Question

Valerie's full net worth and cash flow are included at the end of this document. The case description below talks about some aspects of her

Valerie's full net worth and cash flow are included at the end of this document. The case description below talks about some aspects of her lifestyle, preferences, spending, etc. but is not complete information. This is to allow you to understand her priorities better.

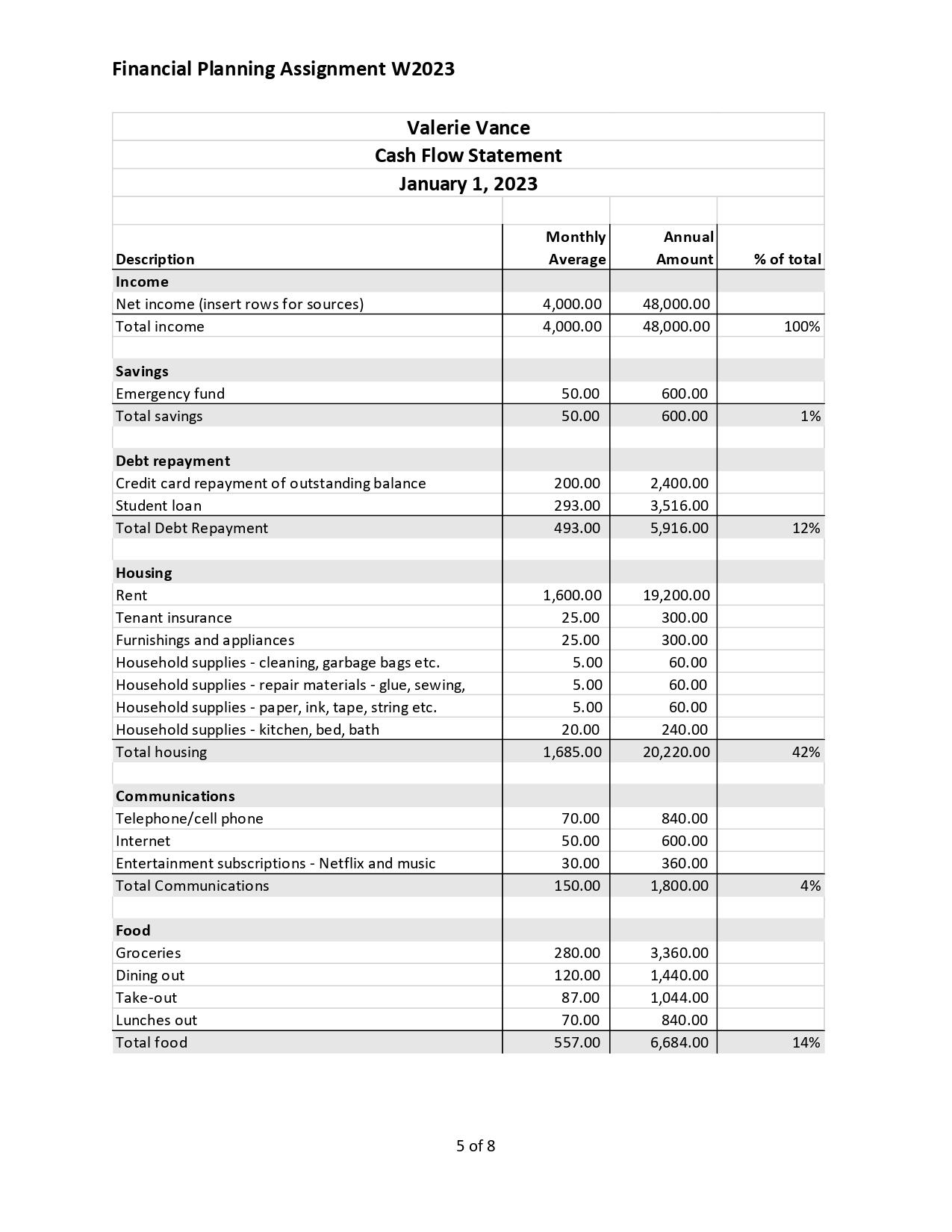

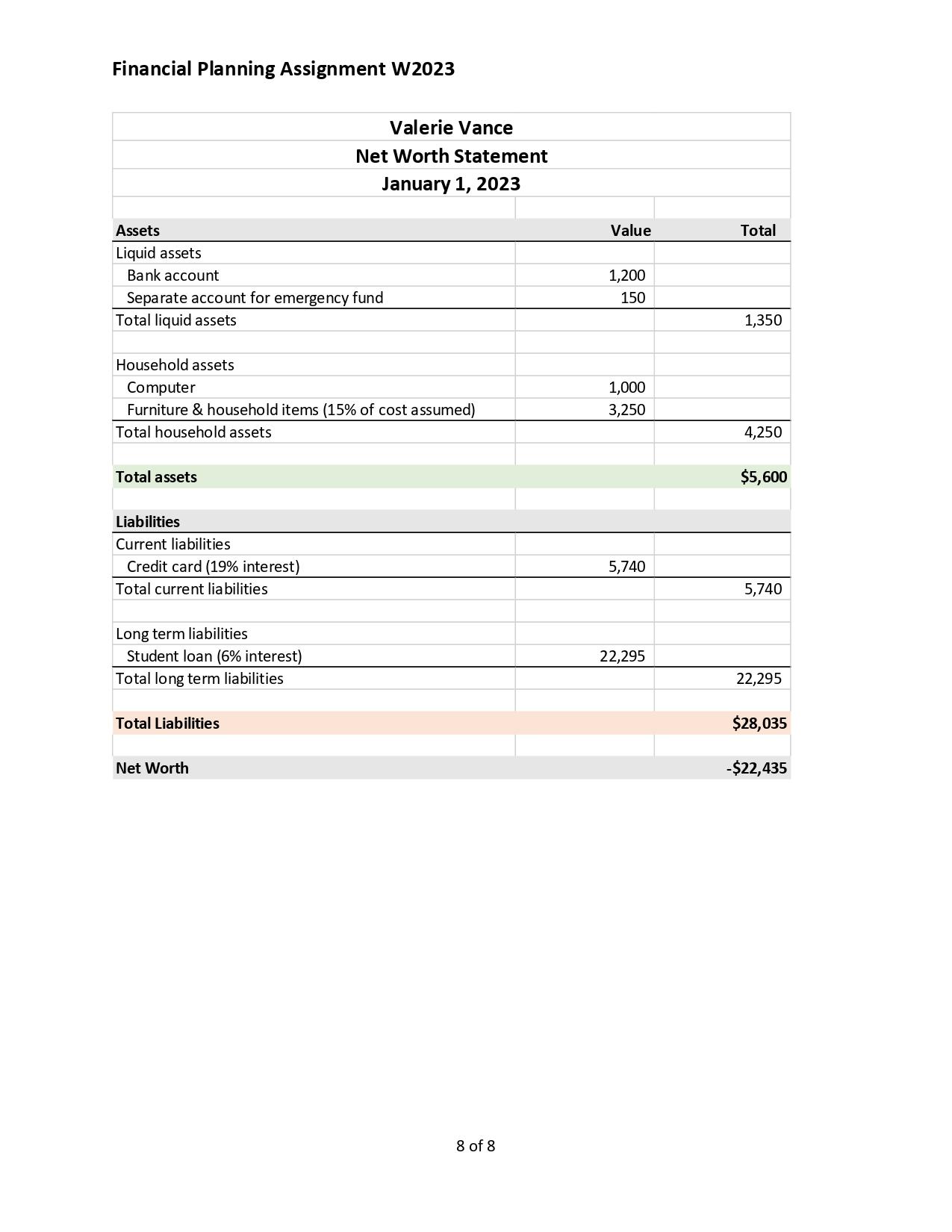

Valerie lives independently and alone, and works full time. She earns $58,000 per year. She receives $4,000 net per month after payroll deductions for CPP, EI, income tax and certain employee benefits. She expects her income to increase only slowly, and she wants to plan based on her current income.

