Answered step by step

Verified Expert Solution

Question

1 Approved Answer

v) Rates are paid in two instalments on September 1 and March 1 each year. Rates for the first half of the accounting period were

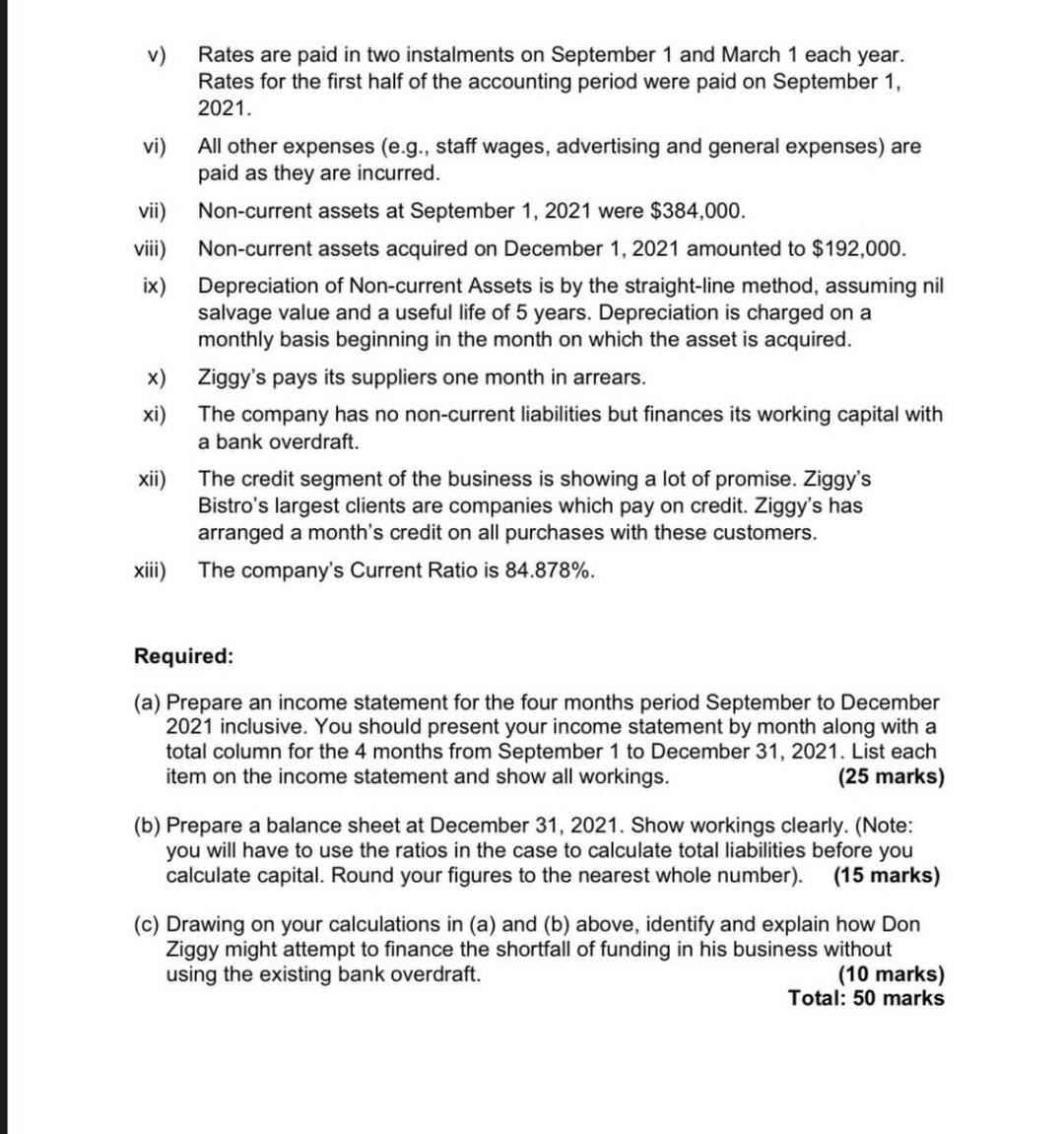

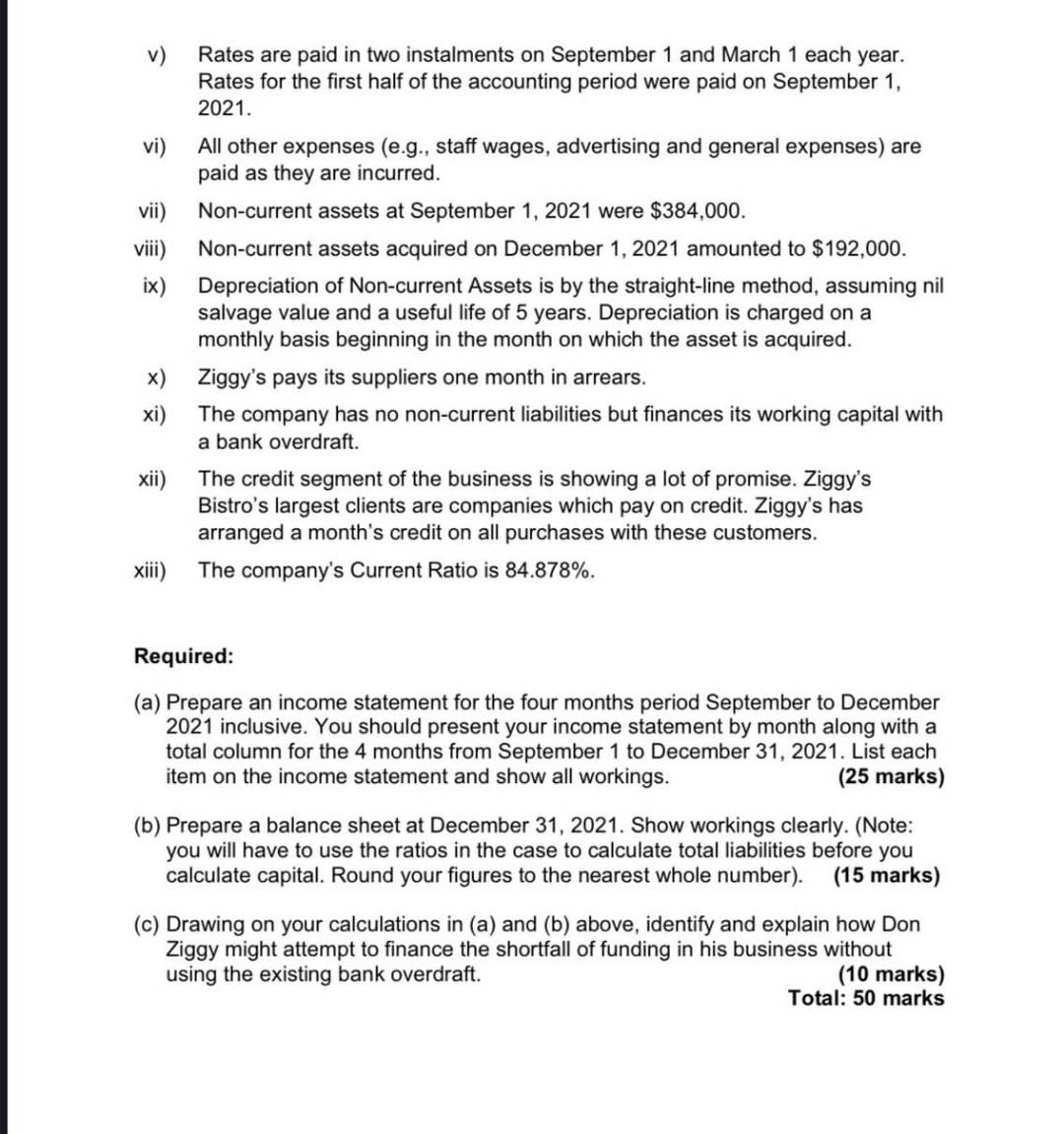

v) Rates are paid in two instalments on September 1 and March 1 each year. Rates for the first half of the accounting period were paid on September 1, 2021. vi) All other expenses (e.g., staff wages, advertising and general expenses) are paid as they are incurred. vii) Non-current assets at September 1, 2021 were $384,000. viii) Non-current assets acquired on December 1, 2021 amounted to $192,000. ix) Depreciation of Non-current Assets is by the straight-line method, assuming nil salvage value and a useful life of 5 years. Depreciation is charged on a monthly basis beginning in the month on which the asset is acquired. x) Ziggy's pays its suppliers one month in arrears. xi) The company has no non-current liabilities but finances its working capital with a bank overdraft. xii) The credit segment of the business is showing a lot of promise. Ziggy's Bistro's largest clients are companies which pay on credit. Ziggy's has arranged a month's credit on all purchases with these customers. xiii) The company's Current Ratio is 84.878%. Required: (a) Prepare an income statement for the four months period September to December 2021 inclusive. You should present your income statement by month along with a total column for the 4 months from September 1 to December 31, 2021. List each item on the income statement and show all workings. (25 marks) (b) Prepare a balance sheet at December 31, 2021. Show workings clearly. (Note: you will have to use the ratios in the case to calculate total liabilities before you calculate capital. Round your figures to the nearest whole number). (15 marks) (c) Drawing on your calculations in (a) and (b) above, identify and explain how Don Ziggy might attempt to finance the shortfall of funding in his business without using the existing bank overdraft. (10 marks) Total: 50 marks v) Rates are paid in two instalments on September 1 and March 1 each year. Rates for the first half of the accounting period were paid on September 1, 2021. vi) All other expenses (e.g., staff wages, advertising and general expenses) are paid as they are incurred. vii) Non-current assets at September 1, 2021 were $384,000. viii) Non-current assets acquired on December 1, 2021 amounted to $192,000. ix) Depreciation of Non-current