Using this data, please calculate the weights of both debt and equity and calculate the WACC. Please show work!

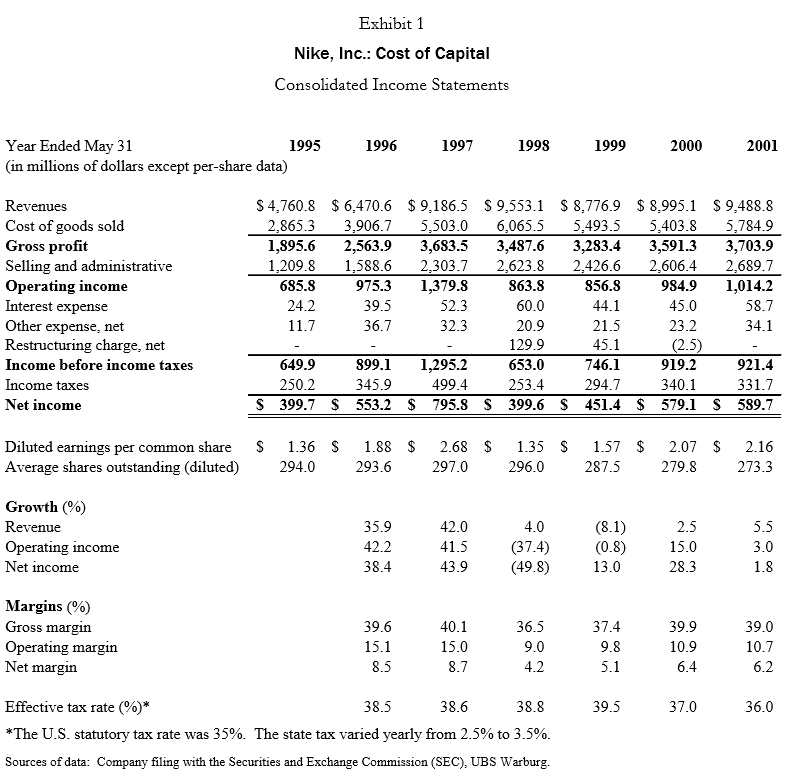

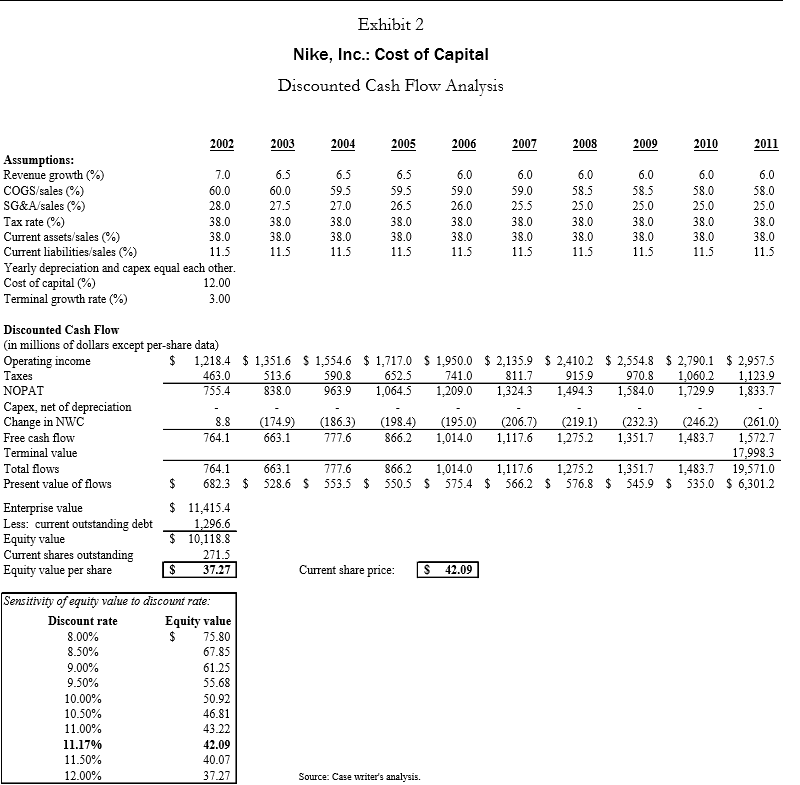

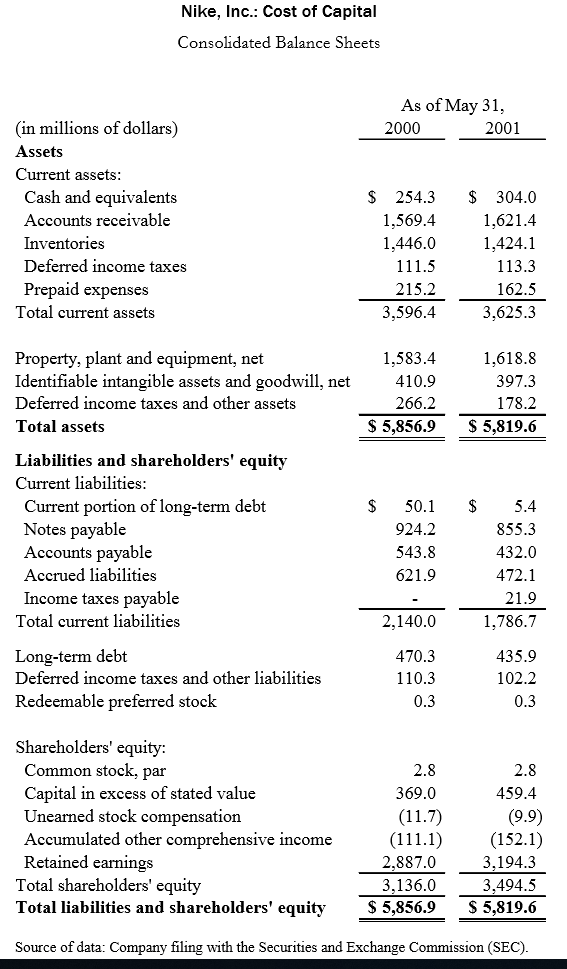

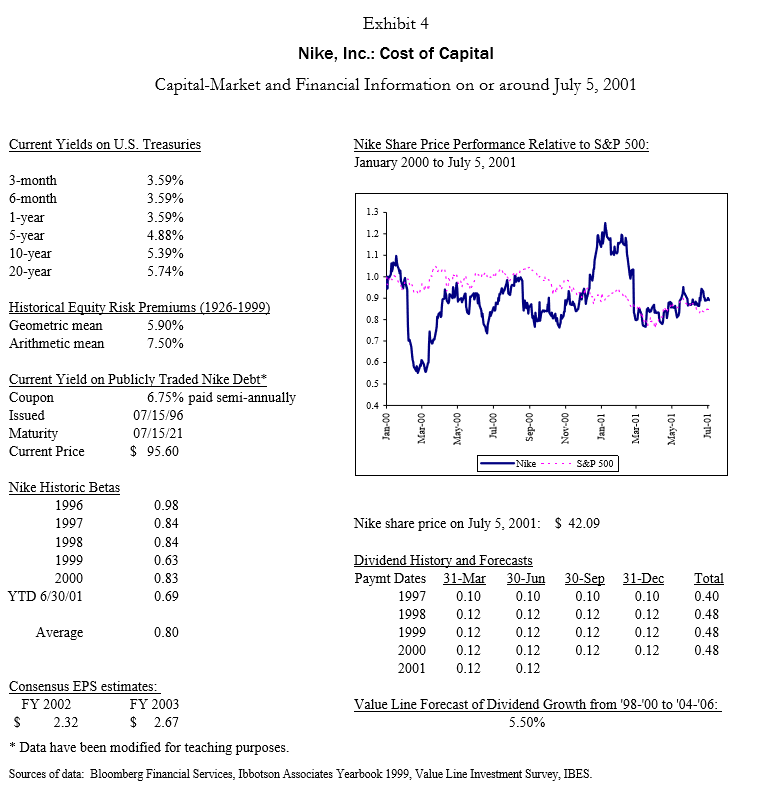

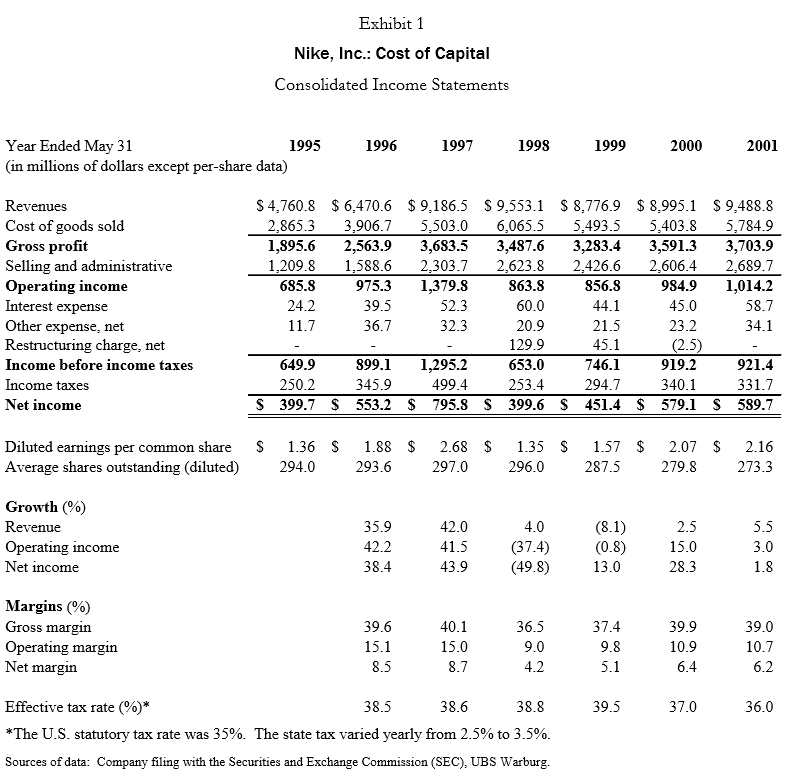

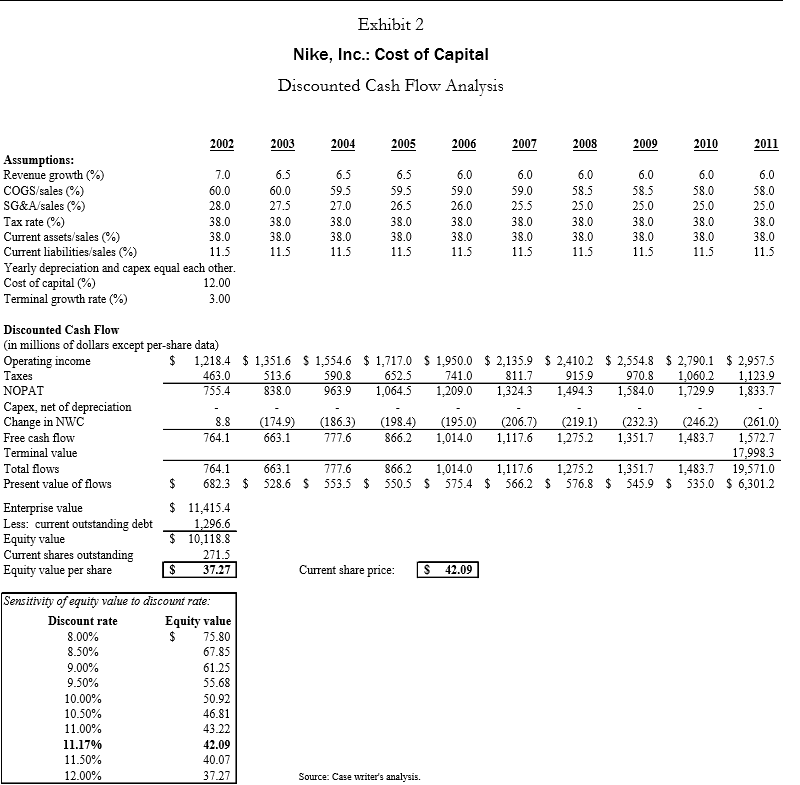

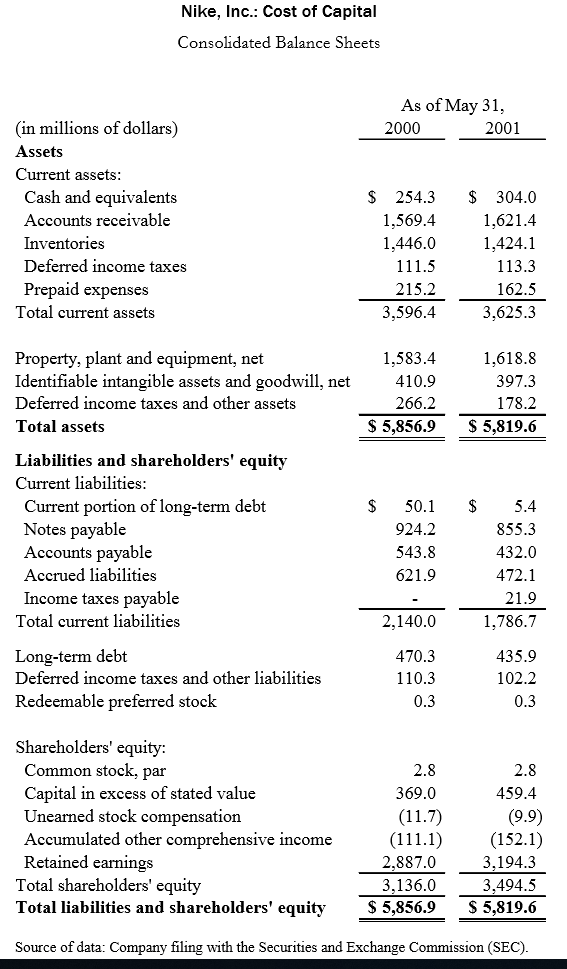

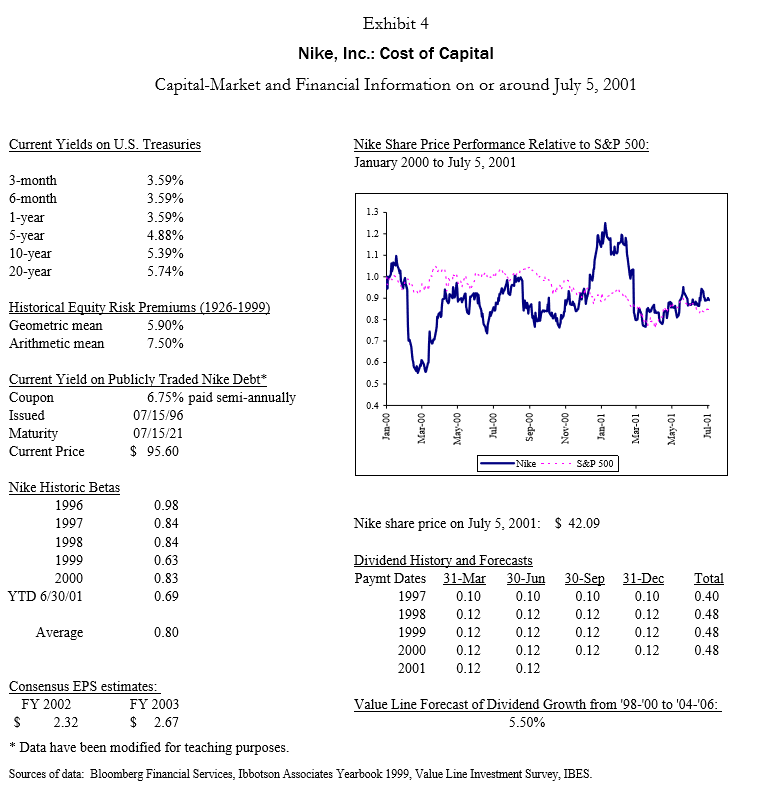

Exhibit1 Nike, Inc.: Cost of Capital Consolidated Income Statements 1996 2000 Year Ended May 31 (in millions of dollars except per-share data) 1995 1997 1998 1999 2001 $4,760.8 $6,470.6 $9,186.5 S 9,553.1 S 8,776.9 $ 8,995.1 S9,488.8 Revenues Cost of goods sold Gross profit Selling and administrative Operating income Interest expense Other expense, net Restructuring charge, net Income before income taxes Income taxes Net income 2,865.3 3.906.7 5.503.0 6,065.5 5.493.55.403.8 5.784.9 1,895.62,563.9 3,683.53,487.6 3,283.43,591.33,703.9 1.209.81.588.6 2.303.7 2,623.8 2.426.6 2606.4 2,689.7 685.8975.3 1,379.8863.8856.8984.9 1,014.2 60.0 20.9 129.9 649.9899.11,295.2 653.0 746.1919.2921.4 