Answered step by step

Verified Expert Solution

Question

1 Approved Answer

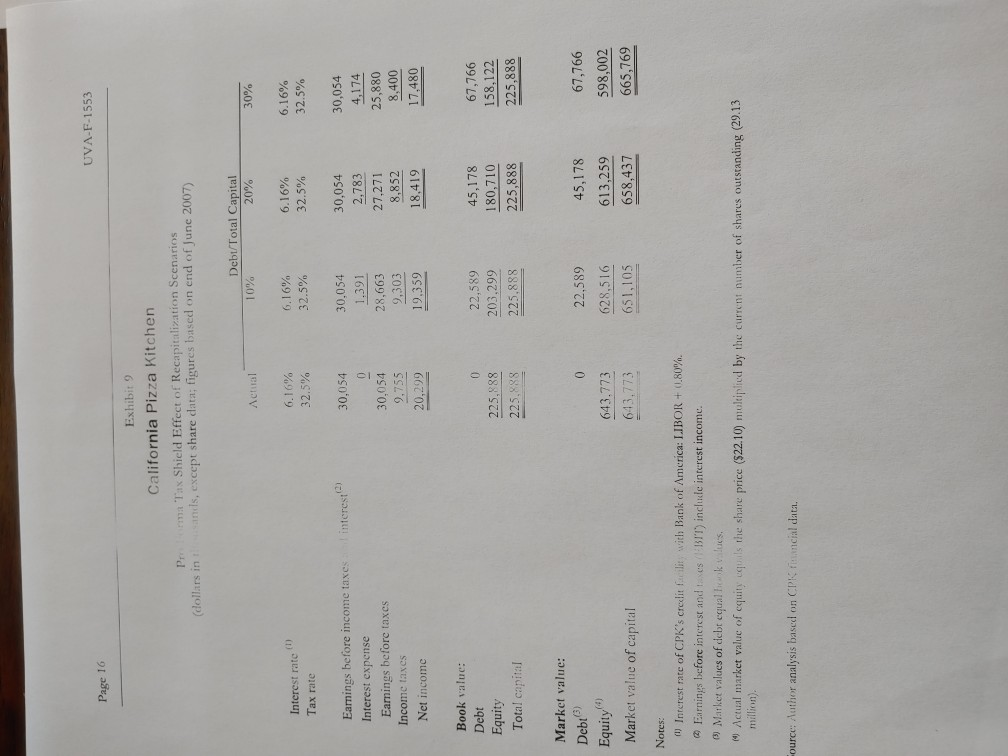

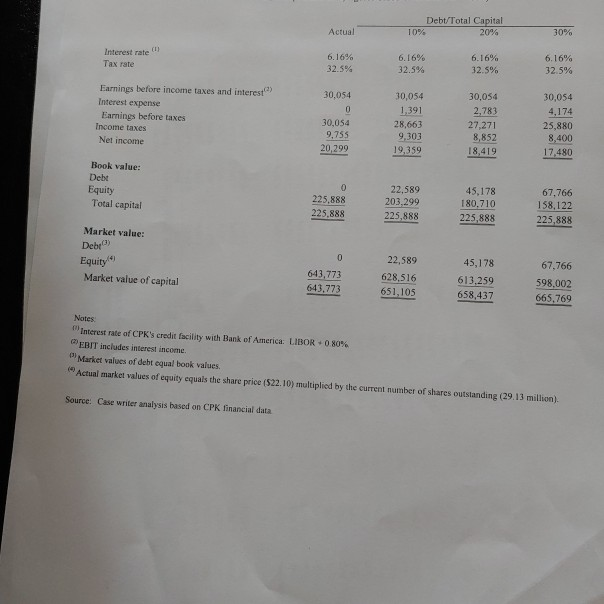

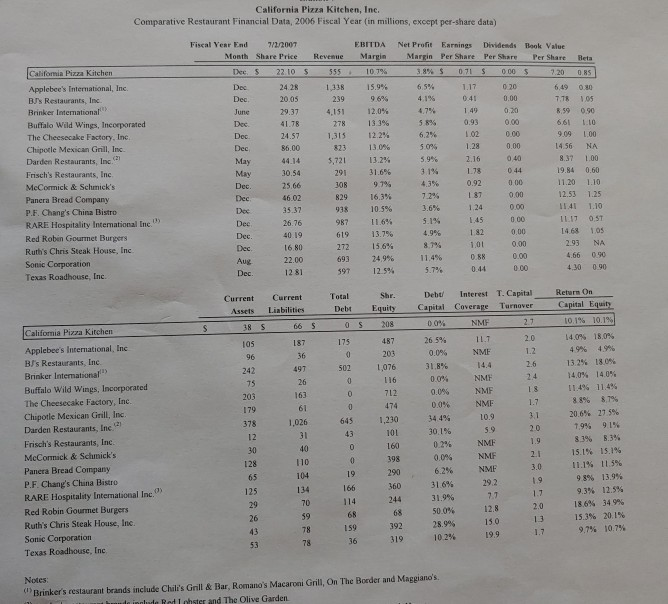

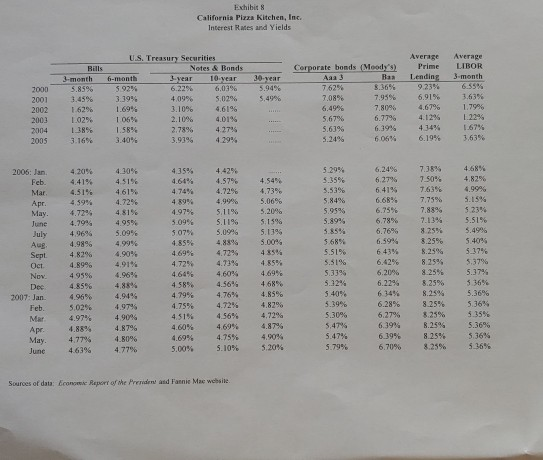

Utilizing case data from figure 9 answer the following questions. if the CPK Debt / equity capital ratio was 10%; what will be the ROE

Utilizing case data from figure 9 answer the following questions. if the CPK Debt / equity capital ratio was 10%; what will be the ROE and WACC. please show the necessary steps for understanding that I can use to answer other questions. thanks

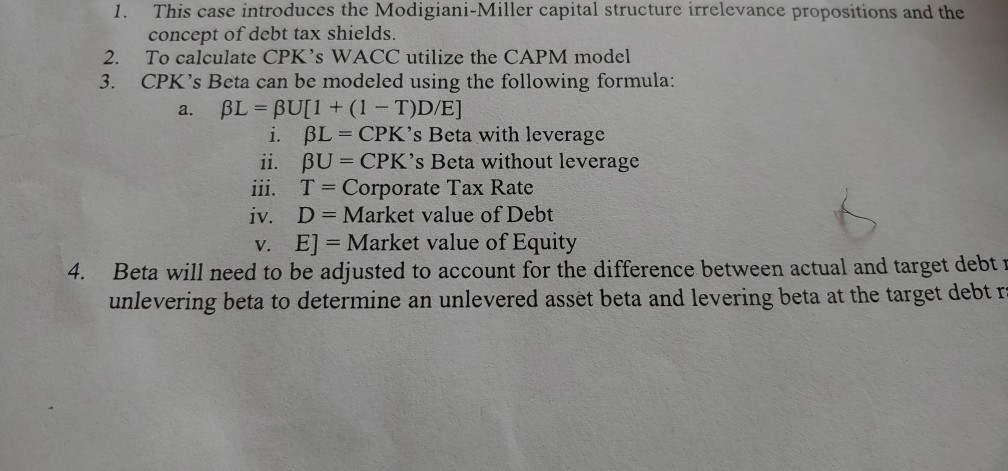

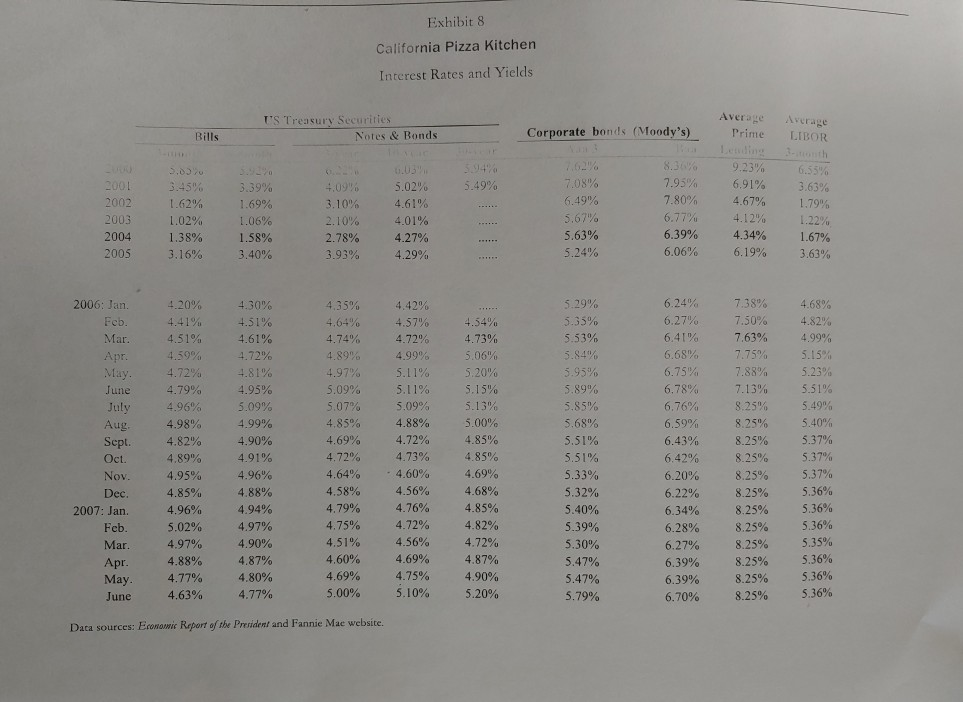

UVA-F-1553 Page 16 Exhibit 9 California Pizza Kitchen Prima Tax Shield Effect of Recapitalization Scenarios (dollars in ands, except share data; figures based on end of June 2007) Dcbt/Total Capital 10% 20% Actual 30% Interest rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% Tax rate interest 30,054 1.391 Earnings before income taxes Interest expense Earnings before taxes Income taxes Net income 30,054 D 30,054 9,755 20,299 28,663 9,303 19.359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 0 Book value: Debt Equity Total capital 22,589 203,299 225,888 225,888 45,178 180,710 225,888 67,766 158,122 225,888 225.888 Market value: Debt 0 22,589 67,766 Equity 643.773 628,516 651,105 45,178 613,259 658,437 598,002 665,769 Market value of capital 643.773 Notes: (1) Interest rate of CPK's creclit felt with Bank of America: LIBOR + 0.80%. Earnings before interest and taxes IT include interest income. Market values of debt equal ek vilues. Actual market value of equity equils the share price ($22.10) multiplied by the current number of shares outstanding (29.13 million). Fource: Author analysis based on CPK financial data. a. 1. This case introduces the Modigiani-Miller capital structure irrelevance propositions and the concept of debt tax shields. 