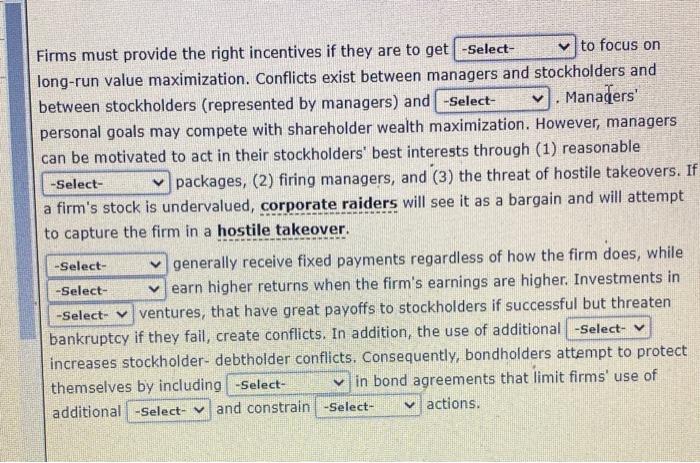

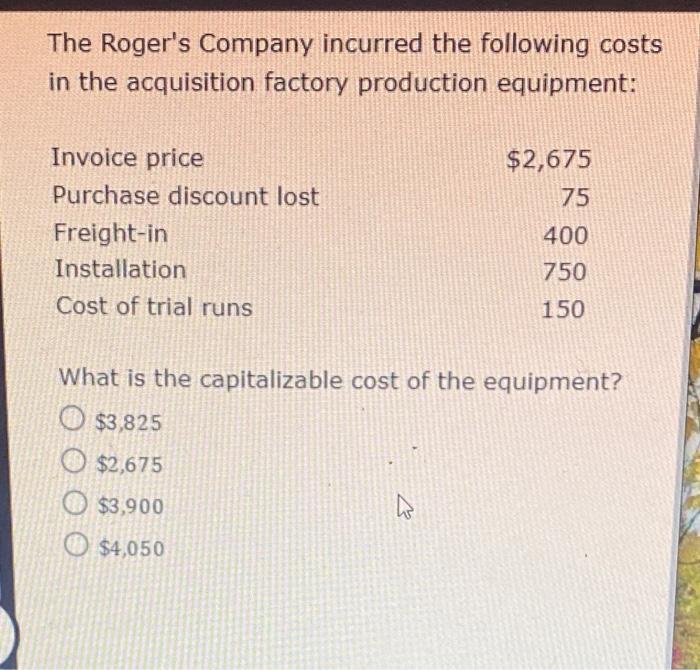

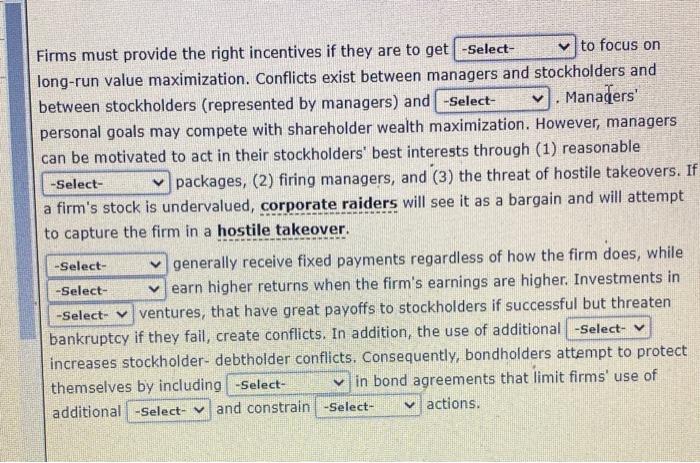

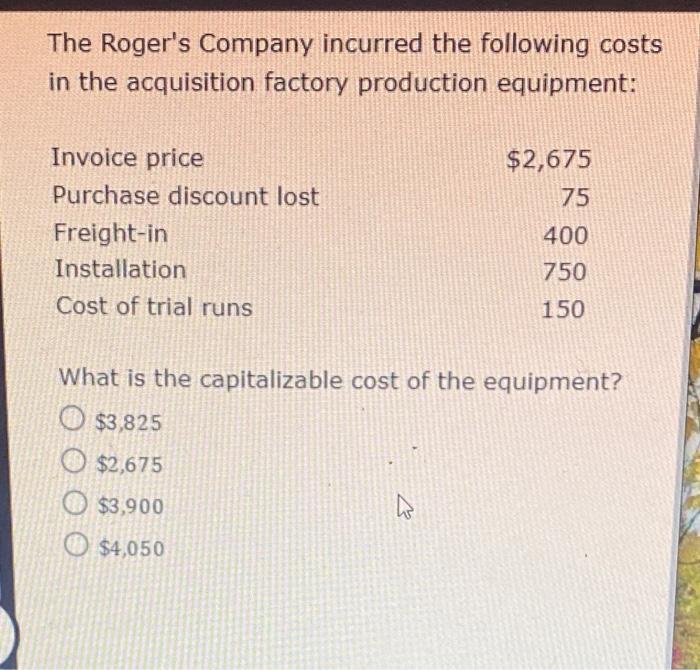

V Firms must provide the right incentives if they are to get -Select- v to focus on long-run value maximization. Conflicts exist between managers and stockholders and between stockholders (represented by managers) and/ -Select- Manaders' personal goals may compete with shareholder wealth maximization. However, managers can be motivated to act in their stockholders' best interests through (1) reasonable -Select- packages, (2) firing managers, and (3) the threat of hostile takeovers. If a firm's stock is undervalued, corporate raiders will see it as a bargain and will attempt to capture the firm in a hostile takeover. -Select- generally receive fixed payments regardless of how the firm does, while -Select- earn higher returns when the firm's earnings are higher. Investments in -Select- vventures, that have great payoffs to stockholders if successful but threaten bankruptcy if they fail, create conflicts. In addition, the use of additional -Select- v increases stockholder- debtholder conflicts. Consequently, bondholders attempt to protect themselves by including -Select- v in bond agreements that limit firms' use of additional -Select- and constrain -Select- v actions. The Roger's Company incurred the following costs in the acquisition factory production equipment: $2,675 75 Invoice price Purchase discount lost Freight-in Installation Cost of trial runs 400 750 150 What is the capitalizable cost of the equipment? O $3,825 O $2,675 O $3,900 0 $4,050 V Firms must provide the right incentives if they are to get -Select- v to focus on long-run value maximization. Conflicts exist between managers and stockholders and between stockholders (represented by managers) and/ -Select- Manaders' personal goals may compete with shareholder wealth maximization. However, managers can be motivated to act in their stockholders' best interests through (1) reasonable -Select- packages, (2) firing managers, and (3) the threat of hostile takeovers. If a firm's stock is undervalued, corporate raiders will see it as a bargain and will attempt to capture the firm in a hostile takeover. -Select- generally receive fixed payments regardless of how the firm does, while -Select- earn higher returns when the firm's earnings are higher. Investments in -Select- vventures, that have great payoffs to stockholders if successful but threaten bankruptcy if they fail, create conflicts. In addition, the use of additional -Select- v increases stockholder- debtholder conflicts. Consequently, bondholders attempt to protect themselves by including -Select- v in bond agreements that limit firms' use of additional -Select- and constrain -Select- v actions. The Roger's Company incurred the following costs in the acquisition factory production equipment: $2,675 75 Invoice price Purchase discount lost Freight-in Installation Cost of trial runs 400 750 150 What is the capitalizable cost of the equipment? O $3,825 O $2,675 O $3,900 0 $4,050