Answered step by step

Verified Expert Solution

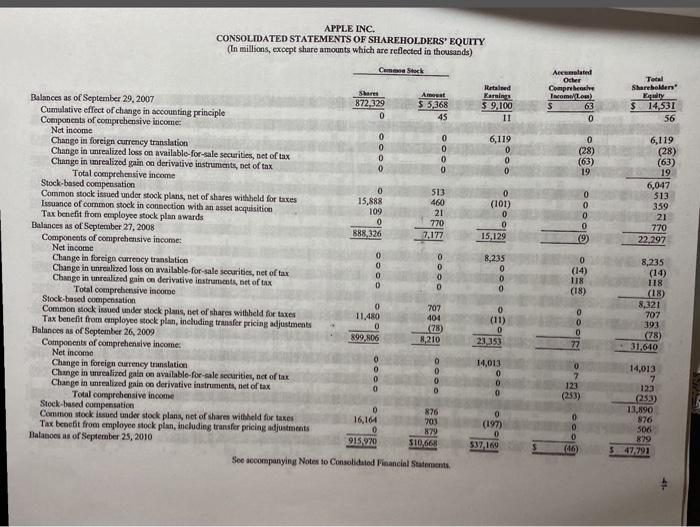

Question

1 Approved Answer

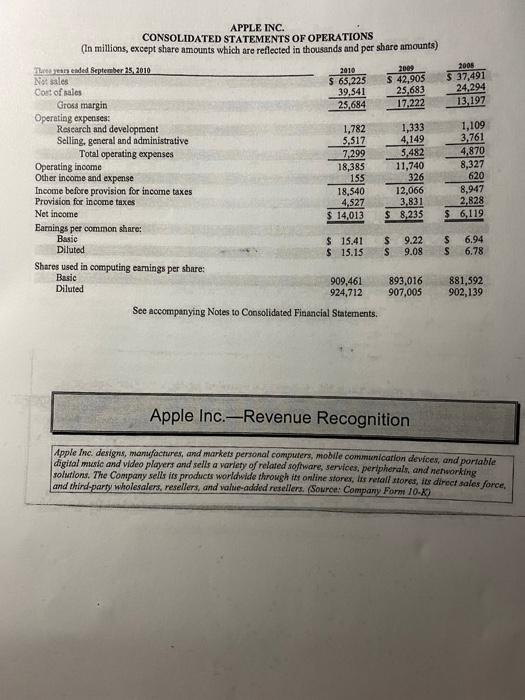

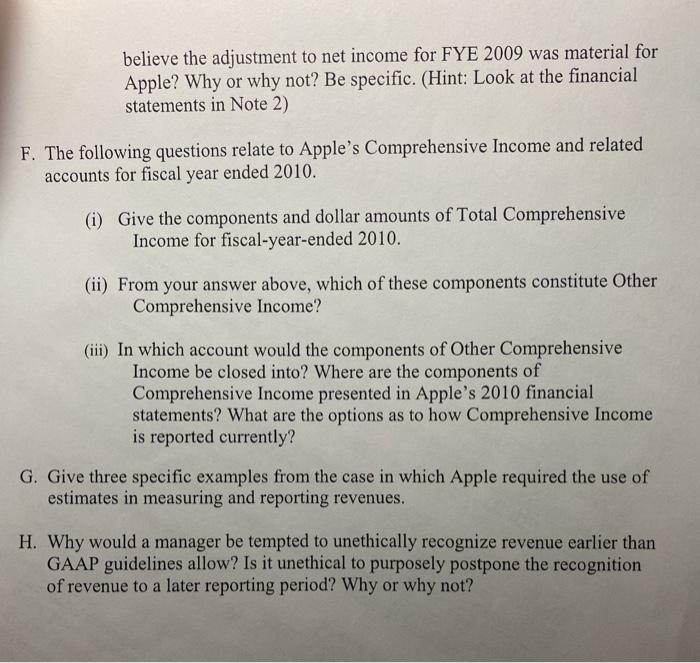

v APPLE INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share amounts which are reflected in thousands and per share amounts) 2008 $ 37,491 24.294