2. To calculate CPK's WACC utilize the CAPM model 3. CPK's Beta can be modeled using the following formula: BL = BU[1 + (1 - T)D/E] i. BL = CPK's Beta with leverage ii. BU = CPK's Beta without leverage iii. T = Corporate Tax Rate iv. D = Market value of Debt v. E] = Market value of Equity Beta will need to be adjusted to account for the difference between actual and target debt unlevering beta to determine an unlevered asset beta and levering beta at the target debt r 4. Exhibit 8 California Pizza Kitchen Interest Rates and Yields T'S Treasury Securities Notes & Bonds Average Prime Corporate bonds (Moody's) Average LIBOR Bills 2001 5.49% 2002 2003 2004 2005 3.03 3.45% 1.62% 1.02% 1.38% 3.16% 3.39% 1.69% 1.06% 1.58% 3.40% 4.09% 3.10% 2.10% 2.78% 3.93% 6.03 5.02% 4.61% 4.01% 4.27% 4.29% 7.08% 6.49% 5.67% 5.63% 5.24% 8.30 7.95% 7.80% 6.77% 6.39% 6.06% 9.23% 6.91% 4.67% 4.12% 4.34% 6.19% 6.55% 3.63% 1.79% 1.22% 1.67% 3.63% 2006: Jan. Feb. Mar. Apr. May June July Aug Sept. Oct. Nov. Dec. 2007: Jan. Feb. Mar Apr. May. June 4.20% 4.41% 4.51% 4.59% 4.72% 4.79% 4.96% 4.98% 4.82% 4.89% 4.95% 4.85% 4.96% 5.02% 4.97% 4.88% 4.77% 4.63% 4.30% 4.51% 4.61% 4.72% 4.81% 4.95% 5.09% 4.99% 4.90% 4.91% 4.96% 4.88% 4.94% 4.97% 4.90% 4.87% 4.80% 4.77% 4.35% 4.64% 4.74% 4.89% 4.97% 5.09% 5.07% 4.85% 4.69% 4.72% 4.64% 4.58% 4.79% 4.75% 4.51% 4.60% 4.69% 5.00% 4.42% 4.57% 4.72% 4.99% 5.11% 5.11% 5.09% 4.88% 4.72% 4.73% - 4.60% 4.56% 4.76% 4.72% 4.56% 4.69% 4.75% 5.10% 4.54% 4.73% 5.06% 5.20% 5.15% 5.13% 5.00% 4.85% 4.85% 4.69% 4.68% 4.85% 4.82% 4.72% 4.87% 4.90% 5.20% 5.29% 5.35% 5.53% 5.84% 5.95% 5.89% 5.85% 5.68% 5.51% 5.51% 5.33% 5.32% 5.40% 5.39% 5.30% 5.47% 5.47% 5.79% 6.24% 6.27% 6.41% 6.68% 6.75% 6.78% 6.76% 6.59% 6.43% 6.42% 6.20% 6.22% 6.34% 6.28% 6.27% 6.39% 6.39% 6.70% 7.38% 7.50% 7.63% 7.75% 7.88% 7.13% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 4.68% 4.82% 4.99% 5.15% 5.23% 5.51% 5.49% 5.40% 5.37% 5.37% 5.37% 5.36% 5.36% 5.36% 5.35% 5.36% 5.36% 5.36% Data sources: Economic Report of the President and Fannie Mae website, Debt/Total Capital 10% 20% Actual 30% () Interest rate Tax rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% Earnings before income taxes and interest Interest expense Earnings before taxes Income taxes Net income 30,054 0 30,054 9,755 20,299 30,054 1.391 28,663 9,303 19,359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17.480 Book value: Debt Equity Total capital 225.888 225.888 22,589 203,299 225,888 45,178 180.710 225,888 67.766 158,122 225,888 Market value: Deb) Equity 0 