Question

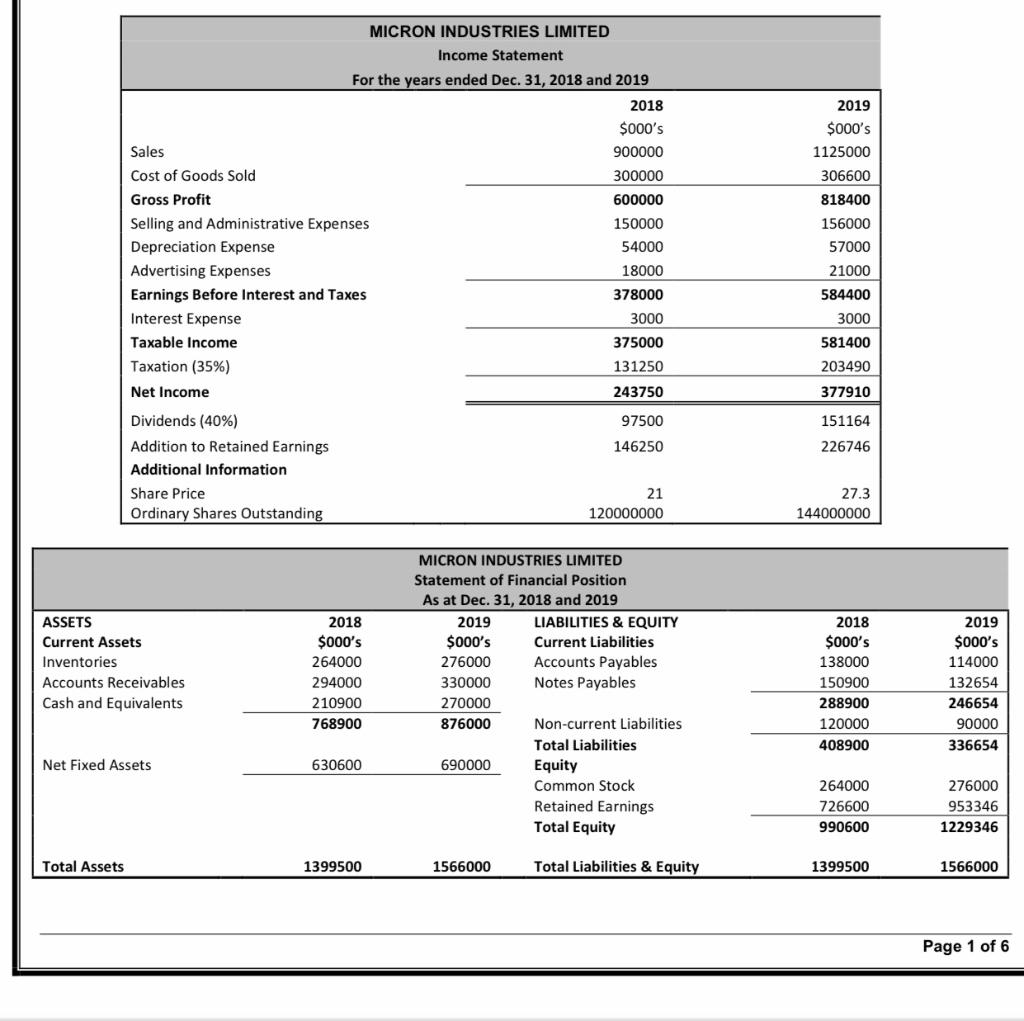

Utilize the 2019 financial statements for Micron Industries provided on page 1 and assume that the company is currently operating below capacity, at 80%. Required:

Utilize the 2019 financial statements for Micron Industries provided on page 1 and assume that the company is currently operating below capacity, at 80%.

Required: Prepare Pro-Forma statements for 2020 (rounding all figures to the nearest dollar) assuming:

All costs/income/expenses and net working capital vary directly with sales/revenue.

No new equity is raised.Sales are projected to increase by 15%

The tax rate and the dividend payout ratio will remain constant.

Interest Expense and Depreciation Expense will remain unchanged

.Clearly state if Micron Industries will require external financing or would have excess financing in 2020, and how much.

MICRON INDUSTRIES LIMITED Income Statement For the years ended Dec. 31, 2018 and 2019 2018 $000's Sales 900000 Cost of Goods Sold 300000 Gross Profit 600000 Selling and Administrative Expenses 150000 Depreciation Expense 54000 Advertising Expenses 18000 Earnings Before Interest and Taxes 378000 Interest Expense 3000 Taxable income 375000 Taxation (35%) 131250 Net Income 243750 Dividends (40%) 97500 Addition to Retained Earnings 146250 Additional Information Share Price 21 Ordinary Shares Outstanding 120000000 2019 $000's 1125000 306600 818400 156000 57000 21000 584400 3000 581400 203490 377910 151164 226746 27.3 144000000 ASSETS Current Assets Inventories Accounts Receivables Cash and Equivalents 2018 $000's 264000 294000 210900 768900 MICRON INDUSTRIES LIMITED Statement of Financial Position As at Dec. 31, 2018 and 2019 2019 LIABILITIES & EQUITY $000's Current Liabilities 276000 Accounts Payables 330000 Notes Payables 270000 Non-current Liabilities Total Liabilities 690000 Equity Common Stock Retained Earnings Total Equity 2018 $000's 138000 150900 288900 120000 408900 2019 $000's 114000 132654 246654 90000 336654 876000 Net Fixed Assets 630600 264000 726600 990600 276000 953346 1229346 Total Assets 1399500 1566000 Total Liabilities & Equity 1399500 1566000 Page 1 of 6 MICRON INDUSTRIES LIMITED Income Statement For the years ended Dec. 31, 2018 and 2019 2018 $000's Sales 900000 Cost of Goods Sold 300000 Gross Profit 600000 Selling and Administrative Expenses 150000 Depreciation Expense 54000 Advertising Expenses 18000 Earnings Before Interest and Taxes 378000 Interest Expense 3000 Taxable income 375000 Taxation (35%) 131250 Net Income 243750 Dividends (40%) 97500 Addition to Retained Earnings 146250 Additional Information Share Price 21 Ordinary Shares Outstanding 120000000 2019 $000's 1125000 306600 818400 156000 57000 21000 584400 3000 581400 203490 377910 151164 226746 27.3 144000000 ASSETS Current Assets Inventories Accounts Receivables Cash and Equivalents 2018 $000's 264000 294000 210900 768900 MICRON INDUSTRIES LIMITED Statement of Financial Position As at Dec. 31, 2018 and 2019 2019 LIABILITIES & EQUITY $000's Current Liabilities 276000 Accounts Payables 330000 Notes Payables 270000 Non-current Liabilities Total Liabilities 690000 Equity Common Stock Retained Earnings Total Equity 2018 $000's 138000 150900 288900 120000 408900 2019 $000's 114000 132654 246654 90000 336654 876000 Net Fixed Assets 630600 264000 726600 990600 276000 953346 1229346 Total Assets 1399500 1566000 Total Liabilities & Equity 1399500 1566000 Page 1 of 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started