Answered step by step

Verified Expert Solution

Question

1 Approved Answer

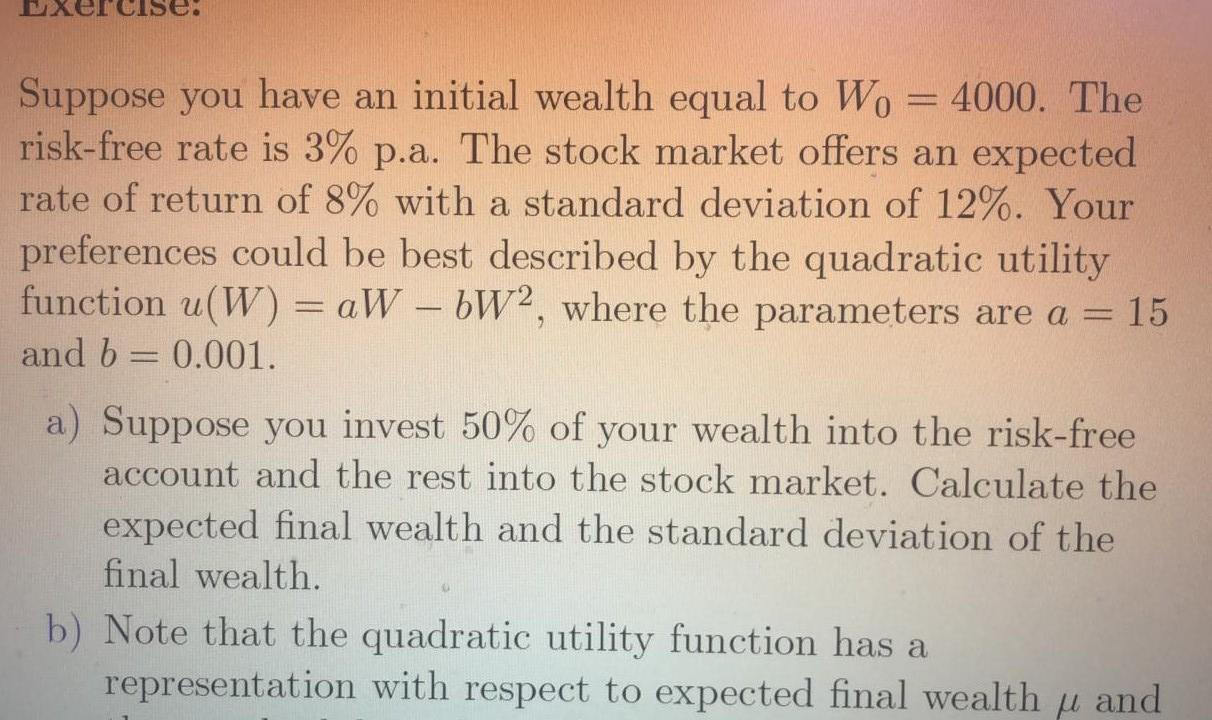

UXEL. Suppose you have an initial wealth equal to Wo = 4000. The risk-free rate is 3% p.a. The stock market offers an expected rate

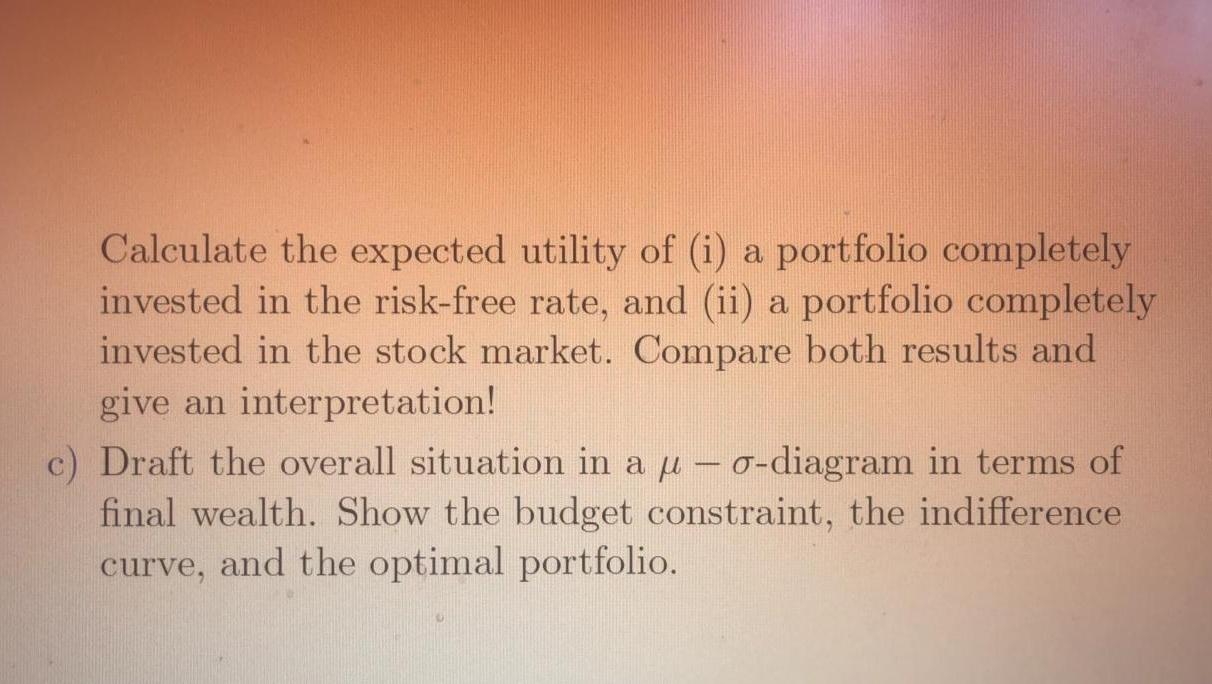

UXEL. Suppose you have an initial wealth equal to Wo = 4000. The risk-free rate is 3% p.a. The stock market offers an expected rate of return of 8% with a standard deviation of 12%. Your preferences could be best described by the quadratic utility function u(W) = aW bW2, where the parameters are a = = 15 and b=0.001. a) Suppose you invest 50% of your wealth into the risk-free account and the rest into the stock market. Calculate the expected final wealth and the standard deviation of the final wealth. b) Note that the quadratic utility function has a representation with respect to expected final wealthy and Calculate the expected utility of (i) a portfolio completely invested in the risk-free rate, and (ii) a portfolio completely invested in the stock market. Compare both results and give an interpretation! c) Draft the overall situation in a j - 0-diagram in terms of final wealth. Show the budget constraint, the indifference curve, and the optimal portfolio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started