Question: Utilizing the text book,pages 264-278. In paragraph (1) Identify one country that has a current and excessive Trade Surplus. Identify the products that are responsible

Utilizing the text book,pages 264-278.

In paragraph (1) Identify one country that has a current and excessive Trade Surplus. Identify the products that are responsible for the Trade Surplus, you may want to add stats.

Note the country the surplus exist with.

In paragraph 2 & 3 I want you to solve the deficit issue utilizing strategies available to the country with the deficit.

Provide examples in your own words.

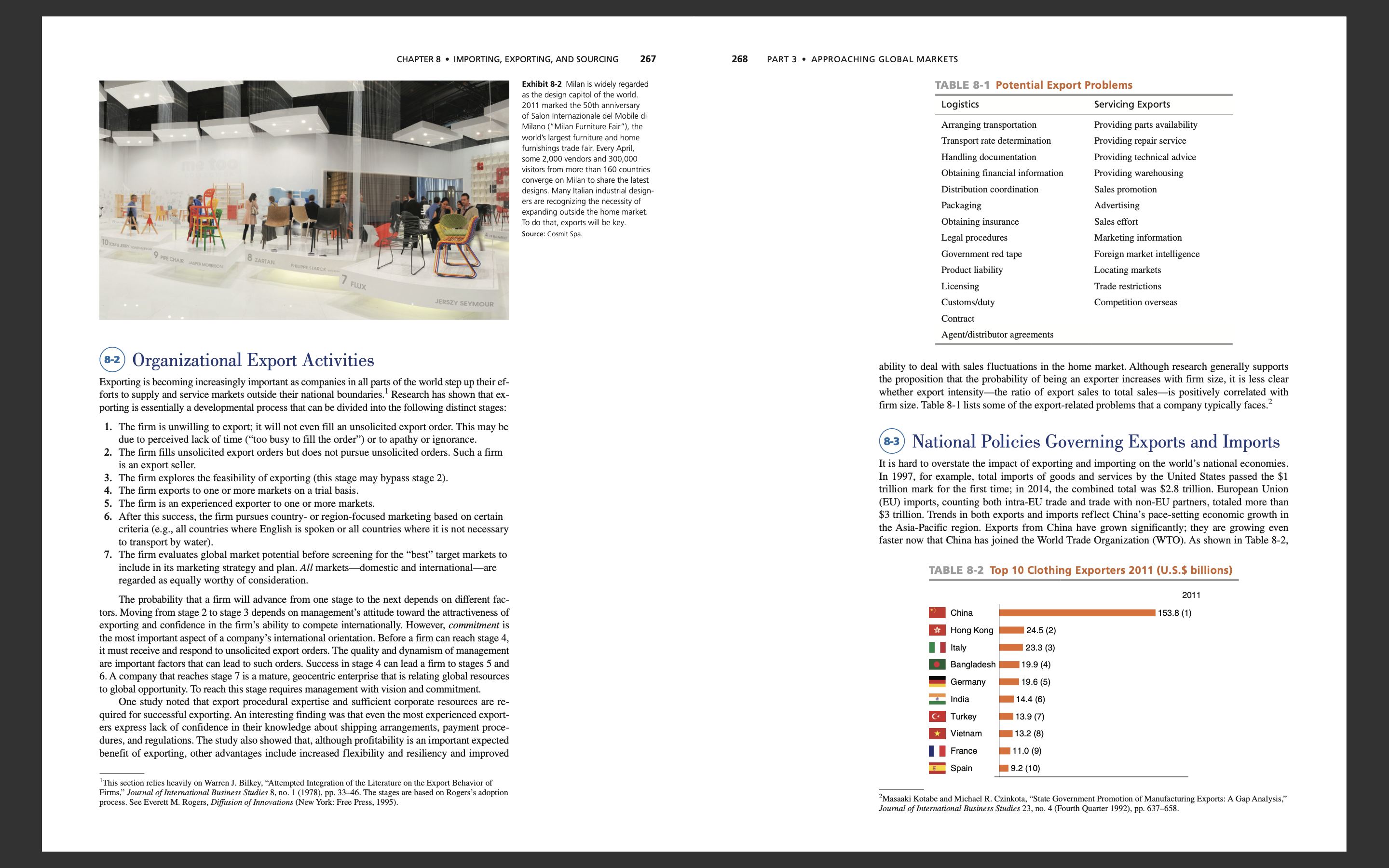

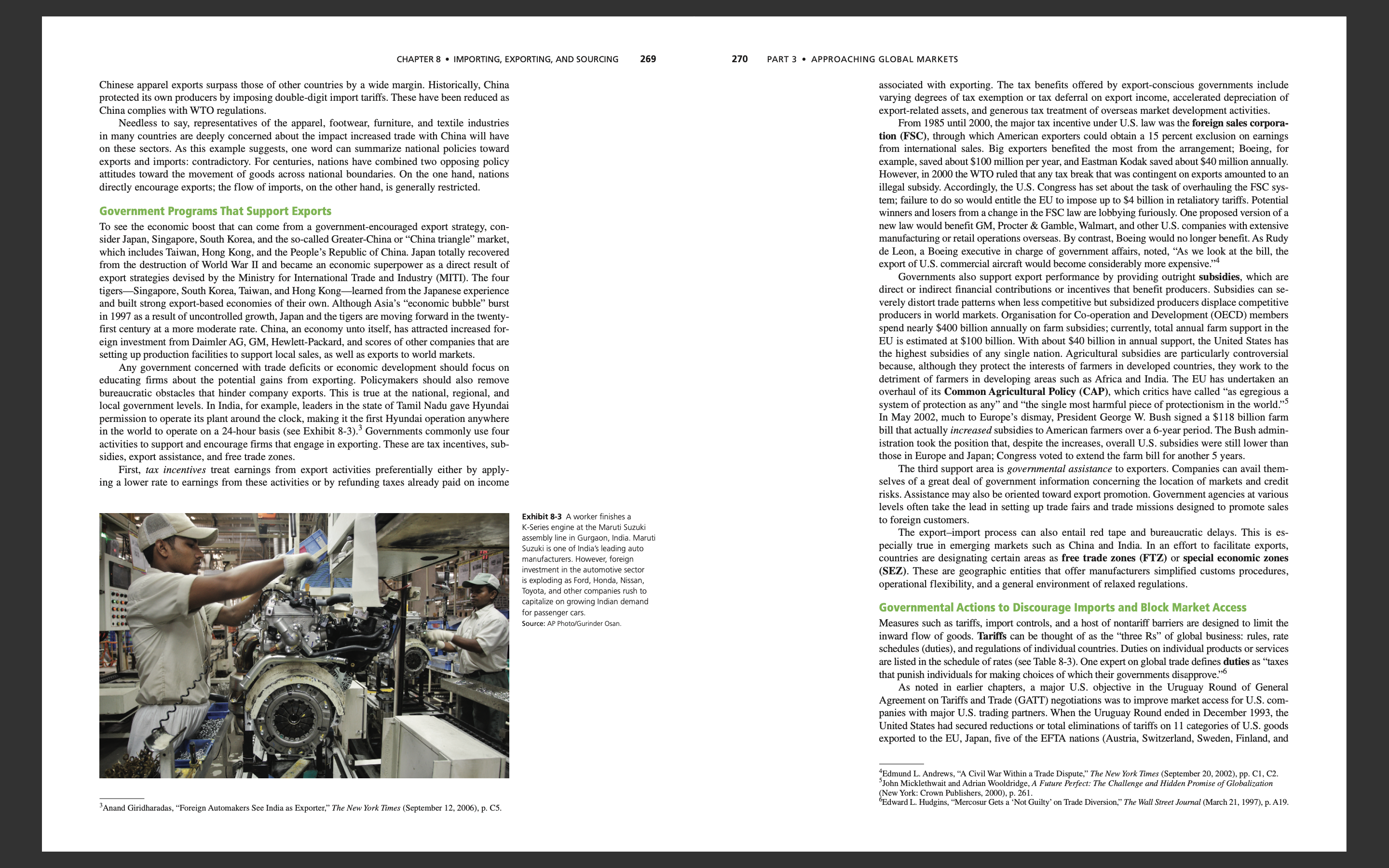

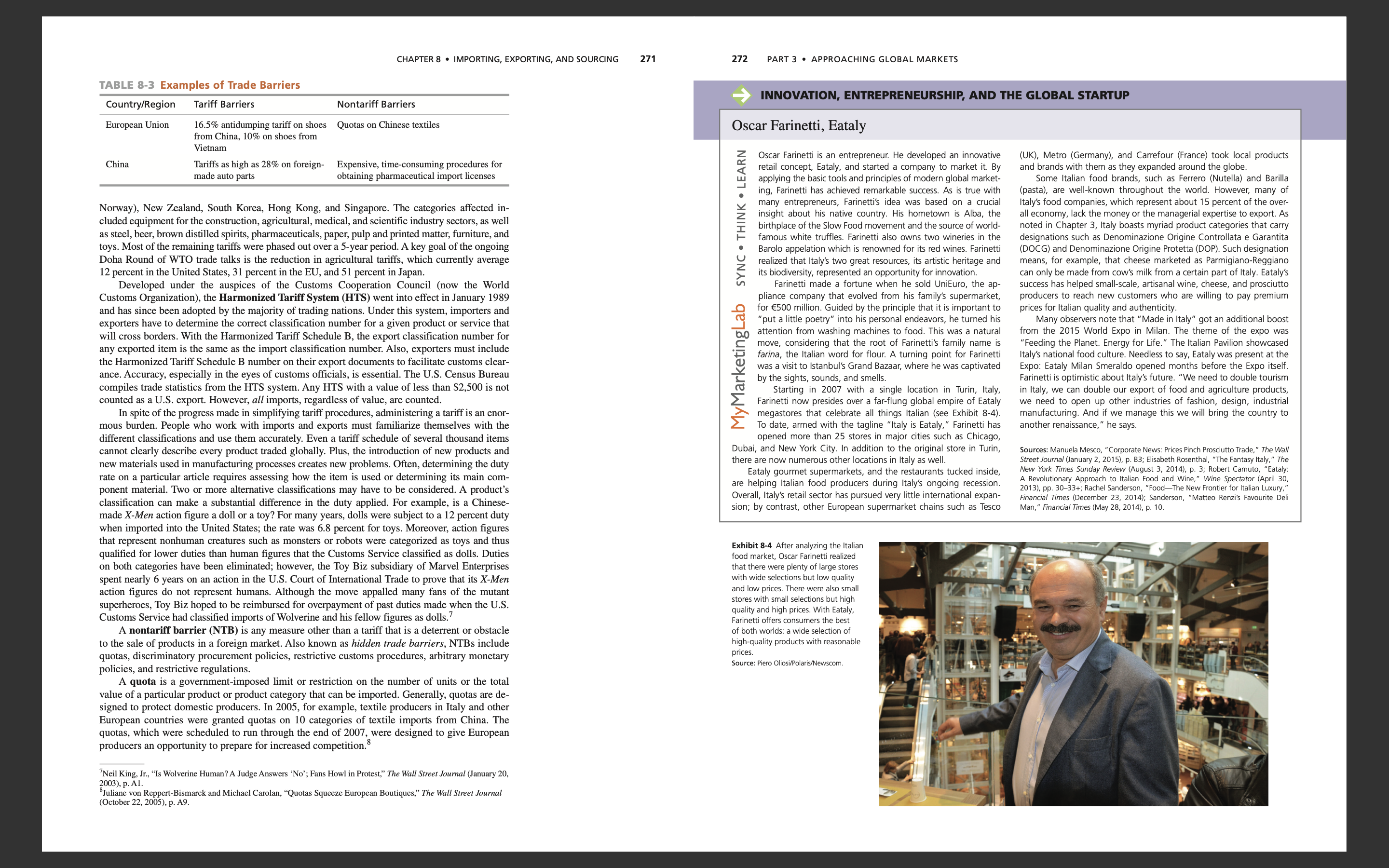

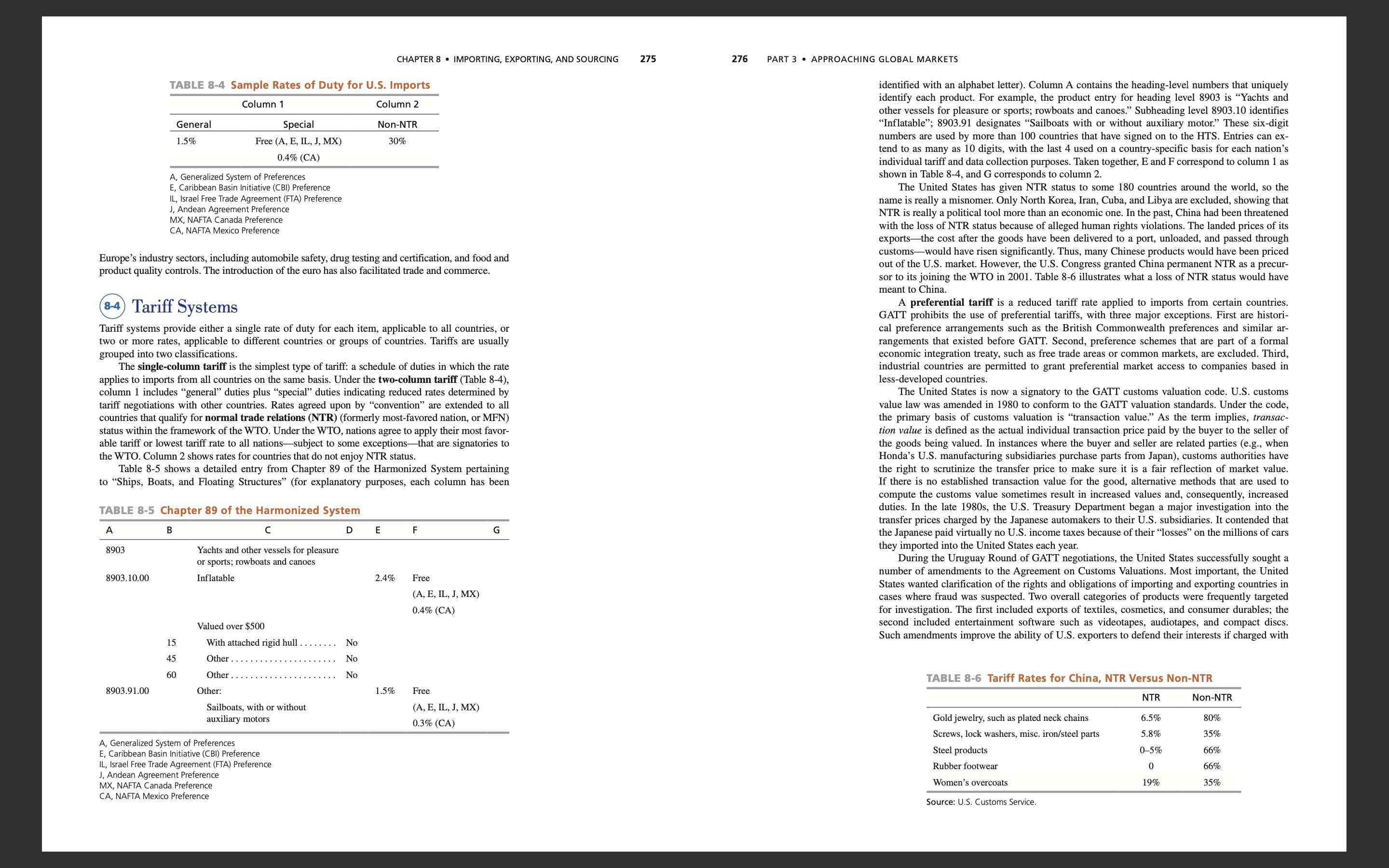

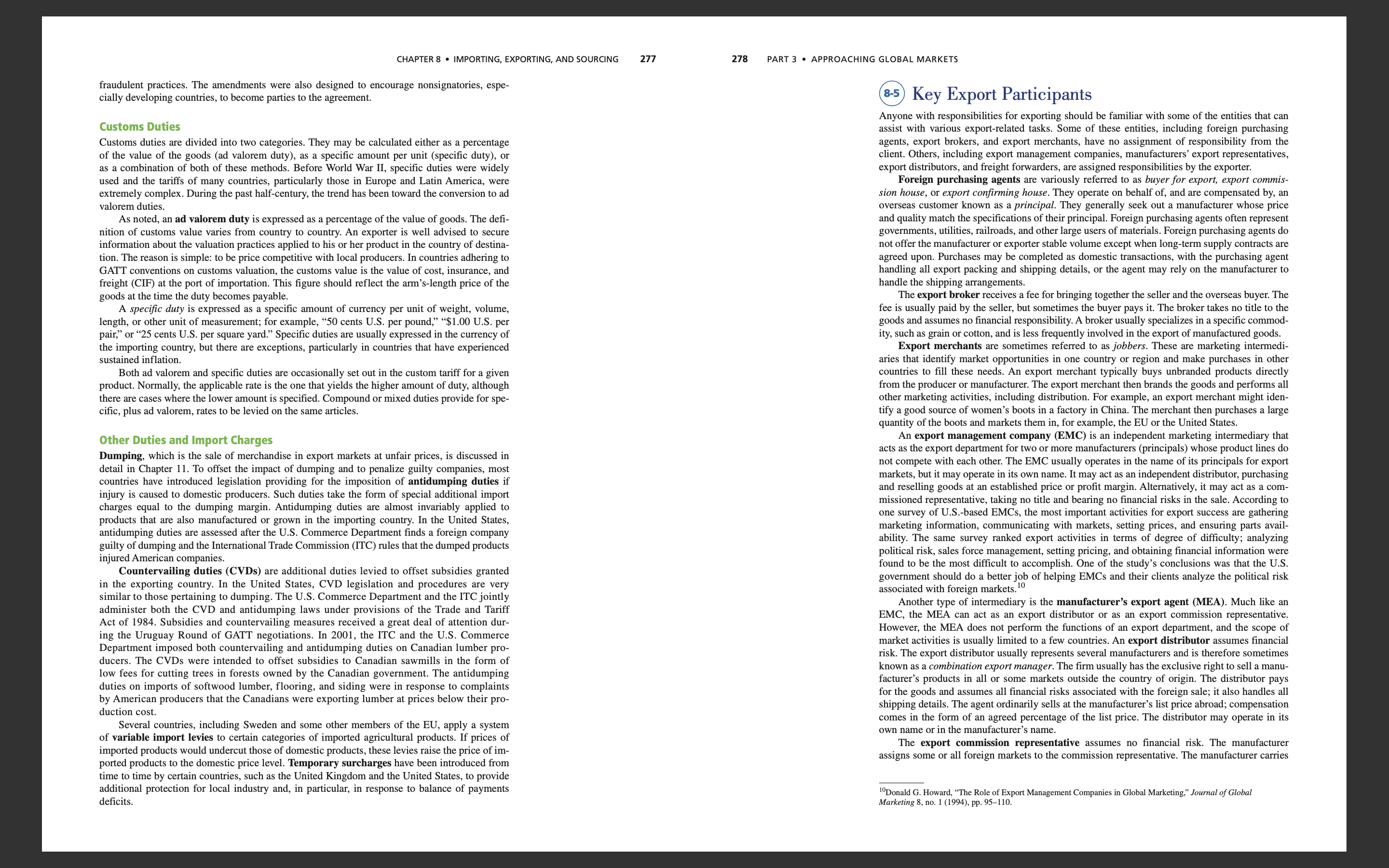

CHAPTER 7 . SEGMENTATION, TARGETING, AND POSITIONING 263 MyMarketingLab Go to the Assignments section of your MyLab to complete these writing exercises. 7-14. Compare and contrast the standardized, concentrated, and differentiated global marketing strategies. Illustrate each strategy with an example from a global company. 7-15. What is a high-touch product? Explain the difference between high-tech product positioning and high-touch product positioning. Can some products be positioned using both strategies? Explain. 8 Importing, Exporting, and Sourcing LEARNING OBJECTIVES 8-1 Compare and contrast export selling 8-6 Identify home-country export and export marketing organization considerations. 8-2 Identify the stages a company goes 8-7 Identify market-country export through, and the problems it is likely organization considerations. to encounter, as it gains experience 8-8 Discuss the various payment as an exporter. methods that are typically used in 8-3 Describe the various national policies trade financing. that pertain to exports and imports 8-9 Identify the factors that global 8-4 Explain the structure of the marketers consider when making Harmonized Tariff System sourcing decisions. 8-5 Describe the various organizations that participate in the export process. CASE 8-1 East-Asian Countries: Export-led Growth for Economic Success Few countries have witnessed economic growth as sustained and incredible as the East-Asian I' countries over the last 30 years. If the 21st century will be defined as the Asian Century, then the key to this achievement can be traced back to Japan's recipe for economic success. Soon after 1860, when the country was forced to open up, Japan's traditional cotton textile industry was wiped out by European goods. By 1914, however, the country was selling half of its automated cotton-spinner produced yarn abroad, accounting for about a quarter of the global cotton yarn exports. This phenomenon represents the two competing theories of economic development in interna- tional trade-import-substitution industrialization (ISI) and export-led growth. ISI is a model of trade and economic growth where a country reduces its share of imported goods by locally producing as 264266 PART 3 . APPROACHING GLOBAL MARKETS 8-1 Export Selling and Export Marketing: Exhibit 8-1 Instead of closing up A Comparison their economies, several countries in To better understand importing and exporting, it is important to distinguish between export East Asia adopted trade policies that promoted exports in targeted industries. selling and export marketing. First of all, export selling does not involve tailoring the product After witnessing Japan's astonishing the price, or the promotional material to suit the requirements of global markets. Also, the only growth before and after World War II, marketing mix element that differs is the "place," that is, the country where the product is sold Hong Kong, Singapore, South Korea, The export selling approach may work for some products or services; for unique products with SE and Taiwan, the so-called Asian Tigers, little or no international competition, such an approach is feasible. Similarly, companies new to replicated the model for trade and economic growth in the 1960s and exporting may initially experience success with selling. Even today, the managerial mind-set in 1970s. Since then, the Asian markets many companies still favors export selling. However, as companies mature in the global mar- have been booming in spite of periods ketplace or as new competitors enter the picture, export marketing becomes necessary. with financial instabilities, with Hong Export marketing targets the customer in the context of the total market environment. The Kong leading the race. export marketer does not simply take the domestic product "as is" and sell it to internationa customers. To the export marketer, the product offered in the home market represents a starting point. It is then modified as needed to meet the preferences of international target markets; this is the approach the Chinese have adopted in the U.S. furniture market. Similarly, the export mar- keter sets prices to fit the marketing strategy and does not merely extend home-country pricing to the target market. Charges incurred in export preparation, transportation, and financing must be taken into account in determining prices. Finally, the export marketer also adjusts strategies and plans for communication and distribution to fit the market. In other words, effective com- munication about product features or uses to buyers in different export markets may require creating brochures with different copy, photographs, or artwork. As the vice president of sales and marketing of one manufacturer noted, "We have to approach the international market with marketing literature as opposed to sales literature." Export marketing is the integrated marketing of goods and services that are destined for customers in international markets. Export marketing requires: 1. An understanding of the target market environment 2. The use of marketing research and identification of market potential much as it can. In a model of export-led growth, a country spe- a controversial model of growth! Find the continuation of Case 3. Decisions concerning product design, pricing, distribution channels, advertising, and cializes completely or substantially in export production. These 8-1 at the end of the chapter. communications-the marketing mix products are usually goods in which the country enjoys compara- This chapter provides an overview of import-export basics. tive advantage. We begin by explaining the difference between export selling and After the research effort has zeroed in on potential markets, there is no substitute for a Which one of these models is more suitable for assuring export marketing. Next is a survey of organizational export activi- personal visit to size up the market firsthand and begin the development of an actual export sustainable and balanced economic growth? This is an age-old ties. An examination of national policies that support exports and marketing program. A market visit should do several things. First, it should confirm (or contradict) debate. There is some factual evidence that tells us that low- or discourage imports follows. After a discussion of tariff systems, assumptions regarding market potential. A second major purpose is to gather the additional dat and middle-income free trade