v

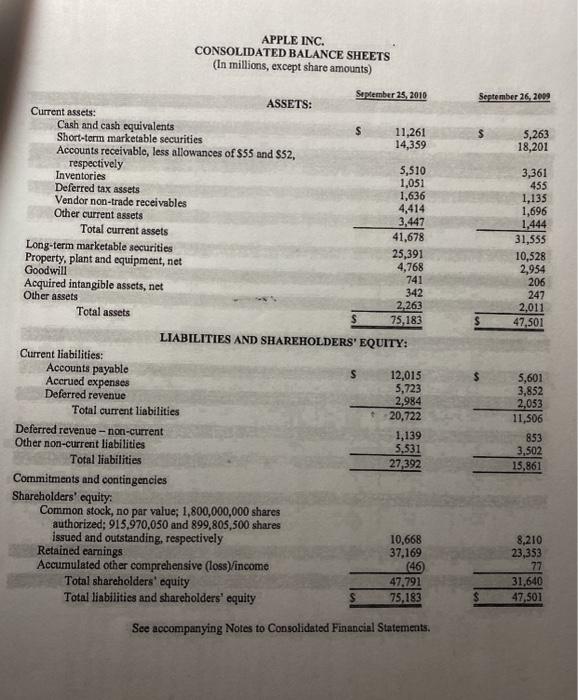

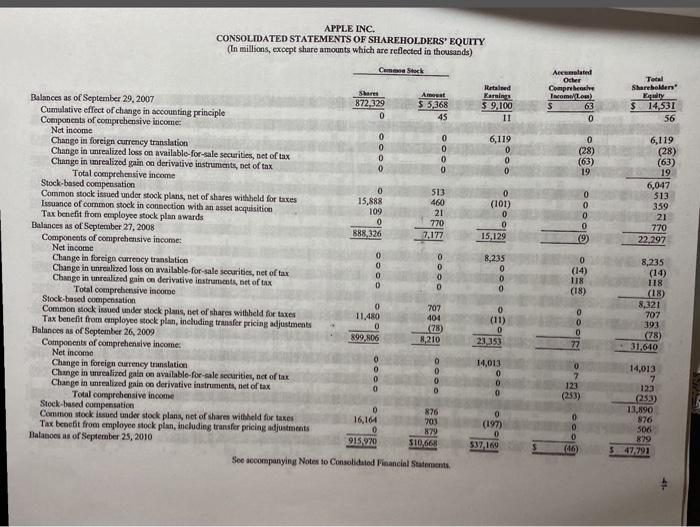

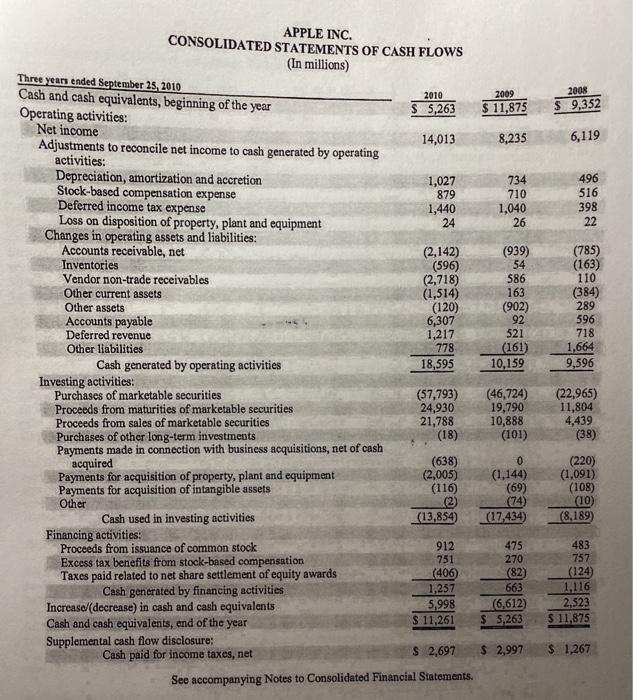

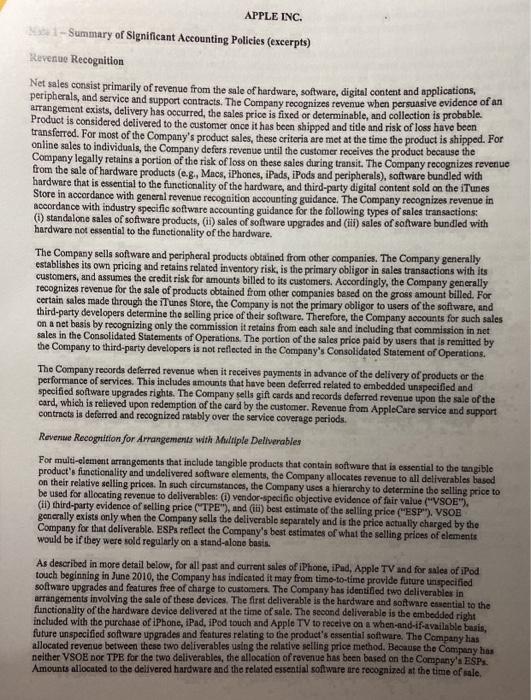

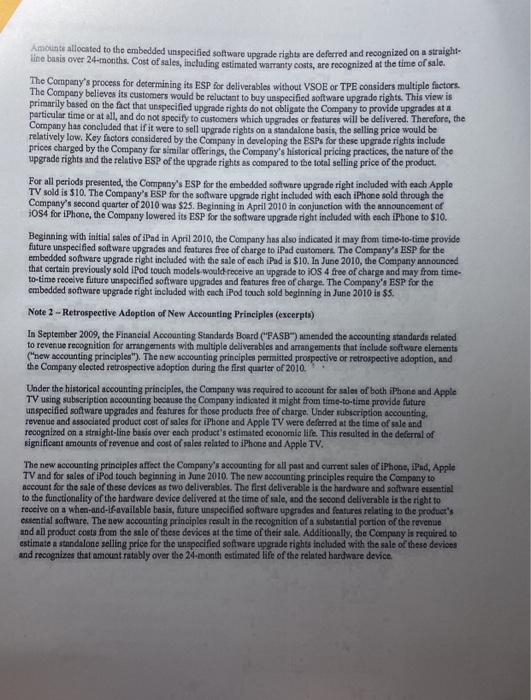

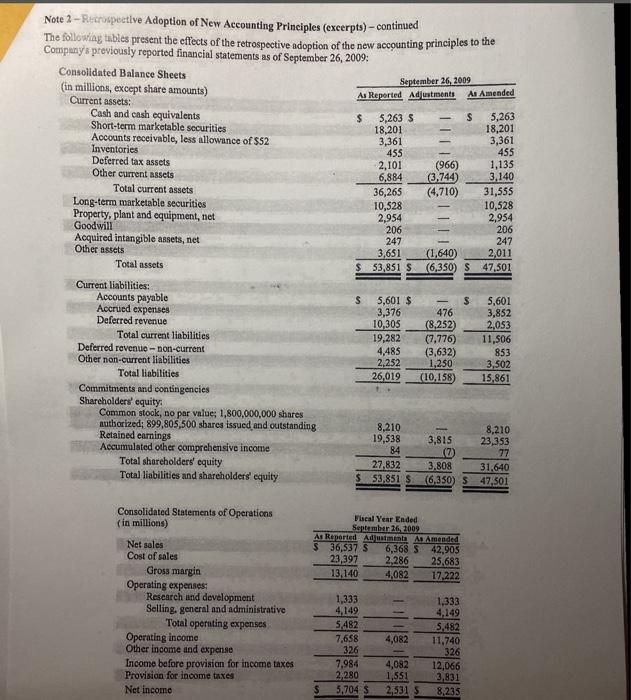

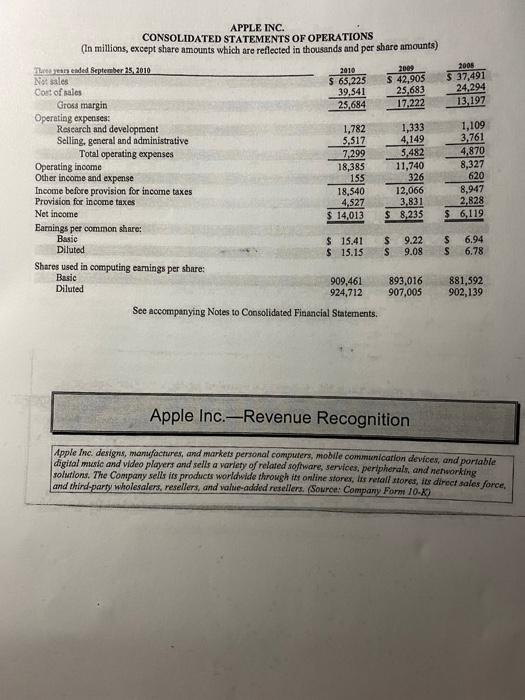

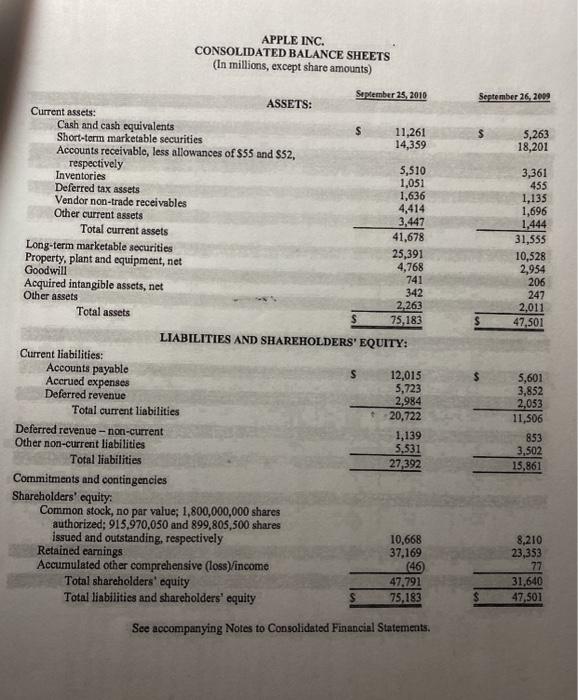

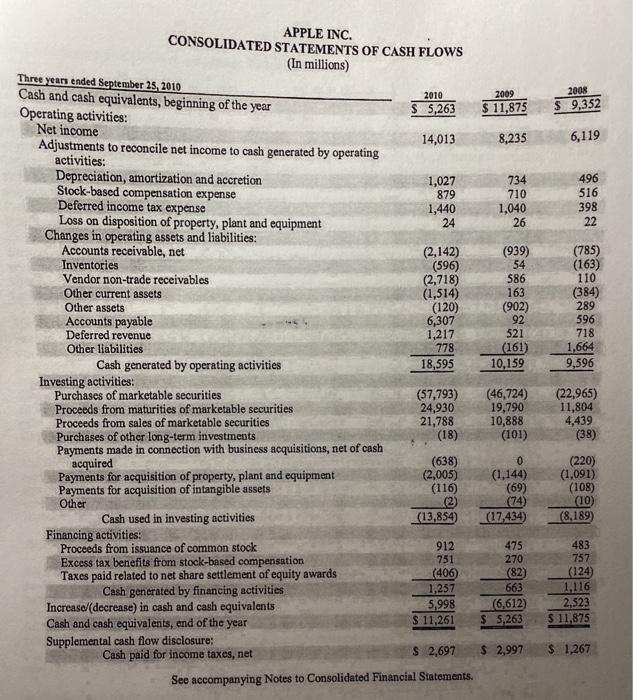

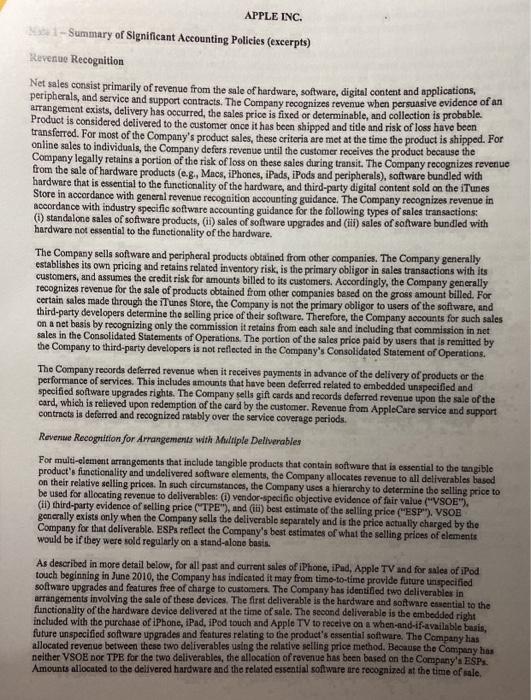

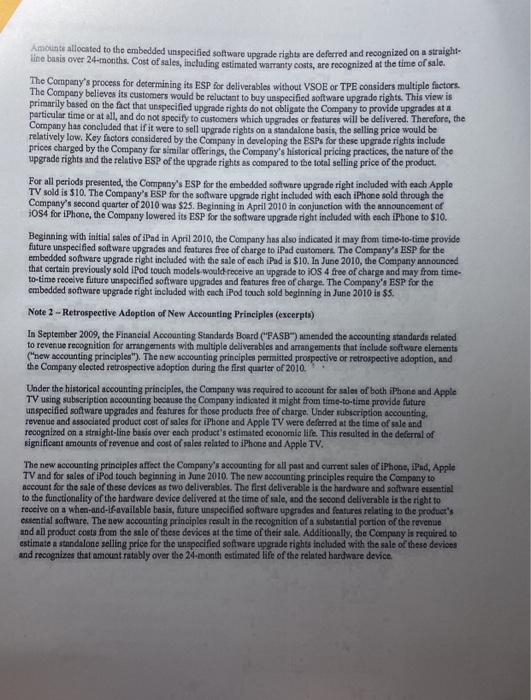

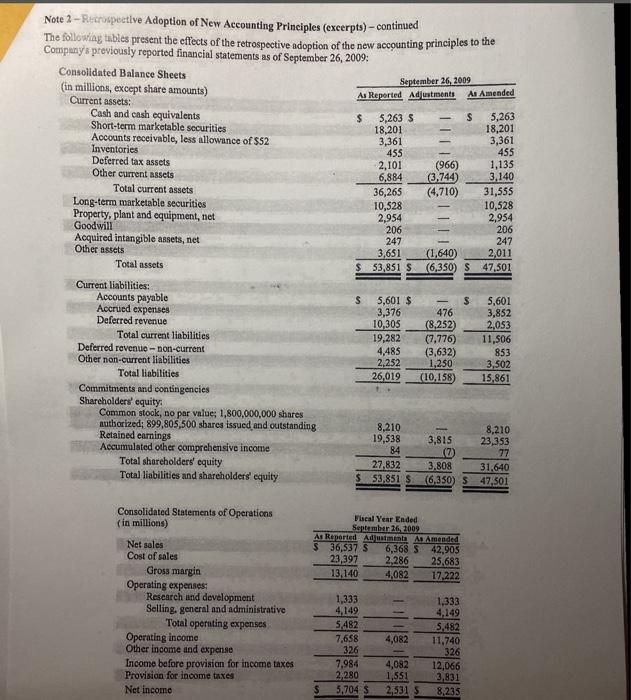

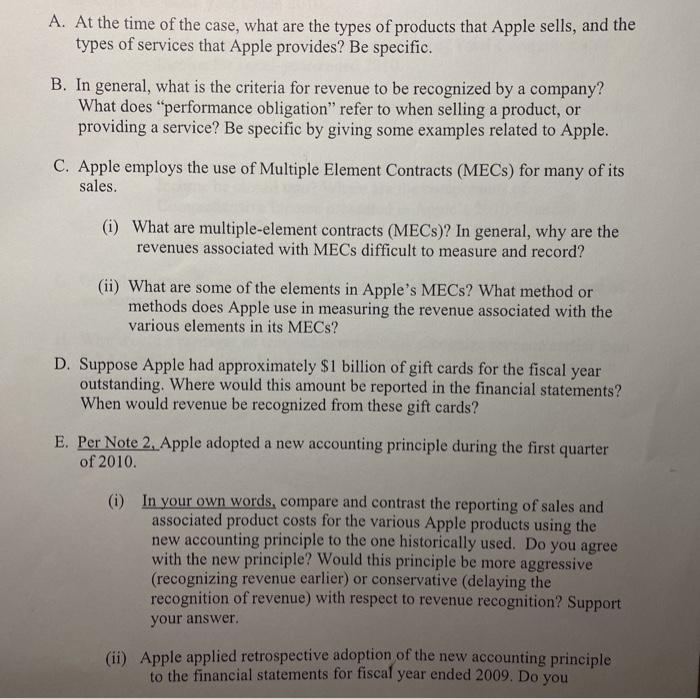

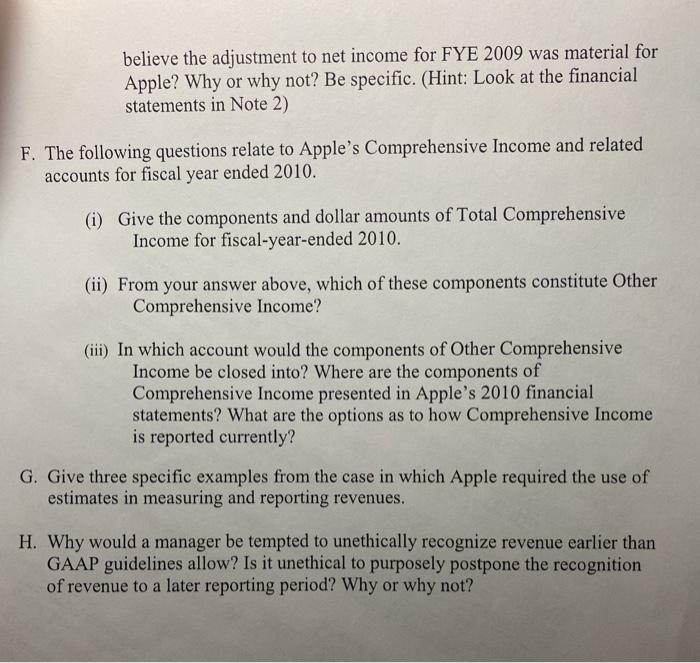

APPLE INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share amounts which are reflected in thousands and per share amounts) 2008 $ 37,491 24.294 13,197 1,109 3,761 4,870 8,327 620 an ended September 25, 2010 2010 2000 Nosales $ 65,225 $ 42,905 Cost of sales 39.541 25,683 Gross margin 25,684 17.222 Operating expenses Research and development 1,782 1,333 Selling, general and ndministrative 5,517 4,149 Total operating expenses 7,299 3,482 Operating income 18,385 11,740 Other income and expense 155 326 Income before provision for income taxes 18,540 Provision for income taxes 12,066 4,527 3,831 Net income $ 14,013 $ 8.235 Earnings per common share: Basic $ 15.41 $ 9.22 Diluted $ 15.15 S 9.08 Shares used in computing earnings per sbare: Basic Diluted 909,461 893,016 924,712 907,005 See accompanying Notes to Consolidated Financial Statements. 8,947 2,828 $ 6,119 $ $ 6.94 6.78 881,592 902,139 Apple Inc.-Revenue Recognition Apple Inc. design, manufactures, and markets personal computers, mobile communication devices, and portable digital music and video players and sells a variety of related software, services, peripherals and networking solutions. The Company sells its products worldwide through its online stores, les retall stores, its direct sales force, and third-party wholesalers, resellers, and value-added resellers. (Source: Company Form 10-20 APPLE INC. CONSOLIDATED BALANCE SHEETS (In millions, except share amounts) September 26, 2009 5,263 18,201 3,361 455 1,135 1,696 1,444 31,555 10,528 2,954 206 247 2,011 47.501 September 25, 2010 ASSETS: Current assets: Cash and cash equivalents 11,261 Short-term marketable securities 14,359 Accounts receivable, less allowances of $55 and 52, respectively 5,510 Inventories 1,051 Deferred tax assets 1,636 Vendor non-trade receivables 4,414 Other current assets 3,447 Total current ass 41,678 Long-term marketable securities 25,391 Property, plant and equipment, net 4,768 Goodwill 741 Acquired intangible assets, net 342 Other assets 2.263 Total assets 75.183 LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable S 12,015 Accrued expenses 5,723 Deferred revenue 2,984 Total current liabilities 20,722 Deferred revenue -non-current 1,139 Other non-current liabilities 5,531 Total liabilities 27,392 Commitments and contingencies Shareholders' equity: Common stock, no par value; 1,800,000,000 shares authorized: 915.970,050 and 899,805,500 shares issued and outstanding, respectively 10,668 Retained earnings 37.169 Accumulated other comprehensive (loss)/income (46) Total shareholders' equity 47.791 Total liabilities and shareholders' equity $ 75.183 5,601 3,852 2,053 11,506 853 3,502 15,861 8,210 23,353 77 31,640 47,501 See accompanying Notes to Consolidated Financial Statements. APPLE INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except share amounts which are reflected in thousands) Cummia Stock Accennated Ocher Comprehensive Income Loa) S Rated Earnings $ 9,100 11 Amount Total Shareholten Equity $ 14,531 56 O. OOO 6,119 0 0 0 loooo olem 0 0 (101) 0 0 15.129 6,119 (28) (63) 19 6,047 $13 359 21 770 22.297 (9 Balances as of September 29, 2007 872.329 $ 5,368 Cumulative effect of change in accounting principle 0 45 Components of comprehensive income: Net income 0 Change in foreign currency translation Change in unrealized loss on available-for-sale securities, net of tax Change in urealized gain on derivative instruments, net of tax Total comprehensive income Stock-based compensation 0 513 Common stock issued under stock plans, net of shares withheld for taxes Issuance of common stock in connection with an asset acquisition 15,888 460 109 21 Tax benefit from employee stock plan awards 0 770 Balances as of September 27, 2008 888,326 7,177 Components of comprehensive income: Net income 0 Change in foreign currency translation Change in unrealized loss on available for sale securities, net of tax Change in unrealized gain on derivative Instruments, net of tax Total comprehensive income Stock-based compensation 0 707 Common stock issued under stock plans, net of shares withheld for taxes 11.480 404 Tax benefit from employee stock plan, including transfer pricing adjustments 0 (28) Balances as of September 26, 2009 899,806 8,210 Components of comprehensive income Net incomo Change in foreign currency translation Change in mrcalized gain on available-for-sale securities, net of tax Change in unrealized gain ce derivative Instruments, net of tax Total comprehensive income Stock-based compensation 0 876 Common stock med under stock plans, net of shares withheld for taxes 16,164 200 Tax benefit from employee stock plan, including transfer pricing adjustments 879 Balances as of September 25, 2010 915,920 $10.668 See accompanying Notes to Consolidated Financial Statements OOO (14) 8,235 0 0 0 0 0 0 8,235 (14) 118 (18) 8,321 (18) 707 0 (11) D 23353 os de Blace 393 28) 31.640 OOOO 14,013 0 0 0 g (233) 0 (197) 0 $37,169 14.013 7 123 (253) 13,890 876 506 879 47 791 0 (46) 2009 $ 11,875 2008 $ 9,352 8,235 6,119 496 516 398 22 APPLE INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Three years ended September 25, 2010 Cash and cash equivalents, beginning of the year 2010 Operating activities: $ 5,263 Net income Adjustments to reconcile net income to cash generated by operating 14,013 activities: Depreciation, amortization and accretion 1,027 Stock-based compensation expense 879 Deferred income tax expense 1,440 Loss on disposition of property, plant