Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using yahoo finance to find Motorola's price data from December 31, 2013 - December 31, 2016. I need to find the stock price, market price,

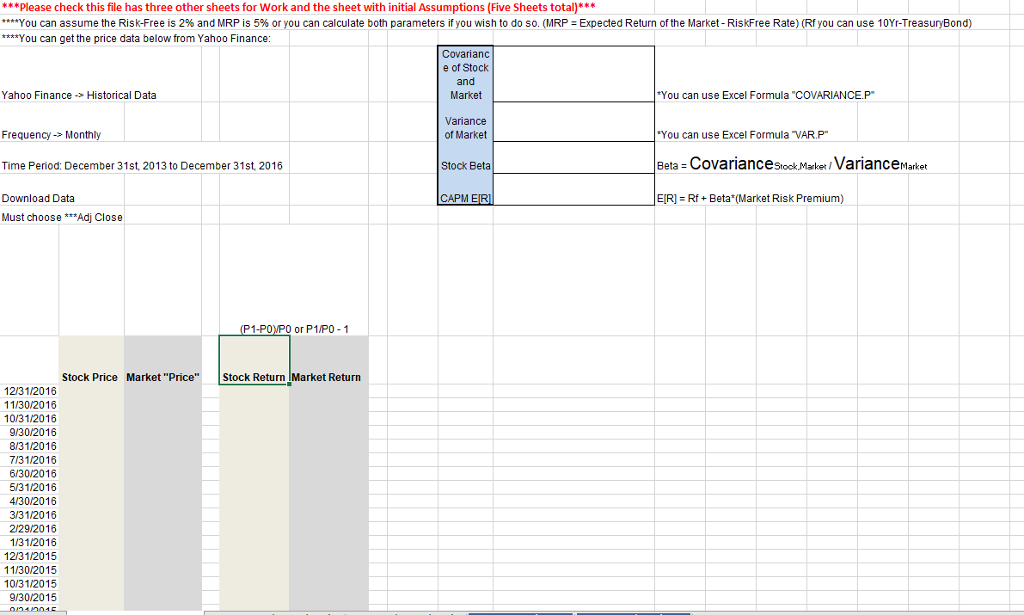

Using yahoo finance to find Motorola's price data from December 31, 2013 - December 31, 2016. I need to find the stock price, market price, stock return, beta, and covariance. Attached is a spread sheet of what the Hw looks like. Please do all work on excel.

How did you find the market price?

***Please check this file has three other sheets for Work and the sheet with initial Assumptions (Five Sheets total)*** ****You can assume the Risk-Free is 2% and MRP is 5% or you can calculate both parameters if you wish to do so. (MRP = Expected Return of the Market - RiskFree Rate) (Rf you can use 10Yr-TreasuryBond) ****You can get the price data below from Yahoo Finance: Covarianc e of Stock and Yahoo Finance -> Historical Data Market *You can use Excel Formula "COVARIANCE.P Frequency -> Monthly Variance of Market "You can use Excel Formula "VAR.P Time Period: December 31st, 2013 to December 31st, 2016 Stock Beta Beta-Covariance Stock Market/VarianceMarket CAPM EIRI E[R] =Rf + Beta (Market Risk Premium) Download Data Must choose ***Adj Close (P1-POMPO or P1/P0 - 1 Stock Return Market Return Stock Price Market "Price" 12/31/2016 11/30/2016 10/31/2016 9/30/2016 8/31/2016 7/31/2016 6/30/2016 5/31/2016 4/30/2016 3/31/2016 2/29/2016 1/31/2016 12/31/2015 11/30/2015 10/31/2015 9/30/2015 041 ***Please check this file has three other sheets for Work and the sheet with initial Assumptions (Five Sheets total)*** ****You can assume the Risk-Free is 2% and MRP is 5% or you can calculate both parameters if you wish to do so. (MRP = Expected Return of the Market - RiskFree Rate) (Rf you can use 10Yr-TreasuryBond) ****You can get the price data below from Yahoo Finance: Covarianc e of Stock and Yahoo Finance -> Historical Data Market *You can use Excel Formula "COVARIANCE.P Frequency -> Monthly Variance of Market "You can use Excel Formula "VAR.P Time Period: December 31st, 2013 to December 31st, 2016 Stock Beta Beta-Covariance Stock Market/VarianceMarket CAPM EIRI E[R] =Rf + Beta (Market Risk Premium) Download Data Must choose ***Adj Close (P1-POMPO or P1/P0 - 1 Stock Return Market Return Stock Price Market "Price" 12/31/2016 11/30/2016 10/31/2016 9/30/2016 8/31/2016 7/31/2016 6/30/2016 5/31/2016 4/30/2016 3/31/2016 2/29/2016 1/31/2016 12/31/2015 11/30/2015 10/31/2015 9/30/2015 041Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started