Question

Using Walgreens Boots Alliance: Determine the most recent stock price and the total dividends paid over the past year. Calculate the current dividend yield on

Using Walgreens Boots Alliance:

Determine the most recent stock price and the total dividends paid over the past year.

Calculate the current dividend yield on the stock.

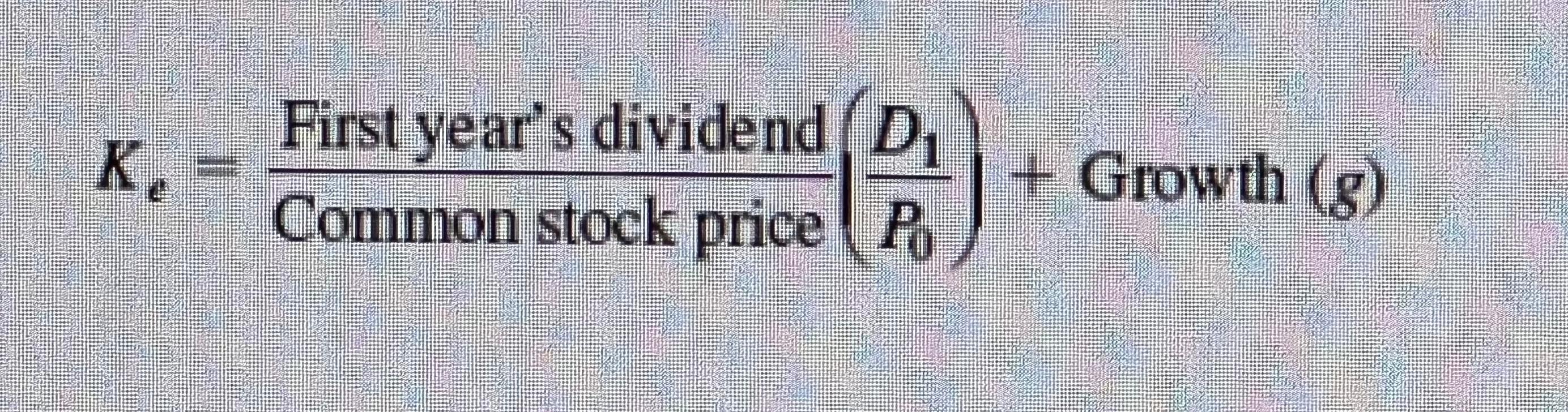

Calculate the required rate of return (Ke) for an investment in the common stock. You should use formula 10-9 in the textbook to do this calculation and use an assumed growth rate of 5%.

Identify the current P/E ratio for the company from a source such as Yahoo! Finance or Barron’s.

Show your calculations of the dividend yield and required rate of return (Ke), and present the P/E ratio. Explain the relationship between your chosen company’s Ke and P/E ratio and what that relationship indicates about the risk of the company’s future cash flows. Explain whether the general relationship between a high Ke and a low P/E ratio (or low Ke and high P/E ratio) is supported by the data for your chosen publicly traded company. Predict the impact on the company’s stock price based on your forecast that the company will grow its dividends by a rate higher than 5%. Compare your company’s P/E ratio with the P/E ratios of two other companies in its industry. Hypothesize which company in this industry should have the lowest Ke based on the P/E comparisons. Summarize the connection between a company’s growth rate, its required rate of return, and its value (stock price).

K First year's dividend D Common stock price Po + Growth (g)

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

K e Required rate of return GGM Gordon Growth Model PE Price to Earnings TTM Trailing Twelve Months Walmart would be a good company to begin the analysis with since it is dividendpaying as well as an ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started