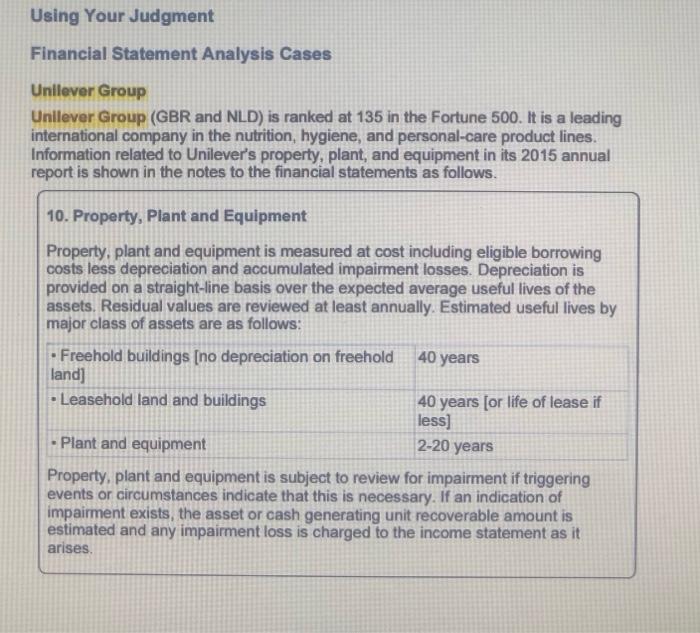

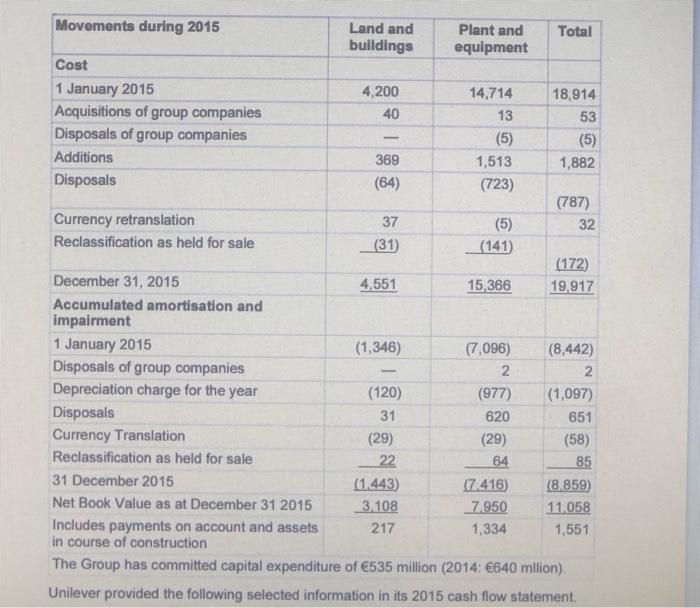

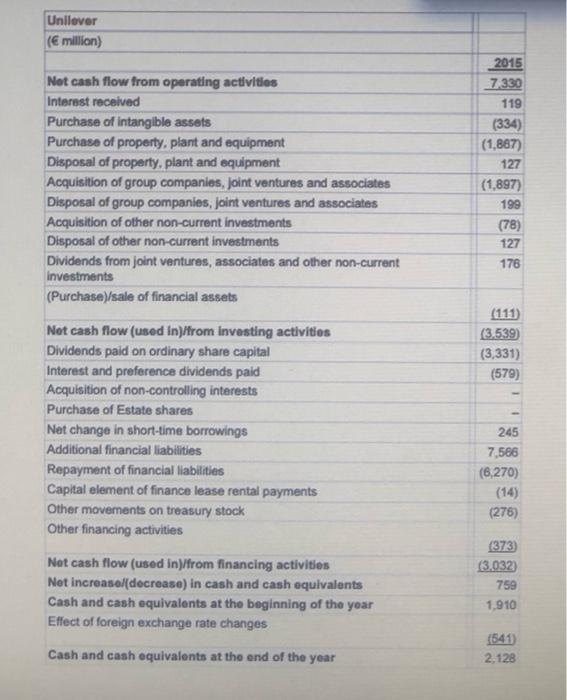

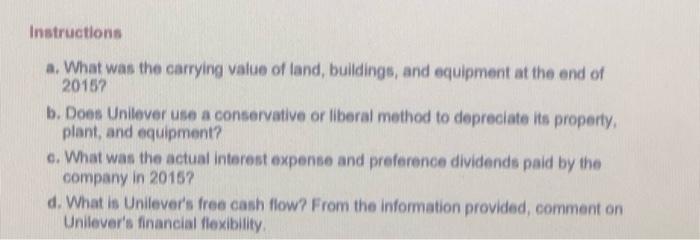

Using Your Judgment Financial Statement Analysis Cases Unilever Group Unilever Group (GBR and NLD) is ranked at 135 in the Fortune 500. It is a leading international company in the nutrition, hygiene, and personal-care product lines. Information related to Unilever's property, plant, and equipment in its 2015 annual report is shown in the notes to the financial statements as follows. 10. Property, Plant and Equipment Property, plant and equipment is measured at cost including eligible borrowing costs less depreciation and accumulated impairment losses. Depreciation is provided on a straight-line basis over the expected average useful lives of the assets. Residual values are reviewed at least annually. Estimated useful lives by major class of assets are as follows: - Freehold buildings (no depreciation on freehold 40 years land] - Leasehold land and buildings 40 years for life of lease if less] Plant and equipment Property, plant and equipment is subject to review for impairment if triggering events or circumstances indicate that this is necessary. If an indication of impairment exists, the asset or cash generating unit recoverable amount is estimated and any impairment loss is charged to the income statement as it arises. 2-20 years Movements during 2015 Land and Plant and Total buildings equipment Cost 1 January 2015 4,200 14,714 18,914 Acquisitions of group companies 40 13 53 Disposals of group companies (5) (5) Additions 369 1,513 1,882 Disposals (64) (723) (787) Currency retranslation 37 (5) 32 Reclassification as held for sale (31) (141 (172) December 31, 2015 4,551 15,366 19,917 Accumulated amortisation and impairment 1 January 2015 (1,346) (7,096) (8,442) Disposals of group companies 2 2. Depreciation charge for the year (120) (977) (1,097) Disposals 31 620 651 Currency Translation (29) (29) (58) Reclassification as held for sale 64 85 31 