253.4 24.2 11.7 52.3 32.3 39.5 58.7 21.5 45.1 23.2 (2.5) 250.2 345.9 294.7 340.1 331.7 S 399.7 S 553.2 S 795.8 S 399.6 S 451.4 579.1 S 589.17 499.4 Diluted earnings per common share S136 S 1.88 S 2.68 S 1.35 S 1.57 S 2.07 S 2.16 Average shares outstanding (diluted) 294.0 293.6 297.0296.0 287.5279.8 273.3 Growth (%) Revenue Operating income Net income 42.0 41.5 43.9 2.5 42.2 38.4 (0.8) 28.3 Margins (%) Gross margin Operating margin Net margin 39.6 40.1 36.5 9.0 37.4 9.8 39.9 10.9 6.4 39.0 10.7 6.2 Effective tax rate (%)* *The U.S. statutory tax rate was 35%. The state tax varied yearly from 2.5% to 3.5% Sources of data: Company filing with the Securities and Exchange Commission (SEC), UBS Warburg. 38.5 38.6 38.8 39.5 37.0 36.0 Exhibit'2 Nike, Inc.: Cost of Capital Discounted Cash Flow Analysis 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Assumptions Revenue growth (%) COGS sales (%) SG&A sales (%) Tax rate (%) Current assets/sales (%) Current liabilities/sales (%) Yearly depreciation and capex equal each other Cost of capital (%) Terminal growth rate (%) 59.