and equipment 24 Changes in operating assets and liabilities: Accounts receivable, net (2,142) Inventories (596) Vendor non-trade receivables (2,718) Other current assets (1,514) Other assets (120) Accounts payable 6,307 Deferred revenue 1,217 Other liabilities 778 Cash generated by operating activities 18,595 Investing activities: Purchases of marketable securities (57.793) Proceeds from maturities of marketable securities 24,930 Proceeds from sales of marketable securities 21,788 Purchases of other long-term investments (18) Payments made in connection with business acquisitions, net of cash acquired (638) Payments for acquisition of property, plant and equipment (2,005) Payments for acquisition of intangible assets (116) Other (2) Cash used in investing activities (13,854) Financing activities: Proceeds from issuance of common stock 912 Excess tax benefits from stock-based compensation 751 Taxes paid related to net share settlement of equity awards (406 Cash generated by financing activities 1,257 Increase/(decrease) in cash and cash equivalents 5,998 Cash and cash equivalents, end of the year $ 11,261 Supplemental cash flow disclosure: Cash paid for income taxes, net $ 2,697 See accompanying Notes to Consolidated Financial Statements. 233* ***822329 3398 3993 (785) (163) 110 (384) 289 596 718 1,664 9,596 (22,965) 11,804 4,439 (38) (220) (1,091) (108) (10) (8.189 483 757 (124) 1,116 2,523 S 11.875 $ 2,997 $ 1,267 APPLE INC. Summary of Significant Accounting Policies (excerpts) Revenue Recognition Net sales consist primarily of revenue from the sale of hardware, software, digital content and applications, peripherals, and service and support contracts. The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, and collection is probable. Product is considered delivered to the customer once it has been shipped and title and risk of loss have been transferred. For most of the Company's product sales, these criteria are met at the time the product is shipped. For online sales to individuals, the Company defers revenue until the customer receives the product because the Company legally retains a portion of the risk of loss on these sales during transit. The Company recognizes revenue from the sale of hardware products (0.g., Macs, iPhone, iPad, iPods and peripherals), software bundled with hardware that is essential to the functionality of the hardware, and third-party digital content sold on the iTunes Store in accordance with general revenue recognition accounting guidance. The Company recognizes revenue in accordance with industry specific software accounting guidance for the following types of sales transactions: standalone sales of software products, (i) sales of software upgrades and (iii) sales of software bundled with hardware not essential to the functionality of the hardware. The Company sells software and peripheral products obtained from other companies. The Company generally establishes its own pricing and retains related inventory risk, is the primary obligor in sales transactions with its customers, and assumes the credit risk for amounts billed to its customers. Accordingly, the Company generally recognizes revenue for the sale of products obtained from other companies based on the grass amount billed. For certain sales made through the iTunes Store, the Company is not the primary obligor to users of the software, and third-party developers determine the selling price of their software. Therefore, the Company accounts for such sales on a net basis by recognizing only the commission it retains from each sale and including that commission in net sales in the Consolidated Statements of Operations. The portion of the sales price paid by users that is remitted by the Company to third-party developers is not reflected in the Company's Consolidated Statement of Operations. The Company records deferred revenue when it receives payments in advance of the delivery of products or the performance of services. This includes amounts that have been deferred related to embedded unspecified and specified software upgrades rights. The Company sells gift cards and records deferred revenue upon the sale of the card, which is relieved upon redemption of the card by the customer. Revenue from AppleCare service and support contracts is deferred and recognized ratably over the service coverage periods. Revenue Recognition for Arrangements with Multiple Deliverables For multi-clement arrangements that include tangible products that contain software that is essential to the tangible product's functionality and undelivered software elements, the Company allocates revenue to all deliverables based on their relative selling prices. In such circumstances, the Company uses a hierarchy to determine the selling price to be used for allocating revenue to deliverables: (1) vendor-specific objective evidence of fair value ("VSOE'). (it) third-party evidence of selling price ("TPE"), and (ii) best estimate of the selling price ("ESP). VSOE generally exists only when the Company sells the deliverable separately and is the price actually charged by the Company for that deliverable. ESPs reflect the Company's best estimates of what the selling prices of elements would be if they were sold regularly on a stand-alone basia. As described in more detail below, for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010, the Company has indicated it may from time-to-time pravide future unspecified software upgrades and features free of charge to customers. The Company has identified two deliverables in arrangements involving the sale of these devices. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale. The second deliverable is the embedded right included with the purchase of iPhone, iPad, iPod touch and Apple TV to receive on a when-and-if-available basis, future unspecified software upgrades and features relating to the product's essential software. The Company has allocated revenue between these two deliverables using the relative selling price method. Because the Company has neither VSOE DO TPE for the two deliverables, the allocation of revenue has been based on the Company's ESP Amounts allocated to the delivered hardware and the related essential software are recognized at the time of sale Amounts allocated to the embedded unspecified software upgrade rights are deferred and recognized on a straight line basis over 24-motths. Cost of sales, including estimated warranty costs, are recognized at the time of sale. The Company's process for determining its ESP for deliverables without VSOE or TPE considers multiple factors The Company believe its customers would be reluctant to buy unspecified software upgrade rights. This view is primarily based on the fact that unspecified upgrade rights do not obligate the Company to provide upgrades ata particular time or at all, and do not specify to customers which upgrades or features will be delivered. Therefore, the Company has concluded that if it were to sell upgrade rights on a standalone basis, the selling price would be relatively low. Key factors considered by the Company in developing the ESPs for these upgrade rights include prices charged by the Company for similar offerings, the Company's historical pricing practices, the nature of the upgrade rights and the relativo ESP of the upgrade rights as compared to the total selling price of the product For all periods presented, the Company's ESP for the embedded software upgrade right included with each Apple TV sold is 510. The Company's ESP for the software upgrade right included with each iPhone sold through the Company's second quarter of 2010 was $25. Beginning in April 2010 in conjunction with the announcement of 1084 for iPhone, the Company lowered its ESP for the software upgrade right included with each iPhone to $10. Beginning with initial sales of iPad in April 2010, the Company has also indicated it may from time-to-time provide future unspecified software upgrades and features free of charge to iPad customers. The Company's ESP for the embedded software upgrade right included with the sale of each iPad is $10. In June 2010, the Company announced that certain previously sold iPod touch models would receive an upgrade to iOS 4 free of charge and may from time- to-time receive future unspecified software upgrades and fontures free of charge. The Company's ESP for the embedded software upgrade right included with each iPod touch sold beginning in June 2010 is $5. Note 2 - Retrospective Adoption of New Accounting Principles (excerpts) In September 2009, the Financial Accounting Standards Board ("FASB") amended the accounting standards related to revenio recognition for arrangements with multiple deliverables and arrangements that include software clements ("new accounting principles"). The new accounting principles permitted prospective or retrospective adoption, and the Company elected retrospective adoption during the first quarter of 2010. Under the historical accounting principles, the Company was required to account for sales of both iPhone and Apple TV using subscription accounting because the Company indicated it might from time to time provide future unspecified software upgrades and features for those products free of charge. Under subscription accounting revenue and associated product cost of sales for iPhone and Apple TV were deferred at the time of sale and recognized on a straight-line basis over each product's estimated economic life. This resulted in the deferral of significant amounts of revenue and cost of sales related to iPhone and Apple TV. The new accounting principles affect the Company's accounting for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010. The new accounting principles require the Company to account for the sale of these devices as two deliverables. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale, and the second deliverable is the right to receive on a when-and-if available basis, future unspecified software upgrades and features relating to the product's eksential software. The new accounting principles result in the recognition of a substantial portion of the revenue and all product costs from the sale of these devices at the time of their sale. Additionally, the Company is required to estimate a standalone selling price for the unspecified software upgrade rights included with the sale of these devices and recognizes that amount ratably over the 24-month estimated life of the related hardware device. E Note 2 - Retrospective Adoption of New Accounting Principles (excerpts) - continued The following tuibles present the effects of the retrospective adoption of the new accounting principles to the Company's previously reported financial statements as of September 26, 2009: Consolidated Balance Sheets September 26, 2009 (in millions, except share amounts) Current assets: As Reported Adjustments As Amended Cash and cash equivalents $ 5,263 $ $ 5,263 Short-term marketable securities 18,201 18,201 Accounts receivable, less allowance of $52 3,361 3,361 Inventories 455 455 Deferred tax assets 2,101 (966) 1,135 Other current assets 6,884 (3,744) 3,140 Total current assets 36,265 (4,710) 31,555 Long-term marketable securities 10,528 10,528 Property, plant and equipment, net 2,954 2,954 Goodwill 206 206 Acquired intangible assets, net 247 247 Other assets 3,651 (1,640) 2,011 Total assets $ 53,851 S (6,350) S 47.501 Current liabilities: Accounts payable $ 5,601 $ $ 5,601 Accrued expenses 3,376 476 3,852 Deferred revenue 10,305 (8,252) 2,053 Total current liabilities 19,282 (7,776) 11,506 Deferred revenue -non-current 4.485 (3,632) 853 Other non-current liabilities 2.252 1,250 3,502 Total liabilities 26,019 (10.158) 15.861 Commitments and contingencies Shareholders' equity Common stock, no par value: 1,800,000,000 shares authorized; 899,805,500 shares issued and outstanding 8,210 Retained earnings 8,210 19,538 3,815 23,353 Accumulated other comprehensive income 84 77 Total shareholders' equity 27.832 3.808 31,640 Total liabilities and shareholders' equity $ 53,851 S (6,350 $ 47,501 Fiscal Year Ended