Valerie tried to do things the "right way" all her life. She graduated from post-secondary education 3 years ago and got hired full-time in a job she likes. Now she wants your professional opinion on the best way to improve and strengthen her financial situation for the future n a way that reflects her priorities.

She successfully paid off a loan to her parents two years after graduation. Then, she increased monthly student loan payment. As a result, her student loan will be paid off 8 years from now.

Unfortunately, she accumulated some credit card debt when she celebrated her graduation with an overseas trip, and furnished her apartment with some high quality furnishings, and bought a lot of new clothes for her job. Her outstanding credit card debt is$5,740 now and she feels ashamed. Each month she pays $200 to reduce the accumulated balance on her credit card. With this plan, the credit card will be paid off in just over 3 years. She is determined to pay the credit card directly and not use a line of credit. She has friends who used lines of credit, and then promptly increased their credit card balance again. She is motivated to pay the credit card directly and anxiously looks forward to the day when it is completed.

Valerie likes to cook, and buys groceries regularly. She also goes out to a restaurant with friends from work four times per month, spending just over $30 on average for her share each time. She enjoys these outings, and she's also concerned about her social standing at work if she didn't attend. On Friday nights after work she buys take-out food for $20 to celebrate the end of the week. Usually she brings leftovers from home for lunch, but twice per month she treats herself and her assistant from work to a casual lunch. She pays $35 each time on average.

