Question

Using the unadjusted trial balance, and some additional information... 1) Create a chart of Accounts 2) Prepare all necessary adjusting journal entries 3) Prepare a

Using the unadjusted trial balance, and some additional information...

1) Create a chart of Accounts

2) Prepare all necessary adjusting journal entries

3) Prepare a full set of financial statements including a note related to significant accounting policies. Please provide the Balance Sheet, Income Statement, Statement of Comprehensive Income, Statement of Retained Earnings, State of Cash Flow, and the Footnote.

| Weaving Way Grocers | ||

| Unadjusted Trial Balance | ||

| Year Ended June 30, 2017 | ||

| Account Name | Debit | Credit |

| Cash | 30,000.00 | |

| Accounts Receivable | 40,000.00 | |

| Supplies | 1,500.00 | |

| Inventory | 60,000.00 | |

| Note Receivable | 20,000.00 | |

| Prepaid Rent | 2,000.00 | |

| Office Equipment | 80,000.00 | |

| Accumulated Depreciation - Office Equipment | 30,000.00 | |

| Accounts Payable | 31,000.00 | |

| Note Payable | 50,000.00 | |

| Common Stock | 60,000.00 | |

| Retained Earnings | 29,500.00 | |

| Sales Revenue | 148,000.00 | |

| Cost of Goods Sold | 70,000.00 | |

| Salaries and Wages Expense | 18,900.00 | |

| Rent Expense | 11,000.00 | |

| Supplies Expense | 1,100.00 | |

| Insurance Expense | 6,000.00 | |

| Advertising Expense | 3,000.00 | |

Additional Information:

| 1. | Depreciation on the office equipment for the year is $10,000.00 |

| 2. | Employee salaries and wages are paid twice a month, on the 22nd for salaries and wages earned from the 1st through the 15th, and on the 7th of the following month for salaries and wages earned from the 16th through the end of the month. Salaries and wages earned from June 16 through June 30 were $1,500. |

| 3. | On October 1, 2016, Weaving Way borrowed $50,000.00 from a local bank and signed a note. The note requires interest to be paid annually on September 30 at 12%. The principal is due in 10 years. |

| 4. | On April 1, 2016, the Weaving Way paid an insurance company $4,800 for a 24 month insurance policy. The entire $6,000.00 was recorded as an expense upon payment. |

| 5. | On April 1, 2016, a customer paid Weaving Way $2,400 for a one year supply of imported Parmesan cheese to be delivered 1/12th per month for the next 12 months. Weaving Way credited Sales Revenue for the full amount. |

| 6. | Weaving Way leased anespresso machine from CoffeeGoGo under a 9-year lease agreement. The lease specifies annual payments of $25,000 beginning July 1, 2016, the beginning of the lease, and at each June 30 thereafter. The equipment is expected to have a useful life of 12 years with no guaranteed salvage value at the end. The machine is expected to have a residual value of $90,995.00. The implicit rate is 10%. |

| 7. | For tax purposes, Weaving Way uses MACRS depreciation and calculated tax depreciation of $16,000.00. |

| 8. | Weaving Way's marginal tax rate is 35% and the average tax rate is 30%. |

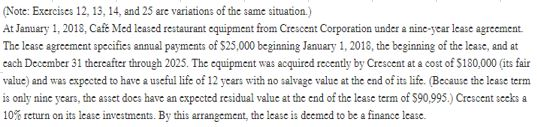

The information provided about the lease is related to the same question.

Note: Exercises 12, 13, 14, and 25 are variations of the same situation.) At January 1, 2018, Cafe Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease agreement specifies annual payments of $25,000 beginning January 1, 2018, the beginning of the lease, and at cach Dccember 31 thercafter through 2025. The equipment was acquired recently by Crescent at a cost of $180,000 its fair value) and was expected to have a useful life of 12 years with no salvage value at the end of its life. (Because the lease term is only nine years, the assct does have an expected residual value at the end of the lcase term of $90,995.) Crescent sccks a 10% return on its lease investments. By this arrangement, the lease is deemed to be a finance lease. Note: Exercises 12, 13, 14, and 25 are variations of the same situation.) At January 1, 2018, Cafe Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease agreement specifies annual payments of $25,000 beginning January 1, 2018, the beginning of the lease, and at cach Dccember 31 thercafter through 2025. The equipment was acquired recently by Crescent at a cost of $180,000 its fair value) and was expected to have a useful life of 12 years with no salvage value at the end of its life. (Because the lease term is only nine years, the assct does have an expected residual value at the end of the lcase term of $90,995.) Crescent sccks a 10% return on its lease investments. By this arrangement, the lease is deemed to be a finance leaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started