September 26, 2009 As Reported Adjustments As Amended S 36,537 5 6,368 S 42.905 23,397 2,286 25,683 13.140 4,082 17,222 Consolidated Statements of Operations (in millions) Net sales Cost of sales Gross margin Operating expenses Research and development Selling, general and administrative Total operating expenses Operating income Other income and expense Income before provision for income taxes Provision for income taxes Net Income - 1,333 4,149 5.482 7,658 326 7.984 2,280 5,704 S 4,082 1,333 4,149 5.482 11.740 326 12,066 3,831 8,235 4,082 1,551 2,531 5 S A. At the time of the case, what are the types of products that Apple sells, and the types of services that Apple provides? Be specific. B. In general, what is the criteria for revenue to be recognized by a company? What does "performance obligation refer to when selling a product, or providing a service? Be specific by giving some examples related to Apple. C. Apple employs the use of Multiple Element Contracts (MECs) for many of its sales. (i) What are multiple-element contracts (MECs)? In general, why are the revenues associated with MECs difficult to measure and record? (ii) What are some of the elements in Apple's MECs? What method or methods does Apple use in measuring the revenue associated with the various elements in its MECs? D. Suppose Apple had approximately $1 billion of gift cards for the fiscal year outstanding. Where would this amount be reported in the financial statements? When would revenue be recognized from these gift cards? E. Per Note 2, Apple adopted a new accounting principle during the first quarter of 2010. (i) In your own words, compare and contrast the reporting of sales and associated product costs for the various Apple products using the new accounting principle to the one historically used. Do you agree with the new principle? Would this principle be more aggressive (recognizing revenue carlier) or conservative (delaying the recognition of revenue) with respect to revenue recognition? Support your answer. (ii) Apple applied retrospective adoption of the new accounting principle to the financial statements for fiscal year ended 2009. Do you believe the adjustment to net income for FYE 2009 was material for Apple? Why or why not? Be specific. (Hint: Look at the financial statements in Note 2) F. The following questions relate to Apple's Comprehensive Income and related accounts for fiscal year ended 2010. (i) Give the components and dollar amounts of Total Comprehensive Income for fiscal-year-ended 2010. (ii) From your answer above, which of these components constitute Other Comprehensive Income? (iii) In which account would the components of Other Comprehensive Income be closed into? Where are the components of Comprehensive Income presented in Apple's 2010 financial statements? What are the options as to how Comprehensive Income is reported currently? G. Give three specific examples from the case in which Apple required the use of estimates in measuring and reporting revenues. H. Why would a manager be tempted to unethically recognize revenue earlier than GAAP guidelines allow? Is it unethical to purposely postpone the recognition of revenue to a later reporting period? Why or why not? APPLE INC. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except share amounts which are reflected in thousands and per share amounts) 2008 $ 37,491 24.294 13,197 1,109 3,761 4,870 8,327 620 an ended September 25, 2010 2010 2000 Nosales $ 65,225 $ 42,905 Cost of sales 39.541 25,683 Gross margin 25,684 17.222 Operating expenses Research and development 1,782 1,333 Selling, general and ndministrative 5,517 4,149 Total operating expenses 7,299 3,482 Operating income 18,385 11,740 Other income and expense 155 326 Income before provision for income taxes 18,540 Provision for income taxes 12,066 4,527 3,831 Net income $ 14,013 $ 8.235 Earnings per common share: Basic $ 15.41 $ 9.22 Diluted $ 15.15 S 9.08 Shares used in computing earnings per sbare: Basic Diluted 909,461 893,016 924,712 907,005 See accompanying Notes to Consolidated Financial Statements. 8,947 2,828 $ 6,119 $ $ 6.94 6.78 881,592 902,139 Apple Inc.-Revenue Recognition Apple Inc. design, manufactures, and markets personal computers, mobile communication devices, and portable digital music and video players and sells a variety of related software, services, peripherals and networking solutions. The Company sells its products worldwide through its online stores, les retall stores, its direct sales force, and third-party wholesalers, resellers, and value-added resellers. (Source: Company Form 10-20 APPLE INC. CONSOLIDATED BALANCE SHEETS (In millions, except share amounts) September 26, 2009 5,263 18,201 3,361 455 1,135 1,696 1,444 31,555 10,528 2,954 206 247 2,011 47.501 September 25, 2010 ASSETS: Current assets: Cash and cash equivalents 11,261 Short-term marketable securities 14,359 Accounts receivable, less allowances of $55 and 52, respectively 5,510 Inventories 1,051 Deferred tax assets 1,636 Vendor non-trade receivables 4,414 Other current assets 3,447 Total current ass 41,678 Long-term marketable securities 25,391 Property, plant and equipment, net 4,768 Goodwill 741 Acquired intangible assets, net 342 Other assets 2.263 Total assets 75.183 LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable S 12,015 Accrued expenses 5,723 Deferred revenue 2,984 Total current liabilities 20,722 Deferred revenue -non-current 1,139 Other non-current liabilities 5,531 Total liabilities 27,392 Commitments and contingencies Shareholders' equity: Common stock, no par value; 1,800,000,000 shares authorized: 915.970,050 and 899,805,500 shares issued and outstanding, respectively 10,668 Retained earnings 37.169 Accumulated other comprehensive (loss)/income (46) Total shareholders' equity 47.791 Total liabilities and shareholders' equity $ 75.183 5,601 3,852 2,053 11,506 853 3,502 15,861 8,210 23,353 77 31,640 47,501 See accompanying Notes to Consolidated Financial Statements. APPLE INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except share