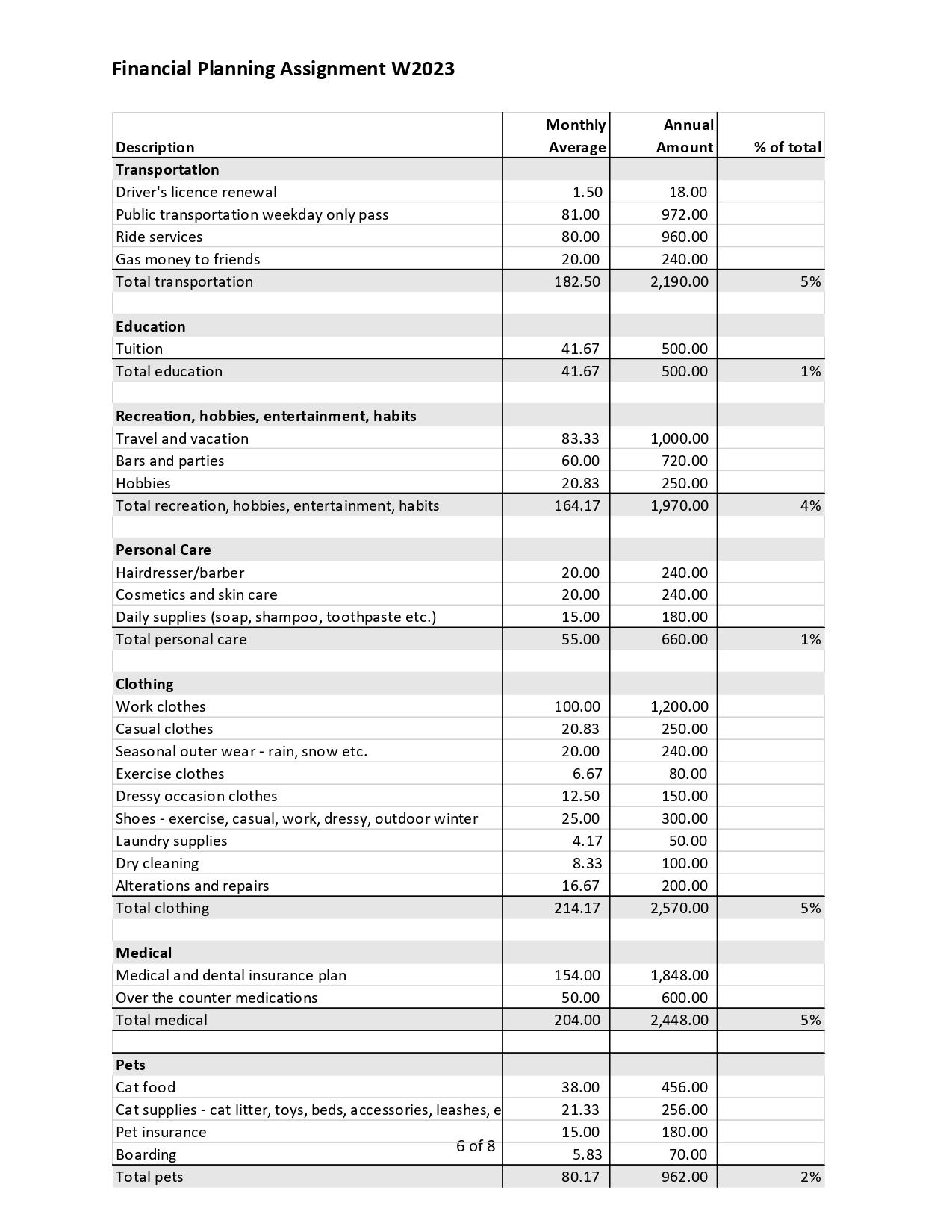

Valerie has a drivers' license, but no car. Occasionally she borrows her parents' car, but she takes the bus for work, and uses a ride service when she goes out to bars and parties with friends, which is about twice per month. Sometimes friends with cars will take her shopping with them, or to the beach, and she contributes money for gas on those occasions.

