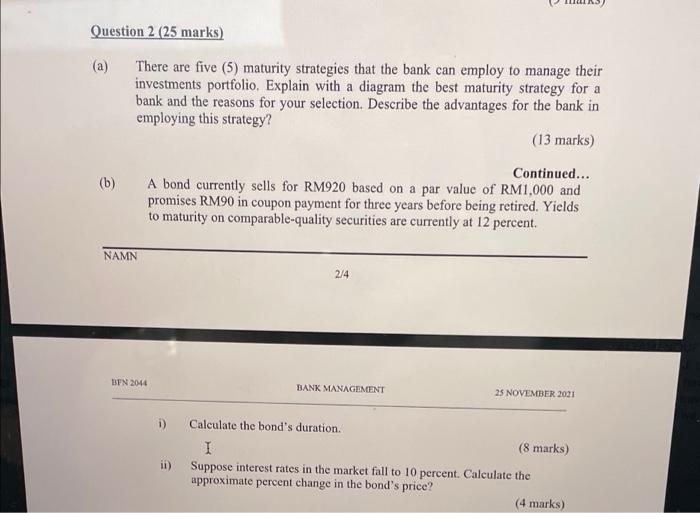

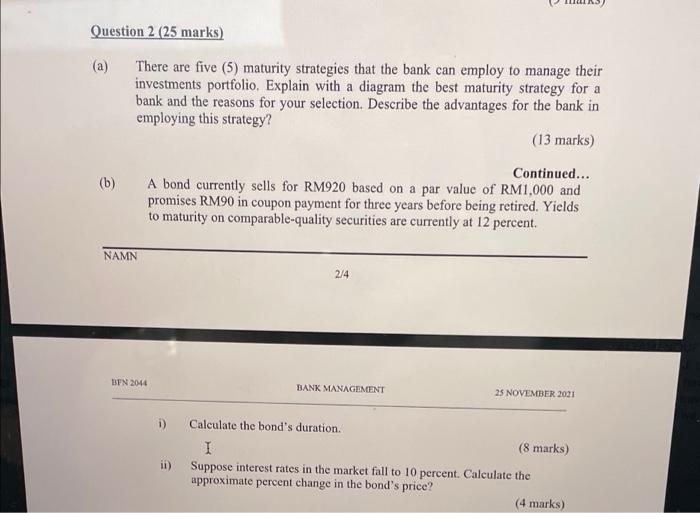

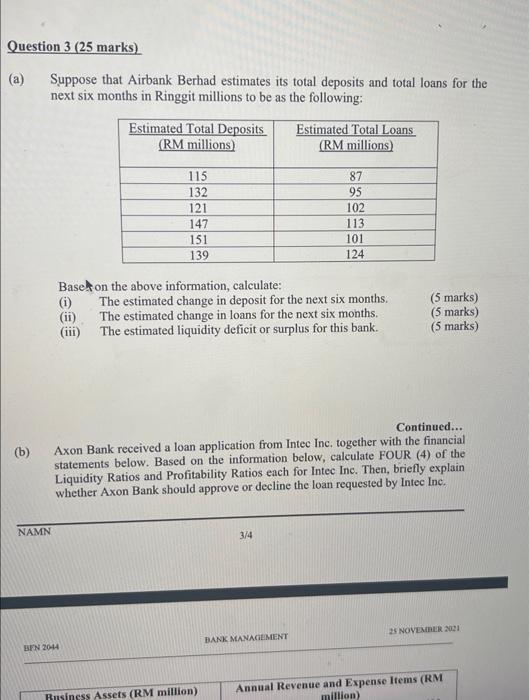

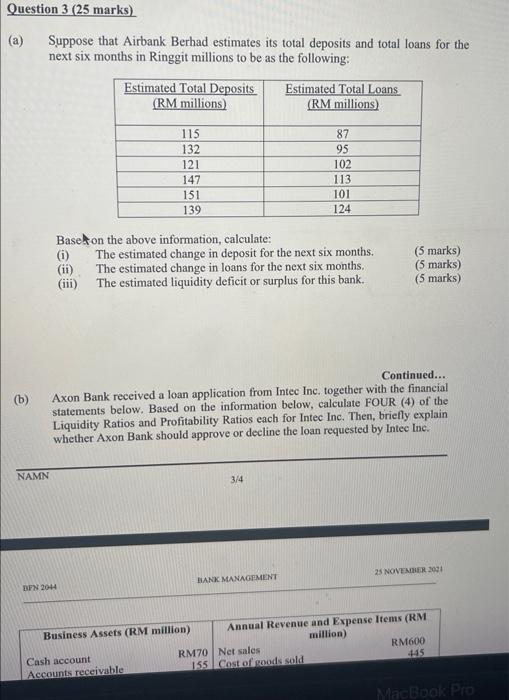

Question 2 (25 marks) (a) There are five (5) maturity strategies that the bank can employ to manage their investments portfolio. Explain with a diagram the best maturity strategy for a bank and the reasons for your selection. Describe the advantages for the bank in employing this strategy? (13 marks) Continued... A bond currently sells for RM920 based on a par value of RM1,000 and promises RM90 in coupon payment for three years before being retired. Yields to maturity on comparable-quality securities are currently at 12 percent. (b) NAMN 214 BFN 2044 BANK MANAGEMENT 25 NOVEMBER 2021 i) Calculate the bond's duration (8 marks) in) Suppose interest rates in the market fall to 10 percent. Calculate the approximate percent change in the bond's price? (4 marks) Question 3 (25 marks) (a) Suppose that Airbank Berhad estimates its total deposits and total loans for the next six months in Ringgit millions to be as the following: Estimated Total Deposits (RM millions) Estimated Total Loans (RM millions 115 132 121 147 151 139 87 95 102 113 101 124 Base on the above information, calculate: (i) The estimated change in deposit for the next six months. (ii) The estimated change in loans for the next six months. (iii) The estimated liquidity deficit or surplus for this bank. (5 marks) (5 marks) (5 marks) (b) Continued... Axon Bank received a loan application from Intec Inc, together with the financial statements below. Based on the information below, calculate FOUR (4) of the Liquidity Ratios and Profitability Ratios each for Intec Inc. Then, briefly explain whether Axon Bank should approve or decline the loan requested by Intec Inc. NAMN 3/4 25 NOVEMBER 2021 BANK MANAGEMENT BIN 2014 Business Assets (RM million) Annual Revenue and Expense Items (RM million) Question 3 (25 marks) Suppose that Airbank Berhad estimates its total deposits and total loans for the next six months in Ringgit millions to be as the following: Estimated Total Deposits Estimated Total Loans (RM millions) (RM millions) 115 132 121 87 95 102 113 101 147 151 139 124 Base on the above information, calculate: (i) The estimated change in deposit for the next six months. (ii) The estimated change in loans for the next six months, The estimated liquidity deficit or surplus for this bank. (5 marks) (5 marks) (5 marks) (b) Continued... Axon Bank received a loan application from Intec Inc. together with the financial statements below. Based on the information below, calculate FOUR (4) of the Liquidity Ratios and Profitability Ratios each for Intec Inc. Then, briefly explain whether Axon Bank should approve or decline the loan requested by Intec Ine. NAMN 3/4 25 NOVEMBER 2001 BANK MANAGEMENT DIN 2014 Business Assets (RM million) Annual Revenue and Expense Items (RM million) Cash account RM70 Net sales RM600 Accounts receivable 155 Cost of woods sold 445 MacBook Pro