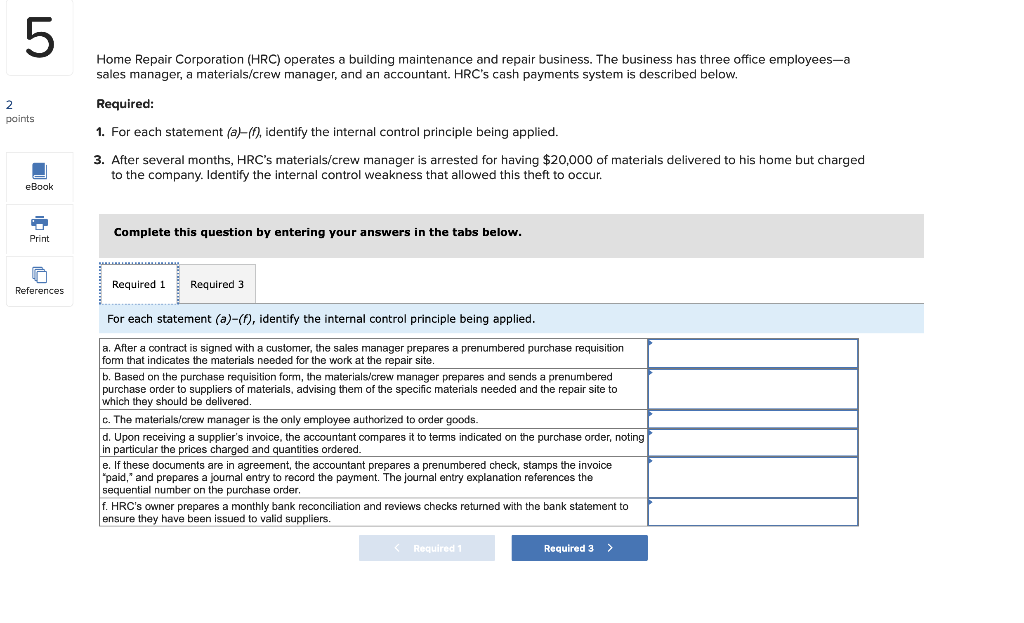

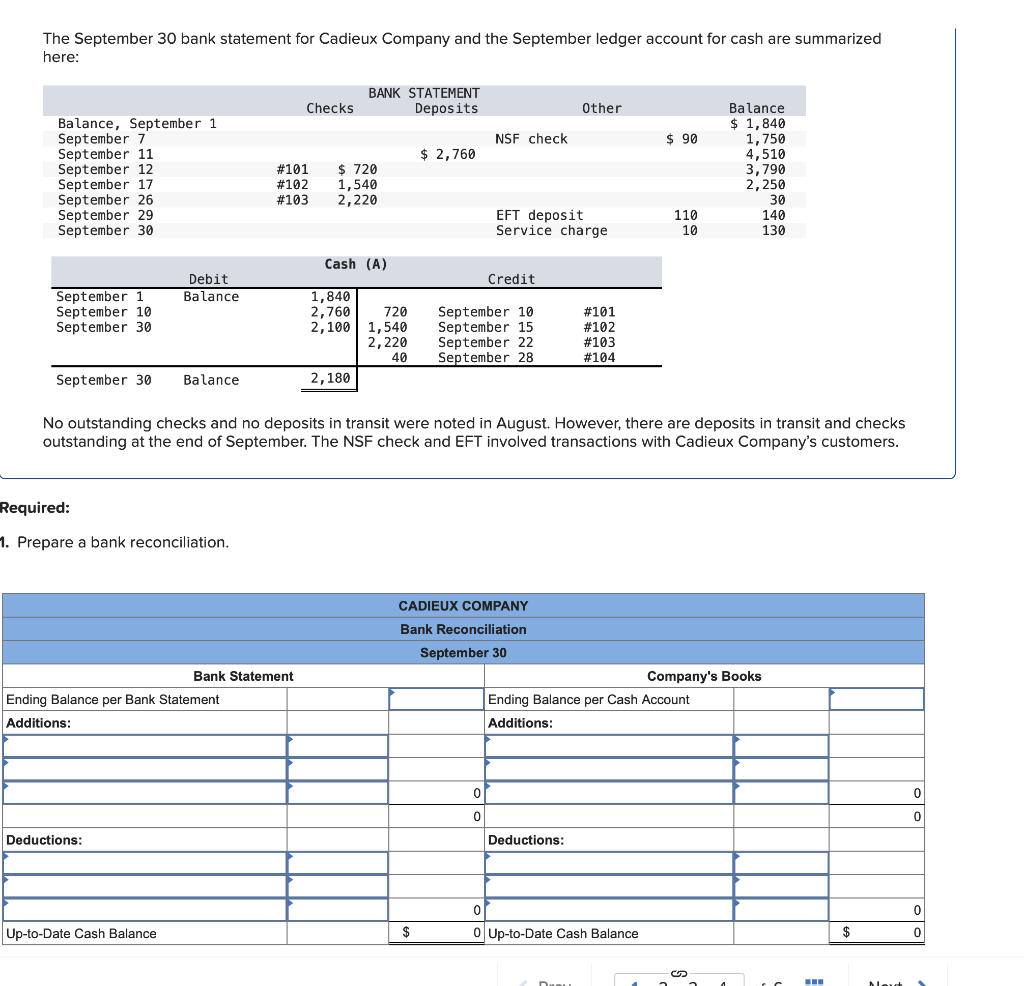

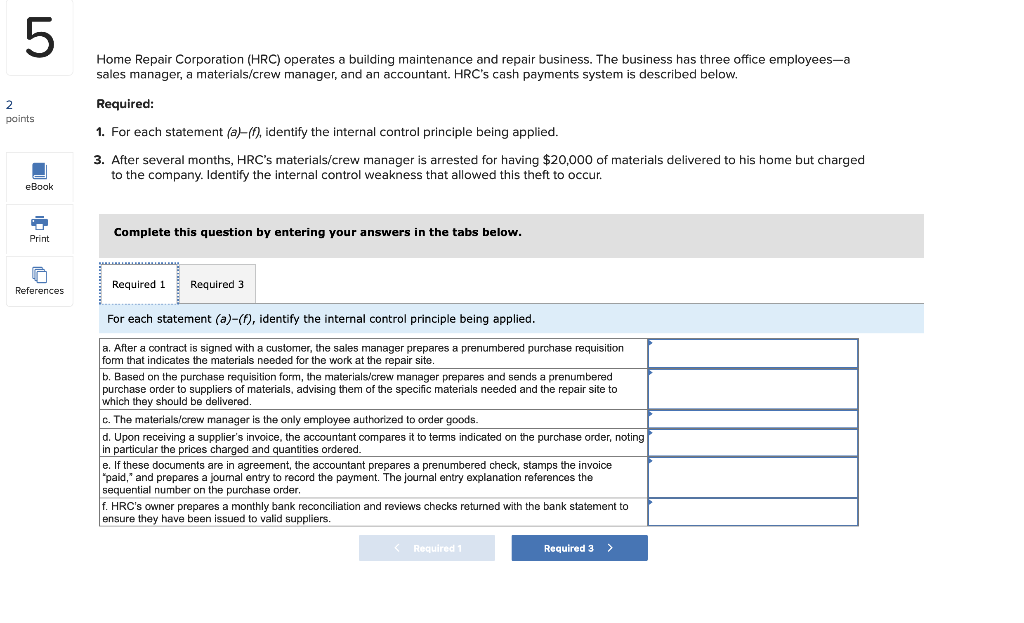

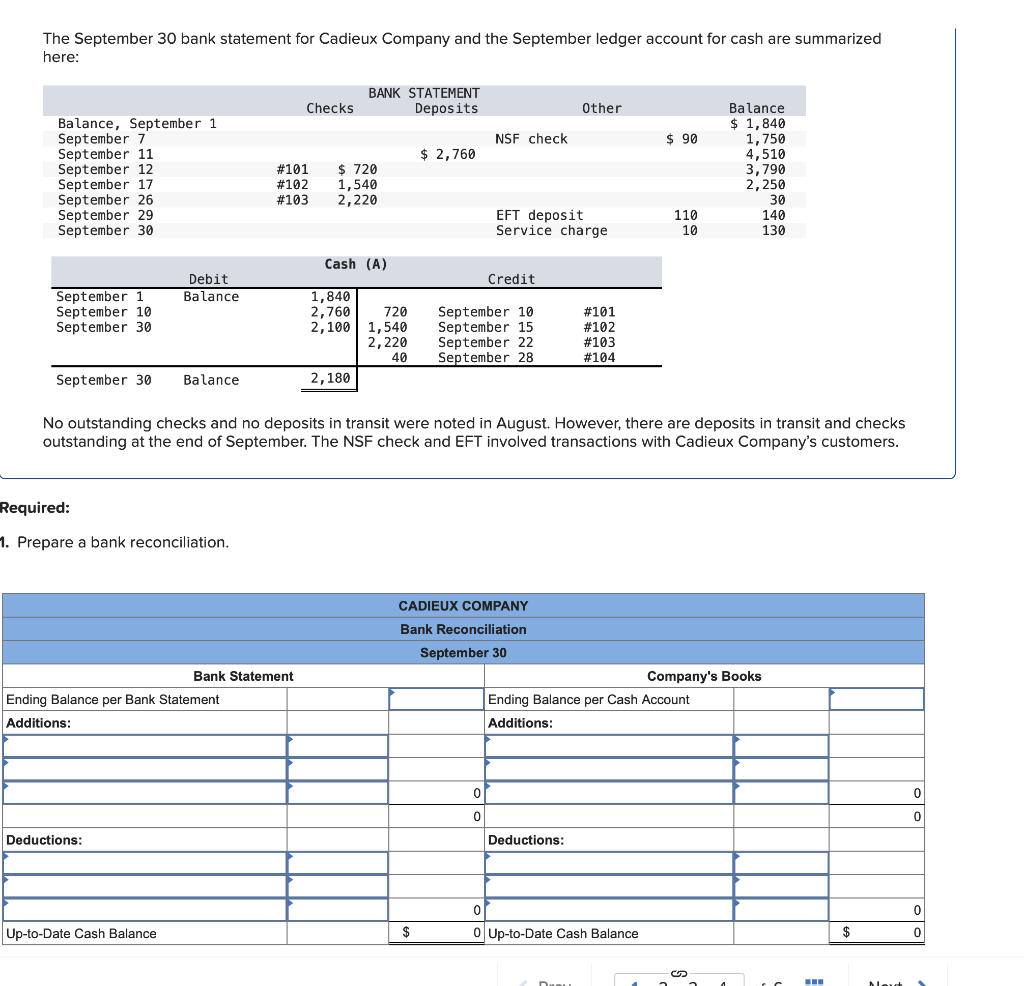

UT 5 Home Repair Corporation (HRC) operates a building maintenance and repair business. The business has three office employees-a sales manager, a materials/crew manager, and an accountant. HRC's cash payments system is described below. 2 paints Required: 1. For each statement (a)-(7), identify the internal control principle being applied. 3. After several months, HRC's materials/crew manager is arrested for having $20,000 of materials delivered to his home but charged to the company. Identify the internal control weakness that allowed this theft to occur. eBook Complete this question by entering your answers in the tabs below. Print References Required 1 Required 3 For each statement (a)-(f), identify the internal control principle being applied. a. After a contract is signed with a customer, the sales manager prepares a prenumbered purchase requisition form that indicates the