Question

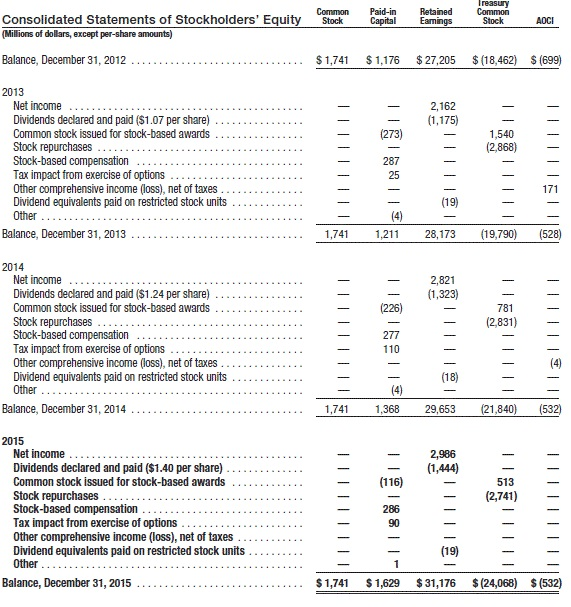

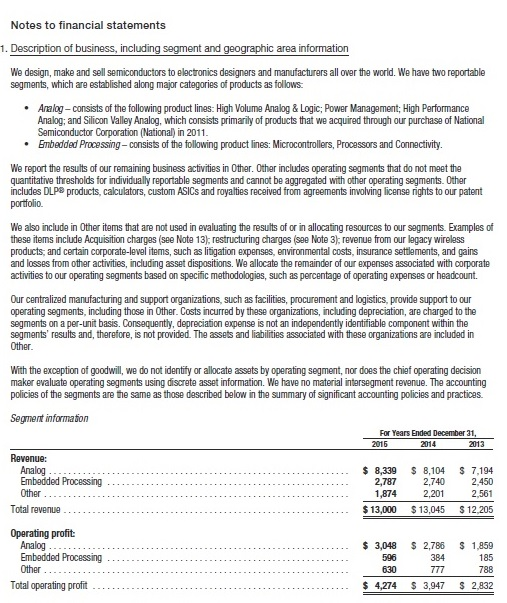

Using the Texas Instruments Inc. 2015 annual report and financial statements , define economic value and explain how an adjusted book value approach to valuing

