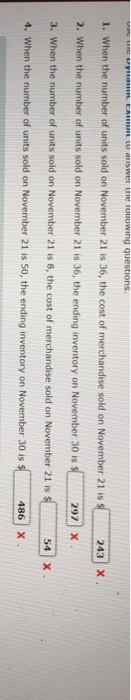

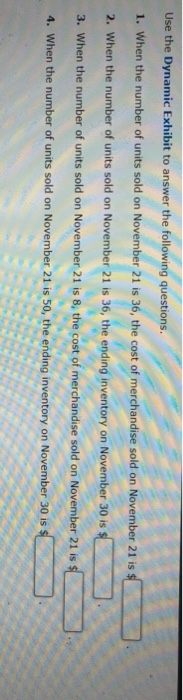

uy . EARL Swerte nowing questions. 1. When the number of units sold on November 21 is 36, the cost of merchandise sold on November 21 243 X 2. When the number of units sold on November 21 is 36, the ending inventory on November 30 is 297 3. When the number of units sold on November 21 is 8, the cost of merchandise sold on November 21 is 54 X 4. When the number of units sold on November 21 is 50, the ending inventory on November 30 is $ 486 X Use the Dynamic Exhibit to answer the following questions. 1. When the number of units sold on November 21 is 36, the cost of merchandise sold on November 21 is $ 2. When the number of units sold on November 21 is 36, the ending inventory on November 30 is $ 3. When the number of units sold on November 21 is 8, the cost of merchandise sold on November 21 is 4. When the number of units sold on November 21 is 50, the ending inventory on November 30 is $ Perpetual Inventory Using Weighted Average Concept In a perpetual inventory system, each purchase and sale of merchandise is recorded in the inventory account and related subsidiary ledger. In this way, the amount of merchandise available for sale and the amount sold are continuously (perpetually) updated in the inventory records. That is, the balance of Merchandise Inventory is the amount of merchandise on hand (available for sale) and the balance of Cost of Merchandise Sold is the cost of the merchandise that has been sold. In the weighted average cost flow method the cost of units sold (cost of merchandise sold) is a weighted average of the purchase costs. The purchase costs are weighted by the quantities purchased at each cost, thus the term weighted average. The ending inventory is determined by multiplying the units in inventory by the weighted average as of the inventory date. The weighted average unit cost normally changes each time a new purchase is made. The weighted average unit cost is determined after each purchase by dividing the total cost of merchandise available for sale by the number of units in inventory. This weighted average unit cost is used to determined the cost of merchandise sold for subsequent sales and ending inventory. Learning Expectation Determine the cost of merchandise sold and ending inventory under a perpetual inventory system that uses the weighted average cost flow. uy . EARL Swerte nowing questions. 1. When the number of units sold on November 21 is 36, the cost of merchandise sold on November 21 243 X 2. When the number of units sold on November 21 is 36, the ending inventory on November 30 is 297 3. When the number of units sold on November 21 is 8, the cost of merchandise sold on November 21 is 54 X 4. When the number of units sold on November 21 is 50, the ending inventory on November 30 is $ 486 X Use the Dynamic Exhibit to answer the following questions. 1. When the number of units sold on November 21 is 36, the cost of merchandise sold on November 21 is $ 2. When the number of units sold on November 21 is 36, the ending inventory on November 30 is $ 3. When the number of units sold on November 21 is 8, the cost of merchandise sold on November 21 is 4. When the number of units sold on November 21 is 50, the ending inventory on November 30 is $ Perpetual Inventory Using Weighted Average Concept In a perpetual inventory system, each purchase and sale of merchandise is recorded in the inventory account and related subsidiary ledger. In this way, the amount of merchandise available for sale and the amount sold are continuously (perpetually) updated in the inventory records. That is, the balance of Merchandise Inventory is the amount of merchandise on hand (available for sale) and the balance of Cost of Merchandise Sold is the cost of the merchandise that has been sold. In the weighted average cost flow method the cost of units sold (cost of merchandise sold) is a weighted average of the purchase costs. The purchase costs are weighted by the quantities purchased at each cost, thus the term weighted average. The ending inventory is determined by multiplying the units in inventory by the weighted average as of the inventory date. The weighted average unit cost normally changes each time a new purchase is made. The weighted average unit cost is determined after each purchase by dividing the total cost of merchandise available for sale by the number of units in inventory. This weighted average unit cost is used to determined the cost of merchandise sold for subsequent sales and ending inventory. Learning Expectation Determine the cost of merchandise sold and ending inventory under a perpetual inventory system that uses the weighted average cost flow