Market value of capital 643,773 643.773 22,589 628,516 651,105 45,178 613,259 658,437 67,766 598.002 665,769 Notes Interest rate of CPK's credit facility with Bank of America: LIBOR 0 80% EBIT includes interest income Market values of debt equal book values. Actual market values of equity equals the share price (522.10) multiplied by the current number of shares outstanding (29.13 million) Source: Case writer analysis based on CPK financial data California Pizza Kitchen, Inc. Comparative Restaurant Financial Data, 2006 Fiscal Year (in millions, except per-share data) Fiscal Year End 7/2/2007 Month Share Price Revenue Dec 22.10 $ EBITDA Margin 10 7% 7.20 085 15.9% Dec Dec yone 133 239 4.151 278 1.315 Dec Dec 5,721 California Pizza Kitchen Applebee's International, Inc. BU's Restaurants, Inc. Brinker International Buffalo Wild Wings, Incorporated The Cheesecake Factory, Inc Chipotle Mexican Grill, Inc Darden Restaurants, Inc. Frisch's Restaurants, Inc McCormick & Schuick's Panera Bread Company P.F. Chang's China Bistro RARE Hospitality International Inc. Red Robin Gourmet Burgers Ruth's Chris Steak House, Inc Sonic Corporation Texas Roadhouse, Inc. Dec May May Dec. Dec Dec Dec Dec. Dec Aug Dec. 24.28 20.05 29.37 41.78 24.57 86.00 44.14 30.54 25.66 46.02 35.37 26.76 40 19 16.80 22.00 1281 Net Profit Earnings Dividends Book Value Margin Per Share Per Share Per Share Reta 3.8% S 0.71 $ 0.00 $ 6.5% 1.17 0.20 6.49 0.80 0:41 0.00 7.TR 1.05 4,7% 1.49 0.20 8.59 0.90 5.8% 0.93 0.00 6.61 1.10 6.2% 1.02 0.00 9.09 1.00 50% 1.28 0.00 14.56 NA 5.9% 2.16 0 40 8.37 1.00 1.78 044 19.84 0.60 0.92 0 00 11.20 1.10 7.2% 187 0.00 12.53 1.25 3.6% 1.24 0.00 11.41 1.10 5.1% 1:45 000 IL17 OST 4.9% 1 82 0.00 14.68 105 87% 1.01 0.00 2.93 NA 11.4% 0.88 0.00 4.66 0.90 5.7% 0.44 0.00 0.90 12.0% 133% 12.2% 13.0% 13.2% 31.6% 9.7% 16:39 10.5% 11.6% 13.796 15.6% 249% 12.5% 291 308 829 938 987 619 272 597 Current Assets 38 $ Current Liabilities Total Debt Shr. Equity 208 Debt Interest T. Capital Capital Coverage Turnover 0.0% NMF 2.1 Return On Capital Equity 10.1% 10.19 0 66 S S S 175 0 105 96 242 75 203 179 378 187 36 497 26 163 487 203 1,076 116 712 502 0 0 0 26 5% 0.0% 31.8% 0.0% 0.096 0.0% 2.0 12 2.6 24 18 14.0% 18.0% 49% 13.2% 18.0% 14,0% 14.0% 11.4% 11,4% 8.8% 