v

v

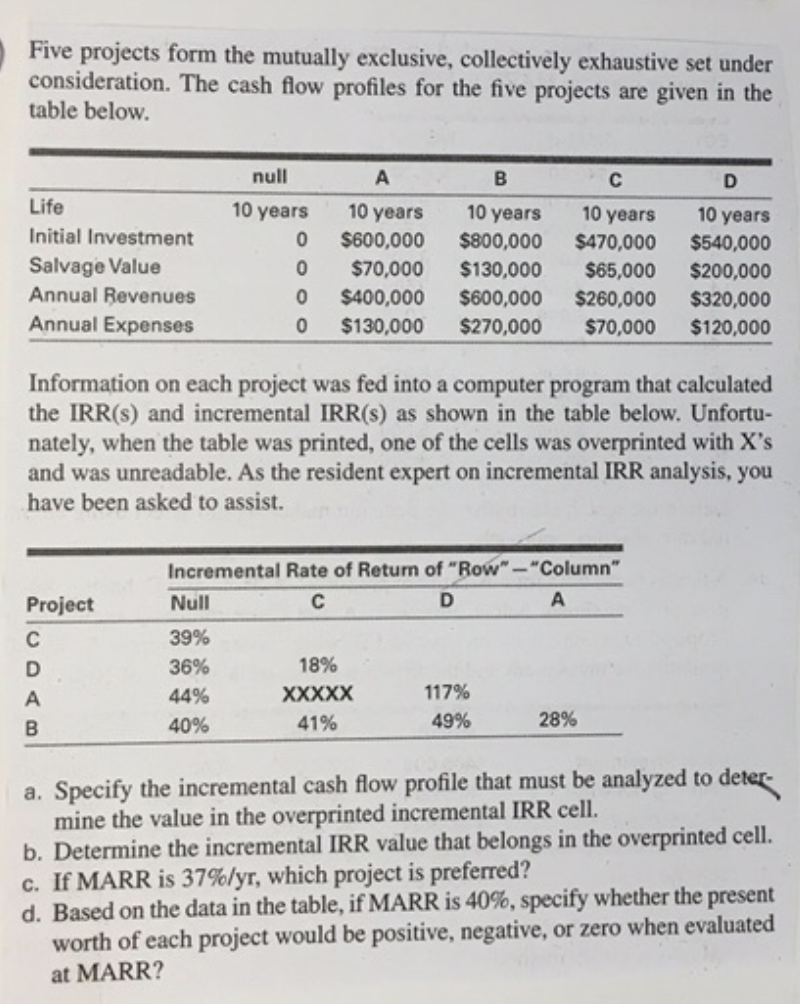

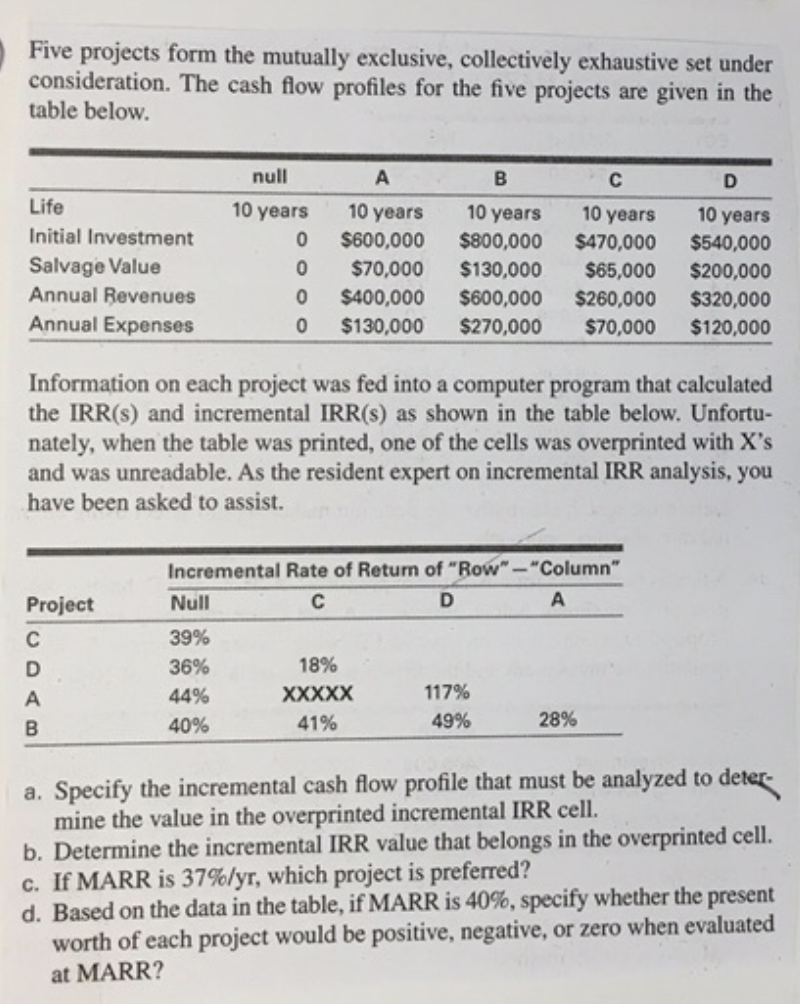

Five projects form the mutually exclusive, collectively exhaustive set under consideration. The cash flow profiles for the five projects are given in the table below. null B D 10 years 0 Life Initial Investment Salvage Value Annual Revenues Annual Expenses 0 10 years $600,000 $70,000 $400,000 $130,000 10 years $800,000 $130,000 $600,000 $270,000 10 years $470,000 $65,000 $260,000 $70,000 10 years $540,000 $200,000 $320,000 $120,000 0 0 Information on each project was fed into a computer program that calculated the IRR(s) and incremental IRR(S) as shown in the table below. Unfortu- nately, when the table was printed, one of the cells was overprinted with X's and was unreadable. As the resident expert on incremental IRR analysis, you have been asked to assist. Project D A B Incremental Rate of Return of "Row" -"Column" Null D 39% 36% 18% 44% XXXXX 117% 40% 41% 49% 28% a. Specify the incremental cash flow profile that must be analyzed to deter- mine the value in the overprinted incremental IRR cell. b. Determine the incremental IRR value that belongs in the overprinted cell. c. If MARR is 37%/yr, which project is preferred? d. Based on the data in the table, if MARR is 40%, specify whether the present worth of each project would be