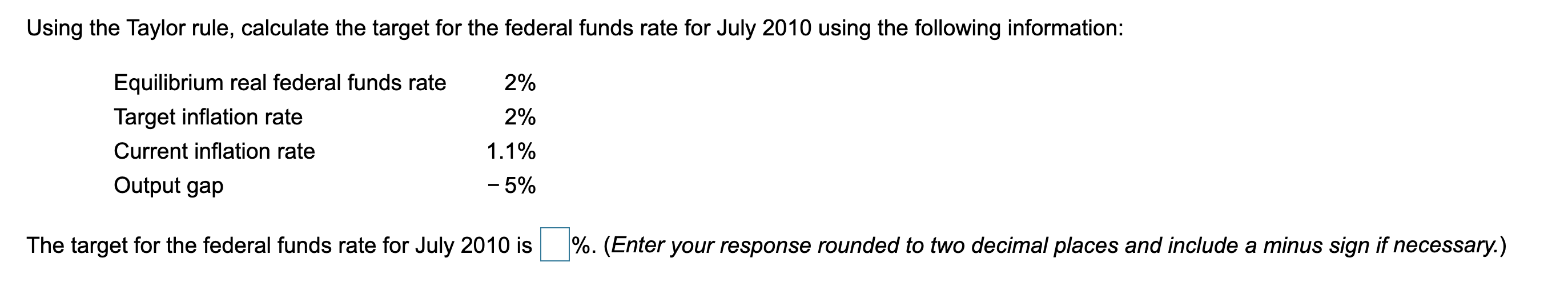

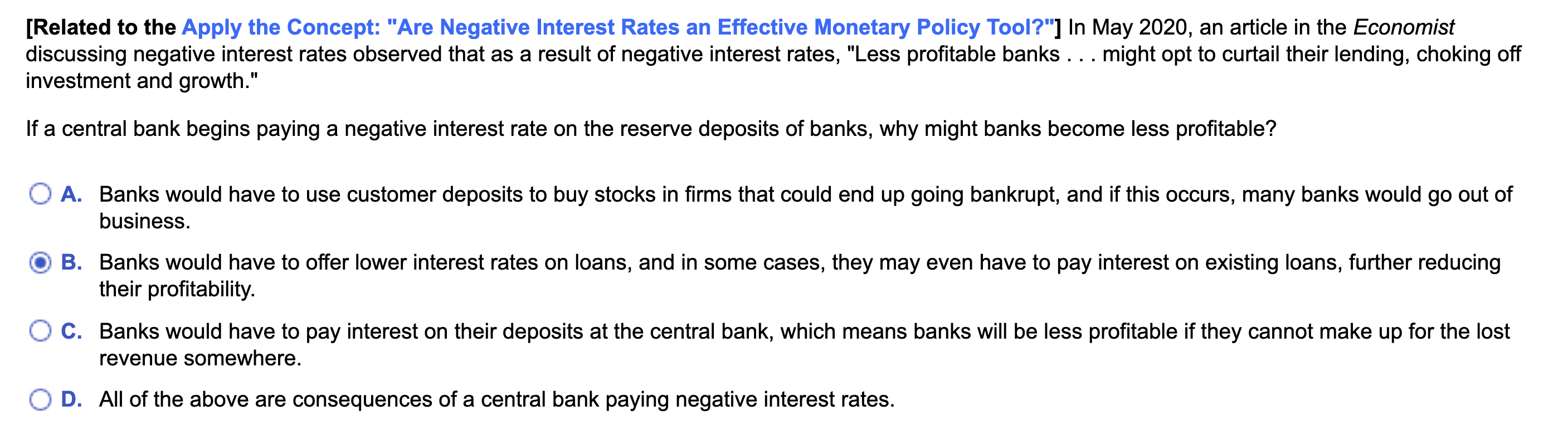

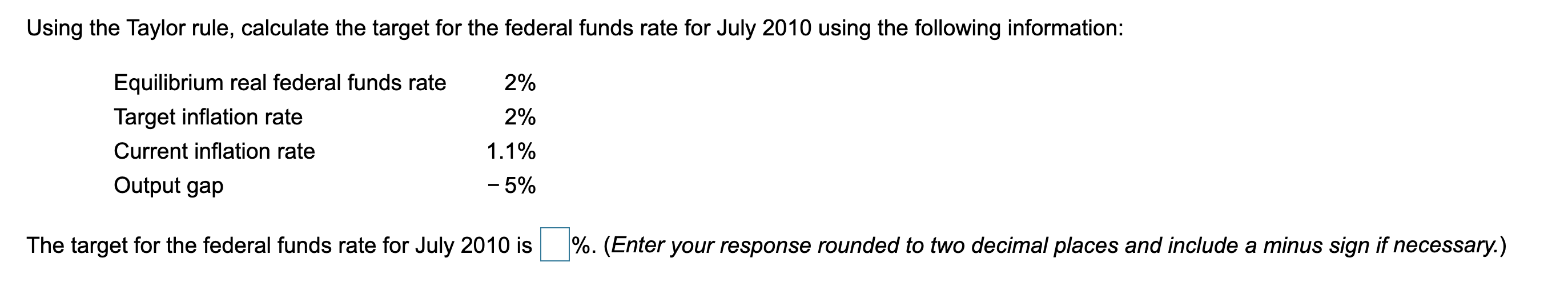

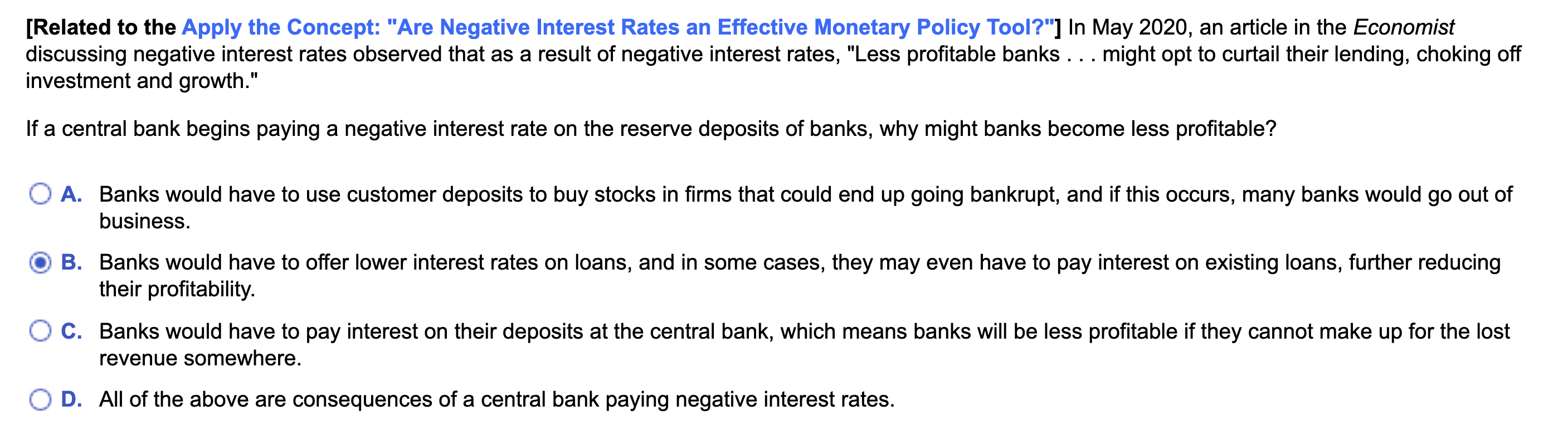

Using the Taylor rule, calculate the target for the federal funds rate for July 2010 using the following information: 2% 2% Equilibrium real federal funds rate Target inflation rate Current inflation rate Output gap 1.1% -5% The target for the federal funds rate for July 2010 is %. (Enter your response rounded to two decimal places and include a minus sign if necessary.) [Related to the Apply the Concept: "Are Negative Interest Rates an Effective Monetary Policy Tool?"] In May 2020, an article in the Economist discussing negative interest rates observed that as a result of negative interest rates, "Less profitable banks ... might opt to curtail their lending, choking off investment and growth." If a central bank begins paying a negative interest rate on the reserve deposits of banks, why might banks become less profitable? O A. Banks would have to use customer deposits to buy stocks in firms that could end up going bankrupt, and if this occurs, many banks would go out of business. B. Banks would have to offer lower interest rates on loans, and in some cases, they may even have to pay interest on existing loans, further reducing their profitability. O C. Banks would have to pay interest on their deposits at the central bank, which means banks will be less profitable if they cannot make up for the lost revenue somewhere. D. All of the above are consequences of a central bank paying negative interest rates. Using the Taylor rule, calculate the target for the federal funds rate for July 2010 using the following information: 2% 2% Equilibrium real federal funds rate Target inflation rate Current inflation rate Output gap 1.1% -5% The target for the federal funds rate for July 2010 is %. (Enter your response rounded to two decimal places and include a minus sign if necessary.) [Related to the Apply the Concept: "Are Negative Interest Rates an Effective Monetary Policy Tool?"] In May 2020, an article in the Economist discussing negative interest rates observed that as a result of negative interest rates, "Less profitable banks ... might opt to curtail their lending, choking off investment and growth." If a central bank begins paying a negative interest rate on the reserve deposits of banks, why might banks become less profitable? O A. Banks would have to use customer deposits to buy stocks in firms that could end up going bankrupt, and if this occurs, many banks would go out of business. B. Banks would have to offer lower interest rates on loans, and in some cases, they may even have to pay interest on existing loans, further reducing their profitability. O C. Banks would have to pay interest on their deposits at the central bank, which means banks will be less profitable if they cannot make up for the lost revenue somewhere. D. All of the above are consequences of a central bank paying negative interest rates