countries have higher economic we introduce key export participants. The next section provides necessary to reach the final go or no-go decision regarding an export-marketing program. Certain growth on an average. This is why many governments previously an overview of organizational design issues as they pertain to kinds of information simply cannot be obtained from secondary sources. For example, an export advocating ISI began liberalizing trade by the mid-1980s exporting. manager or international marketing manager may have a list of potential distributors provided by Following Japan's astounding growth vis-a-vis the trade mod- This is followed by a section devoted to material that the U.S. Department of Commerce. In addition, he or she may have corresponded with distribu els, the Asian Tigers adopted them. China opened four SEZs (spe- can be extremely useful to undergraduates who are majoring tors on the list and formed some tentative idea of whether they meet the company's international cial economic zones) in 1979, and the coastal cities of Shenzhen in international business and international marketing: export criteria. However, it is difficult to negotiate a suitable arrangement with international distributors and Zhuhai became centers of global manufacturing for export financing and payment methods. For many students, that all- without actually meeting face-to-face to allow each sic to appraise the capabilities and character production. Exports of goods and services as a percentage of GDP important first job may be in the import-export department. of the other party. A third reason for a visit to the export market is to develop a marketing plan in between 2011 and 2015 in China has grown by 22.6 percent, with A familiarity with documentary credits and payment-related cooperation with the local agent or distributor. Agreement should be reached on necessary product Malaysia boasting 79.6 percent, and Singapore, 187.6 percent. terminology can help you make a good impression during a job modifications, pricing, advertising and promotion expenditures, and a distribution plan. If the plan Some economists have warned about the limitations of this interview and, perhaps, lead to a job as an export/import coor- calls for investment, agreement on the allocation of costs must also be reached. model, especially in periods of general economic depressions or dinator (see Case 8-3). The chapter ends with a discussion of As shown in Exhibit 8-2, one way to visit a potential market is through a trade show or a state- slumps, and the 2008-2009 global economic crisis has shown outsourcing, a topic that is becoming increasingly important as or federally sponsored trade mission. Each year hundreds of trade fairs, usually organized around some proof of it. However, trade figures from the last 50 years companies in many parts of the world cut costs by shifting both a product category or industry, are held in major markets. By attending these events, company rep speak for themselves: Asian share in world trade has increased blue-collar and white-collar work to nations with low-wage resentatives can conduct market assessment, develop or expand markets, find distributors or agents from 13 percent in 1960 to over 32 percent in 2014-not bad for | workforces. or locate potential end users. Perhaps most important, attending a trade show enables company representatives to learn a great deal about competitors' technology, pricing, and depth of market penetration. For example, exhibits often offer product literature with strategically useful technologic cal information. Overall, company managers or sales personnel should be able to get a good general impression of competitors in the marketplace as they try to sell their own company's product. 265CHAPTER 8 . IMPORTING, EXPORTING, AND SOURCING 267 268 PART 3 . APPROACHING GLOBAL MARKETS Exhibit 8-2 Milan is widely regarded TABLE 8-1 Potential Export Problems as the design capitol of the world 2011 marked the 50th anniversary Logistic Servicing Export of Salon Internazionale del Mobile di Milano ("Milan Furniture Fair"), the Arranging transportation Providing parts availability world's largest furniture and home Transport rate determination Providing repair service furnishings trade fair. Every April, some 2,000 vendors and 300,000 Handling documentation Providing technical advice visitors from more than 160 countries converge on Milan to share the latest Obtaining financial information Providing warehousing designs. Many Italian industrial design- Distribution coordination Sales promotion ers are recognizing the necessity of Packaging Advertising expanding outside the home market. To do that, exports will be key. Obtaining insurance Sales effort Source: Cosmit Spa. 10 TOMAX Legal procedures Marketing information 9 PIPE CHAIR 8 ZARTAN Government red tape Foreign market intelligence Product liability Locating market 7 FLUX Licensing Trade restrictions JERSZY SEYMOUR Customs/duty Competition overseas Contract Agent/distributor agreements 8-2 Organizational Export Activities ability to deal with sales fluctuations in the home market. Although research generally supports Exporting is becoming increasingly important as companies in all parts of the world step up their ef- the proposition that the probability of being an exporter increases with firm size, it is less clear forts to supply and service markets outside their national boundaries. Research has shown that ex- whether export intensity-the ratio of export sales to total sales-is positively correlated with porting is essentially a developmental process that can be divided into the following distinct stages: firm size. Table 8-1 lists some of the export-related problems that a company typically faces. 1. The firm is unwilling to export; it will not even fill an unsolicited export order. This may be due to perceived lack of time ("too busy to fill the order") or to apathy or ignorance. 8-3 2. The firm fills unsolicited export orders but does not pursue unsolicited orders. Such a firm National Policies Governing Exports and Imports is an export seller. It is hard to overstate the impact of exporting and importing on the world's national economies. . The firm explores the feasibility of exporting (this stage may bypass stage 2). In 1997, for example, total imports of goods and services by the United States passed the $ 4. The firm exports to one or more markets on a trial basis. trillion mark for the first time; in 2014, the combined total was $2.8 trillion. European Union 5. The firm is an experienced exporter to one or more markets. (EU) imports, counting both intra-EU trade and trade with non-EU partners, totaled more than 6. After this success, the firm pursues country- or region-focused marketing based on certain $3 trillion. Trends in both exports and imports reflect China's pace-setting economic growth in criteria (e.g., all countries where English is spoken or all countries where it is not necessary the Asia-Pacific region. Exports from China have grown significantly; they are growing even to transport by water). faster now that China has joined the World Trade Organization (WTO). As shown in Table 8-2, 7. The firm evaluates global market potential before screening for the "best" target markets to include in its marketing strategy and plan. All markets-domestic and international-are TABLE 8-2 Top 10 Clothing Exporters 2011 (U.S.