8.79% 20.6% 27 59 7.9% 474 1.7 31 645 43 30.1% California Pizza Kitchen Applebee's International, Inc B's Restaurants, Inc Brinker International Buffalo Wild Wings, Incorporated The Cheesecake Factory, Inc Chipotle Mexican Grill, Inc. Darden Restaurants, Inc. Frisch's Restaurants, Inc McCormick & Schick's Panera Bread Company P.F. Chang's China Bistro RARE Hospitality International Inc.) Red Robin Gourmet Burgers Ruth's Chris Steak House, Inc Sonic Corporation Texas Roadhouse, Inc 30 ILT NME 14.4 NMI NMF NME 10.9 5.9 NMF NMF NMF 29.2 7.7 12.8 150 19.9 0 0 19 61 1,026 31 40 110 104 134 70 59 78 78 128 65 125 29 1,230 101 160 398 290 360 244 68 392 319 1.9 2.1 3.0 19 1.7 20 0.0% 6.2% 31 696 31.9% 50.0% 28.9% 10.2% 166 15.15 15.1% 11.1% 11.5% 98% 13.9% 9.3% 12.5% 18.6% 34 % 15.3% 20.1% 9.7% 10.7% 26 68 159 53 Notes Brinker's restaurant brands include Chili's Grill & Bar, Romano's Macaroni Grill, On The Border and Maggiano's In include odlohster and The Olive Garden Exhibit & California Pizza Kitchen, Inc. Interest Rates and Yields Bills 3-month 5.85 U.S. Treasury Securities Notes & Bonds 6-month 3-year 10 year 5929 6.22% 6,03% 3.39% 4.09% 5.02% 1.69% 3.10% 4,6196 106 2.10% 4.01% 1.58% 2.78% 4.2795 3.40% 3.93% 4.29% 30-year 5.94% 5.49% 2000 2001 2002 2002 2004 2005 Corporate bonds (Moody's) Aaa 3 Ban 76294 8.36% 7.08% 7.95% 6.49% 7,80%. 5.67% 6.77% 5.63% 6.39% 5.2496 6.06% Average Prime Lending 9.23% 6.91% 4.679 4.12% 4349 6.19% Average LIBOR 3-month 6.35% 3.63% 1.79976 L02% 1.18% 3.16% 1.67% 4 205 2006: Jan Feb Mar Apr May June 4359 4.64% 4.74% 4.899 4.97% 5.09% 5.07% 4.85% 5.29% 5.35% 5.53% 5,84% 5.95% 5.89% 5.85% 4.54% 4.73% 5.06% 5.20% 5:15% 5.13% 5.00% 4 35% 7.38% 7.50% 7.6356 7.75% 7.88% 7.13% 8 25% 3.25% 4.51% 4,59% 4.72% 4.79% 4.96% 4.98% 4.82% 4.8996 495% 4.85% 4.95% 5.02% 4.97% Aug Sept Oct Nov. Dec 2007: Jan Feb. Mar 6.24% 6.279 6.41% 6.68% 6.75% 6.789 6.76% 6.59% 6.43% 6.42% 6,20% 6.22% 4.51% 461% 4.72% 4.81% 4.95% 5.09% 4.999 4.90% 4,9194 4.96% 4,88% 4.94% 4.97% 4.90% 4.8796 4.80% 4.77% 4 4256 4.57% 4.72% 4.99% 5.11% 5.1196 5.0996 4,88% 4.72% 4.71% 4.60% 4.56% 4.76% 4.72% 4.56% 4.69% 4.75% 5.10% 4.68% 4.82% 4.99% 5.15% 5.239 5.5196 5.49% 5.40 5.37% 5.37% 5.37% 5.36% 5.36% 5.36% 5.35% 5.36% 5.36% 5.36% 4.72% 4.645 