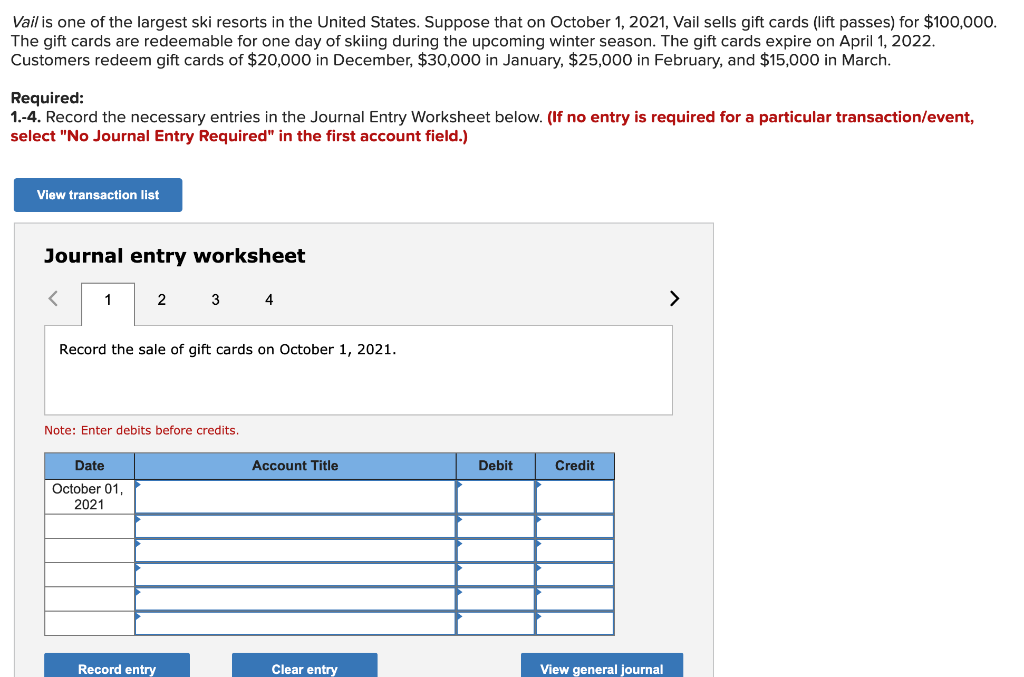

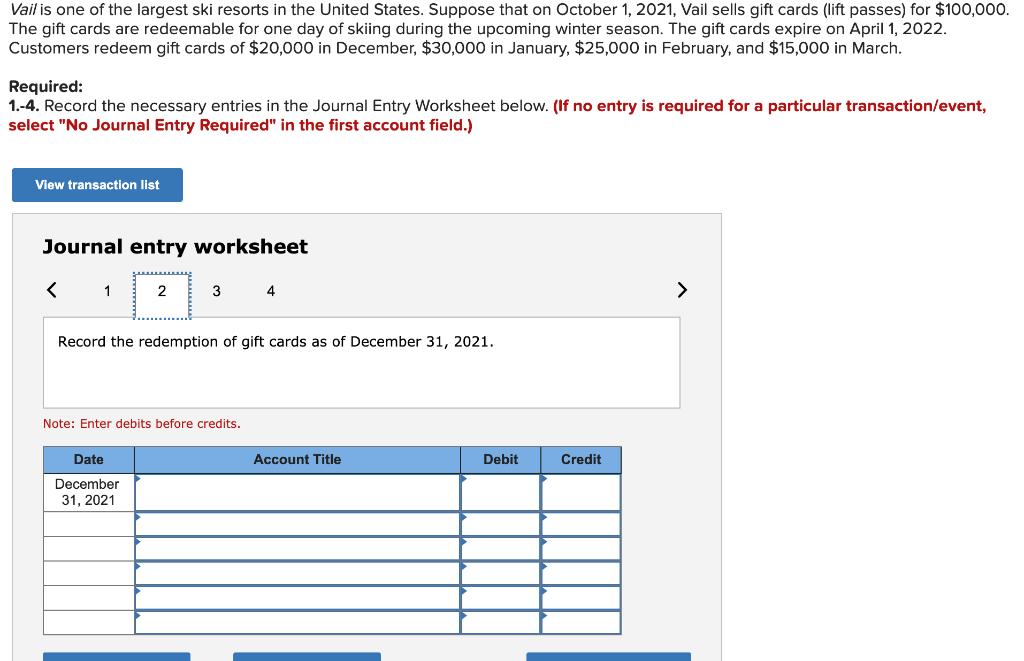

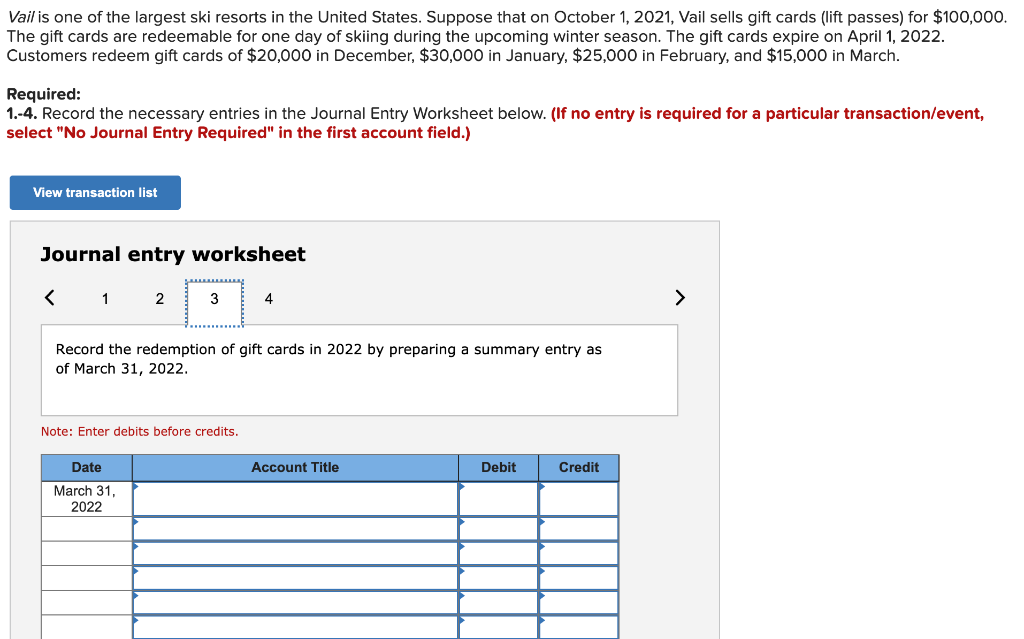

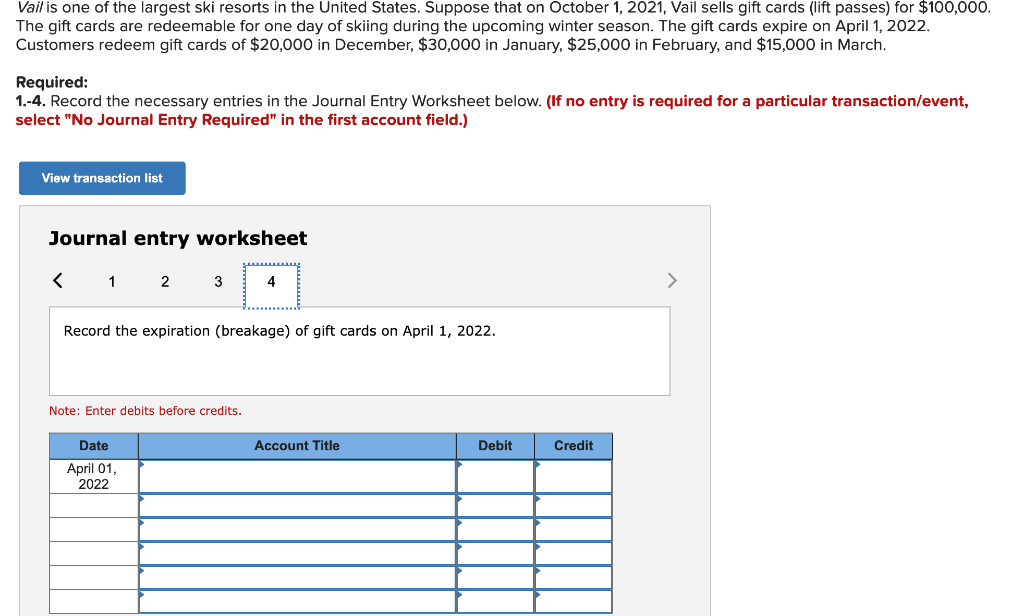

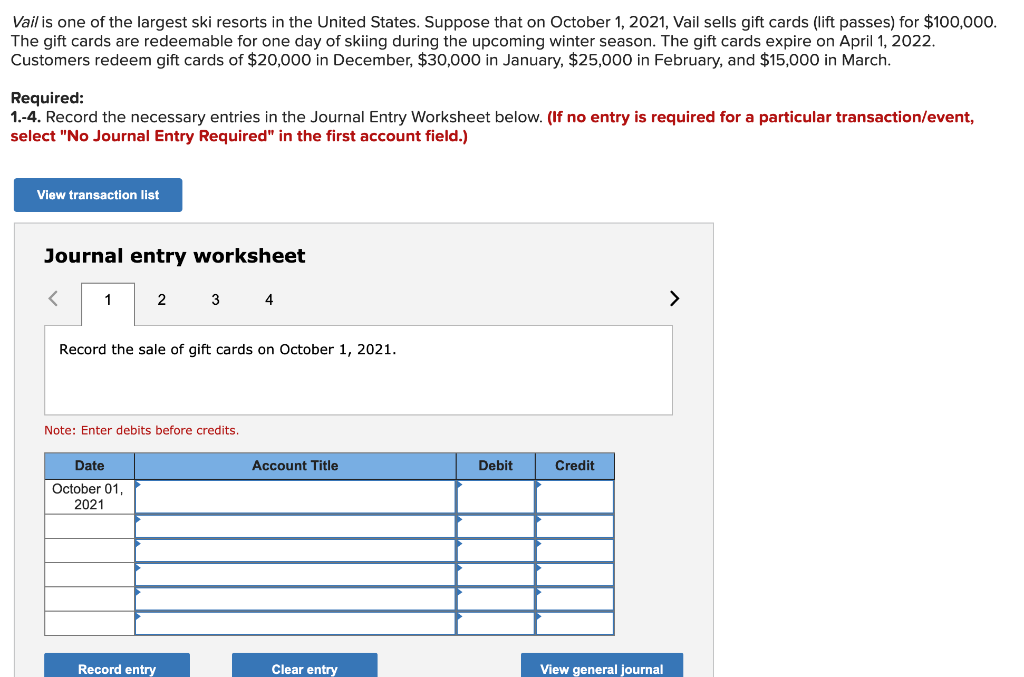

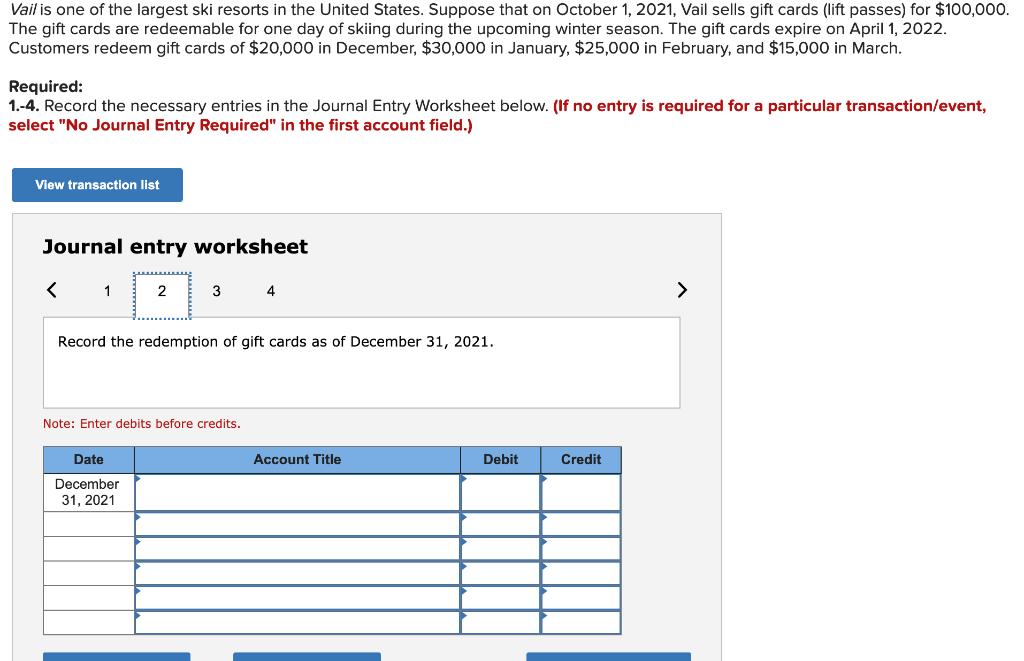

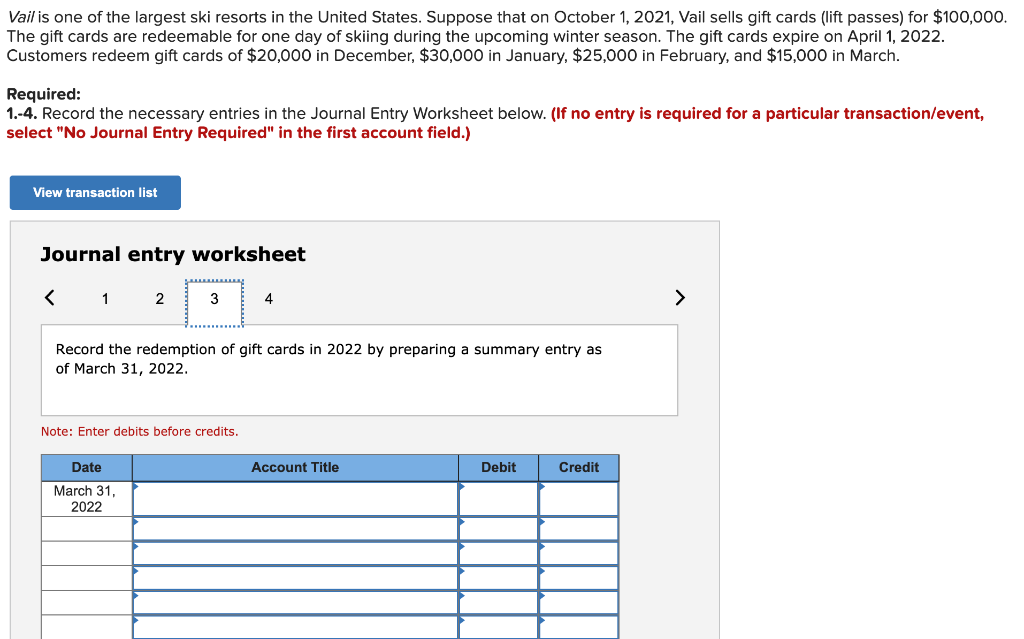

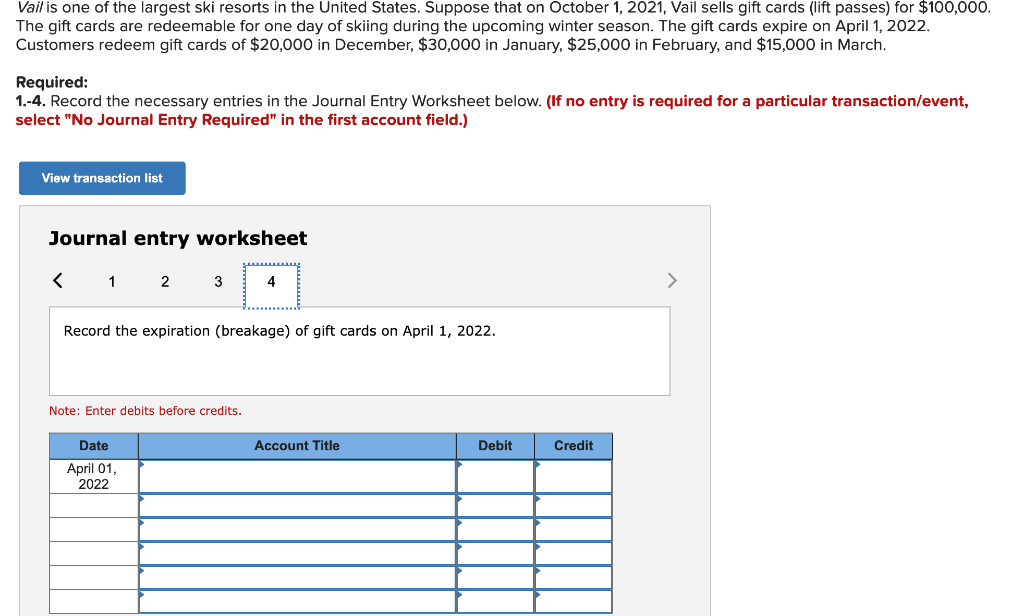

Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2021, Vail sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1, 2022. Customers redeem gift cards of $20,000 in December, $30,000 in January, $25,000 in February, and $15,000 in March. Required: 1.