Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using Worksheets to Create Adjusting Entries and Financial Statements Part 1: Barnes Wallis Enterprises A Senior Manager at Barnes Wallis Enterprises has just emailed you

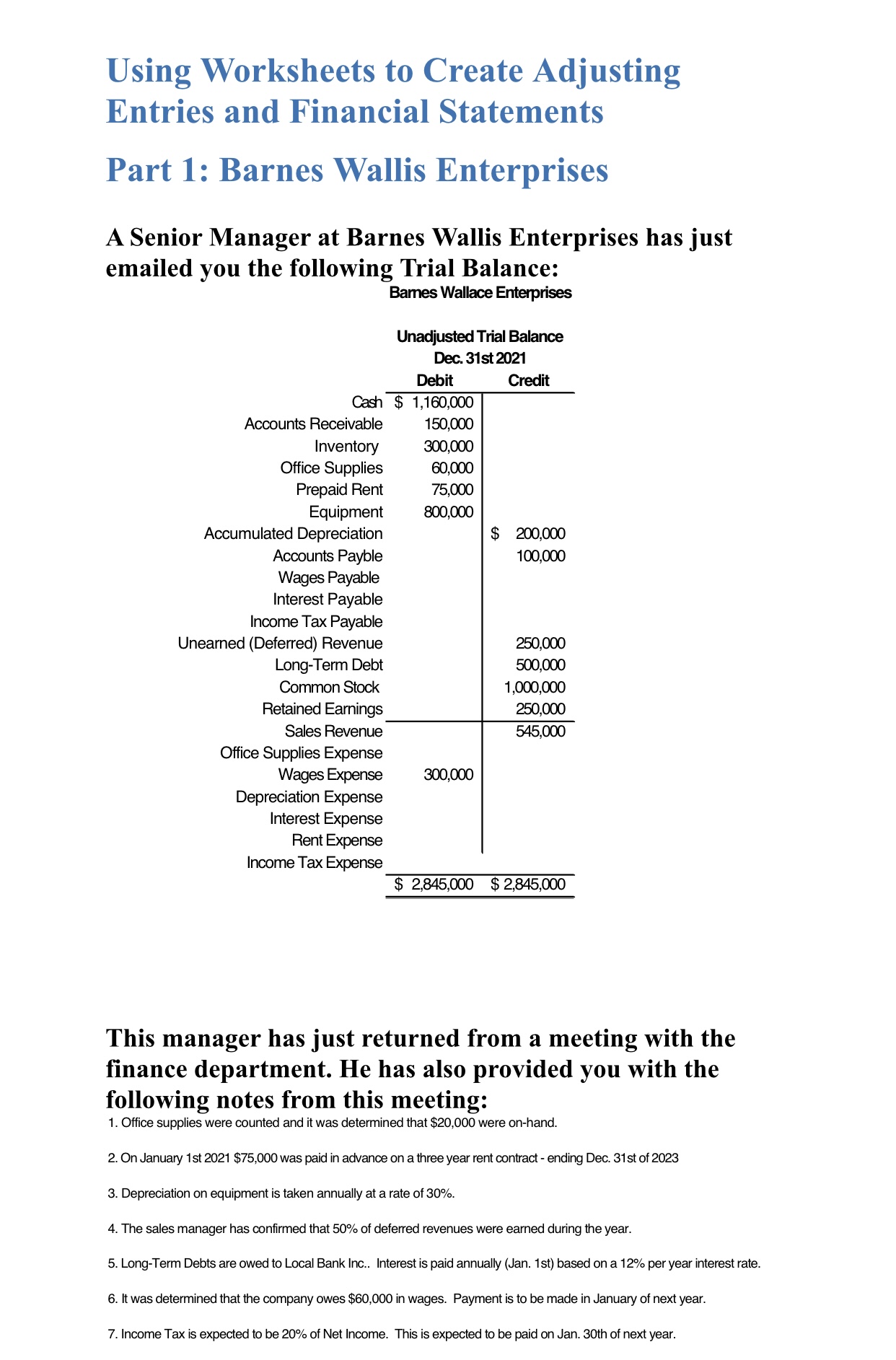

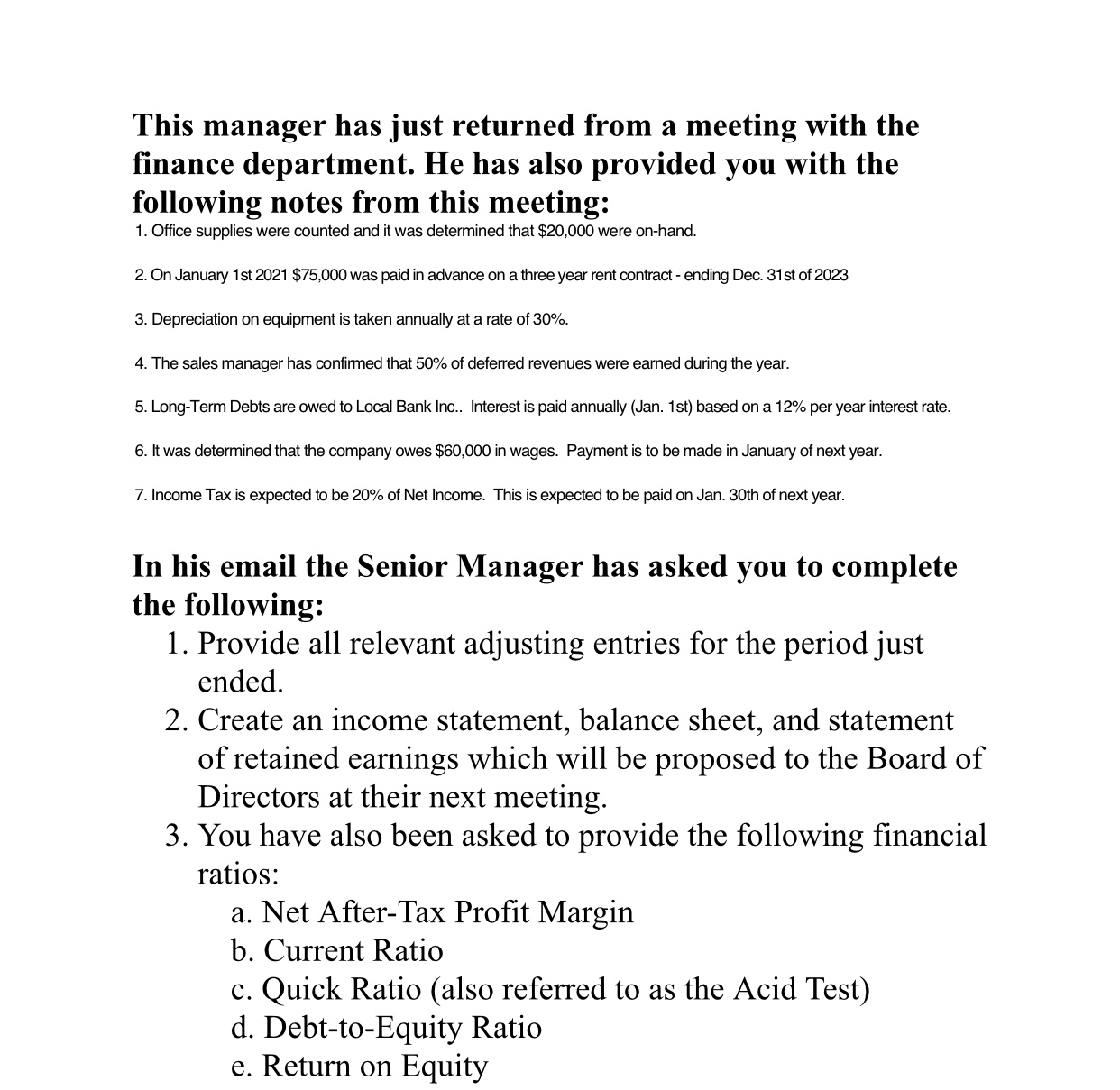

Using Worksheets to Create Adjusting Entries and Financial Statements Part 1: Barnes Wallis Enterprises A Senior Manager at Barnes Wallis Enterprises has just emailed you the following Trial Balance: Barmes Wallace Enterprises This manager has just returned from a meeting with the finance department. He has also provided you with the following notes from this meeting: 1. Office supplies were counted and it was determined that $20,000 were on-hand. 2. On January 1st 2021$75,000 was paid in advance on a three year rent contract - ending Dec. 31st of 2023 3. Depreciation on equipment is taken annually at a rate of 30%. 4. The sales manager has confirmed that 50% of deferred revenues were earned during the year. 5. Long-Term Debts are owed to Local Bank Inc.. Interest is paid annually (Jan. 1st) based on a 12% per year interest rate. 6. It was determined that the company owes $60,000 in wages. Payment is to be made in January of next year. 7. Income Tax is expected to be 20% of Net Income. This is expected to be paid on Jan. 30th of next year. This manager has just returned from a meeting with the finance department. He has also provided you with the following notes from this meeting: 1. Office supplies were counted and it was determined that $20,000 were on-hand. 2. On January 1st 2021$75,000 was paid in advance on a three year rent contract - ending Dec. 31st of 2023 3. Depreciation on equipment is taken annually at a rate of 30%. 