4.58% 4.79% 4.75% 4.51% 4.60% 4.69% 5.00% 4.68% 4.85% 4.87% 5.51% 5.51% 5.3395 5.32% 5.40% 5.39% 5.30% 5.47% 5.47% 5.79% 6 145 8.25% 8.25 8.25% 8.25% 8.25% Apr. 6.28% 6.27% 6.39% 6.39% 6.70% May June 4.77% 4.6396 4,90% 5.20% 3.25% 8.25% 8.25% Sources of data: Cance Report of the Prendi and Fannie Mae website UVA-F-1553 Page 16 Exhibit 9 California Pizza Kitchen Prima Tax Shield Effect of Recapitalization Scenarios (dollars in ands, except share data; figures based on end of June 2007) Dcbt/Total Capital 10% 20% Actual 30% Interest rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% Tax rate interest 30,054 1.391 Earnings before income taxes Interest expense Earnings before taxes Income taxes Net income 30,054 D 30,054 9,755 20,299 28,663 9,303 19.359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17,480 0 Book value: Debt Equity Total capital 22,589 203,299 225,888 225,888 45,178 180,710 225,888 67,766 158,122 225,888 225.888 Market value: Debt 0 22,589 67,766 Equity 643.773 628,516 651,105 45,178 613,259 658,437 598,002 665,769 Market value of capital 643.773 Notes: (1) Interest rate of CPK's creclit felt with Bank of America: LIBOR + 0.80%. Earnings before interest and taxes IT include interest income. Market values of debt equal ek vilues. Actual market value of equity equils the share price ($22.10) multiplied by the current number of shares outstanding (29.13 million). Fource: Author analysis based on CPK financial data. a. 1. This case introduces the Modigiani-Miller capital structure irrelevance propositions and the concept of debt tax shields. 2. To calculate CPK's WACC utilize the CAPM model 3. CPK's Beta can be modeled using the following formula: BL = BU[1 + (1 - T)D/E] i. BL = CPK's Beta with leverage ii. BU = CPK's Beta without leverage iii. T = Corporate Tax Rate iv. D = Market value of Debt v. E] = Market value of Equity Beta will need to be adjusted to account for the difference between actual and target debt unlevering beta to determine an unlevered asset beta and levering beta at the target debt r 4. Exhibit 8 California Pizza Kitchen Interest Rates and Yields T'S Treasury Securities Notes & Bonds Average Prime Corporate bonds (Moody's) Average LIBOR Bills 2001 5.49% 2002 2003 2004 2005 3.03 3.45% 1.62% 