uss the same chart for 4 and 5 as well

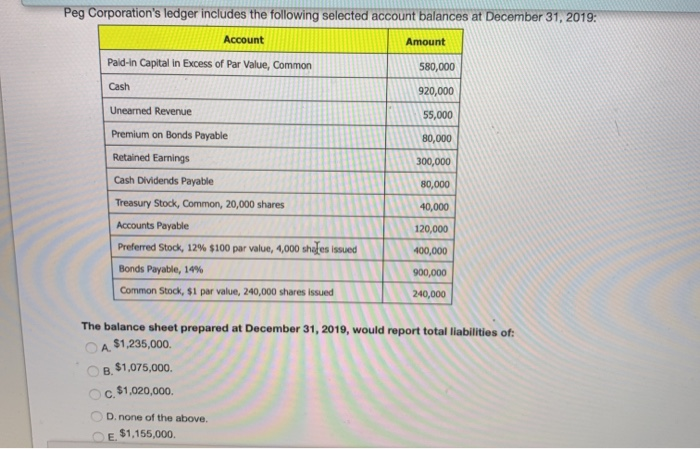

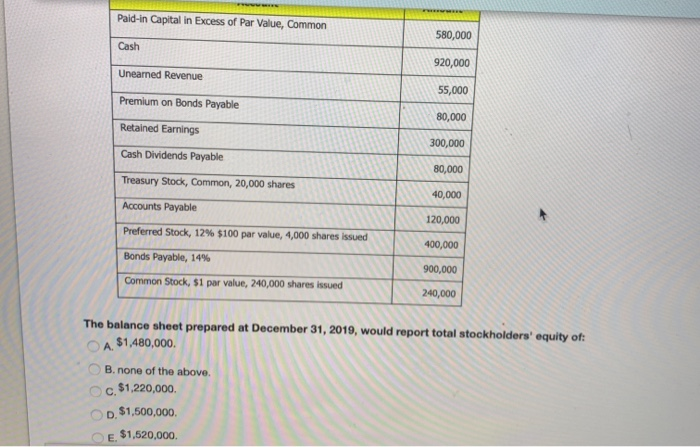

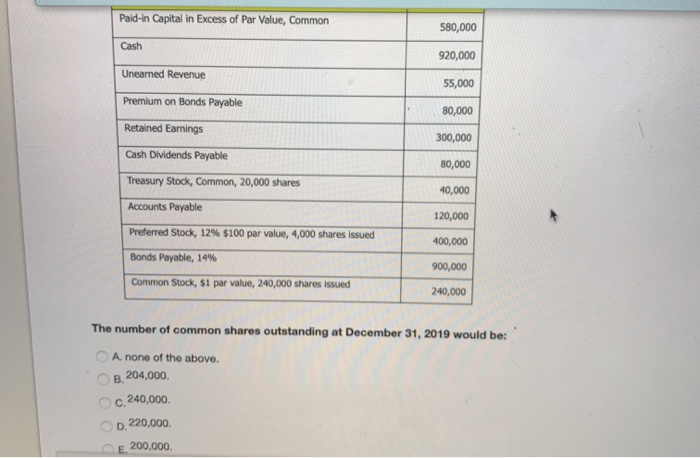

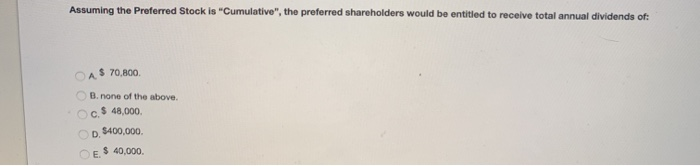

Peg Corporation's ledger includes the following selected account balances at December 31, 2019: Account Amount Paid-in Capital in Excess of Par Value, Common Cash Unearned Revenue Premium on Bonds Payable Retained Earnings Cash Dividends Payable Treasury Stock, Common, 20,000 shares Accounts Payable Preferred Stock, 12% $100 par value, 4,000 Bonds Payable, 19% Common Stock, $1 par value, 240,000 shares 580,000 920,000 55,000 80,000 300,000 80,000 40,000 120,000 400,000 900,000 240,000 port total liabilities of: The balance sheet prepared at December 31, 20 A $1,235,000 B. $1,075,000. c. $1,020,000 D.none of the above. E $1,155,000 Pald-in Capital in Excess of Par Value, Common 580,000 Cash 920,000 55,000 Unearned Revenue Premium on Bonds Payable 80,000 Retained Earnings 300,000 Cash Dividends Payable 80,000 Treasury Stock, Common, 20,000 shares Accounts Payable Preferred Stock, 12% $100 par value, 4,000 shares issued Bonds Payable, 14% Common Stock, $1 par value, 240,000 shares issued 40,000 120,000 400,000 900,000 240,000 The balance sheet prepared at December 31, 2019, would report total stockholders' equity of: A $1,480,000 B. none of the above. c. $1,220,000 D. $1,500,000 $1.520,000 Paid-in Capital in Excess of Par Value, Common 580,000 Cash 920,000 Unearned Revenue 55,000 Premium on Bonds Payable 80,000 Retained Earnings 300,000 Cash Dividends Payable 80,000 Treasury Stock, Common, 20,000 shares 40,000 Accounts Payable 120,000 Preferred Stock, 12% $100 par value, 4,000 shares issued Bonds Payable, 14% 400,000 900,000 240,000 Common Stock, $1 par value, 240,000 shares issued The number of common shares outstanding at December 31, 2019 would be: A none of the above. B. 204,000 c.240,000 E. 200,000 Assuming the Preferred Stock is "Cumulative", the preferred shareholders would be entitled to receive total annual dividends of: CA$ 70,800. B. none of the above. c. $ 48,000 $400,000 40,000 How much is the book value per share of common stock at December 31, 2019, assuming the preferred stock's liquidation value is equal to the par value and there are no dividends in arrears? (Round answer to the nearest whole cent.) A $6.82 OB 56.91 c $3.73 OD 14.01 E none of the above