amounts which are reflected in thousands) Cummia Stock Accennated Ocher Comprehensive Income Loa) S Rated Earnings $ 9,100 11 Amount Total Shareholten Equity $ 14,531 56 O. OOO 6,119 0 0 0 loooo olem 0 0 (101) 0 0 15.129 6,119 (28) (63) 19 6,047 $13 359 21 770 22.297 (9 Balances as of September 29, 2007 872.329 $ 5,368 Cumulative effect of change in accounting principle 0 45 Components of comprehensive income: Net income 0 Change in foreign currency translation Change in unrealized loss on available-for-sale securities, net of tax Change in urealized gain on derivative instruments, net of tax Total comprehensive income Stock-based compensation 0 513 Common stock issued under stock plans, net of shares withheld for taxes Issuance of common stock in connection with an asset acquisition 15,888 460 109 21 Tax benefit from employee stock plan awards 0 770 Balances as of September 27, 2008 888,326 7,177 Components of comprehensive income: Net income 0 Change in foreign currency translation Change in unrealized loss on available for sale securities, net of tax Change in unrealized gain on derivative Instruments, net of tax Total comprehensive income Stock-based compensation 0 707 Common stock issued under stock plans, net of shares withheld for taxes 11.480 404 Tax benefit from employee stock plan, including transfer pricing adjustments 0 (28) Balances as of September 26, 2009 899,806 8,210 Components of comprehensive income Net incomo Change in foreign currency translation Change in mrcalized gain on available-for-sale securities, net of tax Change in unrealized gain ce derivative Instruments, net of tax Total comprehensive income Stock-based compensation 0 876 Common stock med under stock plans, net of shares withheld for taxes 16,164 200 Tax benefit from employee stock plan, including transfer pricing adjustments 879 Balances as of September 25, 2010 915,920 $10.668 See accompanying Notes to Consolidated Financial Statements OOO (14) 8,235 0 0 0 0 0 0 8,235 (14) 118 (18) 8,321 (18) 707 0 (11) D 23353 os de Blace 393 28) 31.640 OOOO 14,013 0 0 0 g (233) 0 (197) 0 $37,169 14.013 7 123 (253) 13,890 876 506 879 47 791 0 (46) 2009 $ 11,875 2008 $ 9,352 8,235 6,119 496 516 398 22 APPLE INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Three years ended September 25, 2010 Cash and cash equivalents, beginning of the year 2010 Operating activities: $ 5,263 Net income Adjustments to reconcile net income to cash generated by operating 14,013 activities: Depreciation, amortization and accretion 1,027 Stock-based compensation expense 879 Deferred income tax expense 1,440 Loss on disposition of property, plant and equipment 24 Changes in operating assets and liabilities: Accounts receivable, net (2,142) Inventories (596) Vendor non-trade receivables (2,718) Other current assets (1,514) Other assets (120) Accounts payable 6,307 Deferred revenue 1,217 Other liabilities 778 Cash generated by operating activities 18,595 Investing activities: Purchases of marketable securities (57.793) Proceeds from maturities of marketable securities 24,930 Proceeds from sales of marketable securities 21,788 Purchases of other long-term investments (18) Payments made in connection with business acquisitions, net of cash acquired (638) Payments for acquisition of property, plant and equipment (2,005) Payments for acquisition of intangible assets (116) Other (2) Cash used in investing activities (13,854) Financing activities: Proceeds from issuance of common stock 912 Excess tax benefits from stock-based compensation 751 Taxes paid related to net share settlement of equity awards (406 Cash generated by financing activities 1,257 Increase/(decrease) in cash and cash equivalents 5,998 Cash and cash equivalents, end of the year $ 11,261 Supplemental cash flow disclosure: Cash paid for income taxes, net $ 2,697 See accompanying Notes to Consolidated Financial Statements. 233* ***822329 3398 3993 (785) (163) 110 (384) 289 596 718 1,664 9,596 (22,965) 11,804 4,439 (38) (220) (1,091) (108) (10) (8.189 483 757 (124) 1,116 2,523 S 11.875 $ 2,997 $ 1,267 APPLE INC. Summary of Significant Accounting Policies (excerpts) Revenue Recognition Net sales consist primarily of revenue from the sale of hardware, software, digital content and applications, peripherals, and service and support contracts. The Company recognizes revenue when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable, and collection is probable. Product is considered delivered to the customer once it has been shipped and title and risk of loss have been transferred. For most of the Company's product sales, these criteria are met at the time the product is shipped. For online sales to individuals, the Company defers revenue until the customer receives the product because the Company legally retains a portion of the risk of loss on these sales during transit. The Company recognizes revenue from the sale of hardware products (0.g., Macs, iPhone, iPad, iPods and peripherals), software bundled with hardware that is essential to the functionality of the hardware, and third-party digital content sold on the iTunes Store in accordance with general revenue recognition accounting guidance. The Company recognizes revenue in accordance with industry specific software accounting guidance for the following types of sales transactions: standalone sales of software products, (i) sales of software upgrades and (iii) sales of software bundled with hardware not essential to the functionality of the hardware. The Company sells software and peripheral products obtained from other companies. The Company generally establishes its own pricing and retains related inventory risk, is the primary obligor in sales transactions with its customers, and assumes the credit risk for amounts billed to its customers. Accordingly, the Company generally recognizes revenue for the sale of products obtained from other companies based on the grass amount billed. For certain sales made through the iTunes Store, the Company is not the primary obligor to users of the software, and