Answered step by step

Verified Expert Solution

Question

1 Approved Answer

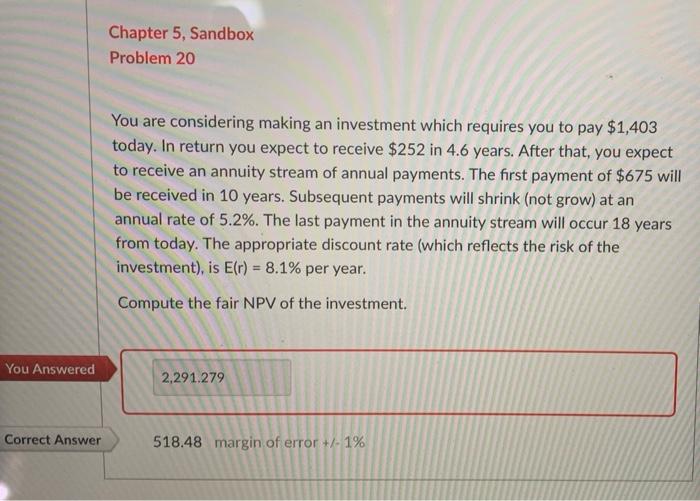

v Chapter 5, Sandbox Problem 20 You are considering making an investment which requires you to pay $1,403 today. In return you expect to receive

v

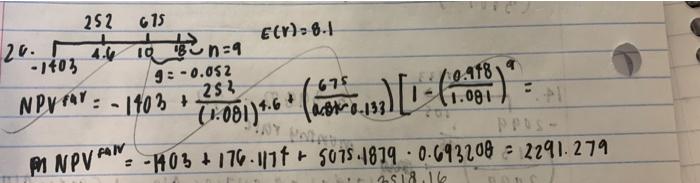

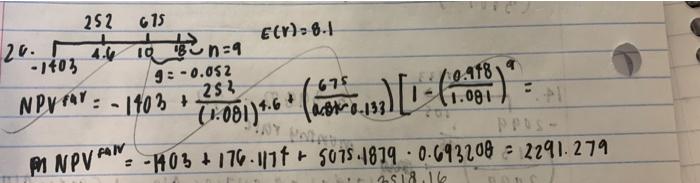

Chapter 5, Sandbox Problem 20 You are considering making an investment which requires you to pay $1,403 today. In return you expect to receive $252 in 4.6 years. After that, you expect to receive an annuity stream of annual payments. The first payment of $675 will be received in 10 years. Subsequent payments will shrink (not grow) at an annual rate of 5.2%. The last payment in the annuity stream will occur 18 years from today. The appropriate discount rate (which reflects the risk of the investment), is E(r) = 8.1% per year. Compute the fair NPV of the investment You Answered 2,291.279 Correct Answer 518.48 margin of error +/- 1% E(Y)8.1 252 615 20. 4.6 una -1003 9:-0.052 NPVAY: -1403 + 14 10 n=9 0.498 675 253 1.091 11.081)4.6* . . M NPV AAP-103 +116-1177 + 9078 1819 -0.693208 = 2291.279 OS18.16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started