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 38.0 12.00 Discounted Cash Flow (in millions of dollars except per-share data) $ 1,218.4 $ 1,351.6 S 1,554.6 $ 1,717.0 S 1,950.0 2,135.9 S 2,410.2 $ 2,554.8 S 2,790.1 $ 2,957.5 970.8 1.060.2 1123.9 838.0963.91,064.5,209.0 1,324.3 1,494.31,584.01,729.91,833.7 ing income 741.0 Taxes NOPAT Capex, net of depreciation Change in NWC Free cash flow Terminal value Total flows Present value of flowS 463.0 513.6 590.8 652.5 915.9 186.3 198.4 195 206.7 32.3) 246.2 764.1 866.2 1,014.0 1,117.6 1,275.21,351.71,483.71,572.7 17,998.3 866.2 1,014.0 1,117.6 1,275.21,351.71,483.719,571.0 $ 682.3 $ 528.6 S 553.5 $ 550.5 S575.4 566.2 S 576.8 $ 545.9 S 535.0 6,301.2 Enterprise value Less: current outstanding debt Equity value Curent shares outstanding $ 11,4154 $ 10,118.8 37.27 271.5 Equity value per share Current share price Sensitivity of equity value to discount rate Discount rate 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11 .00% 11.17% 11.50% 12.00% Equity value $75.80 67.85 61.25 55.68 50.92 46.81 43.22 42.09 40.07 37.27 Source: Case writer's analysis Nike, Inc.: Cost of Capital Consolidated Balance Sheets As of May 31, 2000 (in millions