Answered step by step

Verified Expert Solution

Question

1 Approved Answer

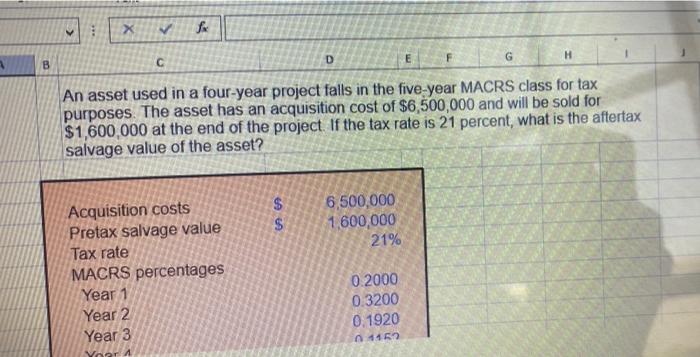

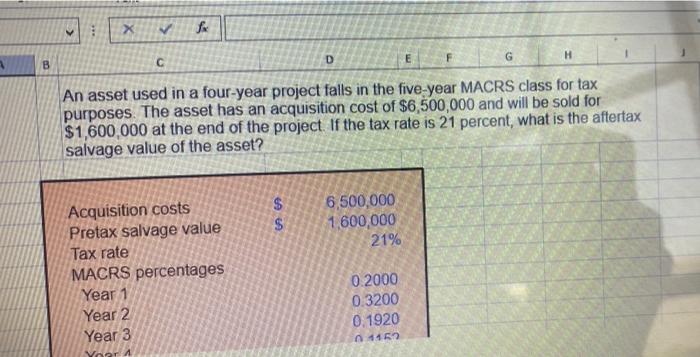

V X fx B C D E G H An asset used in a four-year project falls in the five-year MACRS class for tax purposes.

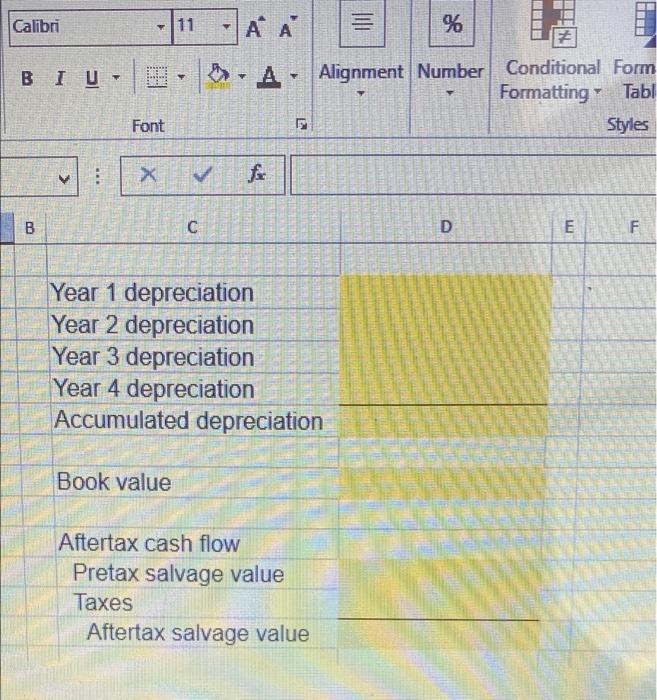

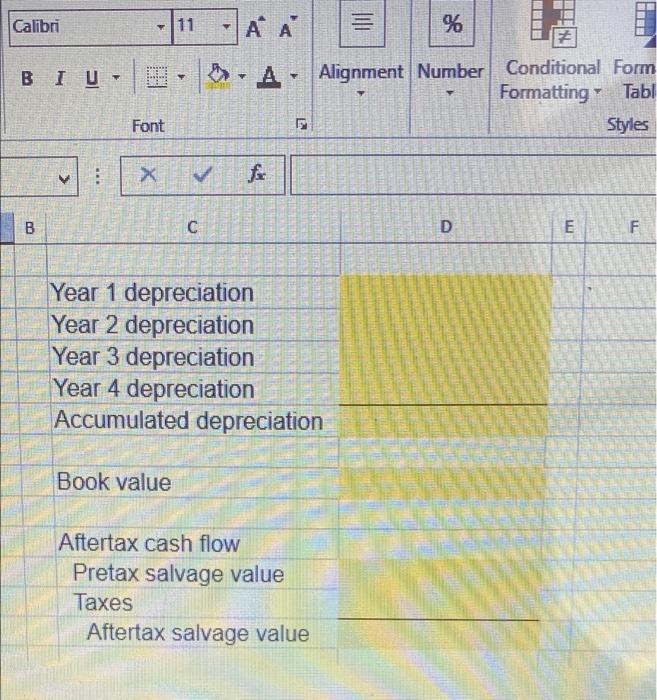

V X fx B C D E G H An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,500,000 and will be sold for $1,600,000 at the end of the project. If the tax rate is 21 percent, what is the aftertax salvage value of the asset? $ 6,500,000 Acquisition costs Pretax salvage value 1,600,000 21% Tax rate MACRS percentages 0.2000 Year 1 0.3200 Year 2 0,1920 Year 3 01152 Your 4 55 Calibri BIU U- B > www. Font W fx C Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation Accumulated depreciation Book value Aftertax cash flow Pretax salvage value Taxes Aftertax salvage value 11 X A A % A Alignment Number D 125 3 |||| E # Conditional Form Formatting Tabl Styles F E LL

V X fx B C D E G H An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,500,000 and will be sold for $1,600,000 at the end of the project. If the tax rate is 21 percent, what is the aftertax salvage value of the asset? $ 6,500,000 Acquisition costs Pretax salvage value 1,600,000 21% Tax rate MACRS percentages 0.2000 Year 1 0.3200 Year 2 0,1920 Year 3 01152 Your 4 55 Calibri BIU U- B > www. Font W fx C Year 1 depreciation Year 2 depreciation Year 3 depreciation Year 4 depreciation Accumulated depreciation Book value Aftertax cash flow Pretax salvage value Taxes Aftertax salvage value 11 X A A % A Alignment Number D 125 3 |||| E # Conditional Form Formatting Tabl Styles F E LL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started