Answered step by step

Verified Expert Solution

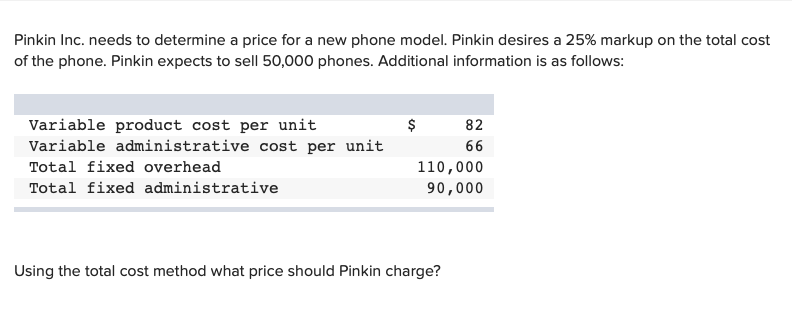

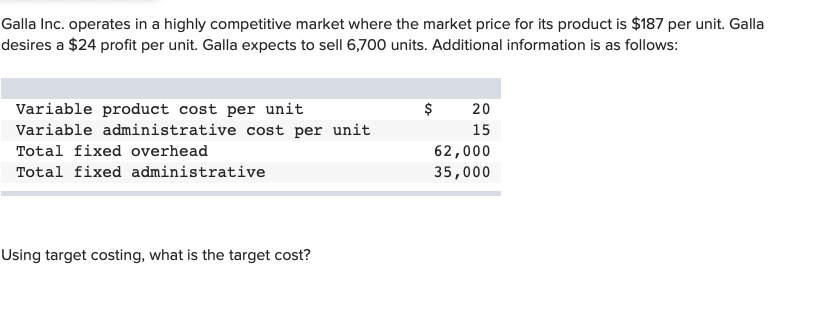

Question

1 Approved Answer

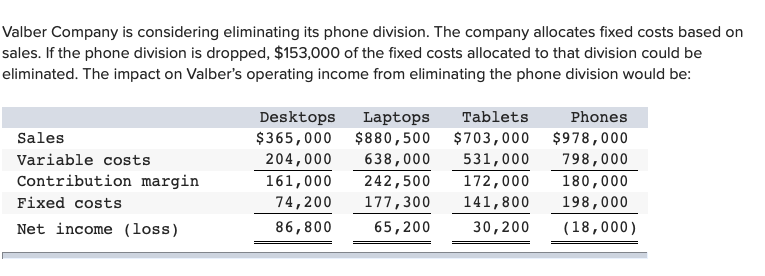

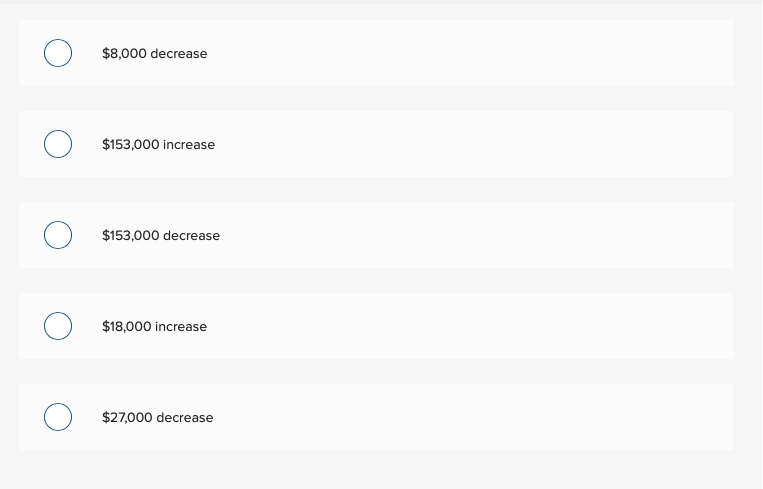

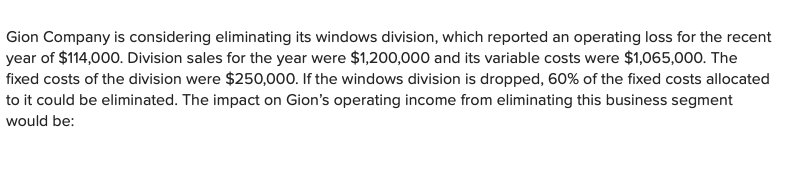

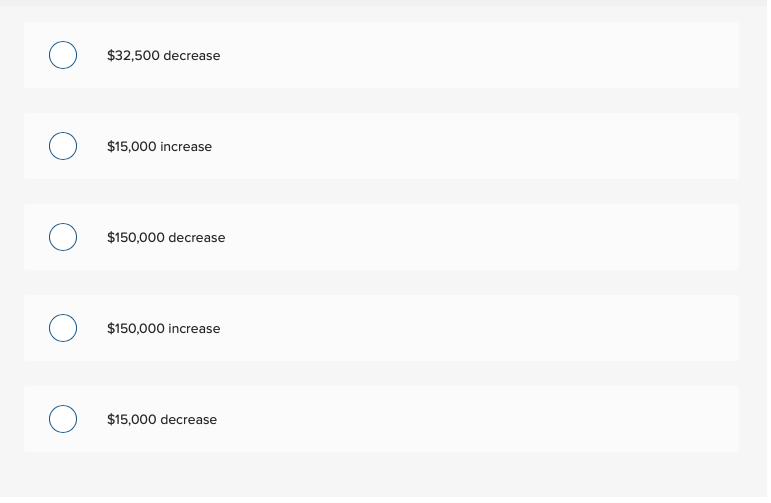

