Question

UW Toys has developed a new productthe Professor Hillier Action Figure (PHAF). They are now deciding how to market the doll. One option is to

UW Toys has developed a new productthe Professor Hillier Action Figure (PHAF). They are now deciding how to market the doll.

One option is to immediately ramp up production and launch an ad campaign throughout the state of Washington. This option would cost $60,000. Based on past experience, new action figures either take off and do well, or fail miserably. Hence, they predict one of two possible outcomes total sales of 20,000 units or total sales of only 4000 units. The net profit per unit sold is $5.

Another option is to first test market the product in Yakima before deciding whether to sell statewide. The test market would require less capital for the production run, and a much smaller ad campaign. Again, they predict one of two possible outcomes for Yakima. The product will either do well (sell 500 units) or do poorly (sell 100 units). The cost for this option is estimated to be $1000. The net profit per unit sold is $5 for the test market as well. Once the test market is complete, University Toys would then use these results to help decide whether to market the toy statewide.

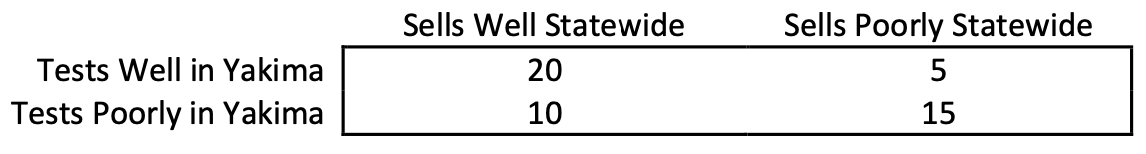

University Toys has test marketed similar toys in the Yakima market 50 times in the past, with the results shown in the table below. Since University Toys thinks PHAF is similar to these other toys, they plan to estimate the probabilities of the various outcomes based on these historical results. For example, ignoring the test-market results, 30 out of 50 of the previous toys sold well statewide, so without a test market they estimate a 60% probability for PHAF to sell well statewide. If a test market is done, these same data should be used to estimate the probabilities of the various outcomes.

There is a complication with the Yakima test market option, however. A rival toy manufacturer is rumored to be considering the development of a Dean Hodge Action Figure (DHAF). After doing the test market in Yakima, if University Toys decides to go ahead and ramp up production and market throughout the state, the cost of doing so would still be $60,000. However, the sales prospects depend upon whether DHAF has been introduced into the market or not. If DHAF has not entered the market, then the sales prospects will be the same as before (i.e., 20,000 units if PHAF does well, or 4000 units if PHAF does poorly, on top of any units sold in the test market). However, if DHAF has entered the market, the increased competition will diminish sales of PHAF. In particular, they expect to sell 10,000 if PHAF does well, and 2000 units if it does poorly, on top of any units sold in the test market. Note that the probability of PHAF doing well or doing poorly is not affected by DHAF, just the final sales totals of each possibility. If a test market is done, there is a 20% chance that DHAF will enter during the test market (before it completes). On the other hand, if UW Toys markets PHAF immediately, they are guaranteed to beat DHAF to market, thus making DHAF a non-factor.

-

Use TreePlan to develop a decision tree to help UW Toys decide the best course of action and the expected payoff. In words below the tree, state the best course of action assuming your goal is to maximize the expected payoff.

-

Now suppose UW Toys is uncertain of the probability that DHAF will enter the market before the end of the test market in Yakima would be completed (if it were done). How does the expected payoff vary as the probability that the DHAF would enter the market changes? On the same worksheet used for part a, generate a data table that shows how the expected payoff and the initial decision changes as the probability that DHAF enters varies from 0% to 100% (at 10% increments). At what probability does the decision change?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started