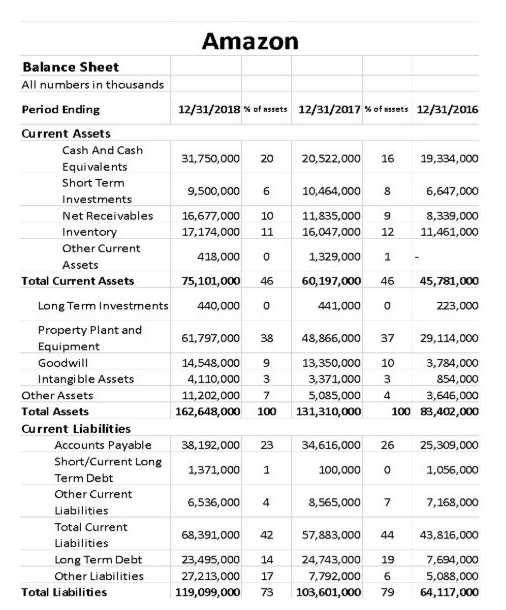

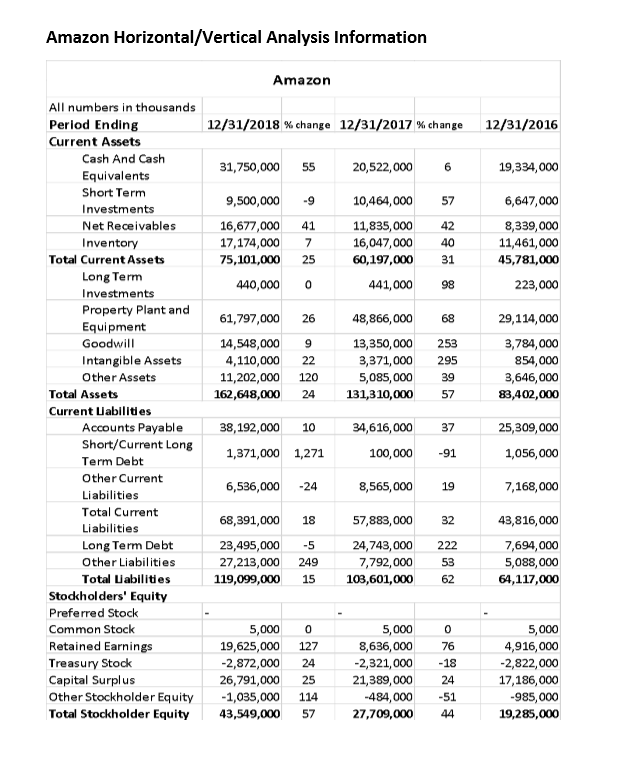

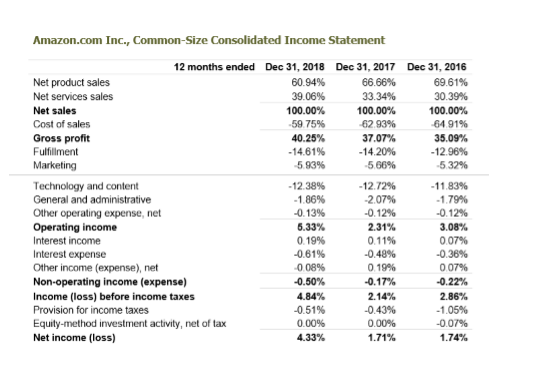

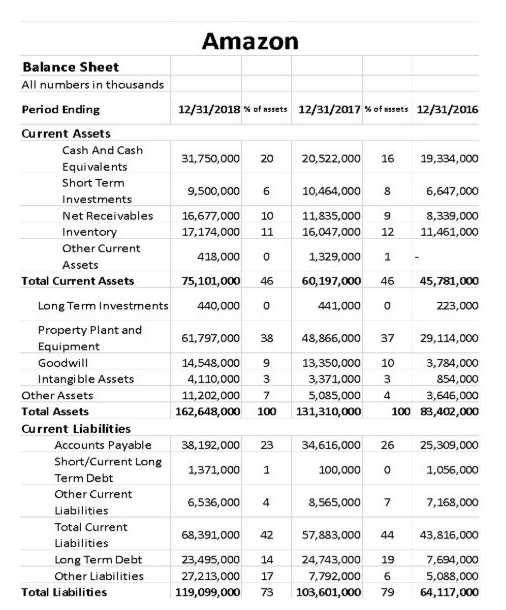

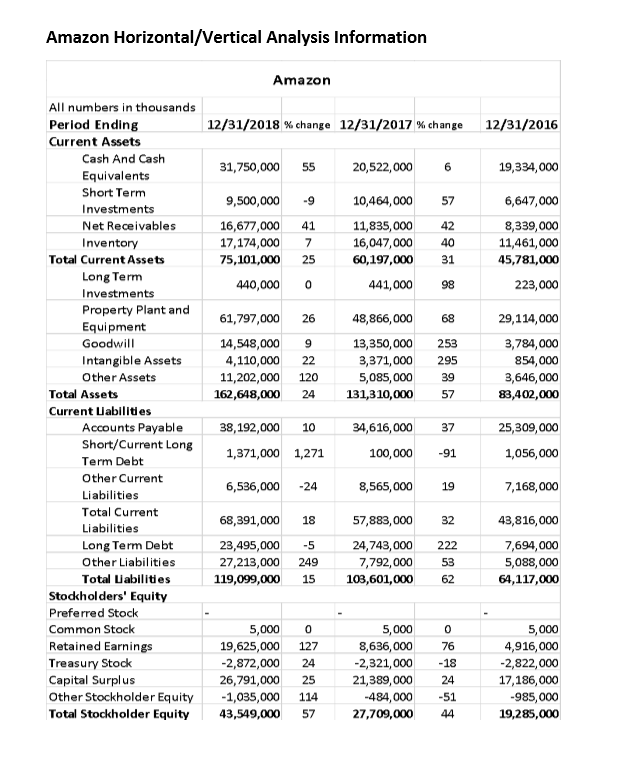

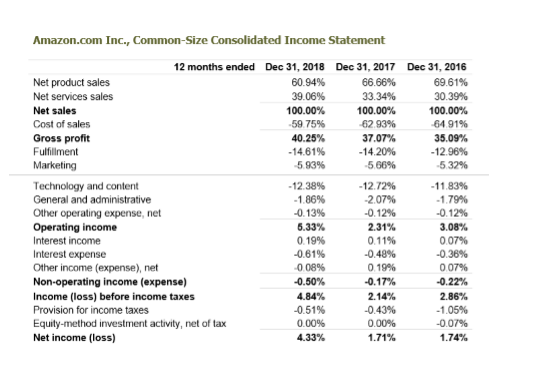

Utilize the 2017 financial statements, annual reports, horizontal and vertical analysis for Amazon to calculate the following ratio. Calculate the cash ratio for Amazon. Multiple Choice Single Response. 52% 50% 35% 49% Amazon Balance Sheet All numbers in thousands Period Ending 12/31/2018 % of assets 12/31/2017 % of assets 12/31/2016 31,750,000 20 20,522,000 16 19,334,000 10,464,000 8 6,647,000 Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Other Current Assets Total Current Assets 9,500,000 6 16,677,000 10 17,174,000 11 418,0000 75,101,000 46 440,000 0 11,835,000 16,047,000 1,329,000 9 12 1 8,339,000 11,461,000 - 45,781,000 60,197,000 441,000 46 0 Long Term Investments 223,000 61,797,000 14,548,000 4,110,000 11,202,000 162,648,000 38 9 3 7 100 48,866,000 13,350,000 3,371,000 5,085,000 131,310,000 37 29,114,000 10 3,784,000 3 854,000 4 3,646,000 1 00 83,402,000 Property Plant and Equipment Goodwill Intangible Assets Other Assets Total Assets Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities 38,192,000 1,371,000 23 1 34,616,000 100,000 26 0 25,309,000 1,056,000 6,536,000 4 8,565,000 7 7,168,000 68,391,000 23,495,000 27,2 13,000 119,099,000 42 14 17 13 57,883,000 24,743,000 7,792,000 6 103,601,000 44 19 43,816,000 7,694,000 5 ,088,000 6 4,117,000 79 Amazon Horizontal/Vertical Analysis Information Amazon 12/31/2018 % change 12/31/2017 % change 12/31/2016 31,750,000 55 20,522,000 6 19,334,000 9,500,000 16,677,000 17,174,000 75,101,000 440,000 -9 41 7 25 10,464,000 11,835,000 16,047,000 60,197,000 441,000 57 42 40 31 98 6,647,000 8,339,000 11,461,000 45,781,000 223,000 48,866,000 68 61,797,000 14,548,000 4,110,000 11,202,000 162,648,000 26 9 22 120 24 13,350,000 3,371,000 5,085,000 