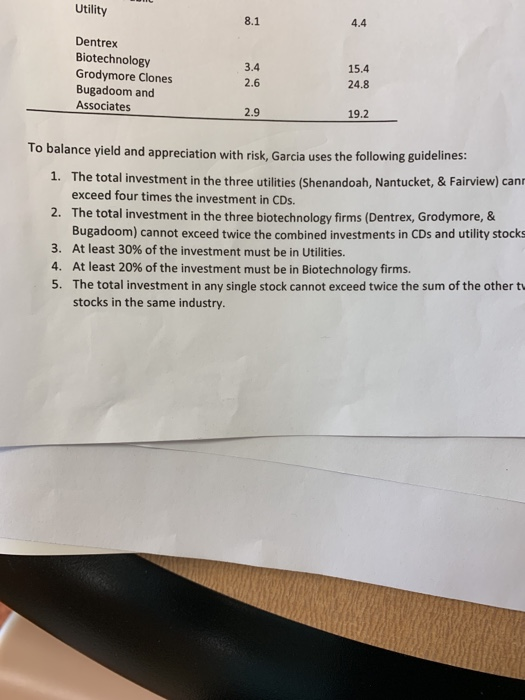

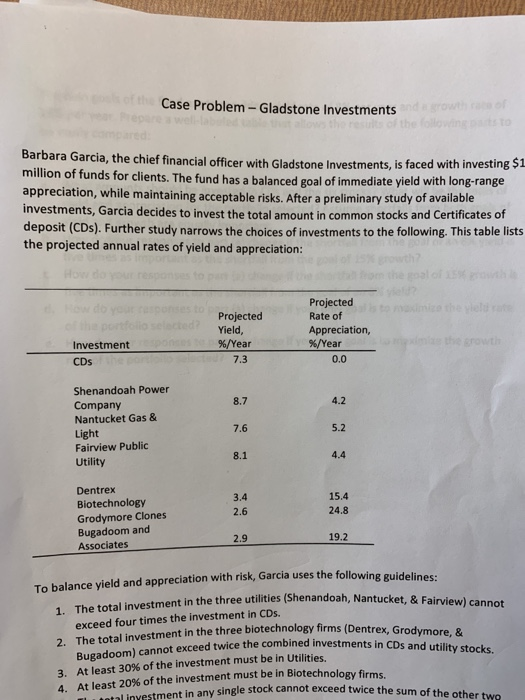

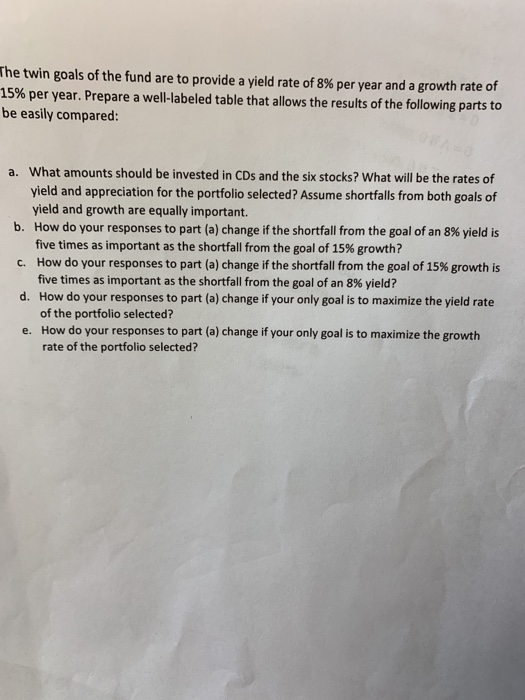

Utility 4.4 8.1 Dentrex Biotechnology Grodymore Clones Bugadoom and Associates 3,4 15.4 2.6 24.8 2.9 19.2 To balance yield and appreciation with risk, Garcia uses the following guidelines: The total investment in the three utilities (Shenandoah, Nantucket, & Fairview) canr 1. exceed four times the investment in CDs. 2. The total investment in the three biotechnology firms (Dentrex, Grodymore, & Bugadoom) cannot exceed twice the combined investments in CDs and utility stocks At least 30% of the investment must be in Utilities. 3. 4. At least 20% of the investment must be in Biotechnology firms. 5. The total investment in any single stock cannot exceed twice the sum of the other tw stocks in the same industry. os of the Case Problem Gladstone Investments repre a well Barbara Garcia, the chief financial officer with Gladstone Investments, is faced with investing million of funds for clients. The fund has a balanced goal of immediate yield with long-range appreciation, while maintaining acceptable risks. After a preliminary study of available investments, Garcia decides to invest the total amount in common stocks and Certificates of deposit (CDs). Further study narrows the choices of investments to the following. This table lists the projected annual rates of yield and appreciation: Projected naimize the yleld rae Projected Yield, %/Year Rate of Appreciation, % / Year the growth Investment 7.3 0.0 CDs Shenandoah Power 4.2 8.7 Company Nantucket Gas & 5.2 7.6 Light Fairview Public 4.4 8.1 Utility Dentrex 15.4 3.4 Biotechnology Grodymore Clones Bugadoom and Associates 24.8 2.6 19.2 2.9 To balance yield and appreciation with risk, Garcia uses the following guidelines: 1. The total investment in the three utilities (Shenandoah, Nantucket, & Fairview) cannot exceed four times the investment in CDs. 2. The total investment in the three biotechnology firms (Dentrex, Grodymore, & Bugadoom) cannot exceed twice the combined investments in CDs and utility stocks. 3. At least 30% of the investment must be in Utilities. 4. At least 20% of the investment must be in Biotechnology firms. ntal investment in any single stock cannot exceed twice the sum of the other two The twin goals of the fund are to provide a yield rate of 8% per year and a growth rate of 15% per year. Prepare a well-labeled table that allows the results of the following parts to be easily compared: a. What amounts should be invested in CDs and the six stocks? What will be the rates of yield and appreciation for the portfolio selected? Assume shortfalls from both goals of yield and growth are equally important. b. How do your responses to part (a) change if the shortfall from the goal of an 8 % yield is five times as important as the shortfall from the goal of 15 % growth? c. How do your responses to part (a) change if the shortfall from the goal of 15 % growth is five times as important as the shortfall from the goal of an 8 % yield? d. How do your responses to part (a) change if your only goal is to maximize the yield rate of the portfolio selected? How do your responses to part (a) change if your only