v

v

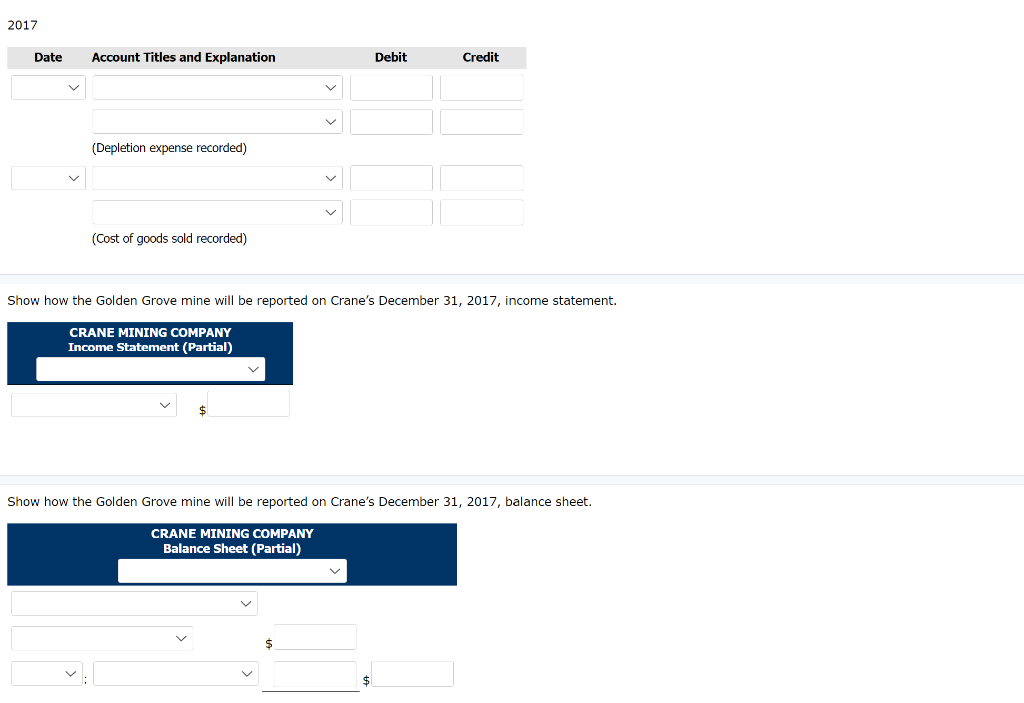

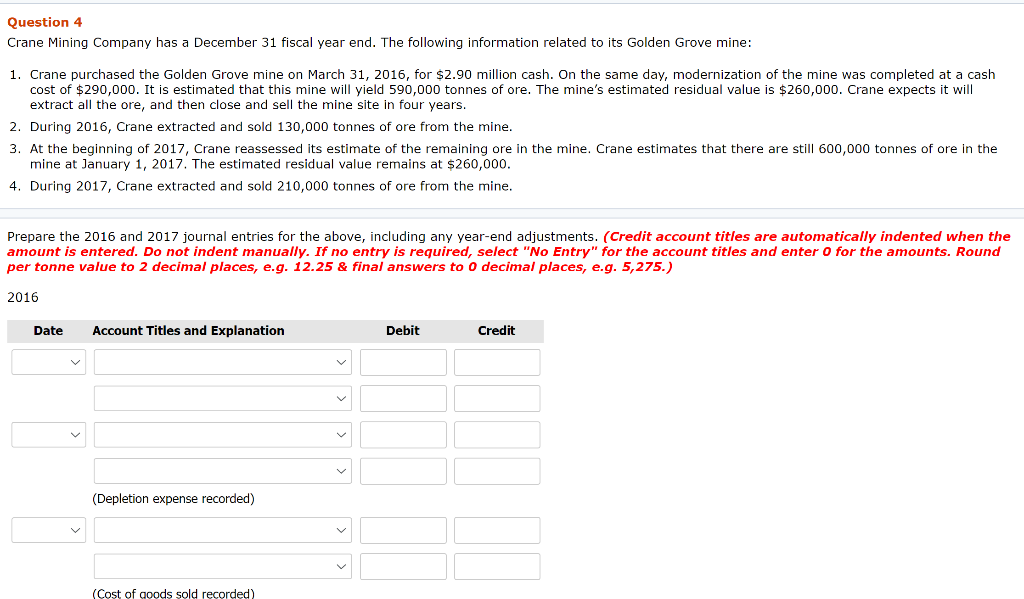

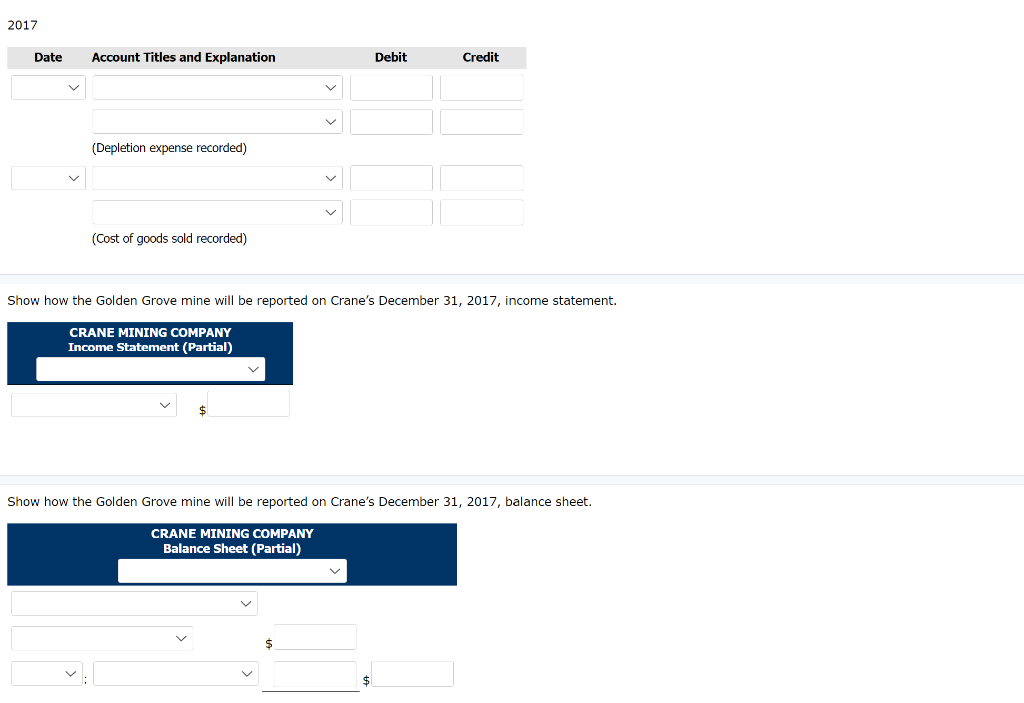

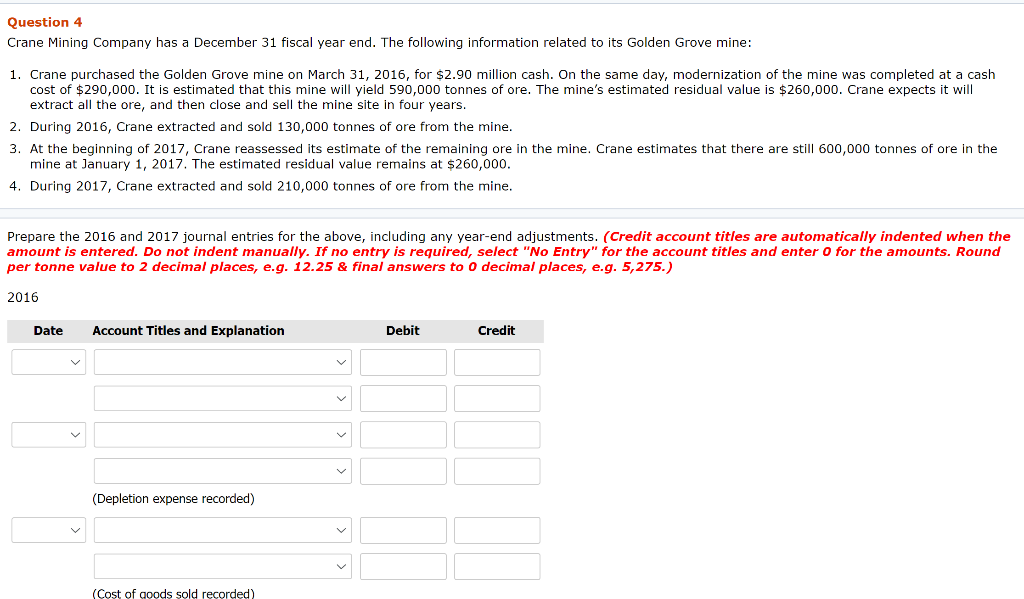

2017 Date Account Titles and Explanation Debit Credit (Depletion expense recorded) (Cost of goods sold recorded) Show how the Golden Grove mine will be reported on Crane's December 31, 2017, income statement. CRANE MINING COMPANY Income Statement (Partial) Show how the Golden Grove mine will be reported on Crane's December 31, 2017, balance sheet. CRANE MINING COMPANY Balance Sheet (Partial) Question 4 Crane Mining Company has a December 31 fiscal year end. The following information related to its Golden Grove mine: 1. Crane purchased the Golden Grove mine on March 31, 2016, for $2.90 million cash. On the same day, modernization of the mine was completed at a cash cost of $290,000. It is estimated that this mine will yield 590,000 tonnes of ore. The mine's estimated residual value is $260,000. Crane expects it will extract all the ore, and then close and sell the mine site in four years. 