Answered step by step

Verified Expert Solution

Question

1 Approved Answer

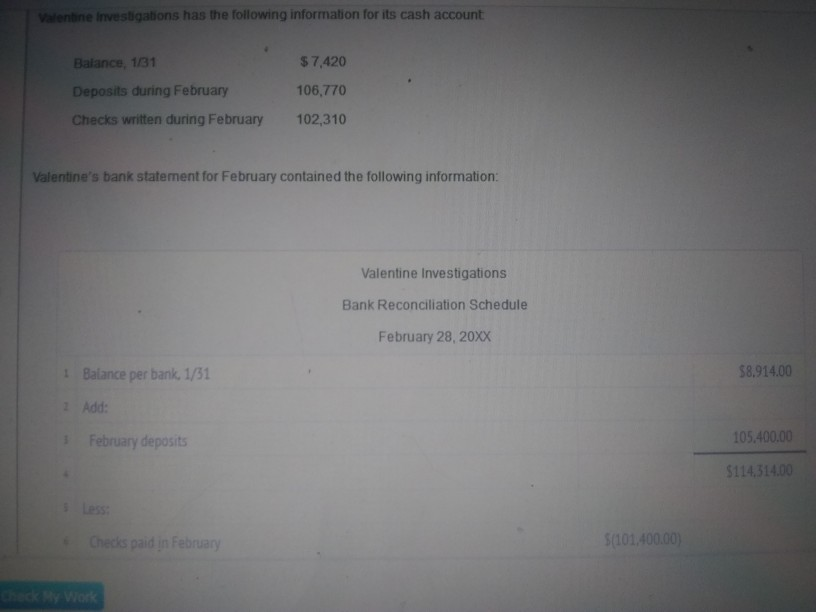

Valentine Ivesigations has the following information for its cash account Balance, 1/31 Deposits during February Checks written during February $7,420 106,770 102,310 Valentine's bank statement

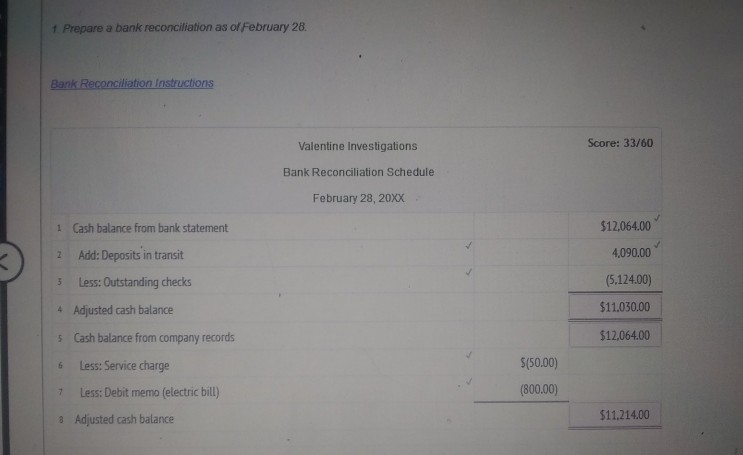

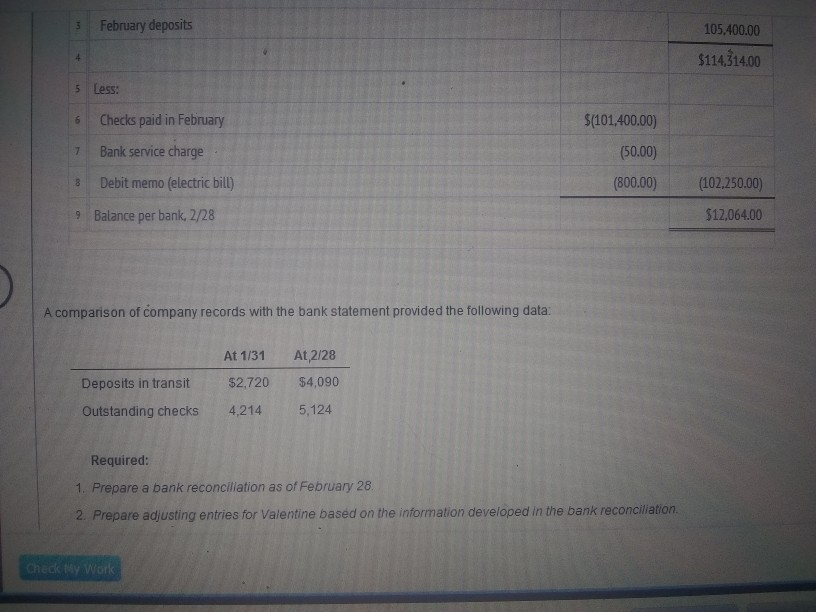

Valentine Ivesigations has the following information for its cash account Balance, 1/31 Deposits during February Checks written during February $7,420 106,770 102,310 Valentine's bank statement for February contained the following information: Valentine Investigations Bank Reconciliation Schedule February 28, 20xx $8.914.00 1 2 3 Balance per bank, 1/31 Add: February deposits 105.400.00 $114,31400 Less Checks paid in February $(101.400.00 t Prepare a bank reconciliation as of February 28 Bank Reconciliation Instructions Score: 33/60 Valentine Investigations Bank Reconciliation Schedule February 28, 20xx Cash balance from bank statement Add: Deposits in transit Less: Outstanding checks Adjusted cash balance Cash balance from company records $12,064.00 4,090.00 (5,124.00) $11.030.00 $12.064.00 1 2 3 4 s 5(50.00) Less:Service charge Less: Debit memo (electric bill) Adjusted cash balance s 7 (800.00) $11.214.00 8 5 February deposits 105,400.00 $114,314.00 5 Less: 6 Checks paid in February 7 Bank service charge 3 Debit memo (electric bill) 9 Balance per bank, 2/28 (101,400.00) (50.00) (800.00)(102.250.00) $12,064.00 A comparison of company records with the bank statement provided the following data. At 1/31 At 2128 Deposits in transit $2,720 $4,090 Outstanding checks 4,214 5,124 Required: 1. Prepare a bank reconcillation as of February 28 2. Prepare adjusting entries for Valentine based on the intormation developed in the bank reconciliation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started