of dollars) Assets Current assets 2001 Cash and equivalents Accounts receivable Inventories Deferred income taxes Prepaid expenses S 254.3 304.0 1.621.4 1,424.1 1,569.4 1,446.0 215.2 3,596.4 162.5 3,625.3 Total current assets Property, plant and equipment, net Identifiable intangible assets and goodwill, net Deferred income taxes and other assets Total assets 1.618.8 397.3 178.2 S 5,856.9S 5,819.6 1,583.4 410.9 266.2 Liabilities and shareholders' equity Current liabilities Current portion of long-term debt Notes payable Accounts payable Accrued liabilities Income taxes payable 924.2 543.8 621.9 $ 50.1 5.4 855.3 432.0 472.1 Total current liabilities 2,140.0 1,786.7 470.3 Long-term debt Deferred income taxes and other liabilities 435.9 102.2 Redeemable preferred stock Shareholders' equity: Common stock, par Capital in excess of stated value Unearned stock compensation Accumulated other comprehensive income Retained earnings 369.0 459.4 (111.1)(152.1) 2,887.0 3,136.0 3.194.3 3,494.5 Total shareholders' equity Total liabilities and shareholders' equityS 5,856.9S 5,819.06 Source of data: Company filing with the Securities and Exchange Commission (SEC). Exhibit 4 Nike, Inc.: Cost of Capital Capital-Market and Financial Information on or around July 5, 2001 Current Yields on U.S. Treasuries Nike Share Price Performance Relative to S&P 500 January 2000 to July 5, 2001 3-month 6-month 1-year 5-year 10-year 20-year 3.59% 3.59% 3.59% 4.88% 5.39% 5.74% 1.3 0.9 0.8 Geometric mean Arithmetic mean 5.90% 7.50% 0.6 Current Yield on Publicly Traded Nike Debt Coupon Issued Maturity Current Price 0.5 6.75% paid semi-annually 07/15/96 07/15/21 S 95.60 -Nike &P 500 Nike Historic Betas 1996 1997 1998 1999 2000 0.98 0.84 0.84 0.63 0.83 0.69 Nike share price on July 5, 2001: 42.09 ividend casts Paymt Dates 31-Mar 0-Jun 30-Sep 31-Dc al 0.40 1997 0.10 1998012 0.12 0.12 0.12 0.48 19990.12 0.12 0.12 0.12 0.48 2000 0.12 0.12 0.12 0.12 0.48 2001 0.12 0.12 YTD 6/30/01 0.10 0.10 0.10 Average 0.80 Consensus EPS estimates FY 2003 S 2.67 * Data have been modified for teaching purposes. FY 2002 S 2.32 Value Line Forecast of Dividend Growth from '98-00 to '04-06 5.50% Sources of data: Bloomberg Financial Services, Ibbotson Associates Yearbook 1999, Value Line Investment Survey, IBES