Question

USING WALMART 10 K REPORT https://201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf MAKE A REPORT USING THE DIRECTION BELOW Directions for the SEC Written Assignment. As stated in the Syllabus, for

USING WALMART 10 K REPORT

https://201.q4cdn.com/262069030/files/doc_financials/2023/ar/Walmart-10K-Reports-Optimized.pdf

MAKE A REPORT USING THE DIRECTION BELOW

Directions for the SEC Written Assignment. As stated in the Syllabus, for this assignment you will discuss your chosen company. You should introduce the company, giving a brief history and background. Also, you should report on the company's results for the fiscal year, based on the Annual Report (10-K) you reviewed. Some of the information is about some of the items you have already looked for when you posted to the discussion forums or prepared your Powerpoint slides. You should also define some of the basic accounting terms you have learned in the course, based on a citable source. Then explain how those terms apply to your company's results. Here is more detail on the things you should discuss.

Introduction

Here are suggested topics for your introduction. Discuss the history of company, founders of the company, what the core business is (i.e., what does the company sell?), who are its customers (i.e., are they consumers, other businesses, a combination?). Do not give a 100-year summary of the company!

Provide some demographic information such as number of employees, where the company sells its' products (domestically, globally, online, bricks-and-mortar stores, etc), location of production facilities (if company is a manufacturer) or stores (if a retailer). You can also discuss who the company's competitors are, any recent changes in the company's operations, or the company's evolution over time.

Keep the introduction brief, and please do not copy and paste from your sources! Use your own words. Most of what you are presenting is factual, so each paragraph should have at least one citation. Most of the facts will likely be from parts of the company's website or from the 10K.

Financial results (Most of your paper will be in this section)

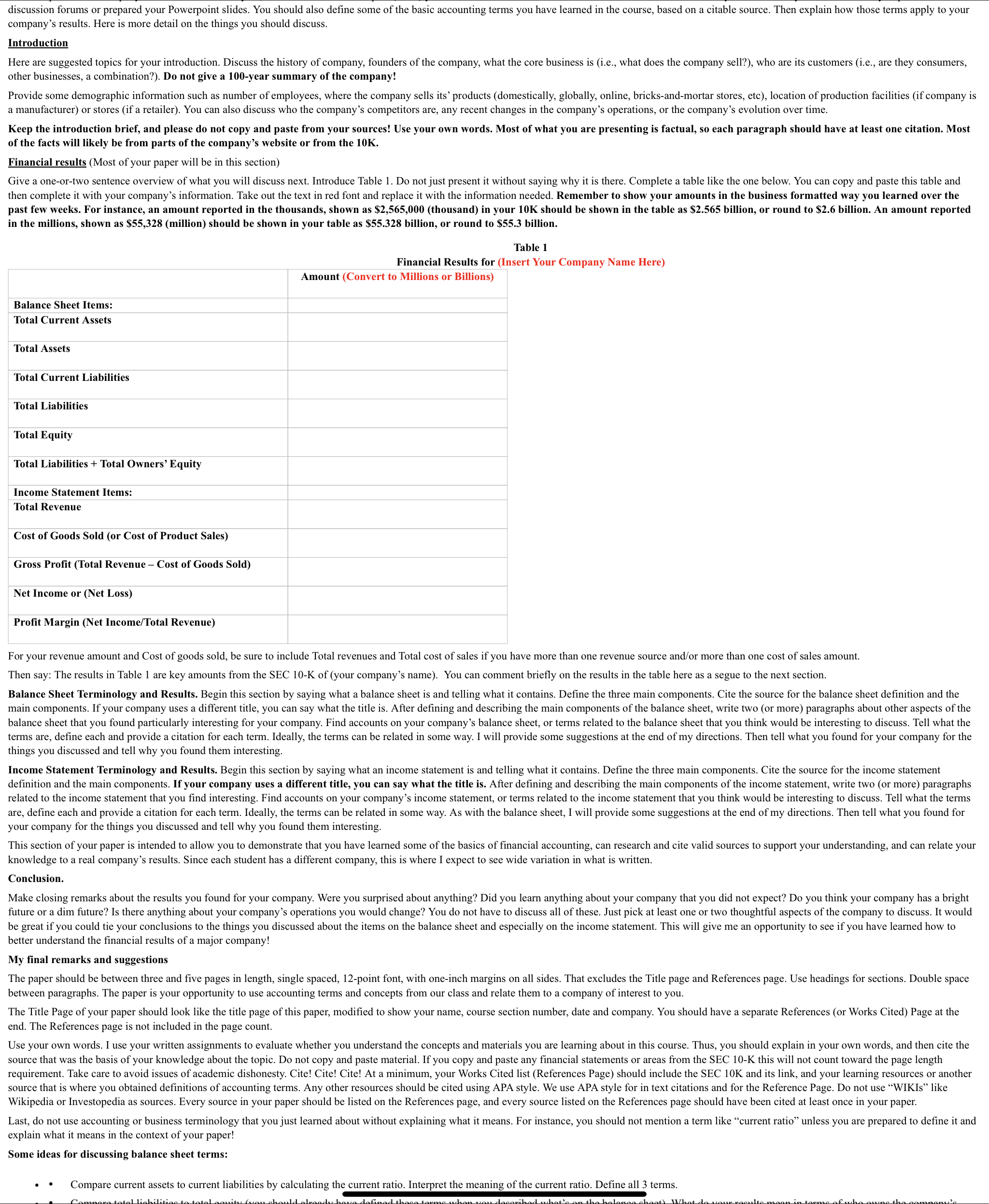

Give a one-or-two sentence overview of what you will discuss next. Introduce Table 1. Do not just present it without saying why it is there. Complete a table like the one below. You can copy and paste this table and then complete it with your company's information. Take out the text in red font and replace it with the information needed. Remember to show your amounts in the business formatted way you learned over the past few weeks. For instance, an amount reported in the thousands, shown as $2,565,000 (thousand) in your 10K should be shown in the table as $2.565 billion, or round to $2.6 billion. An amount reported in the millions, shown as $55,328 (million) should be shown in your table as $55.328 billion, or round to $55.3 billion.

Table 1

Financial Results for (Insert Your Company Name Here)

| Amount (Convert to Millions or Billions) |

Balance Sheet Items: |

|

Total Current Assets |

|

Total Assets |

|

Total Current Liabilities |

|

Total Liabilities |

|

Total Equity |

|

Total Liabilities + Total Owners' Equity |

|

Income Statement Items: |

|

Total Revenue |

|

Cost of Goods Sold (or Cost of Product Sales) |

|

Gross Profit (Total Revenue - Cost of Goods Sold) |

|

Net Income or (Net Loss) |

|

Profit Margin (Net Income/Total Revenue) |

|

For your revenue amount and Cost of goods sold, be sure to include Total revenues and Total cost of sales if you have more than one revenue source and/or more than one cost of sales amount.

Then say: The results in Table 1 are key amounts from the SEC 10-K of (your company's name). You can comment briefly on the results in the table here as a segue to the next section.

Balance Sheet Terminology and Results. Begin this section by saying what a balance sheet is and telling what it contains. Define the three main components. Cite the source for the balance sheet definition and the main components. If your company uses a different title, you can say what the title is. After defining and describing the main components of the balance sheet, write two (or more) paragraphs about other aspects of the balance sheet that you found particularly interesting for your company. Find accounts on your company's balance sheet, or terms related to the balance sheet that you think would be interesting to discuss. Tell what the terms are, define each and provide a citation for each term. Ideally, the terms can be related in some way. I will provide some suggestions at the end of my directions. Then tell what you found for your company for the things you discussed and tell why you found them interesting.

Income Statement Terminology and Results. Begin this section by saying what an income statement is and telling what it contains. Define the three main components. Cite the source for the income statement definition and the main components. If your company uses a different title, you can say what the title is. After defining and describing the main components of the income statement, write two (or more) paragraphs related to the income statement that you find interesting. Find accounts on your company's income statement, or terms related to the income statement that you think would be interesting to discuss. Tell what the terms are, define each and provide a citation for each term. Ideally, the terms can be related in some way. As with the balance sheet, I will provide some suggestions at the end of my directions. Then tell what you found for your company for the things you discussed and tell why you found them interesting.

This section of your paper is intended to allow you to demonstrate that you have learned some of the basics of financial accounting, can research and cite valid sources to support your understanding, and can relate your knowledge to a real company's results. Since each student has a different company, this is where I expect to see wide variation in what is written.

Conclusion.

Make closing remarks about the results you found for your company. Were you surprised about anything? Did you learn anything about your company that you did not expect? Do you think your company has a bright future or a dim future? Is there anything about your company's operations you would change? You do not have to discuss all of these. Just pick at least one or two thoughtful aspects of the company to discuss. It would be great if you could tie your conclusions to the things you discussed about the items on the balance sheet and especially on the income statement. This will give me an opportunity to see if you have learned how to better understand the financial results of a major company!

discussion forums or prepared your Powerpoint slides. You should also define some of the basic accounting terms you have learned in the course, based on a citable source. Then explain how those terms apply to your company's results. Here is more detail on the things you should discuss. Introduction Here are suggested topics for your introduction. Discuss the history of company, founders of the company, what the core business is (i.e., what does the company sell?), who are its customers (i.e., are they consumers, other businesses, a combination?). Do not give a 100-year summary of the company! Provide some demographic information such as number of employees, where the company sells its' products (domestically, globally, online, bricks-and-mortar stores, etc), location of production facilities (if company is a manufacturer) or stores (if a retailer). You can also discuss who the company's competitors are, any recent changes in the company's operations, or the company's evolution over time. Keep the introduction brief, and please do not copy and paste from your sources! Use your own words. Most of what you are presenting is factual, so each paragraph should have at least one citation. Most of the facts will likely be from parts of the company's website or from the 10K. Financial results (Most of your paper will be in this section) Give a one-or-two sentence overview of what you will discuss next. Introduce Table 1. Do not just present it without saying why it is there. Complete a table like the one below. You can copy and paste this table and then complete it with your company's information. Take out the text in red font and replace it with the information needed. Remember to show your amounts in the business formatted way you learned over the past few weeks. For instance, an amount reported in the thousands, shown as $2,565,000 (thousand) in your 10K should be shown in the table as $2.565 billion, or round to $2.6 billion. An amount reported in the millions, shown as $55,328 (million) should be shown in your table as $55.328 billion, or round to $55.3 billion. Table 1 Balance Sheet Items: Financial Results for (Insert Your Company Name Here) Amount (Convert to Millions or Billions) Total Current Assets Total Assets Total Current Liabilities Total Liabilities Total Equity Total Liabilities + Total Owners' Equity Income Statement Items: Total Revenue Cost of Goods Sold (or Cost of Product Sales) Gross Profit (Total Revenue - Cost of Goods Sold) Net Income or (Net Loss) Profit Margin (Net Income/Total Revenue) For your revenue amount and Cost of goods sold, be sure to include Total revenues and Total cost of sales if you have more than one revenue source and/or more than one cost of sales amount. Then say: The results in Table 1 are key amounts from the SEC 10-K of (your company's name). You can comment briefly on the results in the table here as a segue to the next section. Balance Sheet Terminology and Results. Begin this section by saying what a balance sheet is and telling what it contains. Define the three main components. Cite the source for the balance sheet definition and the main components. If your company uses a different title, you can say what the title is. After defining and describing the main components of the balance sheet, write two (or more) paragraphs about other aspects of the balance sheet that you found particularly interesting for your company. Find accounts on your company's balance sheet, or terms related to the balance sheet that you think would be interesting to discuss. Tell what the terms are, define each and provide a citation for each term. Ideally, the terms can be related in some way. I will provide some suggestions at the end of my directions. Then tell what you found for your company for the things you discussed and tell why you found them interesting. Income Statement Terminology and Results. Begin this section by saying what an income statement is and telling what it contains. Define the three main components. Cite the source for the income statement definition and the main components. If your company uses a different title, you can say what the title is. After defining and describing the main components of the income statement, write two (or more) paragraphs related to the income statement that you find interesting. Find accounts on your company's income statement, or terms related to the income statement that you think would be interesting to discuss. Tell what the terms are, define each and provide a citation for each term. Ideally, the terms can be related in some way. As with the balance sheet, I will provide some suggestions at the end of my directions. Then tell what you found for your company for the things you discussed and tell why you found them interesting. This section of your paper is intended to allow you to demonstrate that you have learned some of the basics of financial accounting, can research and cite valid sources to support your understanding, and can relate your knowledge to a real company's results. Since each student has a different company, this is where I expect to see wide variation in what is written. Conclusion. Make closing remarks about the results you found for your company. Were you surprised about anything? Did you learn anything about your company that you did not expect? Do you think your company has a bright future or a dim future? Is there anything about your company's operations you would change? You do not have to discuss all of these. Just pick at least one or two thoughtful aspects of the company to discuss. It would be great if you could tie your conclusions to the things you discussed about the items on the balance sheet and especially on the income statement. This will give me an opportunity to see if you have learned how to better understand the financial results of a major company! My final remarks and suggestions The paper should be between three and five pages in length, single spaced, 12-point font, with one-inch margins on all sides. That excludes the Title page and References page. Use headings for sections. Double space between paragraphs. The paper is your opportunity to use accounting terms and concepts from our class and relate them to a company of interest to you. The Title Page of your paper should look like the title page of this paper, modified to show your name, course section number, date and company. You should have a separate References (or Works Cited) Page at the end. The References page is not included in the page count. Use your own words. I use your written assignments to evaluate whether you understand the concepts and materials you are learning about in this course. Thus, you should explain in your own words, and then cite the source that was the basis of your knowledge about the topic. Do not copy and paste material. If you copy and paste any financial statements or areas from the SEC 10-K this will not count toward the page length requirement. Take care to avoid issues of academic dishonesty. Cite! Cite! Cite! At a minimum, your Works Cited list (References Page) should include the SEC 10K and its link, and your learning resources or another source that is where you obtained definitions of accounting terms. Any other resources should be cited using APA style. We use APA style for in text citations and for the Reference Page. Do not use "WIKIS" like Wikipedia or Investopedia as sources. Every source in your paper should be listed on the References page, and every source listed on the References page should have been cited at least once in your paper. Last, do not use accounting or business terminology that you just learned about without explaining what it means. For instance, you should not mention a term like "current ratio" unless you are prepared to define it and explain what it means in the context of your paper! Some ideas for discussing balance sheet terms: Compare current assets to current liabilities by calculating the current ratio. Interpret the meaning of the current ratio. Define all 3 terms. Compare total liabilities to total equity (vou should olroodu hove defined these terms when you described what's on the balance sheet). What do your results mean in terms of who owns the company's

Step by Step Solution

There are 3 Steps involved in it

Step: 1

ANSWER Introduction Walmart founded by Sam Walton in 1962 has grown from a single discount store to one of the worlds largest multinational retail corporations With its headquarters in Bentonville Ark...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started