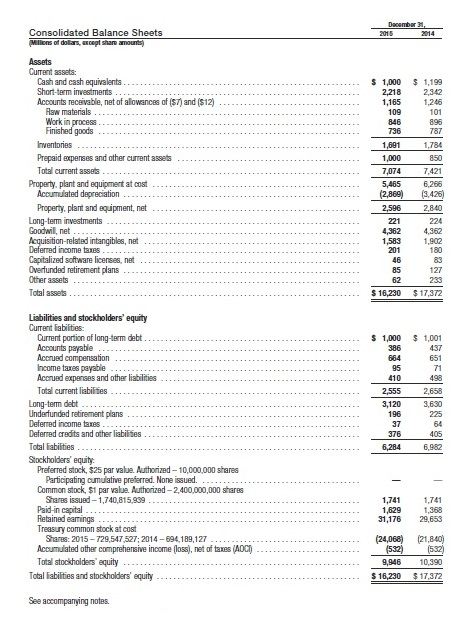

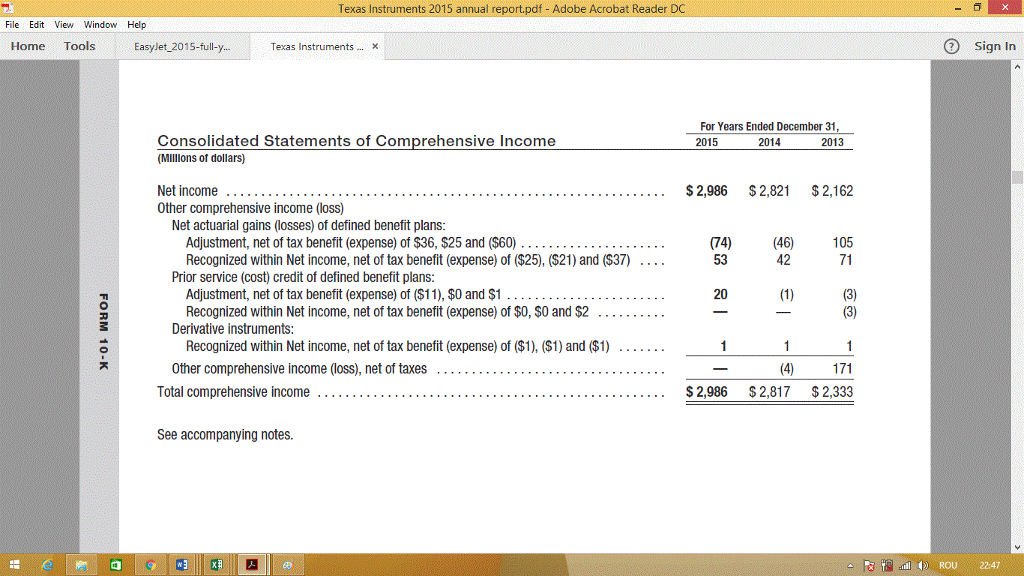

Using the Texas Instruments Inc. 2015 annual report and financial statements , define economic value and explain how an adjusted book value approach to valuing assets and liabilities moves book value nearer to economic value. You are required to provide a written response which highlights four specific elements in Texas Instruments balance sheet that might need to be adjusted to arrive at an economic value.

For each element, explain the type of adjustment and the type of information that might be required before an adjustment could be made to arrive at an economic value for Texas Instruments at its 2015 financial year-end.

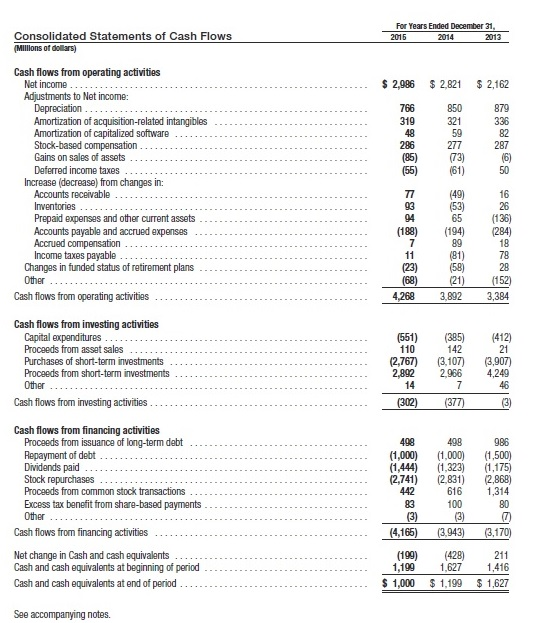

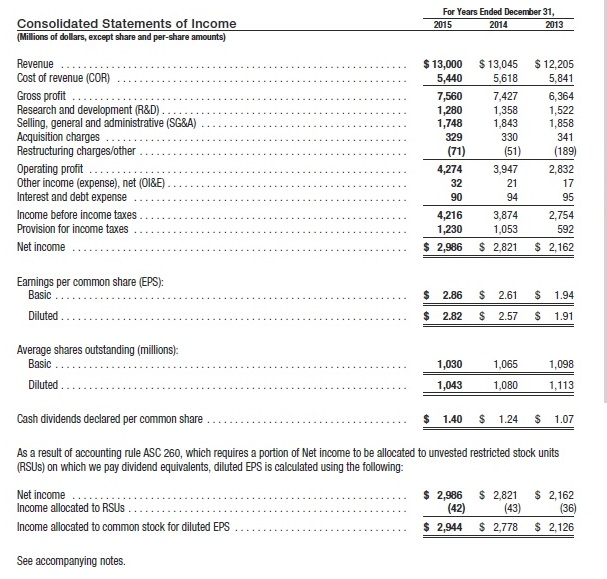

b.Calculate the following market multiple ratios for Texas Instruments Inc. at its 2015 financial year-end:

i.EV/EBITDA

ii.Price-to-earnings ratio (PE ratio)

iii.Price-to-cash-flow ratio

iv.Contrast and explain the results of the different market multiple ratios that you calculated. Evaluate the usefulness of market multiple ratios in company valuation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started