Answered step by step

Verified Expert Solution

Question

1 Approved Answer

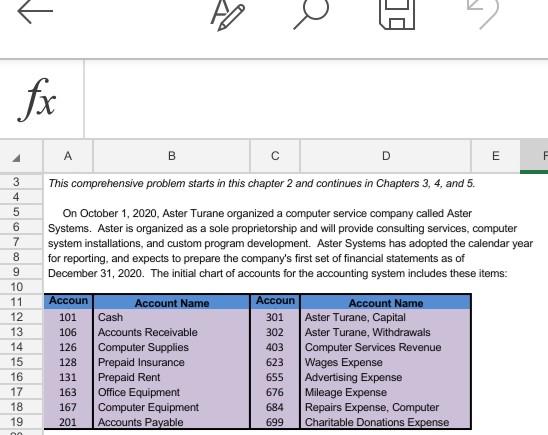

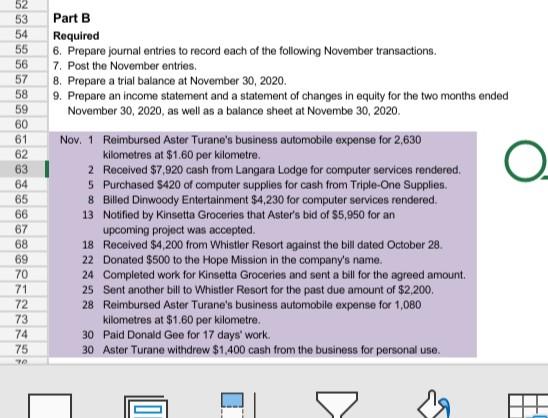

V 4 H fx A E B D This comprehensive problem starts in this chapter 2 and continues in Chapters 3, 4, and 5. 34567892BBB9

V 4 H fx A E B D This comprehensive problem starts in this chapter 2 and continues in Chapters 3, 4, and 5. 34567892BBB9 10 11 12 13 14 15 16 17 18 19 n On October 1, 2020, Aster Turane organized a computer service company called Aster Systems. Aster is organized as a sole proprietorship and will provide consulting services, computer system installations, and custom program development. Aster Systems has adopted the calendar year for reporting, and expects to prepare the company's first set of financial statements as of December 31, 2020. The initial chart of accounts for the accounting system includes these items: Accoun Account Name Accoun Account Name 101 Cash 301 Aster Turane, Capital 106 Accounts Receivable 302 Aster Turane, Withdrawals 126 Computer Supplies 403 Computer Services Revenue 128 Prepaid Insurance Wages Expense 131 Prepaid Rent 655 Advertising Expense 163 Office Equipment 676 Mileage Expense 167 Computer Equipment 684 Repairs Expense, Computer 201 Accounts Payable 699 Charitable Donations Expense 623 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 o O Part B Required 6. Prepare journal entries to record each of the following November transactions. 7. Post the November entries. 8. Prepare a trial balance at November 30, 2020. 9. Prepare an income statement and a statement of changes in equity for the two months ended November 30, 2020, as well as a balance sheet at Novembe 30, 2020 Nov. 1 Reimbursed Aster Turane's business automobile expense for 2,630 kilometres at $1.60 per kilometre. 2 Received $7,920 cash from Langara Lodge for computer services rendered 5 Purchased 5420 of computer supplies for cash from Triple-One Supplies. 8 Billed Dinwoody Entertainment $4.230 for computer services rendered. 13 Notified by Kinsetta Groceries that Aster's bid of $5,950 for an upcoming project was accepted. 18 Received $4,200 from Whistler Resort against the bill dated October 28 22 Donated $500 to the Hope Mission in the company's name. 24 Completed work for kinsetta Groceries and sent a bill for the agreed amount. 25 Sent another bill to Whistler Resort for the past due amount of $2,200. 28 Reimbursed Aster Turane's business automobile expense for 1,080 kilometres at $1.60 per kilometre. 30 Paid Donald Geo for 17 days' work. 30 Aster Turane withdrew $1,400 cash from the business for personal use. V 4 H fx A E B D This comprehensive problem starts in this chapter 2 and continues in Chapters 3, 4, and 5. 34567892BBB9 10 11 12 13 14 15 16 17 18 19 n On October 1, 2020, Aster Turane organized a computer service company called Aster Systems. Aster is organized as a sole proprietorship and will provide consulting services, computer system installations, and custom program development. Aster Systems has adopted the calendar year for reporting, and expects to prepare the company's first set of financial statements as of December 31, 2020. The initial chart of accounts for the accounting system includes these items: Accoun Account Name Accoun Account Name 101 Cash 301 Aster Turane, Capital 106 Accounts Receivable 302 Aster Turane, Withdrawals 126 Computer Supplies 403 Computer Services Revenue 128 Prepaid Insurance Wages Expense 131 Prepaid Rent 655 Advertising Expense 163 Office Equipment 676 Mileage Expense 167 Computer Equipment 684 Repairs Expense, Computer 201 Accounts Payable 699 Charitable Donations Expense 623 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 o O Part B Required 6. Prepare journal entries to record each of the following November transactions. 7. Post the November entries. 8. Prepare a trial balance at November 30, 2020. 9. Prepare an income statement and a statement of changes in equity for the two months ended November 30, 2020, as well as a balance sheet at Novembe 30, 2020 Nov. 1 Reimbursed Aster Turane's business automobile expense for 2,630 kilometres at $1.60 per kilometre. 2 Received $7,920 cash from Langara Lodge for computer services rendered 5 Purchased 5420 of computer supplies for cash from Triple-One Supplies. 8 Billed Dinwoody Entertainment $4.230 for computer services rendered. 13 Notified by Kinsetta Groceries that Aster's bid of $5,950 for an upcoming project was accepted. 18 Received $4,200 from Whistler Resort against the bill dated October 28 22 Donated $500 to the Hope Mission in the company's name. 24 Completed work for kinsetta Groceries and sent a bill for the agreed amount. 25 Sent another bill to Whistler Resort for the past due amount of $2,200. 28 Reimbursed Aster Turane's business automobile expense for 1,080 kilometres at $1.60 per kilometre. 30 Paid Donald Geo for 17 days' work. 30 Aster Turane withdrew $1,400 cash from the business for personal use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started