materials needed for the work at the repair site. b. Based on the purchase requisition form, the materials/crew manager prepares and sends a prenumbered purchase order to suppliers of materials, advising them of the specific materials needed and the repair site to which they should be delivered. . The materials/crew manager is the only employee authorized to order goods. d. Upon receiving a supplier's invoice, the accountant compares it to terms indicated on the purchase order, noting in particular the prices charged and quantities ordered. e. If these documents are in agreement, the accountant prepares a prenumbered check, stamps the invoice "paid," and prepares a journal entry to record the payment. The journal entry explanation references the sequential number on the purchase order, f. HRC's owner prepares a monthly bank reconciliation and reviews checks returned with the bank statement to ensure they have been issued to valid suppliers. Required Required 3 > The September 30 bank statement for Cadieux Company and the September ledger account for cash are summarized here: BANK STATEMENT Deposits Checks Other NSF check $ 90 $ 2,760 Balance, September 1 September 7 September 11 September 12 September 17 September 26 September 29 September 30 #101 #102 $ 720 1,540 2,220 Balance $ 1,840 1,750 4,510 3,790 2,250 30 140 130 #103 EFT deposit Service charge 110 10 Cash (A) Credit Debit Balance September 1 September 10 September 30 1,840 2,760 2,100 720 1,540 2,220 40 September 10 September 15 September 22 September 28 #101 #102 #103 #104 September 30 Balance 2,180 No outstanding checks and no deposits in transit were noted in August. However, there are deposits in transit and checks outstanding at the end of September. The NSF check and EFT involved transactions with Cadieux Company's customers. Required: 1. Prepare a bank reconciliation. CADIEUX COMPANY Bank Reconciliation September 30 Company's Books Ending Balance per Cash Account Additions: Bank Statement Ending Balance per Bank Statement Additions: 0 0 0 0 Deductions: Deductions: 0 0 Up-to-Date Cash Balance $ Up-to-Date Cash Balance $ 0