Answered step by step

Verified Expert Solution

Question

1 Approved Answer

V6 You have two mutually-exclusive projects. The first project (P1) has an initial investment of 17.2 million Czech crowns (CZK), and the first year's positive

V6

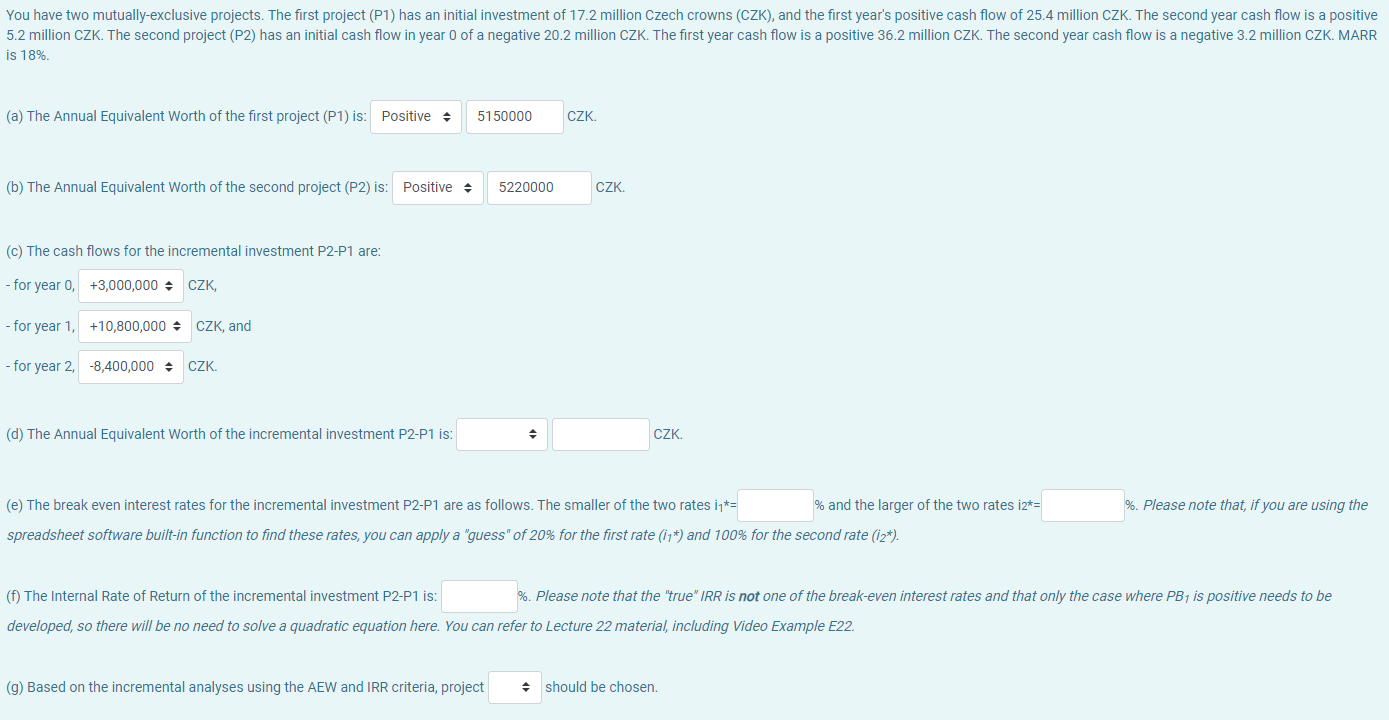

You have two mutually-exclusive projects. The first project (P1) has an initial investment of 17.2 million Czech crowns (CZK), and the first year's positive cash flow of 25.4 million CZK. The second year cash flow is a positive 5.2 million CZK. The second project (P2) has an initial cash flow in year 0 of a negative 20.2 million CZK. The first year cash flow is a positive 36.2 million CZK. The second year cash flow is a negative 3.2 million CZK. MARR is 18%. (a) The Annual Equivalent Worth of the first project (P1) is: Positive (b) The Annual Equivalent Worth of the second project (P2) is: Positive (c) The cash flows for the incremental investment P2-P1 are: - for year 0, +3,000,000 CZK, - for year 1, +10,800,000 CZK, and - for year 2, -8,400,000 CZK. (d) The Annual Equivalent Worth of the incremental investment P2-P1 is: 5150000 5220000 CZK. CZK. CZK. (e) The break even interest rates for the incremental investment P2-P1 are as follows. The smaller of the two rates i*= % and the larger of the two rates i2*= spreadsheet software built-in function to find these rates, you can apply a "guess" of 20% for the first rate (i1*) and 100% for the second rate (12*). %. Please note that, if you are using the (f) The Internal Rate of Return of the incremental investment P2-P1 is: %. Please note that the "true" IRR is not one of the break-even interest rates and that only the case where PB is positive needs to be developed, so there will be no need to solve a quadratic equation here. You can refer to Lecture 22 material, including Video Example E22. (g) Based on the incremental analyses using the AEW and IRR criteria, project should be chosen.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve this problem we will calculate the Annual Equivalent Worth AEW and Internal Rate of Return IRR for the two projects and compare the results G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started