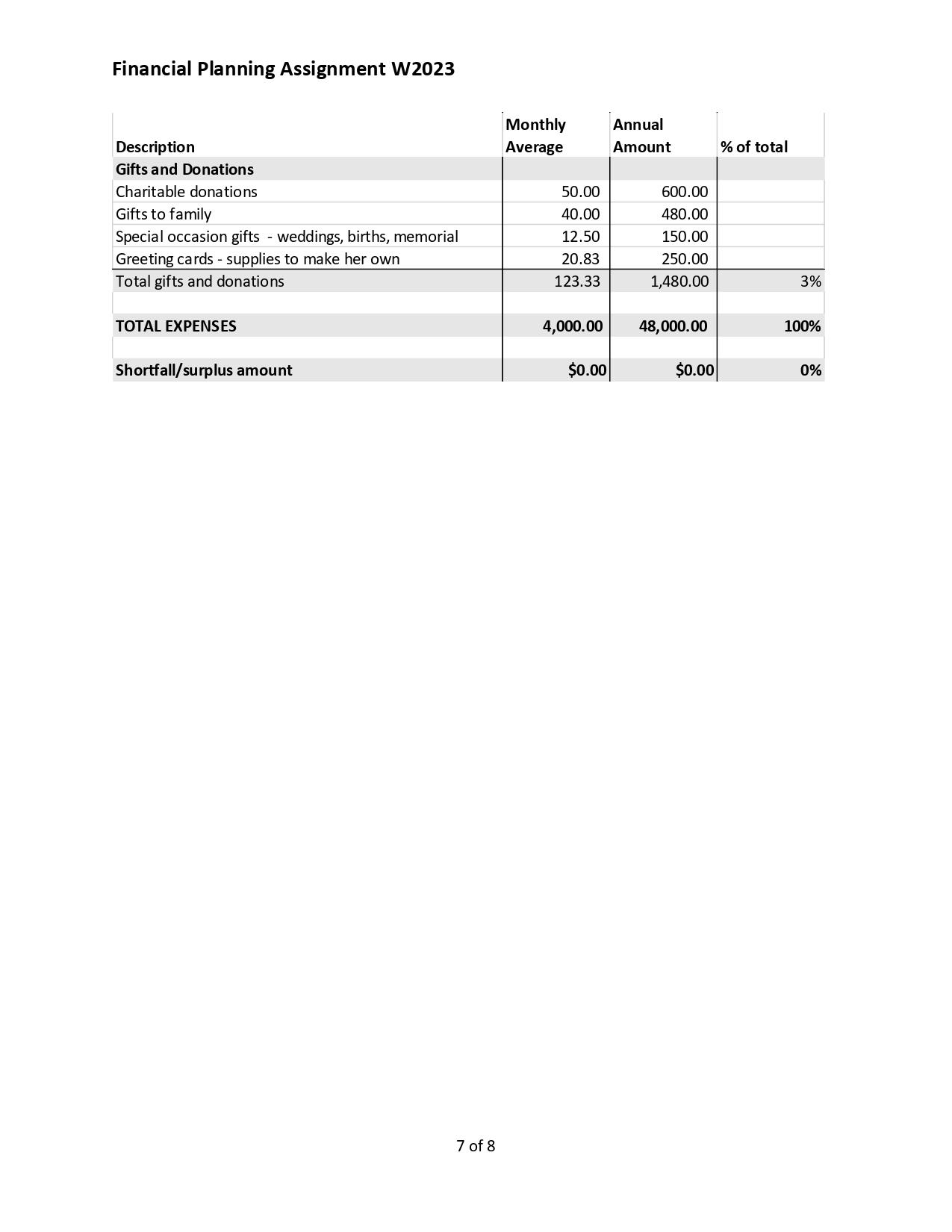

Valerie enjoys doing crafts as a hobby to relax outside of work. She creates interesting items for her home, and also makes greeting cards for family and friends for many occasions. This relaxing activities an important contrast to the pressure she feels while working. For her, it's important for her health to have this outside interest, and she is proud of her creations.

Valerie works with clients for an upscale company, and believe sit's important to maintain a polished professional image. She gets her hair cut a few times per year, wears cosmetics, and spends about $1,200 on shoes and clothes for work each year. She also buys some items for casualwear, and a new pair of running shoes each year for walking and jogging. She replaces her winter outerwear and warm boots, gloves, hat, and scarfs every few years.

Valerie has a health problem that doesn't affect her life or work much, but requires ongoing medication, and affects some of her choices. For privacy reasons related to her health, she will not accept a roommate. She pays for a standard health insurance policy that covers the cost of her medication and dental needs, as her employer does not provide these benefits.

She has a cat. She enjoys having a cat at home because she is frequently alone at home and enjoys the company of the cat.

Valerie loves to travel, but after the big graduation trip, she keeps her annual vacation to 1 week when she travels to see family. She boards her cat at her veterinarian when she goes away.

She contributes $50 per month to the local food bank, and recently streetscaping $50 per month for emergencies.

She keeps gifts to a minimum, preferring to deliver her handmade greeting cards. She gives gifts to her young nieces and nephews on their birthdays, and participates in group gifts at the office for co- workers. On average, one friend gets married per year. She has stopped travelling for weddings, but will usually buy a new dress and take a gift if the wedding is local.

She once read it's important to challenge your mind, so she takes some small personal interest courses each year, spending about $500 per year on tuition for these.

Valerie has a long-term view, and doesn't like to make many changes. For example, she chose a secure apartment close to work where she expects to be happy for years. She doesn't want to move. She is furnishing slowly and carefully with quality items that she hopes will last her lifetime. She enjoys slowly creating a home that she is comfortable in. Valerie absolutely will not request financial help from her friends or family.

B: How to prepare: read the rubric in the submission folder before submitting.

- Submit a letter written to the client that includes the following information:

- Assess net worth according to tools presented in Module 2 Net Worth. This includes stating assets, liabilities, net worth, a discussion of the nature of her assets and liabilities with implications for her net worth increasing or decreasing, as well as relevant discussion of ratios current ratio, liquidity ratio, debt to asset ratio. Make sure to explain your analysis so that the client understands what it means to her personally. Review Module 2 materials before writing. What are the financial risks she faces? Which is the most important?

