Answered step by step

Verified Expert Solution

Question

1 Approved Answer

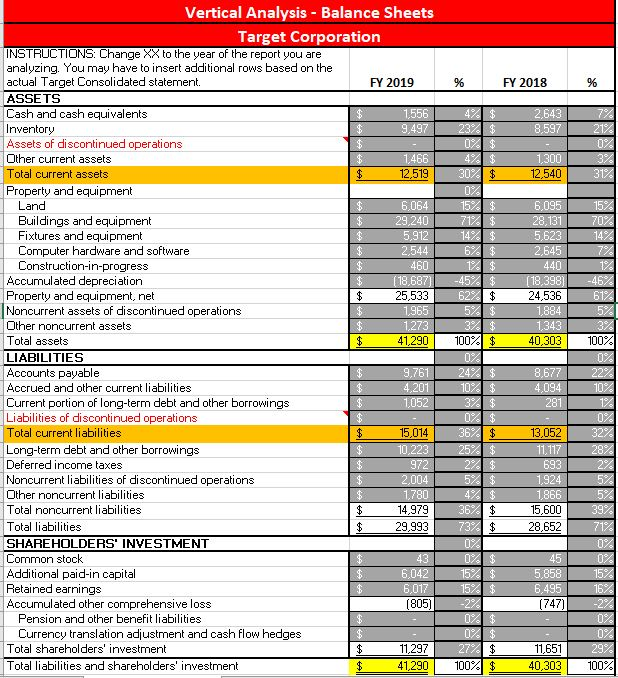

Using the vertical analysis of the balance sheets, identify the significant trends % FY 2018 % 2,643 8.597 21. 23% $ 0% $ 1,300 12,540

Using the vertical analysis of the balance sheets, identify the significant trends

% FY 2018 % 2,643 8.597 21. 23% $ 0% $ 1,300 12,540 0% 3% 31% Vertical Analysis - Balance Sheets Target Corporation INSTRUCTIONS: Change XX to the year of the report you are analyzing. You may have to insert additional rows based on the actual Target Consolidated statement. FY 2019 ASSETS Cash and cash equivalents 1556 Inventory 9.497 Assets of discontinued operations Other current assets $ 1,466 Total current assets $ 12,519 Property and equipment Land $ 6,064 Buildings and equipment 29,240 Fixtures and equipment 5,912 Computer hardware and software 2,544 Construction-in-progress $ 460 Accumulated depreciation $ (18,687) Property and equipment, net $ 25,533 Noncurrent assets of discontinued operations $ 1965 Other noncurrent assets 1.273 Total assets $ 41,290 LIABILITIES Accounts payable $ 9,761 Accrued and other current liabilities 4,201 Current portion of long-term debt and other borrowings 1052 Liabilities of discontinued operations Total current liabilities $ 15,014 Long-term debt and other borrowings $ 10,223 Deferred income taxes 972 Noncurrent liabilities of discontinued operations 2,004 Other noncurrent liabilities $ 1780 Total noncurrent liabilities 14,979 Total liabilities 29,993 SHAREHOLDERS' INVESTMENT Common stock 43 Additional paid-in capital 6,042 Retained earnings $ 6,017 Accumulated other comprehensive loss (805) Pension and other benefit liabilities Currency translation adjustment and cash flow hedges Total shareholders' investment 11,297 Total liabilities and shareholders' investment $ 41,290 30$ 0% 15%$ 71% $ 14% $ 6% $ 1% -45$ 62% $ 5% $ 3%$ 100%A $ 0% 24% $ 10% $ 6,095 28, 131 5,623 2,645 440 (18,3981 24,536 1,884 1,343 40,303 | 8,677 4,094 281 0% $ 36 $ 25$ 15% 70% 14% 7% 1% -46% 61% 5% 3% 100% 0% 22% 10% 1% 0% 32% 28% 2% 5% 5% 39% 71% 0% 0% 15% 16% -2% 0% 0% 29% 100% 13,052 11.117 693 1.924 1,866 15,600 28,652 1 5$ 4% $ 36% $ 73%$ 0% 0% $ 15% $ 15% $ -22 45 5,858 6,495 (747) . $ 0% $ 27%$ 100%A $ 11,651 40,303Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started