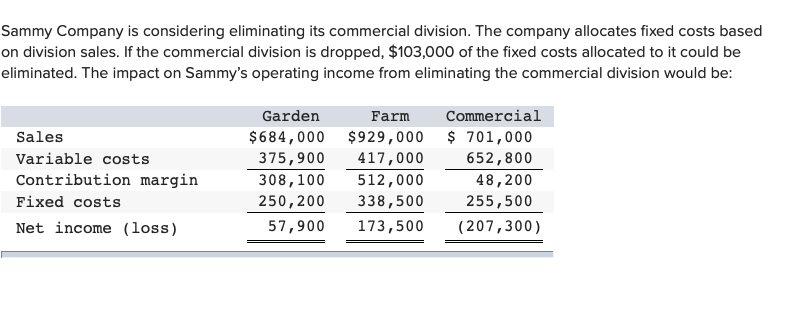

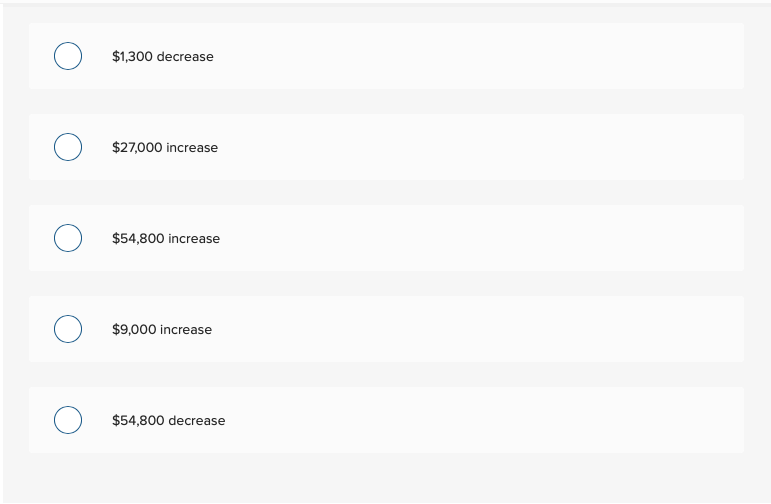

Valber Company is considering eliminating its phone division. The company allocates fixed costs based on sales. If the phone division is dropped, $153,000 of the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started