Question

using this format how would you fill out the balance sheet for the following information: Summary of Events January 1 You started the business by

using this format how would you fill out the balance sheet for the following information:

Summary of Events

January 1 You started the business by contributing $100,000 of personal capital in exchange for common stock

January 1 Paid $5,000 to the lawyers to incorporate your business entity

January 2 Acquired computers for the business for $5,000

January 3 Acquired inventory held for re-sale for $20,000

January 4 First sale took place, as you sold half of the inventory originally purchased. You sold it for $50,000 cash

February 1 You hired your first employee, and paid $5,000 cash for wages. You paid the same amount of wages on the first of each month for the remainder of the year.

February 15 Sold the rest of the inventory for $75,000 cash

March 15 You got sued by an outside party, and got an invoice from lawyers for $2,000 for legal work performed, due in April

April 1 Paid the legal invoice due

April 25 Bought more inventory from your supplier, for $20,000 on credit

May 1 Borrowed $100,000 from the bank, at an annual rate of 10%, due on December 31.

May 31 Sold all remaining inventory for $50,000, on credit.

June 30 Collected on all outstanding Accounts Receivable.

July 15 Sold all of the computers for $1,000 in cash.

September 1 bought more inventory, for $30,000 using long-term note payable.

October 1 sold inventory all that you had on hand, for $50,000 on credit.

November 1 collected on accounts receivable, in all cash.

December 31 made interest payment on the note

December 31 paid $5,000 bonus in cash to employee.

December 31 after books were closed, you paid 50% of all the remaining profit as cash dividend.

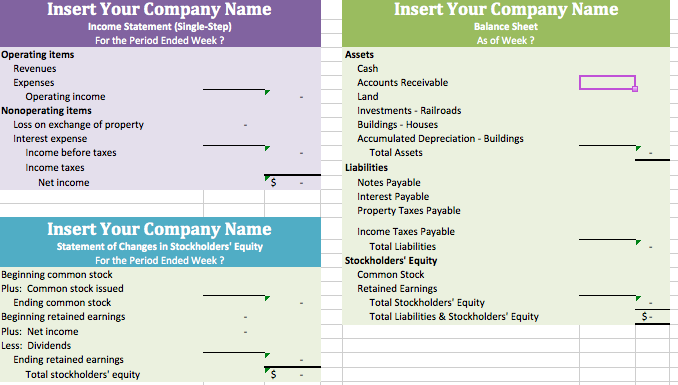

Insert Your Company Name Income Statement (Single-Step) For the Period Ended Week? operating items Revenues Expenses operating income Nonoperating items Loss on exchange of property Interest expense Income before taxes ncome taxes. Net income Insert Your Company Name Statement of Changes in Stockholders' Equity For the Period Ended week Beginning common stock Plus: Common stock issued Ending common stock Beginning retained earnings Plus: Net income Less: Dividends Ending retained earnings Total stockholders' equity Insert Your Company Name Balance Sheet As of Week Assets Cash Accounts Receivable Land Investments Railroads Buildings Houses Accumulated Depreciation Buildings Total Assets Liabilities Notes Payable Interest Payable Property Taxes Payable Income Taxes Payable Total Liabilities Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities & Stockholders' EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started