- Assess cash flow according to key information presented in Module 3 Cash Flow including overall cash flow, discretionary vs necessities, etc. Make sure to explain your analysis so that the client understands what it means to her personally.

- Set a goal with the client. Imagine a goal that naturally comes from your assessment of her financial situation and her wish to improve her financial situation and that reflects her priorities. Explain how the goal will improve her financial situation and why you believe it is her top priority. Imagine discussions with the client to fully define the goal (all 10 points as presented in Module 5 Goal Setting). Make sure to reflect the deep personal meaning and motivation she might express concerning this goal. Thoroughly review the goals material in Module 5 before proceeding. Use Time Value of Money (TVM) to calculate the monthly amount needed to achieve her goal. Show your TVM calculation in an appendix (end of document, not within the letter).

- Identify 2 - 6 discretionary costs that you imagine she will agree to reduce, in light of her preferences, in order to make funds available to achieve the goal. Explain current frequency/spending habit and give a specific, detailed explanation of how she could change her habit to reduce the necessary amount. What cash flow strategy is appropriate for this expense? Make sure your suggestion is mathematically correct, and is detailed so that she knows exactly what to do. (e.g. don't say "reduce expense item x by 30%". This is not detailed.)

- revised cash flow statement: Re-create the existing cash flow statement in Excel with one additional column to show revised monthly spending. The full cash flow statement with current spending and revised spending must be there. If she will increase a debt payment, show the new amount in revised column. If there is a savings goal, add in a line to show savings for [name of] goal and put the amount in the revised column (previously zero). The revised monthly column should show all expenses whether they are changed or not. Make sure your Excel cash flow statement has a professional appearance as described in Module 3 Cash Flow. The Excel spreadsheet must be active. This means formulas for totals must be set up so that the document updates automatically if you change a number in any of the columns. Do not simply type in totals.

- Your summary letter must contain all the information above - explain her current financial situation (net worth and cash flow), fully describe the goal you defined together, and the suggested strategy for expense reductions to achieve the goal.

Make sure you write in a collaborative way, which shows that you and the client have been involved in discussions together. Your letter is a full summary of the analysis and final decisions the two of you made together. You will be graded on your professional and friendly tone, and ease of reading. Use the Readability Statistics in Word to achieve the target of >60% readability score, and grade level 6 - 9. The letter should be longer than one page and not longer than two pages in length. This limitation is not strict, but it would be difficult to achieve everything in one page. Longer than two pages should be edited for clarity and to be briefer.

Financial Planning Assignment W2023 Description Income Net income (insert rows for sources) Total income Savings Emergency fund Total savings Debt repayment Credit card repayment of outstanding balance Student loan Total Debt Repayment Valerie Vance Cash Flow Statement January 1, 2023 Housing Rent Tenant insurance Furnishings and appliances Household supplies - cleaning, garbage bags etc. Household supplies - repair materials - glue, sewing, Household supplies - paper, ink, tape, string etc. Household supplies - kitchen, bed, bath Total housing Communications Telephone/cell phone Internet Entertainment subscriptions - Netflix and music Total Communications Food Groceries Dining out Take-out Lunches out Total food 5 of 8 Monthly Average 4,000.00 4,000.00 50.00 50.00 200.00 293.00 493.00 1,600.00 25.00 25.00 5.00 5.00 5.00 20.00 1,685.00 70.00 50.00 30.00 150.00 280.00 120.00 87.00 70.00 557.00 Annual Amount 48,000.00 48,000.00 600.00 600.00 2,400.00 3,516.00 5,916.00 19,200.00 300.00 300.00 60.00 60.00 60.00 240.00 20,220.00 840.00 600.00 360.00 1,800.00 3,360.00 1,440.00 1,044.00 840.00 6,684.00 % of total 100% 1% 12% 42% 4% 14%

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Total transportation 2190 Total education 500 Total recreation hobbies ente...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started