$ billions) regarded as equally worthy of consideration. 201 1 The probability that a firm will advance from one stage to the next depends on different fac- tors. Moving from stage 2 to stage 3 depends on management's attitude toward the attractiveness of China 153.8 (1) exporting and confidence in the firm's ability to compete internationally. However, commitment is Hong Kong 24.5 (2) the most important aspect of a company's international orientation. Before a firm can reach stage 4, it must receive and respond to unsolicited export orders. The quality and dynamism of management Italy 23.3 (3) are important factors that can lead to such orders. Success in stage 4 can lead a firm to stages 5 and Bangladesh 19.9 (4 ) . A company that reaches stage 7 is a matu c enterprise that is relating global resources Germany 19.6 (5) to global opportunity. To reach this stage requires management with vision and commitment. One study noted that export procedural expertise and sufficient corporate resources are re- India 14.4 (6) quired for successful exporting. An interesting finding was that even the most experienced export- Turkey 13.9 (7) ers express lack of confidence in their knowledge about shipping arrangements, payment proce- Vietnam 13.2 (8) dures, and regulations. The study also showed that, although profitability is an important expected benefit of exporting, other advantages include increased flexibility and resiliency and improved France 11.0 (9 Spain 9.2 (10) This section relies heavily on Warren J. Bilkey, "Attempted Integration of the Literature on the Export Behavior of Firms," Journal of International Business Studies 8, no. 1 (1978), pp. 33-46. The stages are based on Rogers's adoption process. See Everett M. Rogers, Diffusion of Innovations (New York: Free Press, 1995). Masaaki Kotabe and Michael R. Czinkota, "State Government Promotion of Manufacturing Exports: A Gap Analysis," Journal of International Business Studies 23, no. 4 (Fourth Quarter 1992), pp. 637-658.CHAPTER 8 . IMPORTING, EXPORTING, AND SOURCING 269 270 PART 3 . APPROACHING GLOBAL MARKETS Chinese apparel exports surpass those of other countries by a wide margin. Historically, China associated with exporting. The tax benefits offered by export-conscious governments include protected its own producers by imposing double-digit import tariffs. These have been reduced as varying degrees of tax exemption or tax deferral on export income, accelerated depreciation of China complies with WTO regulations. export-related assets, and generous tax treatment of overseas market development activities. Needless to say, representatives of the apparel, footwear, furniture, and textile industries From 1985 until 2000, the major tax incentive under U.S. law was the foreign sales corpora- in many countries are deeply concerned about the impact increased trade with China will have tion (FSC), through which American exporters could obtain a 15 percent exclusion on earnings on these sectors. As this example suggests, one word can summarize national policies toward from international sales. Big exporters benefited the most from the arrangement; Boeing, for exports and imports: contradictory. For centuries, nations have combined two opposing policy example, saved about $100 million per year, and Eastman Kodak sav 10 million annually attitudes toward the movement of goods across national boundaries. On the one hand, nations However, in 2000 the WTO ruled that any tax break that was contingent on ex n exports amounted to an directly encourage exports; the flow of imports, on the other hand, is generally restricted. illegal subsidy. Accordingly, the U.S. Congress has set about the task of overhauling the FSC sys- tem; failure to do so would entitle the EU to impose up to $4 billion in retaliatory tariffs. Potential Government Programs That Support Exports winners and losers from a change in the FSC law are lobbying furiously. One proposed version of a To see the economic boost that can come from a government-encouraged export strategy, con- new law would benefit GM, Procter & Gamble, Walmart, and other U.S. companies with extensive sider Japan, Singapore, South Korea, and the so-called Greater-China or "China triangle" market, manufacturing or retail operations overseas. By contrast, Boeing would no longer benefit. As Rudy which includes Taiwan, Hong Kong, and the People's Republic of China. Japan totally recovered de Leon, a Boeing executive in charge of government affairs, noted, "As we look at the bill, the from the destruction of World War II and became an economic superpower as a direct result of export of U.S. commercial aircraft would become considerably more expensive."* export strategies devised by the Ministry for International Trade and Industry (MITI). The four Governments also support export performance by providing outright subsidies, which are igers-Singapore, South Korea, Taiwan, and Hong Kong-learned from the Japanese experience direct or indirect financial contributions or incentives that benefit producers. Subsidies can se- and built strong export-based economies of their own. Although Asia's "economic bubble" burst verely distort trade patterns when less competitive but subsidized producers displace competitive in 1997 as a result of uncontrolled growth, Japan and the tigers are moving forward in the twenty- producers in world markets. Organisation for Co-operation and Development (OECD) members first century at a more moderate rate. China, an economy unto itself, has attracted increased for spend nearly $400 billion annually on farm subsidies; currently, total annual farm support in the eigninvestment from Daimler AG, GM, Hewlett-Packard, and scores of other companies that are EU is estimated at $100 billion. With about $40 billion in annual support, the United States has setting up production facilities to support local sales, as well as exports to world markets. the highest subsidies of any single nation. Agricultural subsidies are particularly controversial Any government concerned with trade deficits or economic development should focus on because, although they protect the interests of farmers in developed countries, they work to the educating firms about the potential gains from exporting. Policymakers should also remove detriment of farmers in developing areas such as Africa and India. The EU has undertaken an bureaucratic obstacles that hinder company exports. This is true at the national, regional, and overhaul of its Common Agricultural Policy (CAP), which critics have called "as egregious local government levels. In India, for example, leaders in the state of Tamil Nadu gave Hyundai system of protection as any" and "the single most harmful piece of protectionism in the world." permission to operate its plant around the clock, making it the first Hyundai operation anywhere In May 2002, much to Europe's dismay, President George W. Bush signed a $118 billion farm in the world to operate on a 24-hour basis (see Exhibit 8-3)." Governments commonly use four bill that actually increased subsidies to American farmers over a 6-year period. The Bush admin activities to support