1.02% 1.38% 3.16% 3.39% 1.69% 1.06% 1.58% 3.40% 4.09% 3.10% 2.10% 2.78% 3.93% 6.03 5.02% 4.61% 4.01% 4.27% 4.29% 7.08% 6.49% 5.67% 5.63% 5.24% 8.30 7.95% 7.80% 6.77% 6.39% 6.06% 9.23% 6.91% 4.67% 4.12% 4.34% 6.19% 6.55% 3.63% 1.79% 1.22% 1.67% 3.63% 2006: Jan. Feb. Mar. Apr. May June July Aug Sept. Oct. Nov. Dec. 2007: Jan. Feb. Mar Apr. May. June 4.20% 4.41% 4.51% 4.59% 4.72% 4.79% 4.96% 4.98% 4.82% 4.89% 4.95% 4.85% 4.96% 5.02% 4.97% 4.88% 4.77% 4.63% 4.30% 4.51% 4.61% 4.72% 4.81% 4.95% 5.09% 4.99% 4.90% 4.91% 4.96% 4.88% 4.94% 4.97% 4.90% 4.87% 4.80% 4.77% 4.35% 4.64% 4.74% 4.89% 4.97% 5.09% 5.07% 4.85% 4.69% 4.72% 4.64% 4.58% 4.79% 4.75% 4.51% 4.60% 4.69% 5.00% 4.42% 4.57% 4.72% 4.99% 5.11% 5.11% 5.09% 4.88% 4.72% 4.73% - 4.60% 4.56% 4.76% 4.72% 4.56% 4.69% 4.75% 5.10% 4.54% 4.73% 5.06% 5.20% 5.15% 5.13% 5.00% 4.85% 4.85% 4.69% 4.68% 4.85% 4.82% 4.72% 4.87% 4.90% 5.20% 5.29% 5.35% 5.53% 5.84% 5.95% 5.89% 5.85% 5.68% 5.51% 5.51% 5.33% 5.32% 5.40% 5.39% 5.30% 5.47% 5.47% 5.79% 6.24% 6.27% 6.41% 6.68% 6.75% 6.78% 6.76% 6.59% 6.43% 6.42% 6.20% 6.22% 6.34% 6.28% 6.27% 6.39% 6.39% 6.70% 7.38% 7.50% 7.63% 7.75% 7.88% 7.13% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 8.25% 4.68% 4.82% 4.99% 5.15% 5.23% 5.51% 5.49% 5.40% 5.37% 5.37% 5.37% 5.36% 5.36% 5.36% 5.35% 5.36% 5.36% 5.36% Data sources: Economic Report of the President and Fannie Mae website, Debt/Total Capital 10% 20% Actual 30% () Interest rate Tax rate 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% 6.16% 32.5% Earnings before income taxes and interest Interest expense Earnings before taxes Income taxes Net income 30,054 0 30,054 9,755 20,299 30,054 1.391 28,663 9,303 19,359 30,054 2,783 27,271 8,852 18,419 30,054 4,174 25,880 8,400 17.480 Book value: Debt Equity Total capital 225.888 225.888 22,589 203,299 225,888 45,178 180.710 225,888 67.766 158,122 225,888 Market value: Deb) Equity 0 Market value of capital 643,773 643.773 22,589 628,516 651,105 45,178 613,259 658,437 67,766 598.002 665,769 Notes Interest rate of CPK's credit facility with Bank of America: LIBOR 0 80% EBIT includes interest income Market values of debt equal book values. Actual market values of equity equals the share price (522.10) multiplied by the current number of shares outstanding (29.13 million) Source: Case writer analysis based on CPK financial data California Pizza Kitchen, Inc. Comparative Restaurant Financial Data, 2006 Fiscal Year (in millions, except per-share data) Fiscal Year End 7/2/2007 Month Share Price Revenue Dec 22.10 $ EBITDA Margin 10 7% 7.20 085 15.9% Dec Dec yone 133 239 4.151 278 1.315 Dec Dec 5,721 California Pizza Kitchen Applebee's International, Inc. BU's Restaurants, Inc. Brinker International Buffalo Wild Wings, Incorporated The Cheesecake Factory, Inc Chipotle Mexican Grill, Inc Darden Restaurants, Inc. Frisch's Restaurants, Inc McCormick & Schuick's Panera Bread Company P.F. Chang's China Bistro RARE Hospitality International Inc. Red Robin Gourmet Burgers Ruth's Chris Steak House, Inc Sonic Corporation Texas Roadhouse, Inc. Dec May May Dec. Dec Dec Dec Dec. Dec Aug Dec. 24.28 20.05 29.37 41.78 24.57 86.00 44.14 30.54 25.66 46.02 35.37 26.76 40 19 16.80 22.00 1281 Net Profit Earnings Dividends Book Value Margin Per Share Per Share Per Share Reta 3.8% S 0.71 $ 0.00 $ 6.5% 1.17 0.20 6.49 0.80 0:41 0.00 7.TR 1.05 4,7% 1.49 0.20 8.59 0.90 5.8% 0.93 0.00 6.61 1.10 6.2% 1.02 0.00 9.09 1.00 50% 1.28 0.00 14.56 NA 5.9% 2.16 0 40 8.37 1.00 1.78 044 19.84 0.60 0.92 0 00 11.20 1.10 7.2% 187 0.00 12.53 1.25 3.6% 1.24 0.00 11.41 1.10 5.1% 1:45 000 IL17 OST 4.9% 1 82 0.00 14.68 105 87% 1.01 0.00 2.93 NA 11.4% 0.88 0.00 4.66 0.90 5.7% 0.44 0.00 0.90 12.0% 133% 12.2% 13.0% 13.2% 31.6% 9.7% 16:39 10.5% 11.6% 13.796 15.6% 249% 12.5% 291 308 829 938 987 619 272 597 Current Assets 38 $ Current Liabilities Total Debt Shr. Equity 208 Debt Interest T. Capital Capital Coverage Turnover 0.0% NMF 2.1 Return On Capital Equity 10.1% 10.19 0 66 S S S 175 0 105 96 242 75 203 179 378 187 36 497 26 163 487 203 1,076 116 712 502 0 0 0 26 5% 0.0% 31.8% 0.0% 0.096 0.0% 2.0 12 2.6 24 18 14.0% 18.0% 49% 13.2% 18.0% 14,0% 14.0% 11.4% 11,4% 8.8% 8.79% 20.6% 27 59 7.9% 474 1.7 31 645 43 30.1% California Pizza Kitchen Applebee's International, Inc B's Restaurants, Inc Brinker International Buffalo Wild Wings, Incorporated The Cheesecake Factory, Inc Chipotle Mexican Grill, Inc. Darden Restaurants, Inc. Frisch's Restaurants, Inc McCormick & Schick's Panera Bread Company P.F. Chang's China Bistro RARE Hospitality