131,310,000 253 295 39 57 29,114,000 3,784,000 854,000 3,646,000 83,402,000 All numbers in thousands Period Ending Current Assets Cash And Cash Equivalents Short Term Investments Net Receivables Inventory Total Current Assets Long Term Investments Property Plant and Equipment Goodwill Intangible Assets Other Assets Total Assets Current Liabilities Accounts Payable Short/Current Long Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Other Liabilities Total Liabilities Stockholders' Equity Preferred Stock Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity 37 25,309,000 38,192,000 1,371,000 10 1,271 34,616,000 100,000 -91 1,056,000 6,536,000 -24 8,565,000 19 7,168,000 43,816,000 68,391,000 23,495,000 27,213,000 119,099,000 18 -5 249 15 57,883,000 24,743,000 7,792,000 103,601,000 32 222 53 62 7,694,000 5,088,000 64,117,000 5,000 19,625,000 -2,872,000 26,791,000 -1,035,000 43,549,000 0 127 24 25 114 57 5,000 8,636,000 -2,321,000 21,389,000 -484,000 27,709,000 0 76 -18 24 -51 44 5,000 4,916,000 -2,822,000 17,186,000 -985,000 19,285,000 Amazon.com Inc., Common-Size Consolidated Income Statement Dec 31, 2016 69.61% 30.39% 100.00% 64 91% 35.09% -12.96% -5.32% 12 months ended Dec 31, 2018 Dec 31, 2017 Net product sales 60.94% 66.66% Net services sales 39.06% 33.34% Net sales 100.00% 100.00% Cost of sales -59.75% 62.93% Gross profit 40.25% 37.07% Fulfillment - 14.61% -14.20% Marketing 5.93% -5.66% Technology and content -12.38% -12.72% General and administrative -1.86% -2.07% Other operating expense, net -0.13% -0.12% Operating income 5.33% 2.31% Interest income 0.19% 0.11% Interest expense -0.61% -0.48% Other income (expense), net 0 08% 0.19% Non-operating income (expense) -0.50% -0.17% Income (loss) before income taxes 4.84% 2.14% Provision for income taxes -0.51% -0.43% Equity-method investment activity, net of tax 0.00% 0.00% Net income (loss) 4.33% 1.71% -1183% -1.79% -0.12% 3.08% 0.07% -0.36% 0.07% -0.22% 2.86% -1.05% -0.07% 1.74%