third-party developers determine the selling price of their software. Therefore, the Company accounts for such sales on a net basis by recognizing only the commission it retains from each sale and including that commission in net sales in the Consolidated Statements of Operations. The portion of the sales price paid by users that is remitted by the Company to third-party developers is not reflected in the Company's Consolidated Statement of Operations. The Company records deferred revenue when it receives payments in advance of the delivery of products or the performance of services. This includes amounts that have been deferred related to embedded unspecified and specified software upgrades rights. The Company sells gift cards and records deferred revenue upon the sale of the card, which is relieved upon redemption of the card by the customer. Revenue from AppleCare service and support contracts is deferred and recognized ratably over the service coverage periods. Revenue Recognition for Arrangements with Multiple Deliverables For multi-clement arrangements that include tangible products that contain software that is essential to the tangible product's functionality and undelivered software elements, the Company allocates revenue to all deliverables based on their relative selling prices. In such circumstances, the Company uses a hierarchy to determine the selling price to be used for allocating revenue to deliverables: (1) vendor-specific objective evidence of fair value ("VSOE'). (it) third-party evidence of selling price ("TPE"), and (ii) best estimate of the selling price ("ESP). VSOE generally exists only when the Company sells the deliverable separately and is the price actually charged by the Company for that deliverable. ESPs reflect the Company's best estimates of what the selling prices of elements would be if they were sold regularly on a stand-alone basia. As described in more detail below, for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010, the Company has indicated it may from time-to-time pravide future unspecified software upgrades and features free of charge to customers. The Company has identified two deliverables in arrangements involving the sale of these devices. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale. The second deliverable is the embedded right included with the purchase of iPhone, iPad, iPod touch and Apple TV to receive on a when-and-if-available basis, future unspecified software upgrades and features relating to the product's essential software. The Company has allocated revenue between these two deliverables using the relative selling price method. Because the Company has neither VSOE DO TPE for the two deliverables, the allocation of revenue has been based on the Company's ESP Amounts allocated to the delivered hardware and the related essential software are recognized at the time of sale Amounts allocated to the embedded unspecified software upgrade rights are deferred and recognized on a straight line basis over 24-motths. Cost of sales, including estimated warranty costs, are recognized at the time of sale. The Company's process for determining its ESP for deliverables without VSOE or TPE considers multiple factors The Company believe its customers would be reluctant to buy unspecified software upgrade rights. This view is primarily based on the fact that unspecified upgrade rights do not obligate the Company to provide upgrades ata particular time or at all, and do not specify to customers which upgrades or features will be delivered. Therefore, the Company has concluded that if it were to sell upgrade rights on a standalone basis, the selling price would be relatively low. Key factors considered by the Company in developing the ESPs for these upgrade rights include prices charged by the Company for similar offerings, the Company's historical pricing practices, the nature of the upgrade rights and the relativo ESP of the upgrade rights as compared to the total selling price of the product For all periods presented, the Company's ESP for the embedded software upgrade right included with each Apple TV sold is 510. The Company's ESP for the software upgrade right included with each iPhone sold through the Company's second quarter of 2010 was $25. Beginning in April 2010 in conjunction with the announcement of 1084 for iPhone, the Company lowered its ESP for the software upgrade right included with each iPhone to $10. Beginning with initial sales of iPad in April 2010, the Company has also indicated it may from time-to-time provide future unspecified software upgrades and features free of charge to iPad customers. The Company's ESP for the embedded software upgrade right included with the sale of each iPad is $10. In June 2010, the Company announced that certain previously sold iPod touch models would receive an upgrade to iOS 4 free of charge and may from time- to-time receive future unspecified software upgrades and fontures free of charge. The Company's ESP for the embedded software upgrade right included with each iPod touch sold beginning in June 2010 is $5. Note 2 - Retrospective Adoption of New Accounting Principles (excerpts) In September 2009, the Financial Accounting Standards Board ("FASB") amended the accounting standards related to revenio recognition for arrangements with multiple deliverables and arrangements that include software clements ("new accounting principles"). The new accounting principles permitted prospective or retrospective adoption, and the Company elected retrospective adoption during the first quarter of 2010. Under the historical accounting principles, the Company was required to account for sales of both iPhone and Apple TV using subscription accounting because the Company indicated it might from time to time provide future unspecified software upgrades and features for those products free of charge. Under subscription accounting revenue and associated product cost of sales for iPhone and Apple TV were deferred at the time of sale and recognized on a straight-line basis over