and encourage firms that engage in exporting. These are tax incentives, sub- istration took the position that, despite the increases, overall U.S. subsidies were still lower than sidies, export assistance, and free trade zones. hose in Europe and Japan; Congress voted to extend the farm bill for another 5 years. First, tax incentives treat earnings from export activities preferentially either by apply The third support area is governmental assistance to exporters. Companies can avail them- ing a lower rate to earnings from these activities or by refunding taxes already paid on income selves of a great deal of government information concerning the location of markets and credit risks. Assistance may also be oriented toward export promotion. Government agencies at various levels often take the lead in setting up trade fairs and trade missions designed to promote sales Exhibit 8-3 A worker finishes a K-Series engine at the Maruti Suzuki to foreign customers. assembly line in Gurgaon, India. Maruti The export-import process can also entail red tape and bureaucratic delays. This is es- Suzuki is one of India's leading auto pecially true in emerging markets such as China and India. In an effort to facilitate exports manufacturers. However, foreign countries are designating certain areas as free trade zones (FTZ) or special economic zones investment in the automotive sector (SEZ). These are geographic entities that offer manufacturers simplified customs procedures, is exploding as Ford, Honda, Nissan, Toyota, and other companies rush to operational flexibility, and a general environment of relaxed regulations. coco capitalize on growing Indian demand CCOM for passenger cars. Governmental Actions to Discourage Imports and Block Market Access Source: AP Photo/Gurinder Osan Measures such as tariffs, import controls, and a host of nontariff barriers are designed to limit the inward flow of goods. Tariffs can be thought of as the "three Rs" of global business: rules, rate schedules (duties), and regulations of individual countries. Duties on individual products or services are listed in the schedule of rates (see Table 8-3). One expert on global trade defines duties as "taxes that punish individuals for making choices of which their governments disapprove." As noted in earlier chapters, a major U.S. objective in the Uruguay Round of General Agreement on Tariffs and Trade (GATT) negotiations was to improve market access for U.S. com- panies with major U.S. trading partners. When the Uruguay Round ended in December 1993, the United States had secured reductions or total eliminations of tariffs on 1 1 categories of U.S. goods exported to the EU, Japan, five of the EFTA nations (Austria, Switzerland, Sweden, Finland, and 4Edmund L. Andrews, "A Civil War Within a Trade Dispute," The New York Times (September 20, 2002), pp. C1, C2 'John Micklethwait and Adrian Wooldridge, A Future Perfect: The Challenge and Hidden Promise of Globalization (New York: Crown Publishers, 2000), p. 261. Anand Giridharadas, "Foreign Automakers See India as Exporter," The New York Times (September 12, 2006), p. C5. Edward L. Hudgins, "Mercosur Gets a 'Not Guilty' on Trade Diversion," The Wall Street Journal (March 21, 1997), p. A19.CHAPTER 8 . IMPORTING, EXPORTING, AND SOURCING 271 272 PART 3 . APPROACHING GLOBAL MARKETS TABLE 8-3 Examples of Trade Barriers INNOVATION, ENTREPRENEURSHIP, AND THE GLOBAL STARTUP Country/Region Tariff Barriers Nontariff Barriers European Union 16.5% antidumping tariff on shoes Quotas on Chinese textiles Oscar Farinetti, Eataly from China, 10% on shoes from Vietnam Oscar Farinetti is an entrepreneur. He developed an innovative (UK), Metro (Germany), and Carrefour (France) took local products China Tariffs as high as 28% on foreign- Expensive, time-consuming procedures for retail concept, Eataly, and started a company to market it. By and brands with them as they expanded around the globe. made auto parts obtaining pharmaceutical import licenses applying the basic tools and principles of modern global market- Some Italian food brands, such as Ferrero (Nutella) and Barilla ing, Farinetti has achieved remarkable success. As is true with (pasta), are well-known throughout the world. However, many of Norway), New Zealand, South Korea, Hong Kong, and Singapore. The categories affected in- many entrepreneurs, Farinetti's idea was based on a crucial Italy's food companies, which represent about 15 percent of the over- cluded equipment for the construction, agricultural, medical, and scientific industry sectors, as well insight about his native country. His hometown is Alba, the all economy, lack the money or the managerial expertise to export. A SYNC . THINK . LEARN birthplace of the Slow Food movement and the source of world- noted in Chapter 3, Italy boasts myriad product categories that carry as steel, beer, brown distilled spirits, pharmaceuticals, paper, pulp and printed matter, furniture, and famous white truffles. Farinetti also owns two wineries in the designations such as Denominazione Origine Controllata e Garantita toys. Most of the remaining tariffs were phased out over a 5-year period. A key goal of the ongoing Barolo appelation which is renowned for its red wines. Farinetti (DOCG) and Denominazione Origine Protetta (DOP). Such designation Doha Round of WTO trade talks is the reduction in agricultural tariffs, which currently average realized that Italy's two great resources, its artistic heritage and means, for example, that cheese marketed as Parmigiano-Reggiand 2 percent in the United States, 31 percent in the EU, and 51 percent in Japan. its biodiversity, represented an opportunity for innovation. can only be made from cow's milk from a certain part of Italy. Eataly's Developed under the auspices of the Customs Cooperation Council (now the World Farinetti made a fortune when he sold UniEuro, the ap- success has helped small-scale, artisanal wine, cheese, and prosciutto Customs Organization), the Harmonized Tariff System (HTS) went into effect in January 1989 pliance company that evolved from his family's supermarket, producers to reach new customers who are willing to pay premium and has since been adopted by the majority of trading nations. Under this system, importers and for E500 million. Guided by the principle that it is important to prices for Italian quality and authenticity. exporters have to determine the correct classification number for a given product or service that "put a little poetry" into his personal endeavors, he turned his Many observers note that "Made in Italy" got an additional boost will cross borders. With the Harmonized Tariff Schedule B, the export classification number for attention from washing machines to food. This was a natural from the 2015 World Expo in Milan. The theme of the expo was any exported item is the same as the import classification number. Also, exporters must include move, considering that the root of Farinetti's family name is "Feeding the Planet. Energy for Life." The Italian Pavilion showcased the Harmonized Tariff Schedule B number on their export documents to facilitate customs clear- farina, the Italian word for flour. A turning point for Farinetti Italy's national food culture. Needless to say, Eataly was present at