4. The sales manager has confirmed that 50% of deferred revenues were earned during the year. 5. Long-Term Debts are owed to Local Bank Inc.. Interest is paid annually (Jan. 1st) based on a 12\% per year interest rate. 6. It was determined that the company owes $60,000 in wages. Payment is to be made in January of next year. 7. Income Tax is expected to be 20% of Net Income. This is expected to be paid on Jan. 30th of next year. In his email the Senior Manager has asked you to complete the following: 1. Provide all relevant adjusting entries for the period just ended. 2. Create an income statement, balance sheet, and statement of retained earnings which will be proposed to the Board of Directors at their next meeting. 3. You have also been asked to provide the following financial ratios: a. Net After-Tax Profit Margin b. Current Ratio c. Quick Ratio (also referred to as the Acid Test) d. Debt-to-Equity Ratio e. Return on Equity

Using Worksheets to Create Adjusting Entries and Financial Statements Part 1: Barnes Wallis Enterprises A Senior Manager at Barnes Wallis Enterprises has just emailed you the following Trial Balance: Barmes Wallace Enterprises This manager has just returned from a meeting with the finance department. He has also provided you with the following notes from this meeting: 1. Office supplies were counted and it was determined that $20,000 were on-hand. 2. On January 1st 2021$75,000 was paid in advance on a three year rent contract - ending Dec. 31st of 2023 3. Depreciation on equipment is taken annually at a rate of 30%. 