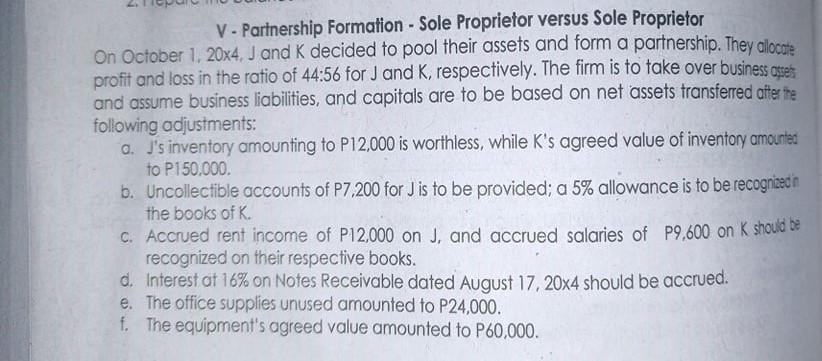

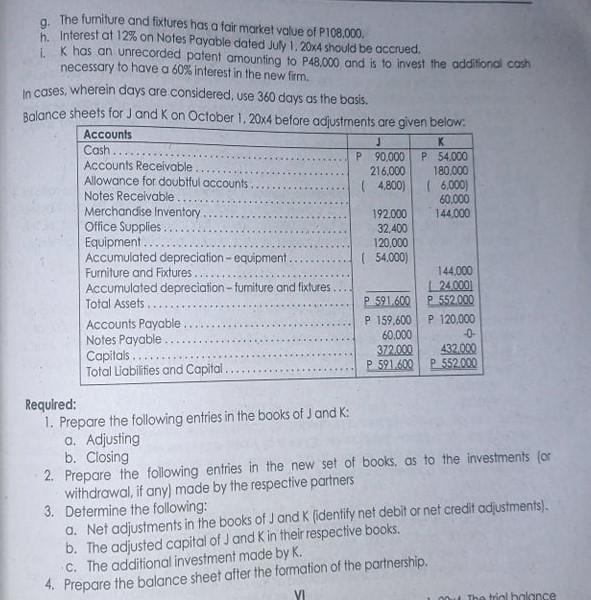

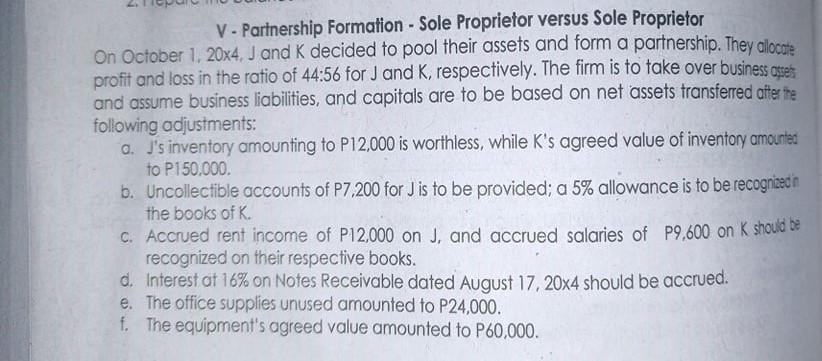

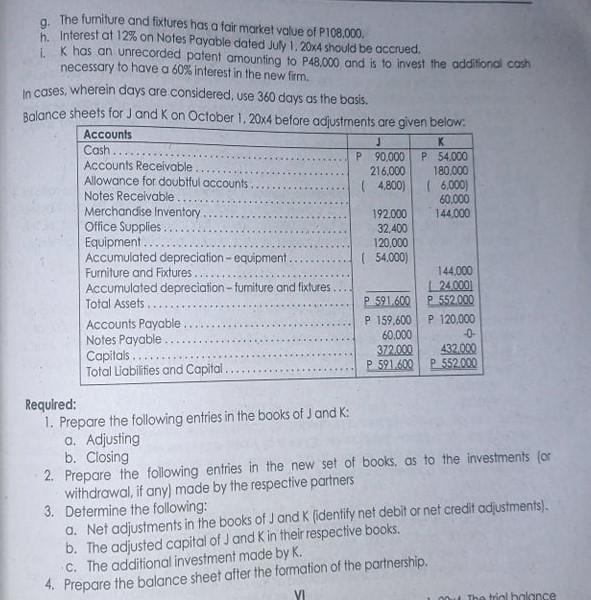

V - Partnership Formation - Sole Proprietor versus Sole Proprietor On October 1, 20x4. J and K decided to pool their assets and form a partnership. They allocate profit and loss in the ratio of 44:56 for J and K, respectively. The firm is to take over business cases and assume business liabilities, and capitals are to be based on net assets transferred after the following adjustments: a. J's inventory amounting to P12,000 is worthless, while K's agreed value of inventory amounted to P150,000 b. Uncollectible accounts of P7.200 for J is to be provided; a 5% allowance is to be recognized in the books of K. C. Accrued rent income of P12.000 on J, and accrued salaries of P9,600 on K should be recognized on their respective books. d. Interest at 16% on Notes Receivable dated August 17, 20x4 should be accrued. e. The office supplies unused amounted to P24,000. f. The equipment's agreed value amounted to P60,000. 9. The furniture and fixtures has a fair market value of P108.000 h. Interest at 12% on Notes Payable dated July 1.20x4 should be accrued. 1. K has an unrecorded patent amounting to P48,000 and is to invest the addifond cash necessary to have a 60% interest in the new firm. In cases, wherein days are considered, use 360 days as the basis. Balance sheets for J and K on October 1.20x4 before adjustments are given below: Accounts K Cash.. P90,000 P 54.000 Accounts Receivable 216,000 180.000 Allowance for doubtful accounts (4800) (6,000) Notes Receivable 60.000 Merchandise Inventory 192.000 144.000 Office Supplies 32.400 Equipment. 120,000 Accumulated depreciation - equipment (54.000) Furniture and Fixtures. 144.000 Accumulated depreciation - furniture and fixtures L24000 Total Assets P. 591.600 P. 552.000 Accounts Payable P 159,600 P 120.000 -0 Notes Payable 60.000 372.000 432.000 Capitals .... Total Liabilities and Capital. P 591.600 P. 552.000 Required: 1. Prepare the following entries in the books of J and K: a. Adjusting b. Closing 2. Prepare the following entries in the new set of books, as to the investments (er withdrawal, if any) made by the respective partners 3. Determine the following: a. Net adjustments in the books of J and K lidentify net debit or net credit adjustments) b. The adjusted capital of J and K in their respective books. C. The additional investment made by K. 4. Prepare the balance sheet after the formation of the partnership The trial balance