Assets is by the straight-line method, assuming nil salvage value and a useful life of 5 years. Depreciation is charged on a monthly basis beginning in the month on which the asset is acquired. x) Ziggy's pays its suppliers one month in arrears. xi) The company has no non-current liabilities but finances its working capital with a bank overdraft. xii) The credit segment of the business is showing a lot of promise. Ziggy's Bistro's largest clients are companies which pay on credit. Ziggy's has arranged a month's credit on all purchases with these customers. xiii) The company's Current Ratio is 84.878%. Required: (a) Prepare an income statement for the four months period September to December 2021 inclusive. You should present your income statement by month along with a total column for the 4 months from September 1 to December 31, 2021. List each item on the income statement and show all workings. (25 marks) (b) Prepare a balance sheet at December 31, 2021. Show workings clearly. (Note: you will have to use the ratios in the case to calculate total liabilities before you calculate capital. Round your figures to the nearest whole number). (15 marks) (c) Drawing on your calculations in (a) and (b) above, identify and explain how Don Ziggy might attempt to finance the shortfall of funding in his business without using the existing bank overdraft. (10 marks) Total: 50 marks v) Rates are paid in two instalments on September 1 and March 1 each year. Rates for the first half of the accounting period were paid on September 1, 2021. vi) All other expenses (e.g., staff wages, advertising and general expenses) are paid as they are incurred. vii) Non-current assets at September 1, 2021 were $384,000. viii) Non-current assets acquired on December 1, 2021 amounted to $192,000. ix) Depreciation of Non-current Assets is by the straight-line method, assuming nil salvage value and a useful life of 5 years. Depreciation is charged on a monthly basis beginning in the month on which the asset is acquired. x) Ziggy's pays its suppliers one month in arrears. xi) The company has no non-current liabilities but finances its working capital with a bank overdraft. xii) The credit segment of the business is showing a lot of promise. Ziggy's Bistro's largest clients are companies which pay on credit. Ziggy's has arranged a month's credit on all purchases with these customers. xiii) The company's Current Ratio is 84.878%. Required: (a) Prepare an income statement for the four months period September to December 2021 inclusive. You should present your income statement by month along with a total column for the 4 months from September 1 to December 31, 2021. List each item on the income statement and show all workings. (25 marks) (b) Prepare a balance sheet at December 31, 2021. Show workings clearly. (Note: you will have to use the ratios in the case to calculate total liabilities before you calculate capital. Round your figures to the nearest whole number). (15 marks) (c) Drawing on your calculations in (a) and (b) above, identify and explain how Don Ziggy might attempt to finance the shortfall of funding in his business without using the existing bank overdraft. (10 marks) Total: 50 marks v) Rates are paid in two instalments on September 1 and March 1 each year. Rates for the first half of the accounting period were paid on September 1, 2021. vi) All other expenses (e.g., staff wages, advertising and general expenses) are paid as they are incurred. vii) Non-current assets at September 1, 2021 were $384,000. viii) Non-current assets acquired on December 1, 2021 amounted to $192,000. ix) Depreciation of Non-current Assets is by the straight-line method, assuming nil salvage value and a useful life of 5 years. Depreciation is charged on a monthly basis beginning in the month on which the asset is acquired. x) Ziggy's pays its suppliers one month in arrears. xi) The company has no non-current liabilities but finances its working capital with a bank overdraft. xii) The credit segment of the business is showing a lot of promise. Ziggy's Bistro's largest clients are companies which pay on credit. Ziggy's has arranged a month's credit on all purchases with these customers. xiii) The company's Current Ratio is 84.878%. Required: (a) Prepare an income statement for the four months period September to December 2021 inclusive. You should present your income statement by month along with a total column for the 4 months from September 1 to December 31, 2021. List each item on the income statement and show all workings. (25 marks) (b) Prepare a balance sheet at December 31, 2021. Show workings clearly. (Note: you will have to use the ratios in the case to calculate total liabilities before you calculate capital. Round your figures to the nearest whole number). (15 marks) (c) Drawing on your calculations in (a) and (b) above, identify and explain how Don Ziggy might attempt to finance the shortfall of funding in his business without using the existing bank overdraft. (10 marks) Total: 50 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started