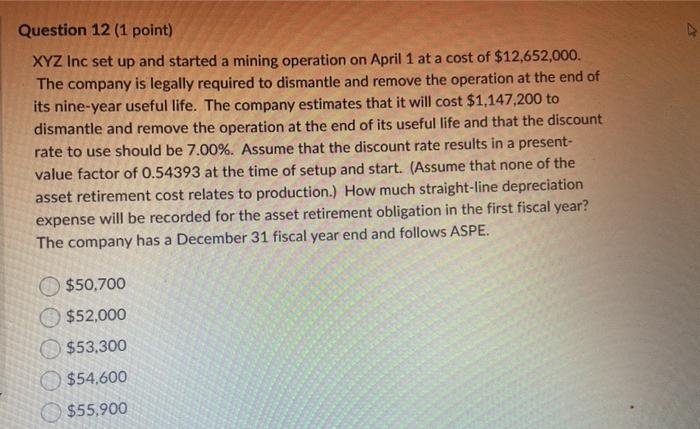

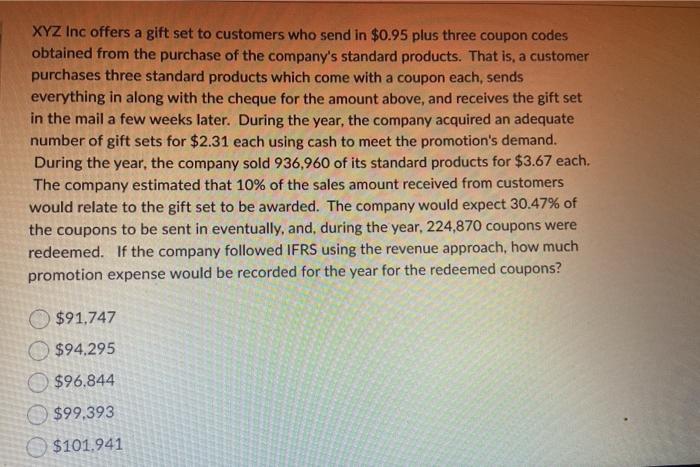

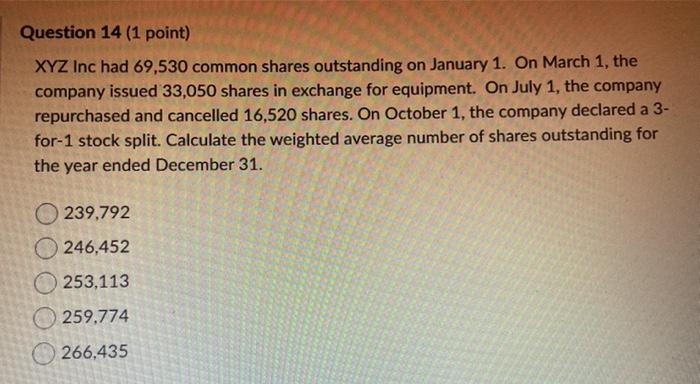

v Question 12 (1 point) XYZ Inc set up and started a mining operation on April 1 at a cost of $12,652,000. The company is legally required to dismantle and remove the operation at the end of its nine-year useful life. The company estimates that it will cost $1,147,200 to dismantle and remove the operation at the end of its useful life and that the discount rate to use should be 7.00%. Assume that the discount rate results in a present- value factor of 0.54393 at the time of setup and start. (Assume that none of the asset retirement cost relates to production.) How much straight-line depreciation expense will be recorded for the asset retirement obligation in the first fiscal year? The company has a December 31 fiscal year end and follows ASPE. $50,700 $52,000 $53,300 $54,600 $55.900 XYZ Inc offers a gift set to customers who send in $0.95 plus three coupon codes obtained from the purchase of the company's standard products. That is, a customer purchases three standard products which come with a coupon each, sends everything in along with the cheque for the amount above, and receives the gift set in the mail a few weeks later. During the year, the company acquired an adequate number of gift sets for $2.31 each using cash to meet the promotion's demand. During the year, the company sold 936,960 of its standard products for $3.67 each. The company estimated that 10% of the sales amount received from customers would relate to the gift set to be awarded. The company would expect 30.47% of the coupons to be sent in eventually, and, during the year, 224,870 coupons were redeemed. If the company followed IFRS using the revenue approach, how much promotion expense would be recorded for the year for the redeemed coupons? $91,747 $94.295 $96.844 $99.393 $101.941 Question 14 (1 point) XYZ Inc had 69,530 common shares outstanding on January 1. On March 1, the company issued 33,050 shares in exchange for equipment. On July 1, the company repurchased and cancelled 16,520 shares. On October 1, the company declared a 3- for-1 stock split. Calculate the weighted average number of shares outstanding for the year ended December 31. 239,792 246,452 253,113 259.774 266.435