Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using this information perform a vertical analysis for both years and a horizontal analysis for the most recent year. Calculate price earnings ratio, current ratio,

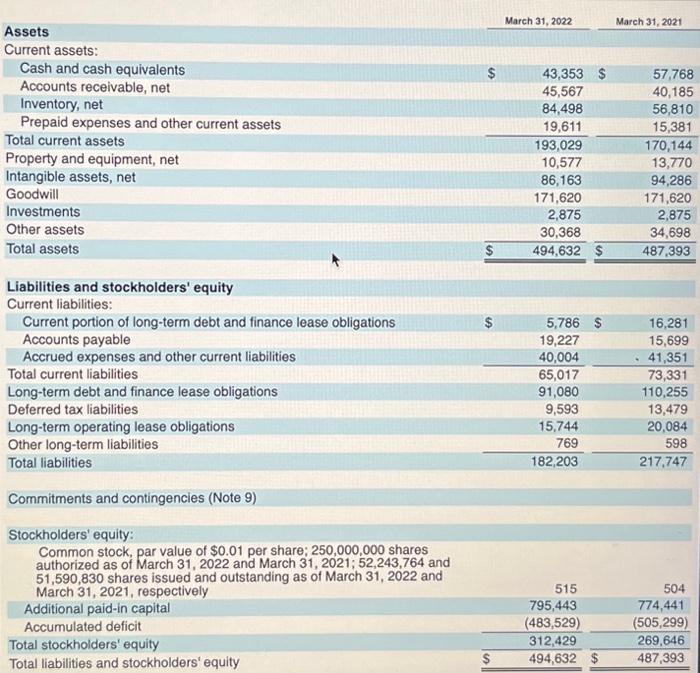

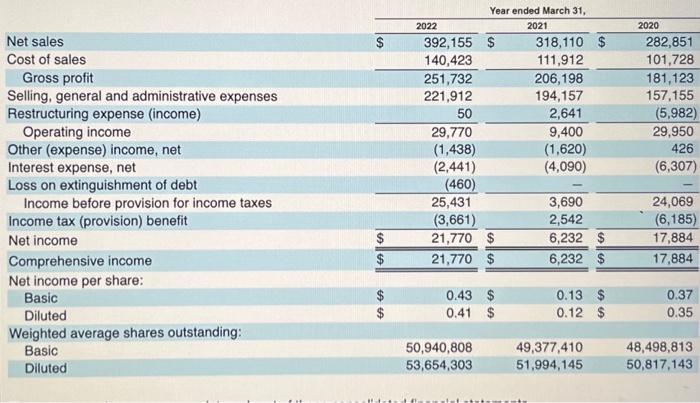

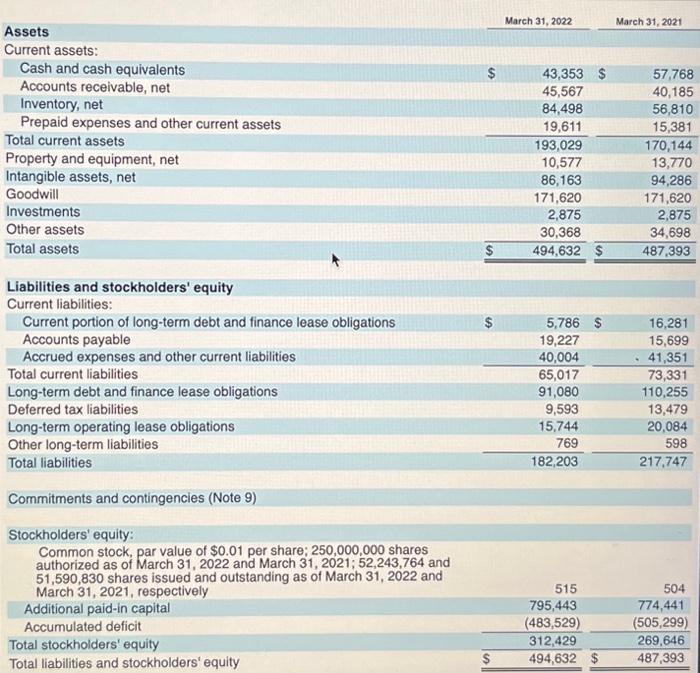

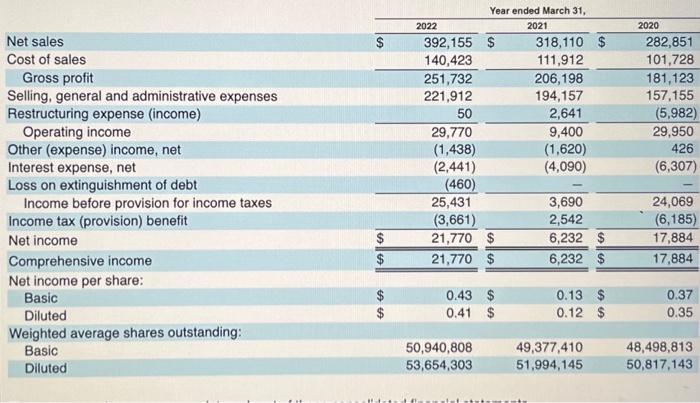

Using this information perform a vertical analysis for both years and a horizontal analysis for the most recent year. Calculate price earnings ratio, current ratio, acid-test ratio, and debt ratio for both years. Calculate return on assets and return on equity for the most recent year.

March 31, 2022 March 31, 2021 Assets Current assets: Cash and cash equivalents Accounts receivable, net Inventory, net Prepaid expenses and other current assets Total current assets Property and equipment, net Intangible assets, net Goodwill Investments Other assets Total assets Liabilities and stockholders' equity Current liabilities: Current portion of long-term debt and finance lease obligations Accounts payable Accrued expenses and other current liabilities Total current liabilities Long-term debt and finance lease obligations Deferred tax liabilities Long-term operating lease obligations Other long-term liabilities Total liabilities \begin{tabular}{rrr} $5,786 & $ & 16,281 \\ 19,227 & & 15,699 \\ 40,004 & & 41,351 \\ \cline { 2 - 3 } 35,017 & 73,331 \\ 91,080 & & 110,255 \\ 9,593 & & 13,479 \\ 15,744 & & 20,084 \\ 769 & 598 \\ \hline 182,203 & & 217,747 \end{tabular} Commitments and contingencies (Note 9) Stockholders' equity: Common stock, par value of $0.01 per share; 250,000,000 shares authorized as of March 31, 2022 and March 31, 2021;52,243,764 and 51,590,830 shares issued and outstanding as of March 31,2022 and March 31, 2021, respectively Additional paid-in capital Accumulated deficit Total stockholders' equity Total liabilities and stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started