goal is to maximize the growth e. rate of the portfolio selected? Utility 4.4 8.1 Dentrex Biotechnology Grodymore Clones Bugadoom and Associates 3,4 15.4 2.6 24.8 2.9 19.2 To balance yield and appreciation with risk, Garcia uses the following guidelines: The total investment in the three utilities (Shenandoah, Nantucket, & Fairview) canr 1. exceed four times the investment in CDs. 2. The total investment in the three biotechnology firms (Dentrex, Grodymore, & Bugadoom) cannot exceed twice the combined investments in CDs and utility stocks At least 30% of the investment must be in Utilities. 3. 4. At least 20% of the investment must be in Biotechnology firms. 5. The total investment in any single stock cannot exceed twice the sum of the other tw stocks in the same industry. os of the Case Problem Gladstone Investments repre a well Barbara Garcia, the chief financial officer with Gladstone Investments, is faced with investing million of funds for clients. The fund has a balanced goal of immediate yield with long-range appreciation, while maintaining acceptable risks. After a preliminary study of available investments, Garcia decides to invest the total amount in common stocks and Certificates of deposit (CDs). Further study narrows the choices of investments to the following. This table lists the projected annual rates of yield and appreciation: Projected naimize the yleld rae Projected Yield, %/Year Rate of Appreciation, % / Year the growth Investment 7.3 0.0 CDs Shenandoah Power 4.2 8.7 Company Nantucket Gas & 5.2 7.6 Light Fairview Public 4.4 8.1 Utility Dentrex 15.4 3.4 Biotechnology Grodymore Clones Bugadoom and Associates 24.8 2.6 19.2 2.9 To balance yield and appreciation with risk, Garcia uses the following guidelines: 1. The total investment in the three utilities (Shenandoah, Nantucket, & Fairview) cannot exceed four times the investment in CDs. 2. The total investment in the three biotechnology firms (Dentrex, Grodymore, & Bugadoom) cannot exceed twice the combined investments in CDs and utility stocks. 3. At least 30% of the investment must be in Utilities. 4. At least 20% of the investment must be in Biotechnology firms. ntal investment in any single stock cannot exceed twice the sum of the other two The twin goals of the fund are to provide a yield rate of 8% per year and a growth rate of 15% per year. Prepare a well-labeled table that allows the results of the following parts to be easily compared: a. What amounts should be invested in CDs and the six stocks? What will be the rates of yield and appreciation for the portfolio selected? Assume shortfalls from both goals of yield and growth are equally important. b. How do your responses to part (a) change if the shortfall from the goal of an 8 % yield is five times as important as the shortfall from the goal of 15 % growth? c. How do your responses to part (a) change if the shortfall from the goal of 15 % growth is five times as important as the shortfall from the goal of an 8 % yield? d. How do your responses to part (a) change if your only goal is to maximize the yield rate of the portfolio selected? How do your responses to part (a) change if your only goal is to maximize the growth e. rate of the portfolio selected