International Inc.) Red Robin Gourmet Burgers Ruth's Chris Steak House, Inc Sonic Corporation Texas Roadhouse, Inc 30 ILT NME 14.4 NMI NMF NME 10.9 5.9 NMF NMF NMF 29.2 7.7 12.8 150 19.9 0 0 19 61 1,026 31 40 110 104 134 70 59 78 78 128 65 125 29 1,230 101 160 398 290 360 244 68 392 319 1.9 2.1 3.0 19 1.7 20 0.0% 6.2% 31 696 31.9% 50.0% 28.9% 10.2% 166 15.15 15.1% 11.1% 11.5% 98% 13.9% 9.3% 12.5% 18.6% 34 % 15.3% 20.1% 9.7% 10.7% 26 68 159 53 Notes Brinker's restaurant brands include Chili's Grill & Bar, Romano's Macaroni Grill, On The Border and Maggiano's In include odlohster and The Olive Garden Exhibit & California Pizza Kitchen, Inc. Interest Rates and Yields Bills 3-month 5.85 U.S. Treasury Securities Notes & Bonds 6-month 3-year 10 year 5929 6.22% 6,03% 3.39% 4.09% 5.02% 1.69% 3.10% 4,6196 106 2.10% 4.01% 1.58% 2.78% 4.2795 3.40% 3.93% 4.29% 30-year 5.94% 5.49% 2000 2001 2002 2002 2004 2005 Corporate bonds (Moody's) Aaa 3 Ban 76294 8.36% 7.08% 7.95% 6.49% 7,80%. 5.67% 6.77% 5.63% 6.39% 5.2496 6.06% Average Prime Lending 9.23% 6.91% 4.679 4.12% 4349 6.19% Average LIBOR 3-month 6.35% 3.63% 1.79976 L02% 1.18% 3.16% 1.67% 4 205 2006: Jan Feb Mar Apr May June 4359 4.64% 4.74% 4.899 4.97% 5.09% 5.07% 4.85% 5.29% 5.35% 5.53% 5,84% 5.95% 5.89% 5.85% 4.54% 4.73% 5.06% 5.20% 5:15% 5.13% 5.00% 4 35% 7.38% 7.50% 7.6356 7.75% 7.88% 7.13% 8 25% 3.25% 4.51% 4,59% 4.72% 4.79% 4.96% 4.98% 4.82% 4.8996 495% 4.85% 4.95% 5.02% 4.97% Aug Sept Oct Nov. Dec 2007: Jan Feb. Mar 6.24% 6.279 6.41% 6.68% 6.75% 6.789 6.76% 6.59% 6.43% 6.42% 6,20% 6.22% 4.51% 461% 4.72% 4.81% 4.95% 5.09% 4.999 4.90% 4,9194 4.96% 4,88% 4.94% 4.97% 4.90% 4.8796 4.80% 4.77% 4 4256 4.57% 4.72% 4.99% 5.11% 5.1196 5.0996 4,88% 4.72% 4.71% 4.60% 4.56% 4.76% 4.72% 4.56% 4.69% 4.75% 5.10% 4.68% 4.82% 4.99% 5.15% 5.239 5.5196 5.49% 5.40 5.37% 5.37% 5.37% 5.36% 5.36% 5.36% 5.35% 5.36% 5.36% 5.36% 4.72% 4.645 4.58% 4.79% 4.75% 4.51% 4.60% 4.69% 5.00% 4.68% 4.85% 4.87% 5.51% 5.51% 5.3395 5.32% 5.40% 5.39% 5.30% 5.47% 5.47% 5.79% 6 145 8.25% 8.25 8.25% 8.25% 8.25% Apr. 6.28% 6.27% 6.39% 6.39% 6.70% May June 4.77% 4.6396 4,90% 5.20% 3.25% 8.25% 8.25% Sources of data: Cance Report of the Prendi and Fannie Mae website

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started