the MyMarketingLab Expo: Eataly Milan Smeraldo opened months before the Expo itself. ance. Accuracy, especially in the eyes of customs officials, is essential. The U.S. Census Bureau was a visit to Istanbul's Grand Bazaar, where he was captivated by the sights, sounds, and smells. Farinetti is optimistic about Italy's future. "We need to double tourism compiles trade statistics from the HTS system. Any HTS with a value of less than $2,500 is not Starting in 2007 with a single location in Turin, Italy, in Italy, we can double our export of food and agriculture products counted as a U.S. export. However, all imports, regardless of value, are counted. Farinetti now presides over a far-flung global empire of Eataly we need to open up other industries of fashion, design, industrial In spite of the progress made in simplifying tariff procedures, administering a tariff is an enor- megastores that celebrate all things Italian (see Exhibit 8-4). manufacturing. And if we manage this we will bring the country to mous burden. People who work with imports and exports must familiarize themselves with the To date, armed with the tagline "Italy is Eataly," Farinetti has another renaissance," he says. different classifications and use them accurately. Even a tariff schedule of several thousand items opened more than 25 stores in major cities such as Chicago, cannot clearly describe every product traded globally. Plus, the introduction of new products and Dubai, and New York City. In addition to the original store in Turin, Sources: Manuela Mesco, "Corporate News: Prices Pinch Prosciutto Trade," The Wall new materials used in manufacturing processes creates new problems. Often, determining the duty there are now numerous other locations in Italy as well. Street Journal (January 2, 2015), p. B3; Elisabeth Rosenthal, "The Fantasy Italy," The New York Times Sunday Review (August 3, 2014), p. 3; Robert Camuto, "Eataly: rate on a particular article requires asse ssing how the item is used or determining its main com- Eataly gourmet supermarkets, and the restaurants tucked inside, are helping Italian food producers during Italy's ongoing recession. A Revolutionary Approach to Italian Food and Wine," Wine Spectator (April 30, ponent material. Two or more alternative classifications may have to be considered. A product's 2013), pp. 30-33+; Rachel Sanderson, "Food-The New Frontier for Italian Luxury," classification can make a substantial difference in the duty applied. For example, is a Chinese- Overall, Italy's retail sector has pursued very little international expan- Financial Times (December 23, 2014); Sanderson, "Matteo Renzi's Favourite Deli made X-Men action figure a doll or a toy? For many years, dolls were subject to a 12 percent duty sion; by contrast, other European supermarket chains such as Tesco Man," Financial Times (May 28, 2014), p. 10. when imported into the United States; the rate was 6.8 percent for toys. Moreover, action figures that represent nonhuman creatures such as monsters or robots were categorized as toys and thus Exhibit 8-4 After analyzing the Italian qualified for lower duties than human figures that the Customs Service classified as dolls. Duties food market, Oscar Farinetti realized on both categories have been eliminated; however, the Toy Biz subsidiary of Marvel Enterprises that there were plenty of large stores spent nearly 6 years on an action in the U.S. Court of International Trade to prove that its X-Men with wide selections but low quality action figures do not represent humans. Although the move appalled many fans of the mutant and low prices. There were also small superheroes, Toy Biz hoped to be reimbursed for overpayment of past duties made when the U.S. stores with small selections but high quality and high prices. With Eataly, Customs Service had classified imports of Wolverine and his fellow figures as dolls.' Farinetti offers consumers the best A nontariff barrier (NTB) is any measure other than a tariff that is a deterrent or obstacle of both worlds: a wide selection of to the sale of products in a foreign market. Also known as hidden trade barriers, NTBs include high-quality products with reasonable quotas, discriminatory procurement policies, restrictive customs procedures, arbitrary monetary prices. policies, and restrictive regulations. Source: Piero Oliosi/Polaris/Newscom. A quota is a government-imposed limit or restriction on the number of units or the total value of a particular product or product category that can be imported. Generally, quotas are de- igned to protect domestic producers. In 2005, for example, textile producers in Italy and other European countries were granted quotas on 10 categories of textile imports from China. The quotas, which were scheduled to run through the end of 2007, were designed to give European producers an opportunity to prepare for increased competition. "Neil King, Jr., "Is Wolverine Human? A Judge Answers 'No'; Fans Howl in Protest," The Wall Street Journal (January 20, 2003), p. Al. Juliane von Reppert-Bismarck and Michael Carolan, "Quotas Squeeze European Boutiques," The Wall Street Journal October 22, 2005), p. A9.CHAPTER 8 . IMPORTING, EXPORTING, AND SOURCING 273 274 PART 3 . APPROACHING GLOBAL MARKETS Exhibit 8-5 In February 2009, U.S. President Barack Obama addressed EMERGING MARKETS BRIEFING BOOK workers at a Caterpillar plant in Peoria, Illinois. The appearance came one month after Caterpillar officials an- Clothing Factory Tragedies in Bangladesh nounced the elimination of 22,000 jobs. The President spoke about his economic recovery and reinvestment As shown in Table 8-2, Bangladesh ranks as the world's number launched by the Foreign Trade Association, an agency that represents plan, noting, "What's happening at 4 clothing exporter; the country has benefited from rising wages hundreds of European retailers. As it turned out, however, the BSCI's this company tells us a larger story in China that have increased the cost of manufacturing there. auditors were not engineers and had not made recommendations about what's happening with our na- As noted in Chapter 2, about 80 percent of Bangladesh's export regarding building safety and stability. tion's economy-because, in many . THINK . LEARN earnings come from its network of more than 5,000 garment The response from Western retailers was swift. For example, CAT ways, you can measure America's manufacturing operations. However, the garment industry has although Walmart had forbidden its contractors from using the bottom line by looking at Caterpillar's been roiled by a series of tragedies that have highlighted the Tazreen factory, some of its clothing was found at the scene of the bottom line." The President added, "Caterpillar has shaped the American often-dangerous conditions facing workers. 