Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Utilizing comparable companies, A , B , and C , find the equity company for Company D , which has a ratio of market value

Utilizing comparable companies, A B and C find the equity company for Company D which has a ratio of market value debt to market value equity of

Company A has an equity beta of no preferred stock, and a debttoequity ratio of

Company B has an equity beta of no preferred stock, and a debttoequity ratio of

Company C has an equity beta of no preferred stock, and a debttoequity ratio of

First unlever the equity betas of Companies A B and C then compute the average, and then relever the average but using Company Ds financial characteristics.

Part Use Hamadas Equation when unlevering and relevering. The relevant tax rate is

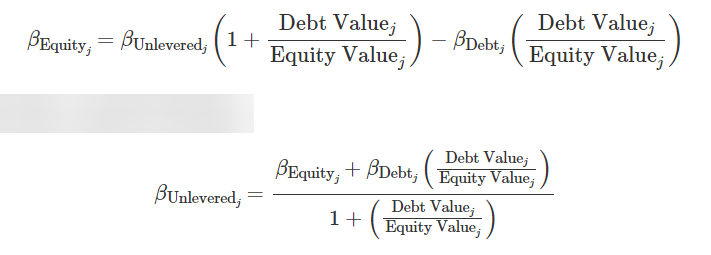

Part Assume all companies have a debt beta of and use the formulas included below to unlever and relever.

Part What is the key assumption used to derive Hamadas Equation? A the debt is constant and riskfree, B the value of the tax shield has the same beta as equity, or C the debttoequity ratio is constant over time.

Formulas for Part :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started