Answered step by step

Verified Expert Solution

Question

1 Approved Answer

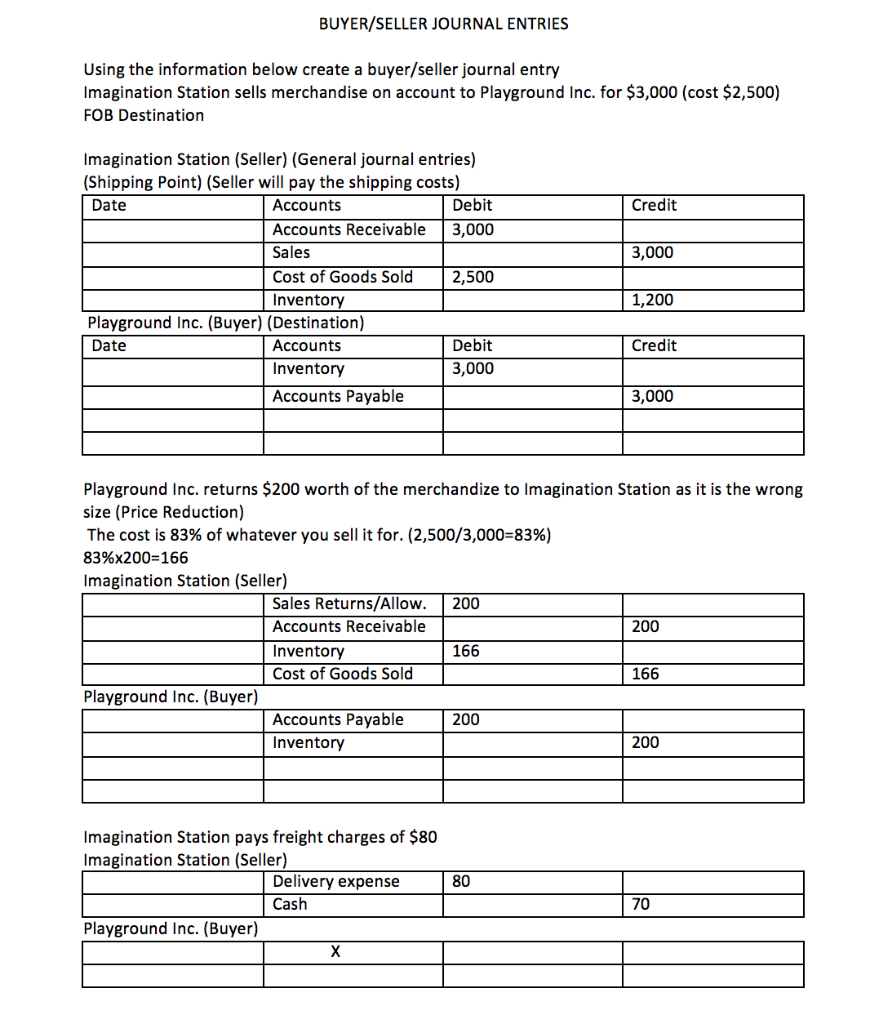

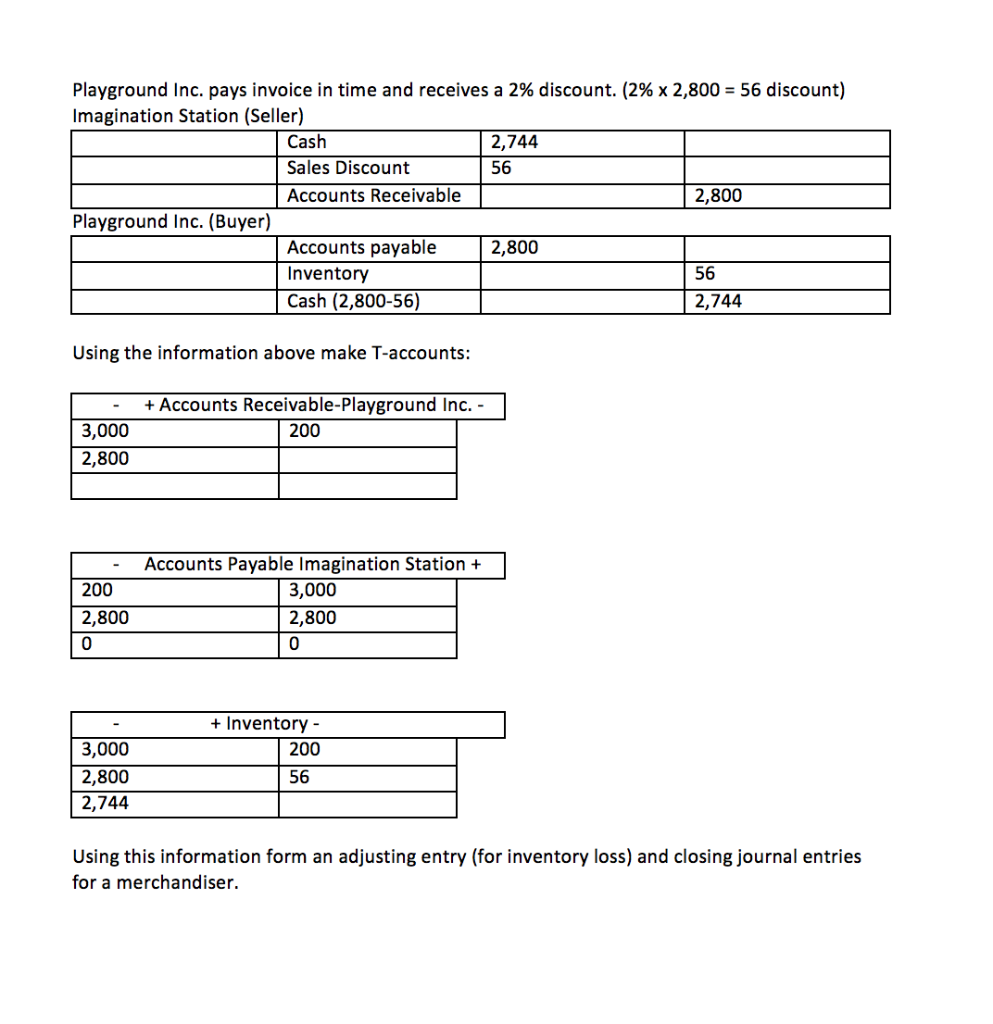

Using this information form an adjusting entry (for inventory loss) and closing journal entries for a merchandiser. BUYER/SELLER JOURNAL ENTRIES Using the information below create

Using this information form an adjusting entry (for inventory loss) and closing journal entries for a merchandiser.

BUYER/SELLER JOURNAL ENTRIES Using the information below create a buyer/seller journal entry Imagination Station sells merchandise on account to Playground Inc. for $3,000 (cost $2,500) FOB Destination Credit 3,000 Imagination Station (Seller) (General journal entries) (Shipping Point) (Seller will pay the shipping costs) Date Accounts Debit Accounts Receivable 3,000 Sales Cost of Goods Sold 2,500 Inventory Playground Inc. (Buyer) (Destination) Date Accounts Debit Inventory 3,000 Accounts Payable 1,200 Credit 3,000 Playground Inc. returns $200 worth of the merchandize to Imagination Station as it is the wrong size (Price Reduction) The cost is 83% of whatever you sell it for. (2,500/3,000=83%) 83%x200=166 Imagination Station (Seller) Sales Returns/Allow. 200 Accounts Receivable 200 Inventory 166 Cost of Goods Sold 166 Playground Inc. (Buyer) Accounts Payable 200 Inventory 200 80 Imagination Station pays freight charges of $80 Imagination Station (Seller) Delivery expense Cash Playground Inc. (Buyer) 70 Playground Inc. pays invoice in time and receives a 2% discount. (2% x 2,800 = 56 discount) Imagination Station (Seller) Cash 2,744 Sales Discount 56 Accounts Receivable 2,800 Playground Inc. (Buyer) Accounts payable 2,800 Inventory 56 Cash (2,800-56) 2,744 Using the information above make T-accounts: + Accounts Receivable-Playground Inc. - 200 3,000 2,800 200 Accounts Payable