4. The sales manager has confirmed that 50% of deferred revenues were earned during the year. 5. Long-Term Debts are owed to Local Bank Inc.. Interest is paid annually (Jan. 1st) based on a 12% per year interest rate. 6. It was determined that the company owes $60,000 in wages. Payment is to be made in January of next year. 7. Income Tax is expected to be 20% of Net Income. This is expected to be paid on Jan. 30th of next year. This manager has just returned from a meeting with the finance department. He has also provided you with the following notes from this meeting: 1. Office supplies were counted and it was determined that $20,000 were on-hand. 2. On January 1st 2021$75,000 was paid in advance on a three year rent contract - ending Dec. 31st of 2023 3. Depreciation on equipment is taken annually at a rate of 30%. 4. The sales manager has confirmed that 50% of deferred revenues were earned during the year. 5. Long-Term Debts are owed to Local Bank Inc.. Interest is paid annually (Jan. 1st) based on a 12\% per year interest rate. 6. It was determined that the company owes $60,000 in wages. Payment is to be made in January of next year. 7. Income Tax is expected to be 20% of Net Income. This is expected to be paid on Jan. 30th of next year. In his email the Senior Manager has asked you to complete the following: 1. Provide all relevant adjusting entries for the period just ended. 2. Create an income statement, balance sheet, and statement of retained earnings which will be proposed to the Board of Directors at their next meeting. 3. You have also been asked to provide the following financial ratios: a. Net After-Tax Profit Margin b. Current Ratio c. Quick Ratio (also referred to as the Acid Test) d. Debt-to-Equity Ratio e. Return on Equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started