positive, negative, or zero when evaluated at MARR? Five projects form the mutually exclusive, collectively exhaustive set under consideration. The cash flow profiles for the five projects are given in the table below. null B D 10 years 0 Life Initial Investment Salvage Value Annual Revenues Annual Expenses 0 10 years $600,000 $70,000 $400,000 $130,000 10 years $800,000 $130,000 $600,000 $270,000 10 years $470,000 $65,000 $260,000 $70,000 10 years $540,000 $200,000 $320,000 $120,000 0 0 Information on each project was fed into a computer program that calculated the IRR(s) and incremental IRR(S) as shown in the table below. Unfortu- nately, when the table was printed, one of the cells was overprinted with X's and was unreadable. As the resident expert on incremental IRR analysis, you have been asked to assist. Project D A B Incremental Rate of Return of "Row" -"Column" Null D 39% 36% 18% 44% XXXXX 117% 40% 41% 49% 28% a. Specify the incremental cash flow profile that must be analyzed to deter- mine the value in the overprinted incremental IRR cell. b. Determine the incremental IRR value that belongs in the overprinted cell. c. If MARR is 37%/yr, which project is preferred? d. Based on the data in the table, if MARR is 40%, specify whether the present worth of each project would be positive, negative, or zero when evaluated at MARR

v

v