Imagination Station + 3,000 2,800 0 2,800 0 + Inventory - 200 3,000 2,800 2,744 56 Using this information form an adjusting entry (for inventory loss) and closing journal entries for a merchandiser. BUYER/SELLER JOURNAL ENTRIES Using the information below create a buyer/seller journal entry Imagination Station sells merchandise on account to Playground Inc. for $3,000 (cost $2,500) FOB Destination Credit 3,000 Imagination Station (Seller) (General journal entries) (Shipping Point) (Seller will pay the shipping costs) Date Accounts Debit Accounts Receivable 3,000 Sales Cost of Goods Sold 2,500 Inventory Playground Inc. (Buyer) (Destination) Date Accounts Debit Inventory 3,000 Accounts Payable 1,200 Credit 3,000 Playground Inc. returns $200 worth of the merchandize to Imagination Station as it is the wrong size (Price Reduction) The cost is 83% of whatever you sell it for. (2,500/3,000=83%) 83%x200=166 Imagination Station (Seller) Sales Returns/Allow. 200 Accounts Receivable 200 Inventory 166 Cost of Goods Sold 166 Playground Inc. (Buyer) Accounts Payable 200 Inventory 200 80 Imagination Station pays freight charges of $80 Imagination Station (Seller) Delivery expense Cash Playground Inc. (Buyer) 70 Playground Inc. pays invoice in time and receives a 2% discount. (2% x 2,800 = 56 discount) Imagination Station (Seller) Cash 2,744 Sales Discount 56 Accounts Receivable 2,800 Playground Inc. (Buyer) Accounts payable 2,800 Inventory 56 Cash (2,800-56) 2,744 Using the information above make T-accounts: + Accounts Receivable-Playground Inc. - 200 3,000 2,800 200 Accounts Payable Imagination Station + 3,000 2,800 0 2,800 0 + Inventory - 200 3,000 2,800 2,744 56 Using this information form an adjusting entry (for inventory loss) and closing journal entries for a merchandiserStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started