Answered step by step

Verified Expert Solution

Question

1 Approved Answer

V. Modern Portfolio Theory 1) How does diversification allow us to reduce portfolio risk? Explain using the formula for portfolio variance. 2) What is

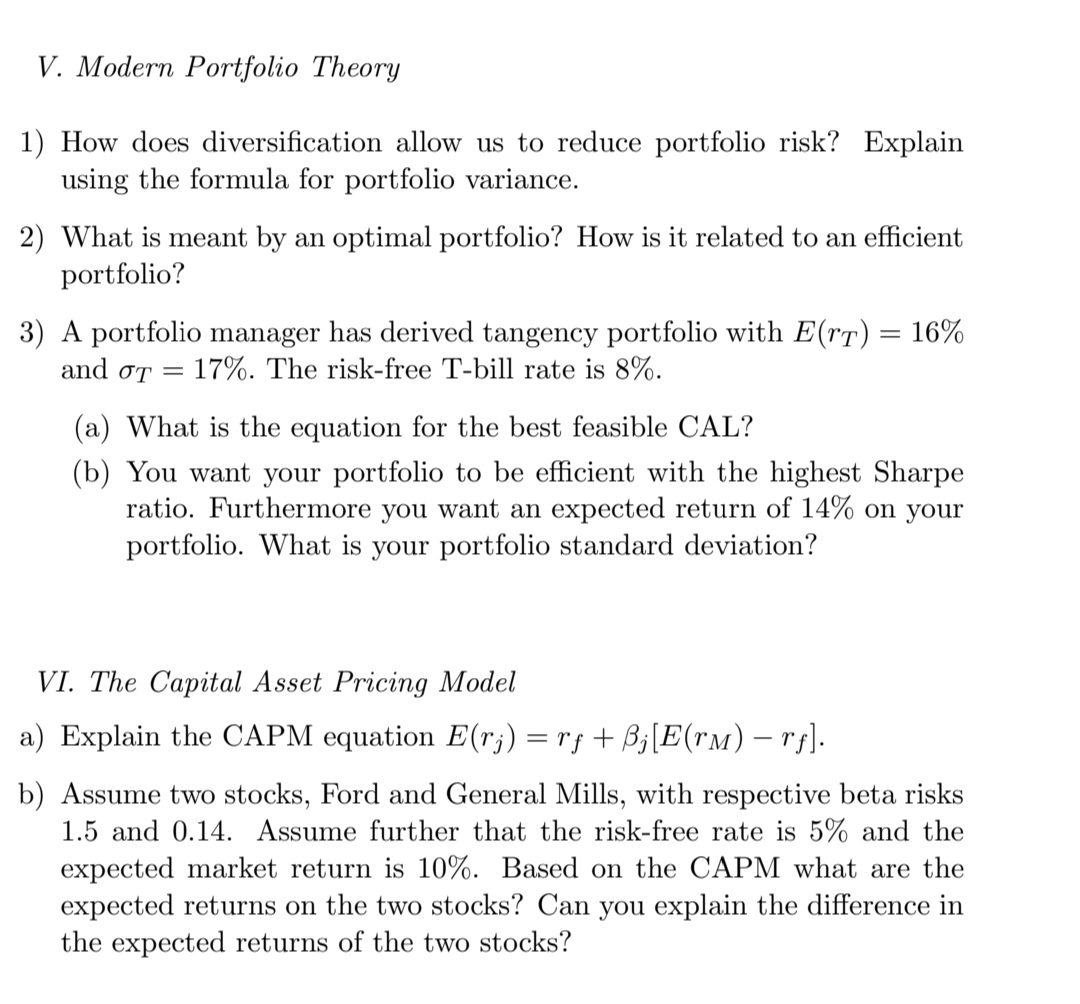

V. Modern Portfolio Theory 1) How does diversification allow us to reduce portfolio risk? Explain using the formula for portfolio variance. 2) What is meant by an optimal portfolio? How is it related to an efficient portfolio? 3) A portfolio manager has derived tangency portfolio with E(T) = 16% 17%. The risk-free T-bill rate is 8%. and T = (a) What is the equation for the best feasible CAL? (b) You want your portfolio to be efficient with the highest Sharpe ratio. Furthermore you want an expected return of 14% on your portfolio. What is your portfolio standard deviation? VI. The Capital Asset Pricing Model a) Explain the CAPM equation E(rj) = r+j[E(rm) r]. b) Assume two stocks, Ford and General Mills, with respective beta risks 1.5 and 0.14. Assume further that the risk-free rate is 5% and the expected market return is 10%. Based on the CAPM what are the expected returns on the two stocks? Can you explain the difference in the expected returns of the two stocks?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

V Modern Portfolio Theory 1 Diversification allows us to reduce portfolio risk by spreading investments across various asset classes or securities Acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started