each product's estimated economic life. This resulted in the deferral of significant amounts of revenue and cost of sales related to iPhone and Apple TV. The new accounting principles affect the Company's accounting for all past and current sales of iPhone, iPad, Apple TV and for sales of iPod touch beginning in June 2010. The new accounting principles require the Company to account for the sale of these devices as two deliverables. The first deliverable is the hardware and software essential to the functionality of the hardware device delivered at the time of sale, and the second deliverable is the right to receive on a when-and-if available basis, future unspecified software upgrades and features relating to the product's eksential software. The new accounting principles result in the recognition of a substantial portion of the revenue and all product costs from the sale of these devices at the time of their sale. Additionally, the Company is required to estimate a standalone selling price for the unspecified software upgrade rights included with the sale of these devices and recognizes that amount ratably over the 24-month estimated life of the related hardware device. E Note 2 - Retrospective Adoption of New Accounting Principles (excerpts) - continued The following tuibles present the effects of the retrospective adoption of the new accounting principles to the Company's previously reported financial statements as of September 26, 2009: Consolidated Balance Sheets September 26, 2009 (in millions, except share amounts) Current assets: As Reported Adjustments As Amended Cash and cash equivalents $ 5,263 $ $ 5,263 Short-term marketable securities 18,201 18,201 Accounts receivable, less allowance of $52 3,361 3,361 Inventories 455 455 Deferred tax assets 2,101 (966) 1,135 Other current assets 6,884 (3,744) 3,140 Total current assets 36,265 (4,710) 31,555 Long-term marketable securities 10,528 10,528 Property, plant and equipment, net 2,954 2,954 Goodwill 206 206 Acquired intangible assets, net 247 247 Other assets 3,651 (1,640) 2,011 Total assets $ 53,851 S (6,350) S 47.501 Current liabilities: Accounts payable $ 5,601 $ $ 5,601 Accrued expenses 3,376 476 3,852 Deferred revenue 10,305 (8,252) 2,053 Total current liabilities 19,282 (7,776) 11,506 Deferred revenue -non-current 4.485 (3,632) 853 Other non-current liabilities 2.252 1,250 3,502 Total liabilities 26,019 (10.158) 15.861 Commitments and contingencies Shareholders' equity Common stock, no par value: 1,800,000,000 shares authorized; 899,805,500 shares issued and outstanding 8,210 Retained earnings 8,210 19,538 3,815 23,353 Accumulated other comprehensive income 84 77 Total shareholders' equity 27.832 3.808 31,640 Total liabilities and shareholders' equity $ 53,851 S (6,350 $ 47,501 Fiscal Year Ended September 26, 2009 As Reported Adjustments As Amended S 36,537 5 6,368 S 42.905 23,397 2,286 25,683 13.140 4,082 17,222 Consolidated Statements of Operations (in millions) Net sales Cost of sales Gross margin Operating expenses Research and development Selling, general and administrative Total operating expenses Operating income Other income and expense Income before provision for income taxes Provision for income taxes Net Income - 1,333 4,149 5.482 7,658 326 7.984 2,280 5,704 S 4,082 1,333 4,149 5.482 11.740 326 12,066 3,831 8,235 4,082 1,551 2,531 5 S A. At the time of the case, what are the types of products that Apple sells, and the types of services that Apple provides? Be specific. B. In general, what is the criteria for revenue to be recognized by a company? What does "performance obligation refer to when selling a product, or providing a service? Be specific by giving some examples related to Apple. C. Apple employs the use of Multiple Element Contracts (MECs) for many of its sales. (i) What are multiple-element contracts (MECs)? In general, why are the revenues associated with MECs difficult to measure and record? (ii) What are some of the elements in Apple's MECs? What method or methods does Apple use in measuring the revenue associated with the various elements in its MECs? D. Suppose Apple had approximately $1 billion of gift cards for the fiscal year outstanding. Where would this amount be reported in the financial statements? When would revenue be recognized from these gift cards? E. Per Note 2, Apple adopted a new accounting principle during the first quarter of 2010. (i) In your own words, compare and contrast the reporting of sales and associated product costs for the various Apple products using the new accounting principle to the one historically used. Do you agree with the new principle? Would this principle be more aggressive (recognizing revenue carlier) or conservative (delaying the recognition of revenue) with respect to revenue recognition? Support your answer. (ii) Apple applied retrospective adoption of the new accounting principle to the financial statements for fiscal year ended 2009. Do you believe the adjustment to net income for FYE 2009 was material for Apple? Why or why not? Be specific. (Hint: Look at the financial statements in Note 2) F. The following questions relate to Apple's Comprehensive Income and related accounts for fiscal year ended 2010. (i) Give the components and dollar amounts of Total Comprehensive Income for fiscal-year-ended 2010. (ii) From your answer above, which of these components constitute Other Comprehensive Income? (iii) In which account would the components of Other Comprehensive Income be closed into? Where are the components of Comprehensive Income presented in Apple's 2010 financial statements? What are the options as to how Comprehensive Income is reported currently? G. Give three specific examples from the case in which Apple required the use of estimates in measuring and reporting revenues. H. Why would a manager be tempted to unethically recognize revenue earlier than GAAP guidelines allow? Is it unethical to purposely postpone the recognition of revenue to a later reporting period? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started