December 2015 (1.443) (7.416) (8.859) Net Book Value as at December 31 2015 3.108 7.950 11.058 Includes payments on account and assets 217 1,334 1,551 in course of construction The Group has committed capital expenditure of 535 million (2014: 640 milion) Unilever provided the following selected information in its 2015 cash flow statement. 22 Unilever ( million) Not cash flow from operating activities Interest received Purchase of intangible assets Purchase of property, plant and equipment Disposal of property, plant and equipment Acquisition of group companies, joint ventures and associates Disposal of group companies, joint ventures and associates Acquisition of other non-current investments Disposal of other non-current investments Dividends from joint ventures, associates and other non-current Investments (Purchase)/sale of financial assets 2015 7330 119 (334) (1,867) 127 (1,897) 199 (78) 127 178 (111) (3539) (3,331) (579) Not cash flow (used in)/from investing activities Dividends paid on ordinary share capital Interest and preference dividends paid Acquisition of non-controlling interests Purchase of Estate shares Net change in short-time borrowings Additional financial liabilities Repayment of financial liabilities Capital element of finance lease rental payments Other movements on treasury stock Other financing activities 245 7,586 (6,270) (14) (276) Net cash flow (used in)/from financing activities Net increasel(decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of the year Effect of foreign exchange rate changes (373) (3.032) 759 1,910 Cash and cash equivalents at the end of the year (541 2.128 Instructions a. What was the carrying value of land, buildings, and equipment at the end of 2015? b. Does Unilever use a conservative or liberal method to depreciate its property, plant, and equipment? c. What was the actual interest expense and preference dividends paid by the company in 2015? d. What is Unilever's free cash flow? From the information provided, comment on Unilever's financial flexibility