-4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 > Record the sale of gift cards on October 1, 2021. Note: Enter debits before credits. Date Account Title Debit Credit October 01, 2021 Record entry Clear entry View general journal Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2021, Vail sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1, 2022. Customers redeem gift cards of $20,000 in December, $30,000 in January, $25,000 in February, and $15,000 in March. Required: 1.-4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 > Record the redemption of gift cards as of December 31, 2021. Note: Enter debits before credits. Date Account Title Debit Credit December 31, 2021 Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2021, Vail sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1, 2022. Customers redeem gift cards of $20,000 in December, $30,000 in January, $25,000 in February, and $15,000 in March. Required: 1.-4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 > Record the redemption of gift cards in 2022 by preparing a summary entry as of March 31, 2022. Note: Enter debits before credits. Account Title Debit Credit Date March 31, 2022 Vail is one of the largest ski resorts in the United States. Suppose that on October 1, 2021, Vail sells gift cards (lift passes) for $100,000. The gift cards are redeemable for one day of skiing during the upcoming winter season. The gift cards expire on April 1, 2022. Customers redeem gift cards of $20,000 in December, $30,000 in January, $25,000 in February, and $15,000 in March. Required: 1.-4. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the expiration (breakage) of gift cards on April 1, 2022. Note: Enter debits before credits. Account Title Debit Credit Date April 01, 2022