2. During 2016, Crane extracted and sold 130,000 tonnes of ore from the mine. 3. At the beginning of 2017, Crane reassessed its estimate of the remaining ore in the mine. Crane estimates that there are still 600,000 tonnes of ore in the mine at January 1, 2017. The estimated residual value remains at $260,000. 4. During 2017, Crane extracted and sold 210,000 tonnes of ore from the mine. Prepare the 2016 and 2017 journal entries for the above, including any year-end adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round per tonne value to 2 decimal places, e.g. 12.25 & final answers to O decimal places, e.g. 5,275.) 2016 Date Account Titles and Explanation Debit Credit (Depletion expense recorded) (Cost of goods sold recorded) 2017 Date Account Titles and Explanation Debit Credit (Depletion expense recorded) (Cost of goods sold recorded) Show how the Golden Grove mine will be reported on Crane's December 31, 2017, income statement. CRANE MINING COMPANY Income Statement (Partial) Show how the Golden Grove mine will be reported on Crane's December 31, 2017, balance sheet. CRANE MINING COMPANY Balance Sheet (Partial) Question 4 Crane Mining Company has a December 31 fiscal year end. The following information related to its Golden Grove mine: 1. Crane purchased the Golden Grove mine on March 31, 2016, for $2.90 million cash. On the same day, modernization of the mine was completed at a cash cost of $290,000. It is estimated that this mine will yield 590,000 tonnes of ore. The mine's estimated residual value is $260,000. Crane expects it will extract all the ore, and then close and sell the mine site in four years. 2. During 2016, Crane extracted and sold 130,000 tonnes of ore from the mine. 3. At the beginning of 2017, Crane reassessed its estimate of the remaining ore in the mine. Crane estimates that there are still 600,000 tonnes of ore in the mine at January 1, 2017. The estimated residual value remains at $260,000. 4. During 2017, Crane extracted and sold 210,000 tonnes of ore from the mine. Prepare the 2016 and 2017 journal entries for the above, including any year-end adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round per tonne value to 2 decimal places, e.g. 12.25 & final answers to O decimal places, e.g. 5,275.) 2016 Date Account Titles and Explanation Debit Credit (Depletion expense recorded) (Cost of goods sold recorded)

v

v