Answered step by step

Verified Expert Solution

Question

1 Approved Answer

v Details 1. Due: Nov. 14. 2. Total points: 30. 3. Please find and refer to the 2022 annual report of FedEx Corporation to answer

v Details

1. Due: Nov. 14.

2. Total points: 30.

3. Please find and refer to the 2022 annual report of FedEx Corporation to answer the following questions.

Required:

1. General information: When does FedEx's fiscal year end? Who is FedEx's auditor? (2 pts)

2. Does FedEx sponsor defined benefit pension plans for its employees? Does FedEx sponsor defined contribution pension plans for its employees? Please cite the appropriate information from the annual report to support your answers (e.g.. "Yes, FedEx does sponsor defined benefit pension plans because on Page X of the annual report, it states that *...) (2 pts)

3. Find the net funded status, fair value of plan assets, and PBO of FedEx's U.S. pension plans at the fiscal year end of 2022 and 2021, respectively (3 pts).

4. The accounting for pension plans includes numerous assumptions. From 2021 to 2022, how did the discount rate and rate of increase in future compensation levels used to determine beneft obligation for U.S. Pension Plans change? How did these changes in assumptions affect PBO? (4 pts)

5. For each fiscal year from 2020 to 2022: What were the actual rate of return and expected rate of retum on FedEx's U.S. Pension Plan assets? Did the differences between actual and expected rate of returns create a gain or loss? (3 pts)

6. Based on the variations in actual and expected rates of return across the three years (2020-2022), can you explain how and why expected return and unexpected retur on pension plan assets are reported differently in the financial statements? (4 pts)

7. In 2020, FedEx announced the closing of its U.S.-based defined benefit pension plans to new non-union employees hired on or after January 1, 2020. Please discuss why companies are shifting away from defined benefit pension plans. Do you, as an employee, prefer a defined benefit or a defined contribution plan? Please explain. (6 pts)

8. If you are enrolled in a defined beneft pension plan, would you be concerned about the safety of your pension if your employer goes bankrupt? Please explain (6 pts).

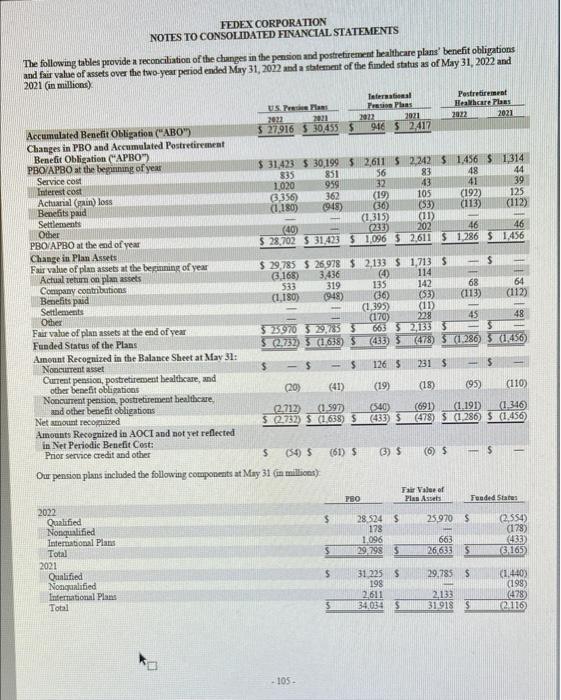

Accumulated Benefit Obligation ("ABO")

Changes in PBO and Accumulated Postretirement

Benefit Obligation ('APBO")

PBO/APBO at the beginning of year

Service cost

Interest cost

Actuarial (pain) loss

Benefits paid

Settlements

Other

PBO/APBO at the end of year

Change in Plan Assets

Fair value of plan assets at the beginning of year

Actual retum on plan assets

Company contributions

Benefits paid

Settlements

Other

Fair value of plan assets at the end of year

Funded Status of the Plans

Amount Recognized in the Balance Sheet at May 31:

1456 $ 1,314

$ 31.423 $ 30,199 $ 2,611 $ 2,242

4

48

83

39

56

851

43

125

835

32

105

(192)

959

(53)

(112)

1.020

(113)

362

6.356

(19)

(6)

(948)

(1.180)

(1315)

(11)

46

46

202

2.611

1456

(33)

1.286

(40

28,702 $ 31.423

1.096

5 29.785 $ 26.978 $ 2,133

3.436

(3,168)

(4)

135

319

533

(36)

(948)

(1,180)

(1.395)

(170)

(433)

126 S

(19)

(11

(11)

228

$ 2,135

(478)

$ 25970 5 29.785

0.732)

5 4.638)

Nonaurent asset

231

(18)

(691)

Current pension, postretirement healthcare, and (110)

(95)

(1.191)

(1340

(1.286) 5

(456)

other benefit obligations

Noncurrent pension, postretirement healthcare, and other benefit obligations

Net amount recognized

Amounts Recognized in AOCI and not yet reflected

s

(0)

(,712)

(2.732)

(54) S

(41)

(1.591)

(1,638)

(540

(6)

(61) $

3 $

in Net Periodic Benefit Cost:

Prior service credit and other

Our pension plans included the following components at May 31 (in millions):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started