Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vacant Land: 1) CGT Event A1 (General/ Other Capital Asset) - No exception/ exemption applicable 2) Capital Gain = $220,000 (KP) - $200,000 (CB) =

Vacant Land:

1) CGT Event A1 (General/ Other Capital Asset) - No exception/ exemption applicable

2) Capital Gain = $220,000 (KP) - $200,000 (CB) = $20,000 Gain (Eligible for 50% CGT Discount)

Rental Property

1) CGT Event A1:

2) Capital Gain:

Jet Ski

Step 1:

Step 2:

Painting

Step 1:

Step 2:

Boat

Step 1:

Step 2:

STEP 3: Subtract current and past capital losses

STEP 4: Apply available discounts/ concessions

STEP 5: Calculate Net Capital Gain/ Losses

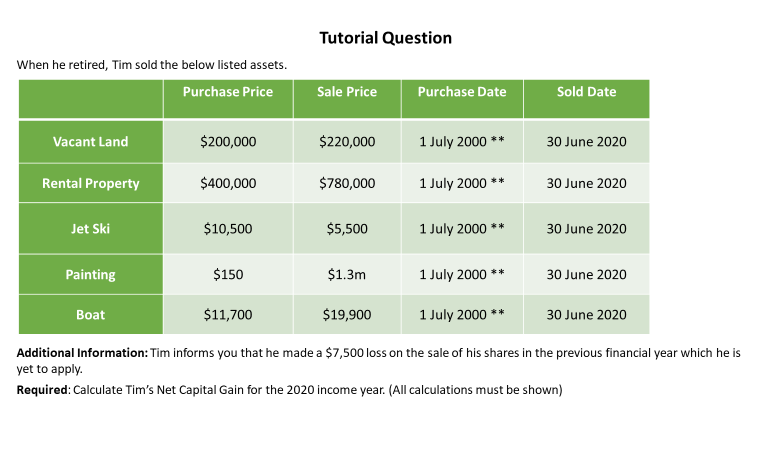

Tutorial Question When he retired, Tim sold the below listed assets. Purchase Price Sale Price Purchase Date Sold Date Vacant Land $200,000 $220,000 1 July 2000 ** 30 June 2020 Rental Property $400,000 $780,000 1 July 2000 ** 30 June 2020 Jet Ski $10,500 $5,500 1 July 2000 ** 30 June 2020 Painting $150 $1.3m 1 July 2000 ** 30 June 2020 Boat $11,700 $19,900 1 July 2000 ** 30 June 2020 Additional Information: Tim informs you that he made a $7,500 loss on the sale of his shares in the previous financial year which he is yet to apply. Required: Calculate Tim's Net Capital Gain for the 2020 income year. (All calculations must be shown) Tutorial Question When he retired, Tim sold the below listed assets. Purchase Price Sale Price Purchase Date Sold Date Vacant Land $200,000 $220,000 1 July 2000 ** 30 June 2020 Rental Property $400,000 $780,000 1 July 2000 ** 30 June 2020 Jet Ski $10,500 $5,500 1 July 2000 ** 30 June 2020 Painting $150 $1.3m 1 July 2000 ** 30 June 2020 Boat $11,700 $19,900 1 July 2000 ** 30 June 2020 Additional Information: Tim informs you that he made a $7,500 loss on the sale of his shares in the previous financial year which he is yet to apply. Required: Calculate Tim's Net Capital Gain for the 2020 income year. (All calculations must be shown)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started