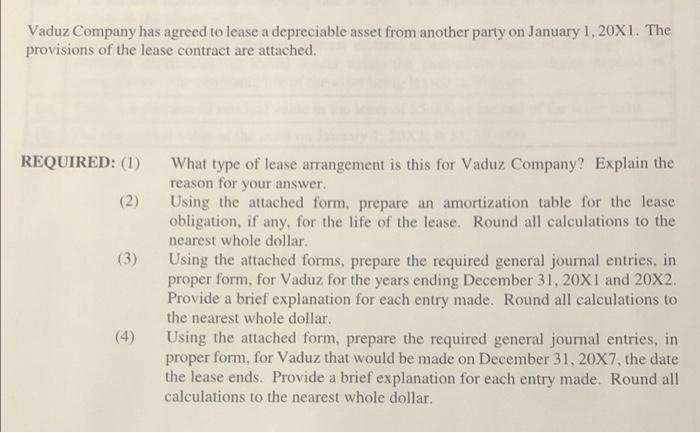

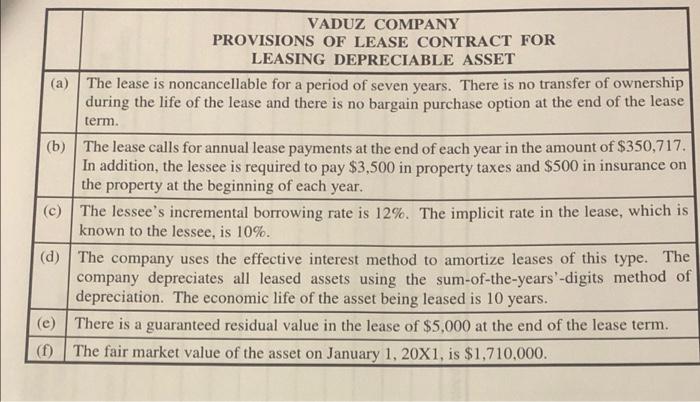

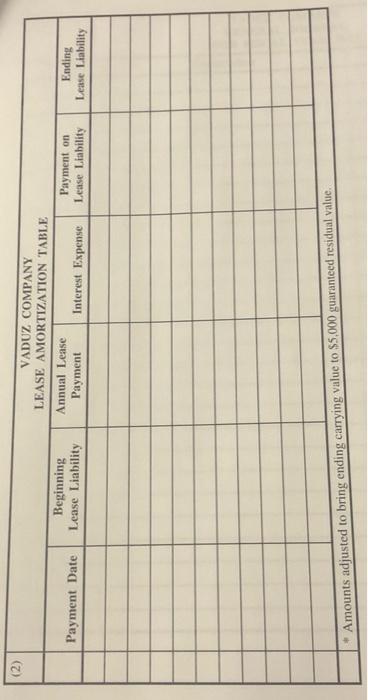

Vaduz Company has agreed to lease a depreciable asset from another party on January 1, 20X1. The provisions of the lease contract are attached. REQUIRED: (1) (2) (3) What type of lease arrangement is this for Vaduz Company? Explain the reason for your answer. Using the attached form, prepare an amortization table for the lease obligation, if any, for the life of the lease. Round all calculations to the nearest whole dollar. Using the attached forms, prepare the required general journal entries, in proper form, for Vaduz for the years ending December 31, 20X1 and 20X2. Provide a brief explanation for each entry made. Round all calculations to the nearest whole dollar. Using the attached form, prepare the required general journal entries, in proper form, for Vaduz that would be made on December 31, 20X7, the date the lease ends. Provide a brief explanation for each entry made. Round all calculations to the nearest whole dollar. (4) VADUZ COMPANY PROVISIONS OF LEASE CONTRACT FOR LEASING DEPRECIABLE ASSET (a) The lease is noncancellable for a period of seven years. There is no transfer of ownership during the life of the lease and there is no bargain purchase option at the end of the lease term. (b) The lease calls for annual lease payments at the end of each year in the amount of $350,717. In addition, the lessee is required to pay $3,500 in property taxes and $500 in insurance on the property at the beginning of each year. c) The lessee's incremental borrowing rate is 12%. The implicit rate in the lease, which is known to the lessee, 10%. (d) The company uses the effective interest method to amortize leases of this type. The company depreciates all leased assets using the sum-of-the-years-digits method of depreciation. The economic life of the asset being leased is 10 years. (e) There is a guaranteed residual value in the lease of $5,000 at the end of the lease term. (1) The fair market value of the asset on January 1, 20X1, is $1,710,000. (2) VADUZ COMPANY LEASE AMORTIZATION TABLE Annual Lease Payment Interest Expense Beginning Lease Liability Payment Date Payment on Lease Liability Ending Lease Liability * Amounts adjusted to bring ending carrying value to $5,000 guaranteed residual value