in retail and is a member of the Army Reserve. Aurora attended Army Reserve training sessions one weekend per month. The training takes place over 100 miles away from home. She incurred the following expenses that were not reimbursed: Drove 2, 880 miles based on written records. Aurora and Reed own two vehicles and both are available for personal use. Total mileage in 2016 for Aurora's sedan was 15,000 miles. Her car was placed in service 7/1/2013. Her average daily roundtrip commuting distance is 20 miles. $2, 136 for lodging (within federal per diem rate for the area). $1, 572 for meals (within federal per diem rate for the area). $250 for required uniforms, permitted to be worn while off-duty. Reed owns rental property, which he placed into service in 2005. Rental property: Reed is an active participant. Single family residence, 1000 Sunflower Street, Your City, Your State. Purchased property: 04/30/2005. Rented: 1/1/2016-12/31/2016. Annual rental income: $9, 960. Insurance: $700. Management fees: $498. Reed did some plumbing repairs himself. He spent $50 for materials and estimates that a plumber would have charged $150 for labor. Real property tax: $1, 250. Depreciation: $2,000. Reed did not make any payments that would require him to file Form 1099. Reed and Aurora did not itemize last year and do not have enough deductions to itemize this year. Reed and Aurora have a health insurance plan through Reed's former employer's retiree coverage which qualifies as minimum essential coverage