2012 fire. Walmart has since implemented a "zero-tolerance policy" landscape, and shown the world what In 2010, dozens of Bangledeshis were killed in two separate for contractors who use factories without Walmart's authorization a great American company looks like." fires in factories that made clothing for Western clients such Walmart has donated $1.6 million to provide fire-safety training to Source: bp3/ZUMA Press/Newscom. as Hennes & Mauritz, JCPenney, and Gap. In November 2012, garment workers in Bangladesh. SYN 112 garment workers were killed when a fire broke out at Despite such efforts, the Workers Rights Consortium, the Tazreen Fashions, a clothing manufacturer in Dhaka, Bangladesh. International Labor Organization, the Interfaith Center for Corporate Tazreen's clients included Walmart and other well-known global Responsibility, and other groups that monitor labor issues are stepping retail brands. The tragedy highlighted the Bangladesh Fire and up pressure on the companies that participate in the global garment Building Safety Agreement, a contract that increasing numbers supply chain. Too often, the activists charge, Western retailers pay lip Discriminatory procurement policies can take the form of government rules, laws, or ad- of workers, unions, and marketers have signed. service to concerns about factory safety; in reality, critics say, the retailers ministrative regulations requiring that goods or services be purchased from domestic companies. In April 2013, tragedy struck another factory in Dhaka (see continue to focus on low prices rather than the welfare of workers. A MyMarketingLab Exhibit 8-6). More than 500 people-most of them women- the head of the Cambodian garment manufacturers association told the For example, the Buy American Act of 1933 stipulates that U.S. federal agencies and govern- were killed. This time, however, fire was not the cause. Rather, Financial Times, "The buyer and consumer must be willing to pay more." ment programs must buy goods produced in the United States. The act does not apply if domestic the eight-story Rana Plaza building in Dhaka collapsed. The cally produced goods are not available, if the cost is unreasonable, or if "buying local" would building housed garment factories that employed about 5,000 Sources: Syed Zain Al-Mahmood, Christina Passariello, and Preetika Ra be inconsistent with the public interest. Similarly, the Fly American Act states that U.S. govern- garment workers making clothing such as the Joe Fresh line Global Garment Trail: From Bangladesh to a Mall Near You," The Wall Street Journal ment employees must fly on domestic carriers whenever possible. One of the most controversial for Loblaw, a Canadian retailer; Italy's Benetton was another (May 4-5, 2013), pp. A1, A11; Syed Zain Al-Mahmood and Tom Wright, "Collapsed Factory Was Built Without Permit," The Wall Street Journal (April 26, 2013), p. A9; aspects of U.S. President Barack Obama's $885 billion economic stimulus bill was a proposed customer. Syed Zain Al-Mahmood and Shelly Banjo, "Deadly Collapse," The Wall Street Journal provision requiring that all manufactured goods purchased with stimulus money be "Made in In the aftermath of the tragedy, it was revealed that the build- (April 25, 2013), pp. A1, A10; Shelly Banjo and Syed Zain Al-Mahmood, "Bangladesh the USA" (see Exhibit 8-5). Opponents alleged that the proposal's language violated U.S. trade ing's owner was a local politician who had not obtained the necessary Fire Spurs Rights Campaign," The Wall Street Journal (April 8, 2013), p. B3; Barney permits from Dhaka's building-safety authority. Some of the factories Jopson and Amy Kazmin, agreements; the clause elicited strong protests from key trading partners, some of which an ounced that they would retaliate with protectionist measures of their own. Congress ultimately in the Rana Plaza building had been certified in audits conducted by (December 18, 2012); Rahul Jacob, "Lip Service to Workers Isn't Worth the Price," Financial Times (December 6, 2012), p. 10; Jonathan Birchall, "Western Brands in oned down the protectionist rhetoric, thus averting a possible trade war." the Business Social Compliance Initiative (BSCI). The Initiative was Bangladesh Face Safety Push," Financial Times (December 19, 2010). Customs procedures are considered restrictive if they are administered in a way that makes compliance difficult and expensive. For example, the U.S. Department of Commerce might clas- sify a product under a certain harmonized number; Canadian customs may disagree. The U.S. Exhibit 8-6 Following the collapse of an eight-story building that housed exporter may have to attend a hearing with Canadian customs officials to reach an agreement. several Bangladesh garment factories Such delays cost time and money for both the importer and the exporter. relatives of missing workers argued Discriminatory exchange rate policies distort trade in much the same way as selective im- and pleaded with army officials as the port duties and export subsidies. As noted earlier, some Western policymakers have argued that search for survivors continued. China is pursuing policies that ensure an artificially weak currency. Such a policy has the effect Source: AP Photo/Kevin Frayer. of giving Chinese goods a competitive price edge in world markets. Finally, restrictive administrative and technical regulations also can create barriers to trade. These may take the form of antidumping regulations, product size regulations, and safety and health regulations. Some of these regulations are intended to keep out foreign goods; others are directed toward legitimate domestic objectives. For example, the safety and pollution regu- lations being developed in the United States for automobiles are motivated almost entirely by legitimate concerns about highway safety and pollution. However, an effect of these regulations has been to make it so expensive to comply with U.S. safety requirements that some automakers have withdrawn certain models from the market. Volkswagen, for example, was forced to stop selling diesel automobiles in the United States for several years. As discussed in earlier chapters, there is a growing trend to remove all such restrictive trade barriers on a regional basis. The largest single effort was undertaken by the EU and resulted in the creation of a single market starting January 1, 1993. The intent was to have one standard for all of "David Lynch, "Buy American' Clause Stirs Up Controversy," USA Today (February 4, 2009), p. 3B.CHAPTERS - IMvoRrING, EXPORTING, AND SOURCING TABLE 8-4 Sample Rates of Duty for U.S. Imports Column 1 Column 2 General Special Non-NTR 1.5% Free (A, Ii, IL, 1. MX) 30% 0.4% (CA) A, Generalized System at Pretetenres E, Caribbean basin Initiative (Cal) Preterence IL, Israel Free Trade Agreement (FlA) Preterenre J, Andean Agreement Preference Mx, NAFTA Canada Preference cA, NANA Mexico Preterenre Europe's industry sectors, including automobile safety, drug testing and certication and food and product quality controls. The introduction ofthe euro has also facilitated trade and oommerce. Tariff Systems Tariff systems provide either a single rate of duty for each item, applicable to all countries, or two or more rates, applicable to different countries or groups of countries. Thriffs are usually grouped into two classications. The single-column min is the simplest type of toner; a schedule of duties in which the rare applies to imports from all countries on the same basis. Under the twiroolumn txrill' (Table 8-4), column 1 includes \"general" duties plus \"special" duties indicating Ieduced rates determined by tariff negotiations with other countries. Rates agreed upon by \"convention" are extended to all countries that quality for normal trade relations (N111) (formerly mosttavoted nation or mt) status within the frarncworlt of the wm. Under the Win, nations agree to apply their most favor able tariff or lowest tariff rate to all nationssubject to some exceptionsthat are signatories to the WTU. Column 2 shows rates for countries that do not enjoy NTR status. Table 8-5 shows a detailed entry from Chapter 89 of the Harmonized System pertaining to \"Ships. Boats, and Floating Structures\" (for explanatory purposes, each column has been TABLE 8-5 Chapter 89 of the Harmonized System A E C D E903 Yachts and other vessels for pleasure or spos; rowboats and canoes 890110.00 Inflatable . Free (A. E, 1].. I, MX) 04% (CA) Valued over $500 With attached rigid hull ........ No Other ...................... No other ...................... No 89033100 Other: , Free Sailboats. with or without (A. E. IL. 1. MX) \"'me \"mm\" 0.3% (CA) A, Generalized System of Preferences E, Caribbean Basin Initiative (cal) Preference IL. Israel Flee rrads Agreement (HA) Prelerence l, Andean Agreement Preference MX, NAFTA Canada Pretetenre CA, NArrA MEXICO Prelerence 275 275 PART 3 - APvRoAcHING GLOEAL MARKETS identied with an alphabet letter). Column A contains the headinglevel numbers that uniquely identify each product. For example. the product entry for heading level 3903 is "Yachts and other vessels for pleaslu'e or sports: rowboats and canoes\" Subheading level 8903.10 idenh'es \"Inflatable"; 8903.91 designates \"Sailboats with or without auxiliary motor." These sixdigit number: an used by more than 100 countries that have signed on to the HTS. Entries can ex- tend to as many as lo digits, with the last 4 used on a countryspecic basis for each nation's indiw'dual tadrtaiid data collection purposes Taken together. E and F correspond to column 1 as shown in Thble 8-4, and G corresponds to column 2. The United States has given NTR status In some 180 countries around the world, so the name is really a misnomer. Only North Korea lmn, Cuba, and Libya are excluded, showing that NTR is really a political tool more than an economic one. In the past China had been threatened with the loss of NTR status because of alleged human rights violations. The landed prices of its exportsthe cost aer the goods have been delivered to a port, unloaded, and passed through customswould have risen significantly. Thus, many Chinese products would have been priced out of the US. market. However. the US. Congress granted China permanent m as a precur- sor to its joining the WTO in 2001s Table 8-6 illustrates what a loss of NTR status would have meant to China. A preferential tuner is a reduced tariff rate applied to imports from certain countries. GATI' prohibits the use of preferential tarirrs, with three major exceptions. First are histori- cal preterence arrangements such as the British Commonwealth prererences and similar are rangernents that existed before GATT. Second, preference schemes that are part of a formal economic integration treaty, such as free trade areas or common markets, are excluded. Third, industrial counnics are permitted to grant preferential market acoess to companies based in less-developed countries. The United States is now a signatory to the GATT customs valuah'on Code. US customs value law was amended in 1980 to conform to the GATT valuation standards. Under the code, the primary basis of customs valuation is \"transaction value." As the term implies, Immac- n'on value is dened as the actual individual transaction price paid by the buyer to the seller at the goods being valued. ln instances where the buyer and seller are related parties (eg. when Honda's US. manufacturing subsidiaries purchase parts from Japan), customs authorities have the right to scrutinize the transfer price to make sure it is a fair reection of market value. If there is no established transaction value {or the good, alternative methods that are used to compute the customs value sometimes result in increased values and, consequently. increased duties. In the late 1980s, the us. Treasury Department began a major investigation into the transfer prices charged by the Japanese automakers to their US. subsidiaries. It contended that the Japanese paid virtually no US. income taxes because of their "losses" on the millions of cars they imported into the United States each year. During the Umguay Round of GATT negotiations. the United States successfully sought a number of amendments to the Agreement on Custom Valuations. Most important, the United States wanted clarication of the rights and obligations of importing and exporting countries in cases where fraud was suspected. nvo overall categories of products were frequently targeted for investigations The rst included exports of textiles, cosmetics, and consumer durables: the second included entertainment sonwate such as videotapes, audiotapes, and compact discs. Such amendments improve the ability of US. exporters to defend their interests if charged with TABLE 86 Tariff Rates for China, NTR Versus Nun-NTR NTR Non-NTR Gold jewelry, such as plated neck chains 6.5% 30% Screws, lock washers, misc. iron/steel parts 5.3% 35% Steel products 075% 66% Rubber tootwesr o 66% Women's overconts 19% 35% some: us Customs Service. CHAPTER 8 . IMPORTING, EXPORTING, AND SOURCING 277 8 PART 3 . APPROACHING GLOBAL MARKETS fraudulent practices. The amendments were also designed to encourage nonsignatories, espe- cially developing countries, to become parties to the agreement. 8-5 Key Export Participants Anyone with responsibilities for exporting should be familiar with some of the entities that can Customs Duties assist with various export-related tasks. Some of these entities, including foreign purchasing Customs duties are divided into two categories. They may be calculated either as a percentage agents, export brokers, and export merchants, have no assignment of responsibility from the of the value of the goods (ad valorem duty), as a specific amount per unit (specific duty), or client. Others, including export management companies, manufacturers' export representatives, as a combination of both of these methods. Before World War II, specific duties were widely export distributors, and freight forwarders, are assigned responsibilities by the exporter used and the tariffs of many countries, particularly those in Europe and Latin America, were Foreign purchasing agents are variously referred to as buyer for export, export commis- extremely complex. During the past half-century, the trend has been toward the conversion to ad sion house, or export confirming house. They operate on behalf of, and are compensated by, ar valorem duties. overseas customer known as a principal. They generally seek out a manufacturer whose price As noted, an ad valorem duty is expressed as a percentage of the value of goods. The defi- and quality match the specifications of their principal. Foreign purchasing agents often represent nition of customs value varies from country to country. An exporter is well advised to secure governments, utilities, railroads, and other large users of materials. Foreign purchasing agents do information about the valuation practices applied to his or her product in the country of