Using what I provided, please finish "REQ 4" I am stuck! I provided the other parts that are finished as a help.

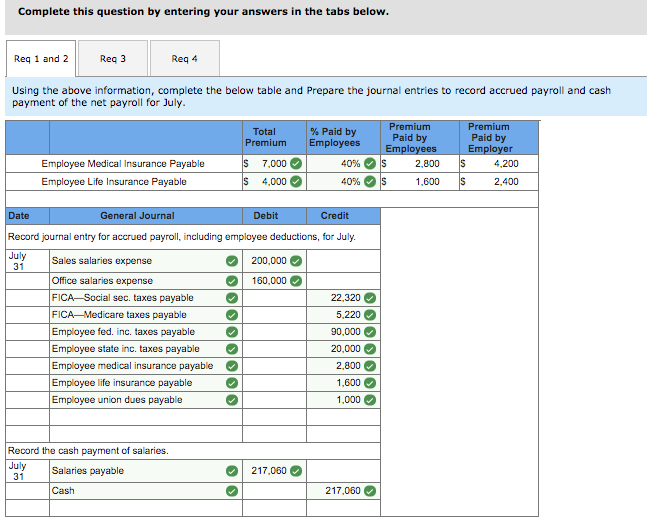

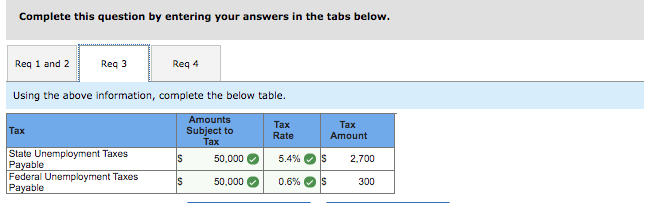

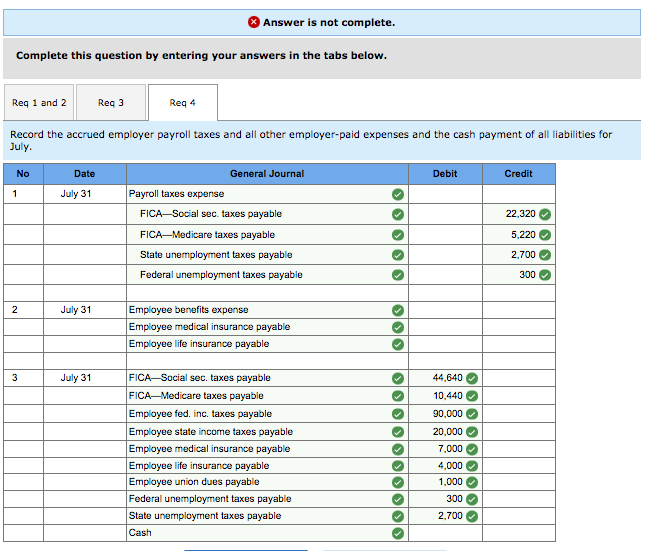

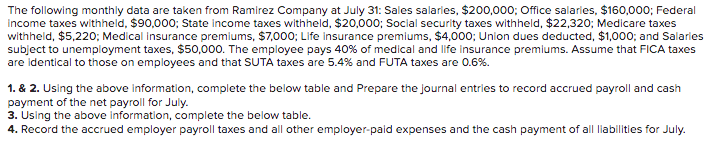

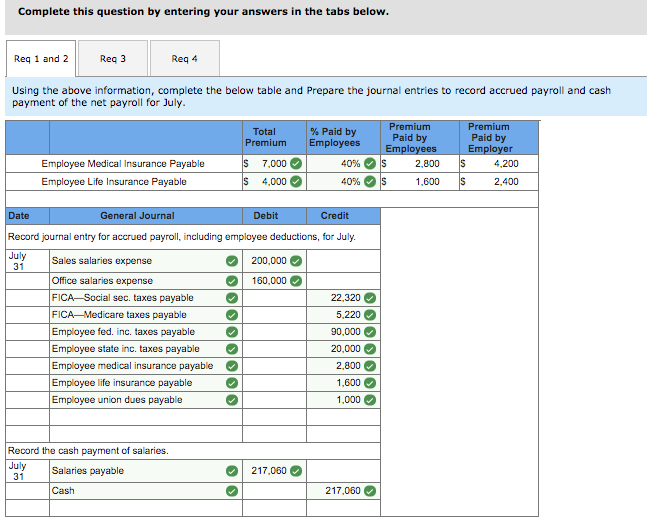

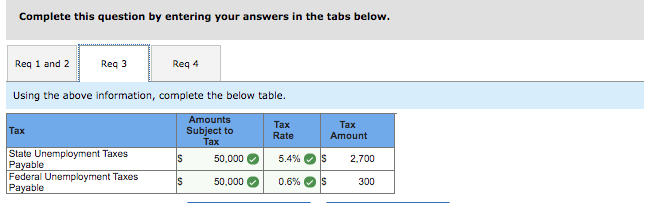

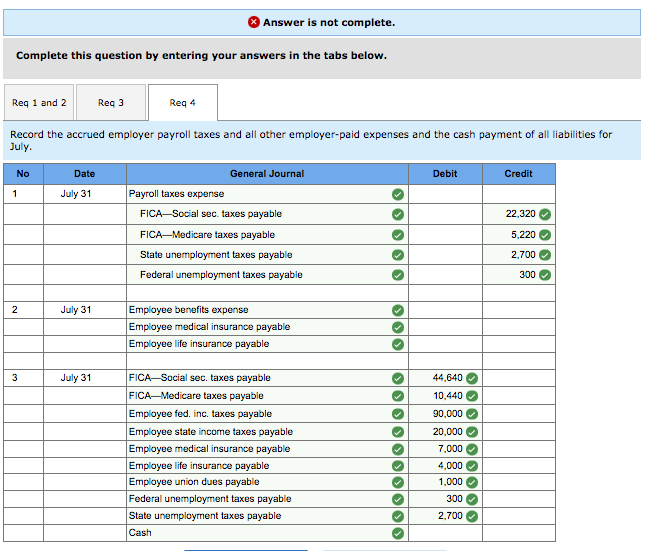

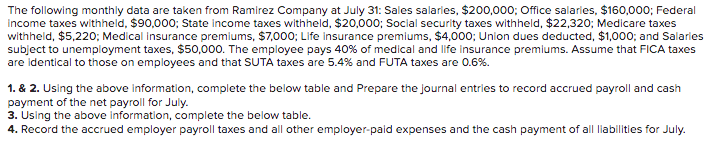

Complete this question by entering your answers in the tabs below. Req 1 and 2 Req3 Req 4 Using the above information, complete the below table and prepare the journal entries to record accrued payroll and cash payment of the net payroll for July. Total Premium % Paid by Employees Premium Paid by Employees S 2,800 Premium Paid by Employer IS 4,200 S 2.400 40% Employee Medical Insurance Payable Employee Life Insurance Payable S 7.000 IS 4,000 40% S 1,600 Date General Journal Debit Credit Record journal entry for accrued payroll, including employee deductions, for July. July 31 Sales salaries expense 200.000 Office salaries expense 160.000 FICA Social sec, taxes payable 22.320 FICA-Medicare taxes payable 5,220 Employee fed. inc. taxes payable 90,000 Employee state inc. taxes payable 20,000 Employee medical insurance payable 2.800 Employee life insurance payable 1,600 Employee union dues payable 1.000 Record the cash payment of salaries, July Salaries payable 31 Cash 217.060 217,060 Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Reg 4 Using the above information, complete the below table. Tax Amounts Subject to Tax 50,000 Tax Rate Tax Amount S 5.4% S 2,700 State Unemployment Taxes Payable Federal Unemployment Taxes Payable S 50,000 0.6% S 300 Answer is not complete. Complete this question by entering your answers in the tabs below. Req 1 and 2 Reg 3 Req 4 Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July No Date Debit Credit 1 July 31 22,320 General Journal Payroll taxes expense FICA-Social sec, taxes payable FICA-Medicare taxes payable State unemployment taxes payable Federal unemployment taxes payable 5,220 00 2,700 300 OO 2 July 31 Employee benefits expense Employee medical insurance payable Employee life insurance payable OOO 3 July 31 FICA-Social sec. taxes payable FICAMedicare taxes payable Employee fed. inc. taxes payable Employee state income taxes payable Employee medical insurance payable Employee life insurance payable Employee union dues payable Federal unemployment taxes payable State unemployment taxes payable Cash 44,640 10,440 90.000 20.000 7.000 4,000 1,000 300 2.700 The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $200,000; Office salaries, $160,000; Federal income taxes withheld, $90,000; State income taxes withheld, $20,000: Social security taxes withheld, $22,320; Medicare taxes withheld, $5,220; Medical insurance premiums, $7,000; Life insurance premiums, $4.000: Union dues deducted $1,000; and Salaries subject to unemployment taxes, $50,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll and cash payment of the net payroll for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and all other employer-paid expenses and the cash payment of all liabilities for July