Question

Using the theory of purchasing power parity and forecasts of expected inflation over the next year, forecast the spot exchange rate for the above for

Using the theory of purchasing power parity and forecasts of expected inflation over the next year, forecast the spot exchange rate for the above for one year in the future.

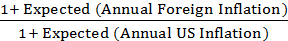

S2 = S1 1+ Expected (Annual Foreign Inflation)1+ Expected (Annual US Inflation)

where S1 = Current spot rate expressed in European terms S2 = Spot rate in one year expressed in European terms

Utilize the following data:

- S1 = Current spot rates in one year expressed in European terms from above.

- Each countrys Inflation, GDP deflator (annual %) from your last weeks worksheet.

- US Inflation, GDP deflator (annual %) of 1.8%. (Instructor may update)

1. United Kingdom -

| Future Spot Rate in One Year Based on Estimated Inflation Rates Show initial equation and its terms and not just the final answer for full credit. |

2. Tanzania

| Future Spot Rate in One Year Based on Estimated Inflation Rates Show initial equation and its terms and not just the final answer for full credit. |

TZS -

| 1 Dollar = 2,298.20 1 TZS = 0.00044 |

GBP

1 Dollar = 0.79

1 Pound = 1.27

TZS INFLATION - 2.7

GBP INFLATION - 2.2

US INFLATION RATE 1.8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started