destina- not offer the manufacturer or exporter stable volume except when long-term supply contracts are tion. The reason is simple: to be price competitive with local producers. In countries adhering to agreed upon. Purchases may be completed as domestic transactions, with the purchasing agen GATT conventions on customs valuation, the customs value is the value of cost, insurance, and handling all export packing and shipping details, or the agent may rely on the manufacturer to reight (CIF) at the port of importation. This figure should reflect the arm's-length price of the handle the shipping arrangements. goods at the time the duty becomes payable. The export broker receives a fee for bringing together the seller and the overseas buyer. The A specific duty is expressed as a specific amount of currency per unit of weight, volume, fee is usually paid by the seller, but sometimes the buyer pays it. The broker takes no title to the length, or other unit of measurement; for example, "50 cents U.S. per pound," "$1.00 U.S. per goods and assumes no financial responsibility. A broker usually specializes in a specific commod- pair," or "25 cents U.S. per square yard." Specific duties are usually expressed in the currency of ity, such as grain or cotton, and is less frequently involved in the export of manufactured goods. the importing country, but there are exceptions, particularly in countries that have experienced Export merchants are sometimes referred to as jobbers. These are marketing intermedi sustained inflation. aries that identify market opportunities in one country or region and make purchases in other Both ad valorem and specific duties are occasionally set out in the custom tariff for a given countries to fill these needs. An export merchant typically buys unbranded products directly product. Normally, the applicable rate is the one that yields the higher amount of duty, although from the producer or manufacturer. The export merchant then brands the goods and performs all there are cases where the lower amount is specified. Compound or mixed duties provide for spe- other marketing activities, including distribution. For example, an export merchant might iden- cific, plus ad valorem, rates to be levied on the same articles ify a good source of women's boots in a factory in China. The merchant then purchases a large quantity of the boots and markets them in, for example, the EU or the United States. Other Duties and Import Charges An export management company (EMC) is an independent marketing intermediary that Dumping, which is the sale of merchandise in export markets at unfair prices, is discussed in acts as the export department for two or more manufacturers (principals) whose product lines do detail in Chapter 11. To offset the impact of dumping and to penalize guilty companies, most not compete with each other. The EMC usually operates in the name of its principals for export countries have introduced legislation providing for the imposition of antidumping duties if markets, but it may operate in its own name. It may act as an independent distributor, purchasing injury is caused to domestic producers. Such duties take the form of special additional import and reselling goods at an established price or profit margin. Alternatively, it may act as a com- charges equal to the dumping margin. Antidumping duties are almost invariably applied to missioned representative, taking no title and bearing no financial risks in the sale. According to products that are also manufactured or grown in the importing country. In the United States, one survey of U.S.-based EMCs, the most important activities for export success are gathering antidumping duties are assessed after the U.S. Commerce Department finds a foreign company marketing information, communicating with markets, setting prices, and ensuring parts avail- guilty of dumping and the International Trade Commission (ITC) rules that the dumped products ability. The same survey ranked export activities in terms of degree of difficulty; analyzing political risk, sales force management, setting pricing, and obtaining financial information were injured American companies. Countervailing duties (CVDs) are additional duties levied to offset subsidies granted found to be the most difficult to accomplish. One of the study's conclusions was that the U.S. government should do a better job of helping EMCs and their clients analyze the political risk in the exporting country. In the United States, CVD legislation and procedures are very similar to those pertaining to dumping. The U.S. Commerce Department and the ITC jointly associated with foreign markets. administer both the CVD and antidumping laws under provisions of the Trade and Tariff Another type of intermediary is the manufacturer's export agent (MEA). Much like an Act of 1984. Subsidies and countervailing measures received a great deal of attention dur- EMC, the MEA can act as an export distributor or as an export commission representative ing the Uruguay Round of GATT negotiations. In 2001, the ITC and the U.S. Commerce However, the MEA does not perform the functions of an export department, and the scope of Department imposed both countervailing and antidumping duties on Canadian lumber pro- market activities is usually limited to a few countries. An export distributor assumes financial ducers. The CVDs were intended to offset subsidies to Canadian sawmills in the form of risk. The export distributor usually represents several manufacturers and is therefore sometimes low fees for cutting trees in forests owned by the Canadian government. The antidumping known as a combination export manager. The firm usually has the exclusive right to sell a manu duties on imports of softwood lumber, flooring, and siding were in response to complaints facturer's products in all or some markets outside the country of origin. The distributor pays by American producers that the Canadians were exporting lumber at prices below their pro- for the goods and assumes all financial risks associated with the foreign sale; it also handles al duction cost. shipping details. The agent ordinarily sells at the manufacturer's list price abroad; compensation Several countries, including Sweden and some other members of the EU, apply a system comes in the form of an agreed percentage of the list price. The distributor may operate in its of variable import levies to certain categories of imported agricultural products. If prices of own name or in the manufacturer's name. imported products would undercut those of domestic products, these levies raise the price of im- The export commission representative assumes no financial risk. The manufacturer ported products to the domestic price level. Temporary surcharges have been introduced from assigns some or all foreign markets to the commission representative. The manufacturer carries time to time by certain countries, such as the United Kingdom and the United States, to provide dditional protection for local industry and, in particular, in response to balance of payments Donald G. Howard, "The Role of Export Management Companies in Global Marketing," Journal of Global deficits. Marketing 8, no. 1 (1994), pp. 95-110

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts